Components of remuneration

Components of remuneration

- Group

- Governance

- Remuneration policy and objectives

- Components of remuneration

Pay for performance

The year 2024 closed with significant improvement in all operating and financial indicators, thanks to the full execution of the ambitious investment plan, the increase in remuneration in regulated businesses and the effectiveness of the managerial initiatives undertaken. Indeed, the 16% drop in revenues was entirely due to the normalization of energy commodity prices that were offset by the positive internal dynamics that led energy customers to increase by 774 thousand, volumes of marketed waste to rise by 190 thousand tons, and the adjusted value of assets to grow by 248 million euro.

These growth levers, combined with some acquisitions concluded to integrate the range of services offered to customers and strengthen the market positioning, allowed Ebitda to show further progress, building on its track record of over twenty years of growth. Net profit post minorities also saw growth with a percentage change of 32%, highlighting the value created by management.

Positive cash generation was able to finance 812 million euro of investments and the payment of growing dividends, reducing leverage to 2.5x, one of the most conservative values in the sector, which provides ample financial flexibility to pursue further growth opportunities. The good quality of the results was confirmed by the financial analysts covering the Hera stock, whose estimates have been outperformed in all of the quarterly periods, with the average target price rising from 3.94 euro to 4.05 euro after the presentation of the preliminary financial results in early 2025 and the 83% of the recommendations advising the purchase of the stock.

| mn€ | 2021* | 2022* | 2023* | 2024* | Variation 2023/2024 | Percentage of variation 2023/2024 |

|---|---|---|---|---|---|---|

| Revenues |

10,555 |

20,082 | 15,331 | 12,890 |

(2,441) |

(16%) |

| Ebitda |

1,219 |

1,295 | 1,495 | 1,588 |

+93 |

+6% |

| Operating profit |

607 |

628 | 741 | 830 |

+89 |

+12% |

| Net profit post minorities |

330 |

322 | 375 | 447 |

+119 |

+32% |

| Net financial dept | 3,261 | 4,250 | 3,828 | 3,987 | +159 | +4% |

| Financial leverage (Net dept / Ebitda) | 2.7x | 3.3x | 2.6x | 2.5x | (0.0x) | (2)% |

*managerial values, including gas warehouse inventory valuation as shown in paragraph 1.04 of the consolidated and separate financial statements

In 2024, the Group’s leadership model, which is a benchmark in the variable remuneration of management, was updated with the inclusion of entrepreneurial inclination among the evaluation elements. This transformation seeks to strengthen the sense of belonging and individual responsibility, promoting a proactive attitude and greater determination to overcome business challenges.

Furthermore, in line with the corporate purpose of creating value for all stakeholders, Hera also in 2024 recorded a growth in shared value quantified in CSV Ebitda, coming to 10%, expanding the sustainable approach to management aligned with 11 global goals (SDGs) of the United Nations. This approach, which has proven to be crucial for the strategic plans and included in the variable remuneration of management, allowed the Group to maintain the positive ratings of the main ESG rating agencies.

In 2024, Hera was confirmed in the Dow Jones Sustainability Index, Europe and World, positioning itself as a world leader in the reference sector for the fifth consecutive year. The Group’s inclusion was also confirmed in the FTSE For Good and Mib Esg indexes of Borsa Italiana, the World Top100 of Refinitiv Diversity & Inclusion and Bloomberg Gender & Equality. In terms of ratings, Morningstar Sustainalytics has further improved the assessment of Hera’s ESG risk management, considering it to be the second best among all global multi-utilities. Hera was then ranked first in Italy for sustainability governance, in the ESG Identity Corporate Index ranking drawn up by Etica News, while ISS Esg placed Hera at the top of the sector for environmental aspects.

The following table illustrates the creation of shared value (CSV) Ebitda and investment data, certified by external auditors.

| mn€ | 2021 | 2022 | 2023 | 2024 | Variation 2023/2024 | Percentage of variation 2023/2024 |

|---|---|---|---|---|---|---|

| CSV Ebitda |

571 |

670 | 776 | 857 | +81 | +10% |

| % CSV Ebitda |

46.6% |

51.8% | 51.9% | 54.0% |

+2.1 p.p. |

+4% |

| CS investments | 453 | 510 | 558 | 655 | +97 | +17% |

The positive results were also reflected in a total shareholders return of 20.5% in 2024, which includes the appreciation of the value of the shares and the payment of a dividend set at 14.0 cents. The following graph illustrates the trend of total shareholders return over the year in comparison with the weighted average of regulated utilities and the weighted average of Italian utilities.

