Hera strategy - Hera Group

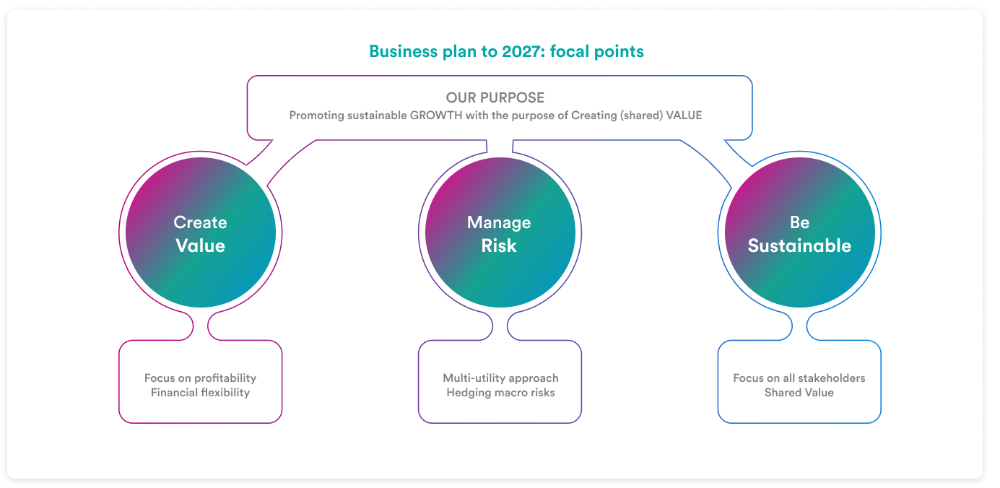

Sustainability remains one of the cornerstones of the Group’s strategies for growth, perfectly integrated and relevant to all operating areas, with an increasing focus on creating value for stakeholders, as shown by the recent introduction of the concept of corporate purpose in the Group’s Articles of Association: The Group’s strategy is in fact guided by the corporate purpose, at the centre of which there is the creation of shared value for the Planet, People and Prosperity.

The Group has enhanced its five-year strategy, following the new European directives and at the same time maintaining its coherence with the goals of the UN’s 2030 Agenda, which for years has guided Hera’s commitment towards sustainable development.

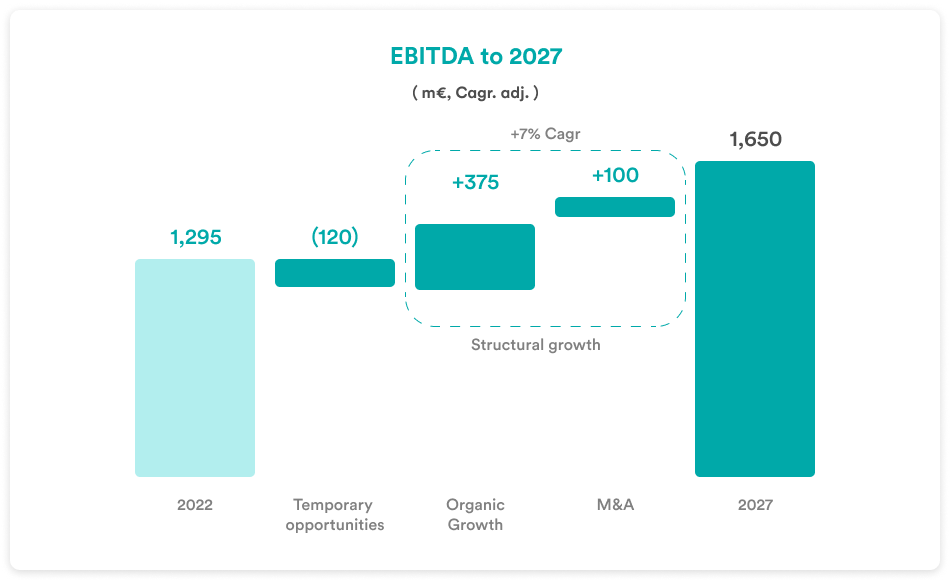

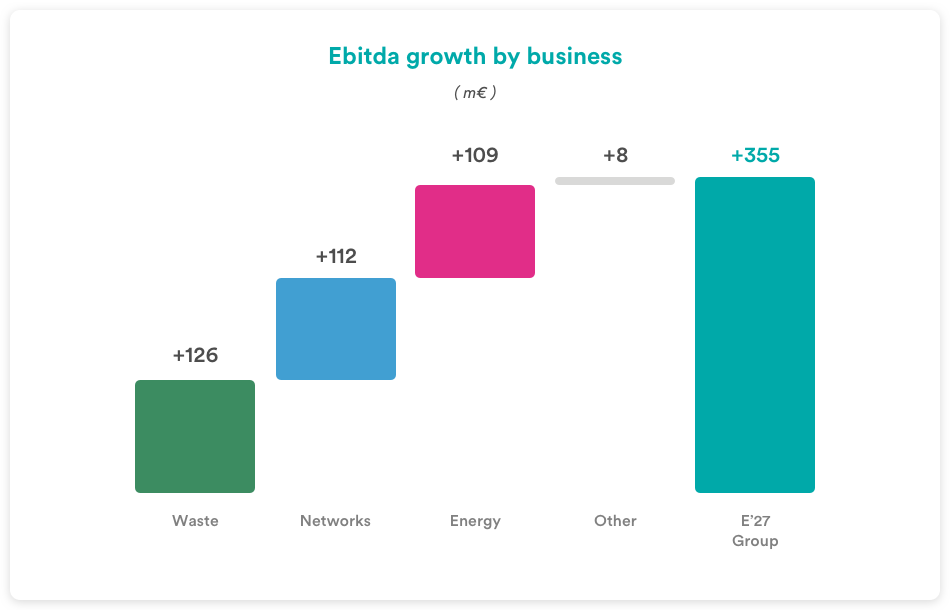

The Business Plan to 2027 confirms and reinforces the growth expected by the previous Plan: within 2027, the Hera Group expects Ebitda to reach 1,650 m€, (+355 million compared to the 1,295 million seen in 2022), with an average annual increase of 5%, net of some discontinuities related to the end of the SuperEcoBonus and lower margins in the Last Resort Markets.