THera’s stock displayed a consistently higher total return to shareholders throughout the year than both regulated utilities and utilities as a whole, confirming the positive reception of the business plan and solid quarterly performance.

The following chart, which relates the performance of the Hera Group’s results over a three-year period, the shareholders’ return and the total remuneration of the executive members, confirms the effectiveness of the remuneration, aimed at pursuing the creation of value for all stakeholders. Indeed, having included performance indicators such as return on invested capital (ROI) in comparison with the cost of capital (WACC) within variable remuneration made it possible to carefully track the long-term value creation levers (EVA) with efficient capital allocation. This approach was especially rewarding over the past years, as the end of the expansionary monetary policy introduced by the European Central Bank raised the average cost of capital (WACC), making it necessary to boost returns in order to continue creating value. For this reason, to protect shareholder interests, Hera did not limit itself to including ROI in the metrics measured for the Management’s variable remuneration, but also deemed it appropriate to factor in the ROI/WACC differential.

*Includes eight months of remuneration of the current Executive Chairman and four months of remuneration of the previous Executive Chairman.

The definition of consistent remuneration policies at Group level is also expressed in a relationship between the remuneration of executive members and that of employees has been stable over time, confirming the creation of value shared with all stakeholders.

| Pay ratio(x) | 2021 | 2022 | 2023* | 2024 |

|---|---|---|---|---|

| Fixed remuneration Executive Chairman vs average employee remuneration |

9.4x |

9.3x | 9.3x | 9.6x |

| Fixed CEO Compensation vs Average Employee Compensation |

9.5x |

8.9x | 9.3x | 9.6x |

| Average employee remuneration | 40.5 | 41.0 | 41.0 | 41.0 |

*Includes eight months of remuneration for the current Executive Chairman and four months of remuneration for the previous Executive Chairman.

Remuneration components

The structure of the remuneration package, foreseen for the various roles, functions and positions, has been defined with a view to balancing the fixed and variable components, taking into account the Company’s specific risk profile and its desire to maintain a strong alignment between the level of corporate and individual performance and remuneration, effectively incentivizing commitment, professional growth and the adoption of behaviours deemed functional to the achievement of corporate values and objectives. The overall remuneration contains a balanced mix of fixed, variable and benefit components, with a focus on identifying the metrics considered most effective in reflecting the medium-long term prospects of the Group.

The fundamental components of the Hera Group’s remuneration, the related purposes and the scope of recipients to whom they are applied, are summarized in the following table:

|

Component |

Description |

Purpose |

Administrative Executives |

Directors |

Executives |

Employees and Workers |

|---|---|---|---|---|---|---|

|

Fixed |

(Gross annual salary) |

Rewards technical, professional and managerial skills |

|

|

|

|

|

Short-term variable remuneration |

(Balanced scorecard) |

Rewards annual performance based on objectives linked to the company’s strategic priorities as well as the adoption of behaviours consistent with the leadership model |

|

|

|

|

|

(Incentive plan for sales staff) |

Applied to employees and managers holding commercial sales positions, rewards the achievement of commercial objectives |

|

|

|

||

|

(Performance bonus) |

Applied to the pool of workers, employees and managers, collectively rewards annual performance, based on the achievement of pre-set and measurable KPIs |

|

|

|

||

|

Medium-long term variable remuneration |

(Deferred incentive plan for management retention) |

Rewards medium and long-term performance with a view to retention |

|

|

|

|

|

Non-monetary benefits and welfare |

(Welfare plan) |

Integrates the remuneration package with a view to further strengthening manager retention |

|

|

|

|

|

(Other non-monetary benefits) |

Integrates the remuneration package with a total reward perspective |

|

|

|

|

|

|

Other components of remuneration |

(Non-competition agreement) |

Applied to key figures such as commercial staff, those linked to waste treatment or in the energy trading and the services sector, represents a hedging instrument against the transfer of competitive advantages to competitors |