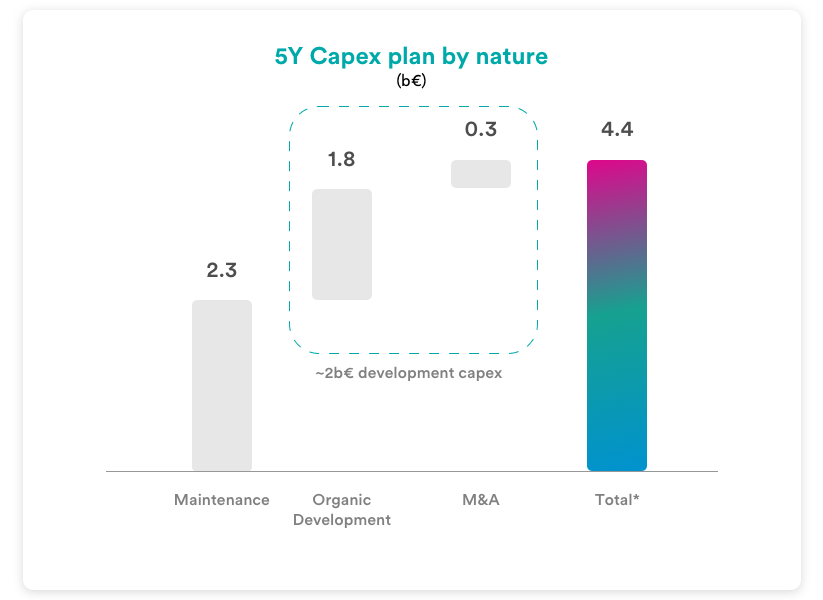

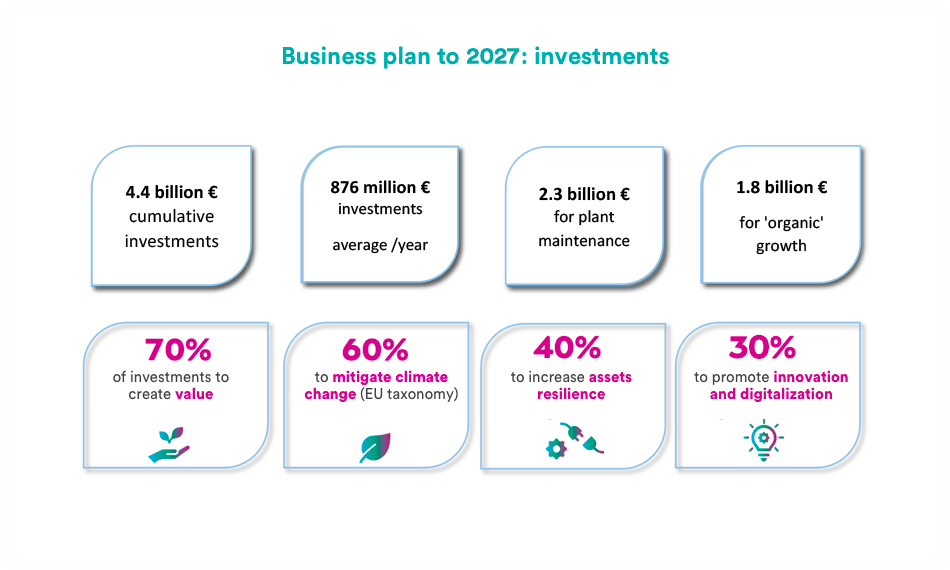

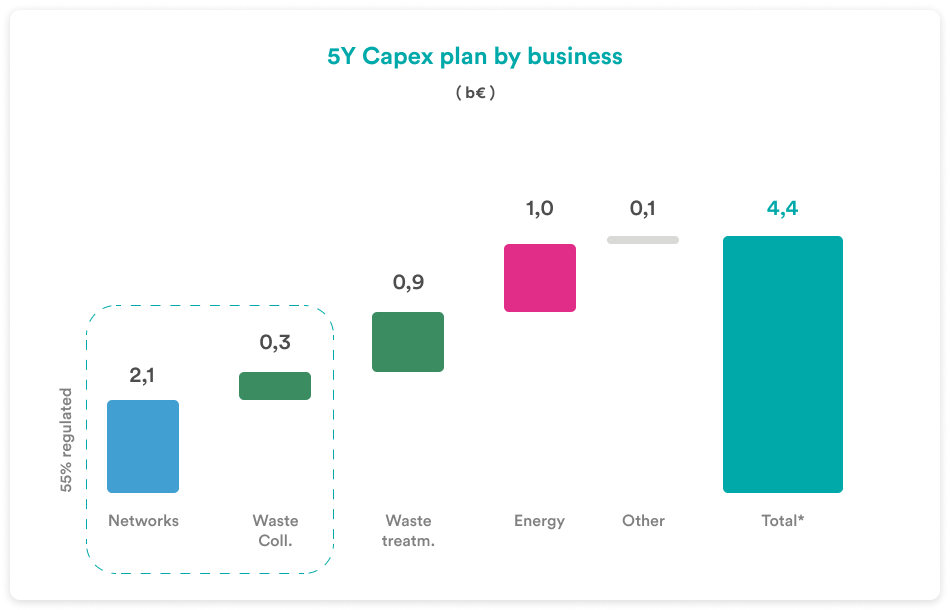

Investments total 4.4 bn€, approximately 876 million per year: a very significant rise, equivalent to +10% compared to the last capex plan. The allocation of investments combines actions to increase the assets resilience (about 2.4 bn€) with organic development opportunities (about 1.8 bn€) and M&A activities (about 0.3 bn€).

Looking to allocation of investments by "nature", about 30% of resources will be dedicated to innovation across all managed activities.

40% is dedicated to the resilience of infrastructures while 39% of the investments planned for 2027 will allow us to reduce the consumption of natural resources and "close the loop" of our activities, through the development and adoption of circular economy solutions and models and aligned with the European taxonomy (around 2.5 bn€ of aligned investments).

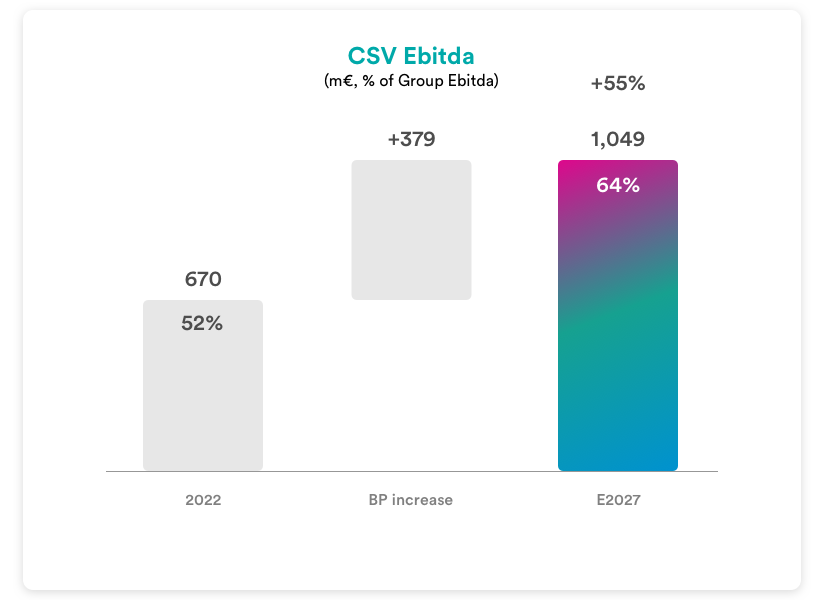

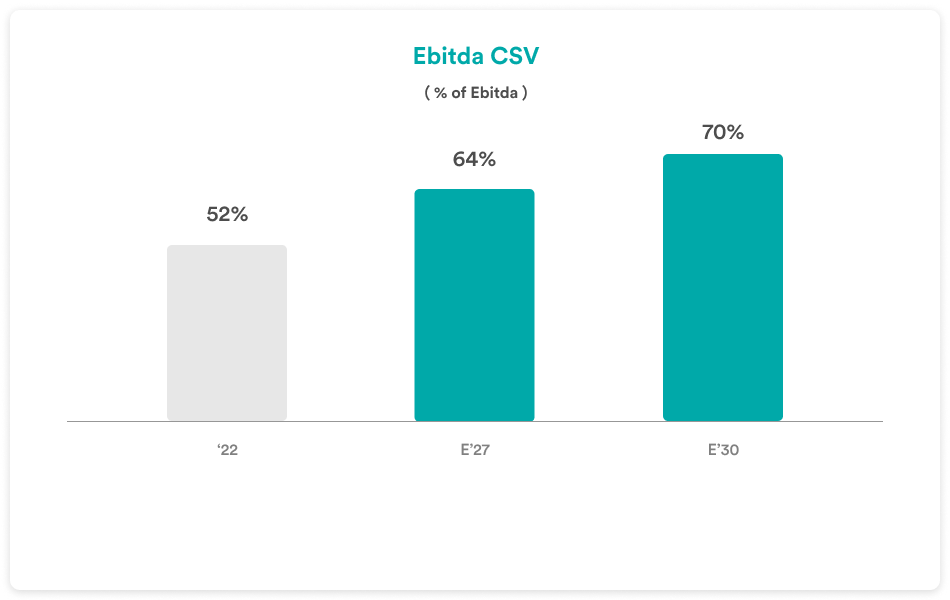

Finally, approximately 70% of total investments are allocated to projects that create value not only for shareholders but generate shared value to all stakeholders and support the growth of the CSV Ebitda, up to 64% of the Group's Ebitda by 2027.

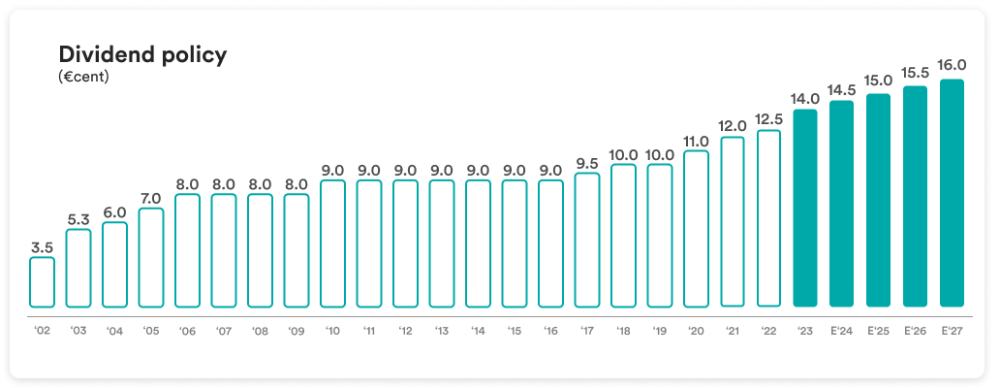

Further increase in dividends with an average annual growth rate of 5.1%, to reach 16 €cent by 2027 (+28% more than the last dividend paid).

Operating cash flows will increase, supporting investments, dividends and expansion through M&As, maintaining financial solidity with the Debt/Ebitda ratio at 2.7x in 2027, thus leaving room for other investment projects not included in the Plan.

Operating-financial policies fully confirmed and renewed commitment towards development and growth, with interventions focused on the circular economy, energy transition, environmental protection, technological evolution and social cohesion.

VALUE CREATION

The Group's strategy focuses on creating value through four main growth levers: efficient allocation of capital to investment projects with the best risk-return profiles, expansion of market shares in the businesses covered, expansion of the scope through M&A transactions and extraction of synergies or cost efficiencies, including financial ones.

As far as the overall EBITDA is concerned, the planned projects will make it possible to reach EUR 1,650 million by 2027, an improvement of EUR 355 million compared to the 2022 figure. Then, taking into account a series of business opportunities that will come to an end during the Plan period, the growth developed over the Plan reaches EUR 475 million, with an average annual rate of 7%.