|

|

|

|

|

|

applies to the entire workforce belonging to this category |

|||||

|

|

applies to a part of the workforce belonging to this category based on certain characteristics linked to the role and/or strategic nature of the position |

|||||

The Hera Group’s Remuneration Policy, in addition to providing specific rules and methodologies for the remuneration of management, defines some compensation guidelines to be applied to the remaining part of the company workforce. More specifically, concerning all organisational positions, including with reference to resources other than management, the market remuneration comparison is constantly updated both for the fixed remuneration components and for the variable components and benefits, and consequently the most suitable measures are adopted for internal process of a structured process aimed at rewarding individual contributions to the creation of added value, in addition to ensuring fair and sustainable working conditions.

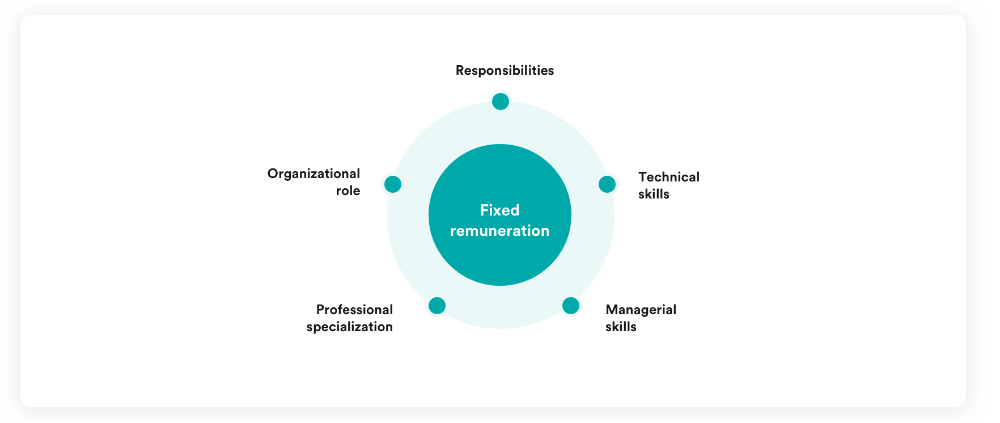

Therefore, the main remuneration components defined for management and the related purposes and characteristics are applied – mutatis mutandis and according to a proportionality criterion, the rationales of which are summarised in the graphic representation above – to the entire workforce, based on harmonisation and dissemination of the underlying principles indicated, also taking into consideration the working conditions of all employees and in full compliance with the principles of equality between individual demographic characteristics (gender, age, geographic origin, etc.).

Compensation and remuneration elements

The structure of the remuneration package, envisaged for the various offices, departments and positions, is defined with a view to balancing the fixed, variable and non-monetary monetary components, taking the specific risk profile of the Company into account.

The main components of remuneration for Hera Group Directors - and, within the limits of what is highlighted in paragraph II of the Executive Summary above, of other personnel - of the Hera Group are:

The fixed remuneration component is determined by the professional specialisation and the organisational role held with the related responsibilities. It therefore reflects the technical, professional and managerial skills, as periodically updated.

The levels of fixed remuneration component are established with respect to the specific nature of the company and its risk profile, with the aim of attracting and retaining highly capable resources.

For each manager, the benchmark remuneration level is elaborated starting from the weight of the organisational position held. The weight is defined by internal staff trained specifically and certified by specialised consultancy companies based on the rigorous application of the job evaluation methodology recognised as among best industry practice. The weight of the position is, therefore, tested against remuneration benchmarks with the reference markets, obtained from specialised industry companies that carry out remuneration surveys in which the Group participates and take into consideration for 2024 a total of 341 companies, of which 25% are Italian and 75% are foreign. In addition, 10% of the companies have a headcount of over 5,000.

With reference to the Executive Directors, the benchmark is further focused on the Group’s main direct competitors, such as A2A, Iren and ACEA as well as a select panel of companies in the energy industry belonging to the relevant external markets.

This process thus ensures internal equity as well as external competitiveness through a well-considered market benchmark, interpreted in light of the Company’s choice to adopt a salary positioning that is in the mid-market range.