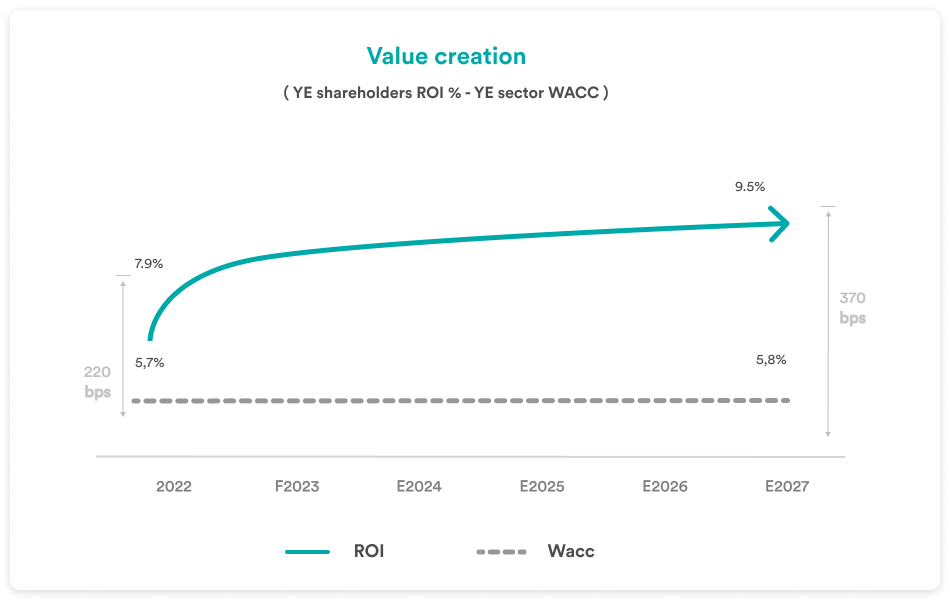

Thanks to these growth targets of the economic indicators, the Plan projects an increase in return on invested capital (ROI) to 9.5% in 2027, up from 7.9% in 2022. Maintaining the historically conservative risk profile, this level of return implies an important increase in value creation: the differential between ROI and WACC increases from 2.2% in 2022 to 3.7% in 2027.

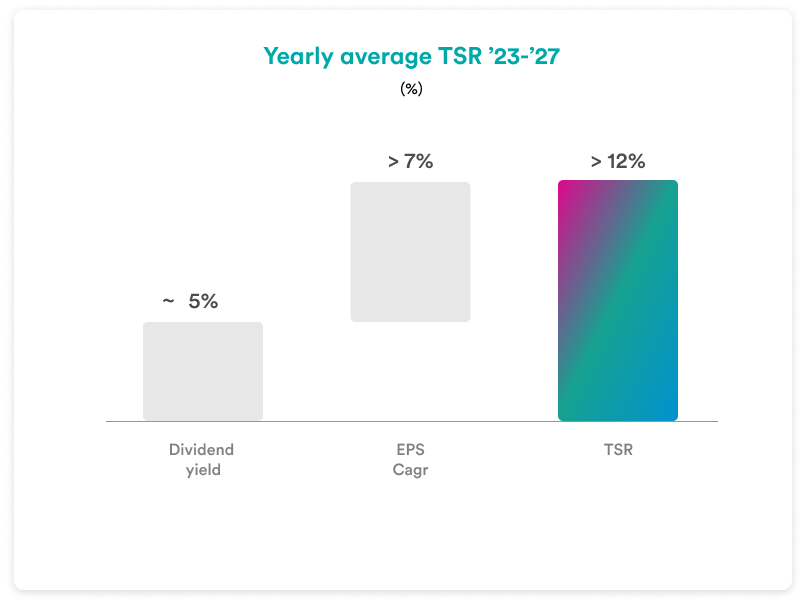

Dividends are expected to increase steadily each year until reaching a coupon of 16 eurocents by 2027 (+28% compared to the last dividend paid), with net earnings per share also expected to grow by an average of 7% per year. At current Hera share prices, the new policy guarantees an average yield of 5% and offers full visibility on prospective dividends in each year of the plan.

As a result, the total shareholder return (TSR), which takes into account both expected earnings performance and dividend yield, stands at over 12% on average per annum.

SUSTAINABLE GROWTH

Hera also confirms its important focus on the circular economy and decarbonisation, in order to encourage and support the ecological transition of the territories served with concrete initiatives aimed at citizens, public administrations and industrial customers, making available the extensive plant base and know-how gained in the various business sectors.