The short-term variable component of remuneration is linked to the achievement of individual and Group objectives, which derive directly from the Company’s strategic priorities through the adoption of the balanced scorecard model.

| Recipients | Executive Directors – managers (directors, A and B managers) and executives of the Hera Group. |

| Objectives | Executive Directors: Group economic-financial objectives (Ebitda, net result, net debt and Ebitda CSV) and a Group customer satisfaction objective (ICS). The remaining recipients: performance objectives divided into three areas: a) project objectives; b) economic objectives of the budget unit; c) Leadership Area, weighted on the basis of the performance indicators applied for Executive Directors. |

| Incentivation level | Upon reaching 100% of individual objectives: percentage of the RAL, divided by recipient category, depending on the weight of the recipient’s position within the organization and the strategic value of the tasks. |

Recipients

The recipients of the BSC system are, in addition to the Executive Directors, all managers (divided into the following levels: directors, A managers and B managers) and executives of Hera Spa and of the companies belonging to the Group. With reference to the population of managers, for the year 2025, the perimeter includes 38 directors and 117 managers.

Structure of the targets

The short-term incentive system provides for the assignment of an individual BSC card to each recipient. With reference to the Executive Directors, the individual profile provides for the assignment of Group economic-financial and sustainability objectives (Ebitda, net result, net debt and Ebitda CSV) and of an indicator linked to the Group’s customer satisfaction survey (ICS).

For the remaining recipients, each BSC card includes individual objectives associated with specific performance indicators divided into three areas. The relative weight of each area and its contents are represented in the diagram below:

|

|

|

Target Project Area |

Economic Target Area, companies |

Leadership Area |

|---|---|---|---|---|

|

Weighting |

Directors |

50% - 80% |

10% - 40% |

10% |

|

Managers |

40% - 70% |

10% - 40% |

20% |

|

|

Executives |

70% |

- |

30% |

|

|

Content |

|

Defined on the basis of the Group’s strategic map, derived from the Business plan and in line with the medium-long term policies and objectives on all ESG dimensions

|

The result is automatically evaluated on the basis of the final values from the civil balance sheet of the economic indicators assigned with a “reached/not reached” logic |

Based on the degree of adoption of the behaviors envisaged by the leadership model adopted by the Group |

The individual result is subsequently weighted by a corporate result profile, which takes into account the performance recorded by the Group with reference, for 2025, to five parameters:

- Ebitda;

- Net result;

- Net debt;

- Shared-value EBITDA (CSV);

- Residential customer satisfaction index (ICS).

Measuring the targets

Individual performance is determined on the basis of the achievement of the objectives actually pursued and the specific weight of the single objective, according to the following methods:

| Target project achieved (rating level: 100%) | Target project almost completely achieved (rating level: 90%-80%-70%) | Target project partially achieved (rating level: 60%-50%) | Target project with significant deviations (rating level: 40%-30%- 20%-10%) | Target project not achieved (0% score) | |

|---|---|---|---|---|---|

| Indicators | All relevant targets achieved* or exceeded: 100% targets achieved | Most relevant targets achieved*: 75%<=targets <100% achieved |

More than half or half of relevant targets achieved*: 75%<targets <=50% achieved |

Only some relevant targets achieved*: 50%<target <=10% achieved |

No relevant target achieved* |

* Relevant targets are understood as those whose achievement is a prerequisite for the full achievement of the target project;

- economic objectives of the individual budget units: the result is automatically evaluated on the basis of the final values from the civil budget of the economic indicators assigned with an achieved/not achieved logic;

- adoption of the conduct envisaged by the leadership model: includes 360-degree observations that can be activated across the company organization and is consolidated through the involvement of the managers of the individual teams who evaluate the skills envisaged by the model.