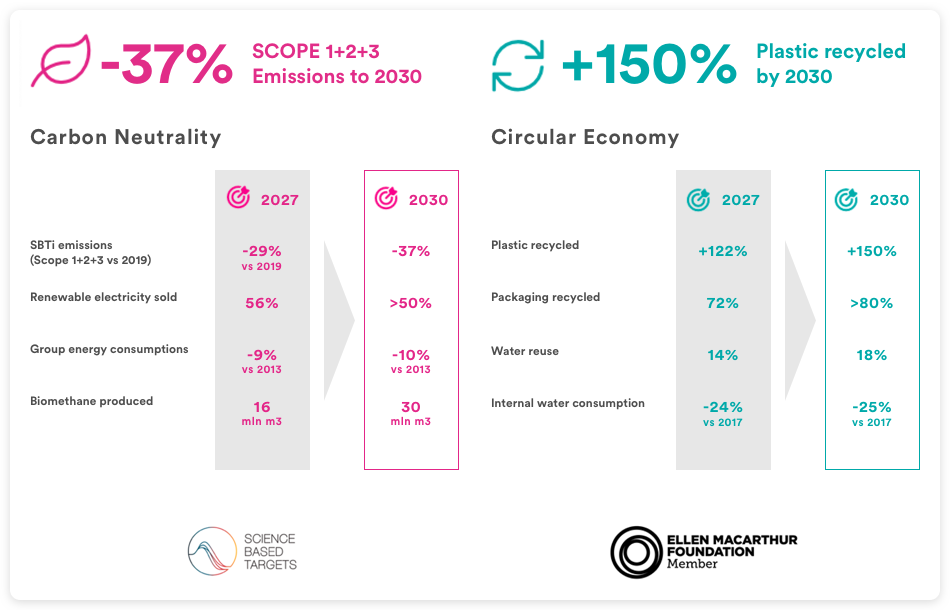

The initiatives envisaged in the Business Plan to 2027 make it possible to project a trajectory that is perfectly consistent with the achievement of the industrial objectives to 2030 in terms of circular economy and carbon neutrality.

With reference to the circular economy, the traced path confirms the 2030 targets such as the increase in recycled plastics (+150% compared to 2017), or the reuse of wastewater (up to 18% of the total by 2030).

Regarding the Group's commitment to reduce carbon emissions, the ambitious 37% reduction target to 2030, already validated by the prestigious international network Science Based Target initiative (SBTi), is confirmed, projecting a 29% reduction as early as 2027.

At the same time, the 'shared-value EBITDA' will continue to grow significantly: it is expected to rise to 64% of the Group's total EBITDA in 2027, amounting to approximately EUR 1,049 million (compared to EUR 670 million in 2022), in line with the target of 70% by 2030.

INCREASE IN RESILIENCE

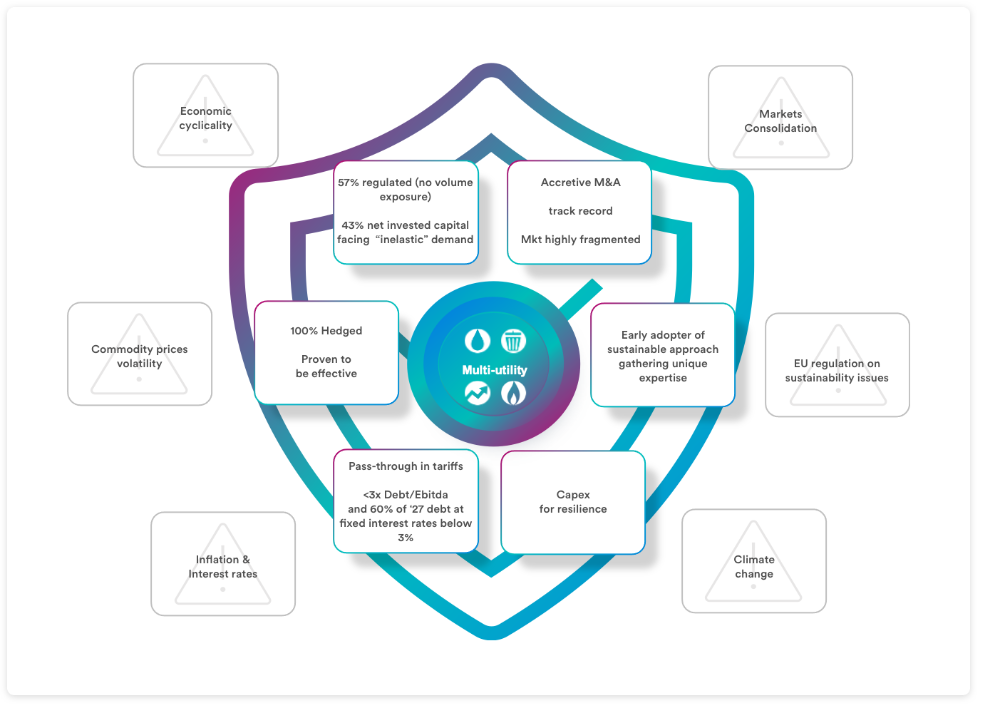

The diversified asset management strategy also confirms the focus on strengthening the three main lines of business, maintaining the current balance, which has ensured a constant uninterrupted growth and the strong resilience of the Group's results in all the scenario situations experienced over the last twenty years.

This set-up sees regulated assets remaining at around 60% of invested capital as of 2027, thus providing regulatory protection against the cyclical nature of demand, inflation and interest rate trends.

Even with regard to the remaining 40% of the portfolio, attributable to market-based assets, the strategy of low-risk appetite is guaranteed by the implementation of hedging policies on operational risks in asset management, which have proven particularly effective even in situations of wide fluctuations in commodity prices experienced over time.

INVESTMENTS

The strategy to 2027 foresees financial resources set aside for investments, increasing by 10% compared to the previous capex plan. Investments coming to 876 m€ every year are planned during the entire 5-years period, to fuel the plant base maintenance and both organic growth and external growth initiatives, including M&A opportunities.

The new Business Plan revolves around three strategic levers.

In all the businesses Group's projects are placed around these dimensions with the aim of combining the development of the multi-utility with that of the context in which it operates, in a "win-win" perspective to increase shared value.

The Group's investment plan reserves significant resources to meet climate and technological challenges:

- 31% of investments will contribute to decarbonization,

- 39% will be allocated for resource regeneration,

-

40% will be dedicated to innovation and to improve the resilience of our assets.

The 4.4-billion-euro investment plan will allocate

- 2.1 bn€ to Networks for plant base maintenance and network development;

- 1.2 bn€ to Waste to enhance the Global Waste Management service and plastic recycling activities;

- 1.0 bn€ to Energy to increase the share of renewable energy produced and sold;

- 0.1 bn€ to Other Services to promote the TLC network evolution, the renewal of data centres and the optimization of network measurement systems.

Respecting the Group’s objective of maintaining a resilient growth profile, prepared to seize the opportunities that arise over the next five years, all business areas will contribute to growth in Ebitda, benefiting from various drivers/opportunities:

WASTE

Waste will see the sharpest growth, coming to +126 m€. The market context and our current leadership, based on a unique, broad, modern, sustainable and diversified plant base, provides a solid “platform” and will allow us to seize many upside opportunities over the next 5 years, due to the strong growth in demand for sustainability-focused services.

NETWORKS

It will be the second driver of growth, with an increase of +112 m€. This is the main enabler for developing smart solutions and innovative projects that are synergistic with the other activities in our portfolio. We will therefore step up our investment in resilience and digitisation, to achieve greater infrastructure readiness.

ENERGY

Energy will continue to be the most visible and resilient basis of our results and will grow by +109 m€. In fact, the Group has already proved to be very competitive in this business, and still has plenty of room to expand both its market share and the range of value-added and sustainable services it offers.

The same commitment, which we reserve for each business, will guide us in our actions to support carbon neutrality and the circular economy.

The projects set out in the new Plan to 2027 will make it possible to pursue a course of growth consistent with the ecological transition targets to be reached by 2030.

The targets are measured against industrial indicators that summarize two areas, carbon neutrality and the circular economy, in such a way that for each one it is possible to verify whether the target for 2027 is consistent with the progress required to achieve the objectives for 2030.

The main goals in these two areas include:

CARBON NEUTRALITY

- reducing CO2 emissions by 37% within 2030 (compared to 2019) concerning both the Group’s own emissions (Scope 1 and 2) and those of customers (Scope 3)

- increasing the amount of renewable electricity sold compared to total electricity sold, reaching the target of 50% by 2030

- reducing the Group’s energy consumption by 10% by 2030 (compared to 2013 consumption)

- increasing the amount of biomethane produced from OFMSW, with the aim of reaching 30 million m3/year by 2030

CIRCULAR ECONOMY

- increasing the amount of plastic recycled (and sold) by Aliplast, with a volume growth target coming to +122% in 2027 and +150% in 2030, compared to 2017 figures

- as regards the proportion of recycled packaging, in the areas served by the Group, the target of 70% set by the EU for 2030 was already achieved in 2017. The Group’s goal for 2030 is more challenging, and expects to meet and exceed the target of 80% recycled packaging

- increasing reuse of wastewater up to 18% of total wastewater by 2030

- reducing internal water consumption by 25% within 2030, compared to 2017 consumption

The new Plan further reinforces the Hera Group’s focus on generating value for its shareholders as well. They can indeed count on a return on invested capital well above the weighted average cost of capital and on a solid and transparent dividend policy, whose payment has been fully confirmed in 2023.

The growth rate of dividends by 2027 will be higher than that already foreseen in the previous Industrial Plan, with an increase of 1.5 €cents per share in 2023 and 0.5 €cents in the following years, up to 16 €cents per share by 2027, which represents an average annual growth over the Plan period of +5.1%.

With this Business Plan, the Group confirms its strategy’s consistency with the most recent and ambitious European policies as well as the recommendations of the UN Agenda. The significant amount of investments, equal to 70% of the total, going towards Shared Value initiatives and the ensuing economic growth provide a guarantee of the Group’s medium to long-term development.

The Group's commitment to generating value for the community is confirmed by the growth of Shared Value EBITDA registered in recent years, which rose from 33% of the Group's total EBITDA in 2016 to 52% in 2022.

Estimates to 2027, drawn on the basis of the Plan projects and initiatives, project a Shared Value EBITDA above 64%, in line with the target of 70% by 2030.

Entirely geared towards Shared Value, the Plan includes projects capable of both developing the businesses managed by the Group and promoting the wellbeing of local areas, workers and stakeholders in general, following a rationale of mutual benefit.

Working together with the stakeholders, a path of growth for the Group and the surrounding ecosystem will be designed which gives full value to the prosperity of the local community over the medium and long term.

The increase in Ebitda, consistent with the objectives on the UN’s 2030 Agenda, will be pursued thanks to investments for shared-value projects corresponding to roughly 70% of the total for 2023-2027, or more than 3 bn€ out of the total 4.4 bn€ allocated under the Plan.

Some key sustainable projects are:

- projects related to the transition to the circular economy

- sustainable water management projects

- energy transition and renewable energy projects

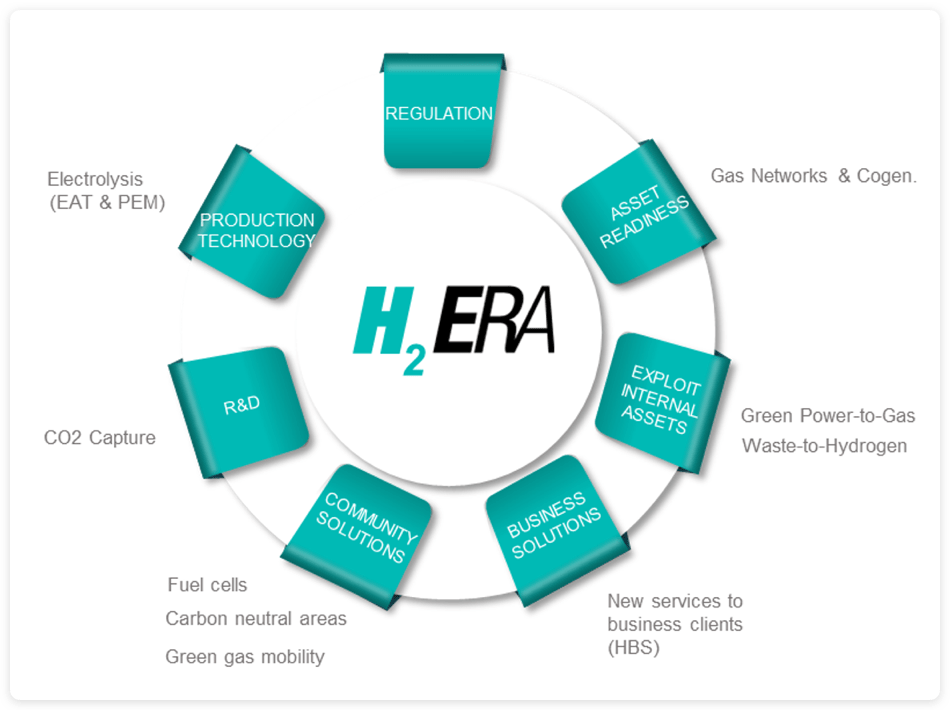

The Hera Group and hydrogen

![]() Hera will reduce emissions by 37% by 2030. This scientifically certified target is one of the most ambitious among companies in Italy and is consistent with the “well below 2 C” scenario, which aims to limit the increase in global temperature to significantly less than 2°C compared to pre-industrial data. Hera’s commitment is not limited to the emissions produced by the Group’s own activities, but also covers those of its customers, related to electricity and gas sales, and its suppliers.

Hera will reduce emissions by 37% by 2030. This scientifically certified target is one of the most ambitious among companies in Italy and is consistent with the “well below 2 C” scenario, which aims to limit the increase in global temperature to significantly less than 2°C compared to pre-industrial data. Hera’s commitment is not limited to the emissions produced by the Group’s own activities, but also covers those of its customers, related to electricity and gas sales, and its suppliers.

The interventions planned include further expansion in district heating, an increased use of electricity from renewable sources and energy upgrading for buildings, but also launching initiatives to develop hydrogen as an energy vector.

For further details on Hera and sustainable development

In order to promote growth in shared value and the implementation of projects inspired by a circular economy, since 2017 the Group is included in the CE100 program, promoted by the MacArthur Foundation.

Stefano Venier, Hera's CEO from April 2014 to April 2022, met Ellen MacArthur to assess the current situation and discuss future prospects

Page updated 24 January 2024