The evaluation is carried out on the eight skills foreseen by the model and is calculated on the basis of the arithmetic mean of the evaluations associated with the skills; the target for each recipient is defined within an evaluation scale from one to five, a value that represents the excellence of expression of the single skill throughout the reference period; the percentage of achievement of the objective on behaviors is distributed over ten bands according to the following scheme:

| Arithmetic mean of the 8 evaluations | Result(%) |

|---|---|

| >=3,0 | 100% |

| > 2.8 and < 3.0 | 90% |

| > 2.7 and <= 2.8 | 80% |

| > 2.6 and <= 2,7 | 70% |

| > 2.5 and <= 2.6 | 60% |

| > 2.4 and <= 2.5 | 50% |

| > 2.3 and <= 2.4 | 40% |

| > 2.2 and <= 2.3 | 30% |

| > 2.1 and <= 2.2 | 20% |

| > 2.0 and <= 2.1 | 10% |

Based on the performance profile obtained by the Company on the five parameters, the weighting percentage to be applied to the individual results up to 115% of the result is defined according to the following scheme:

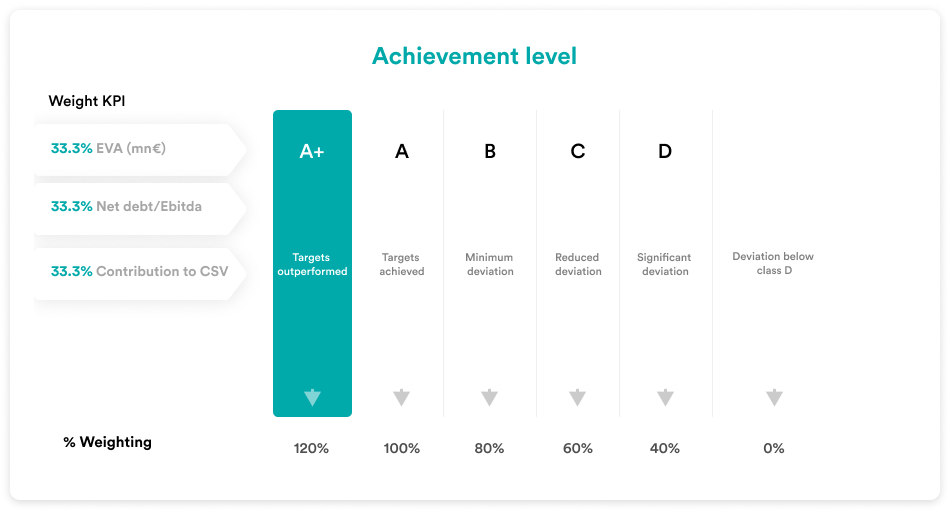

Each KPI is evaluated separately. The weighting percentage is determined by calculating the weighted average of the percentage values resulting from the results of each individual indicator. Any indicator that records a final result lower than class D (high deviation) will result in the value of the premium linked to the indicator being reset to zero. Only for the population with a managerial qualification, the weighting percentage in class A+ is equal to 120%.

Incentivation

The short-term variable remuneration provided by the Bsc system upon reaching 100% of the individual objectives has an amount expressed as a percentage of the Gross Annual Salary, including any gross fixed emoluments for the positions held, divided by category of recipients.

For managers, two levels of variable remuneration are foreseen (managers A and managers B) distinguished on the basis of the weight of the manager’s position within the organization and the strategic importance of the tasks.

The following table shows for the different levels, the % of variable remuneration and the maximum variable remuneration in case of maximum individual performance and over performance of all company targets:

| Position held | INDIVIDUAL VARIABLE MAXIMUM (A) | MAXIMUM COMPANY WEIGHTING (B) | MAXIMUM VARIABLE PAY IN RELATION TO GROSS ANNUAL SALARY (AXB) |

|---|---|---|---|

| Executive Chairman and CEO |

50% | 115% | 57.5% |

| Directors | 30% | 115% | 34.5% |

| A-class managers | 22% | 115% | 25.3% |

| B-class managers | 17% | 115% | 19.6% |

| B-class executives | 10% | 120% | 12.0% |

The tabel below shows the mechanism for measuring a director's maximum bonus:

| Component | Description | Example of exceeding company targets and maximum individual evaluation | Example of achievement of company targets and maximum individual evaluation |

|---|---|---|---|

| A | RAL (euro) | 100,000 | 100,000 |

| B | Target bonus (% Gross Annual Salary | 30% | 30% |

| C | Target bonus (euro) = A x B | 30,000 | 30,000 |

| D | Individual targets achieved (%) | 100% | 100% |

| E | Weighting coefficient company performance (%) |

115% | 100% |

| F | Bonus value paid (euro) = C x D x E | 34,500 | 30,000 |

Finally, and without prejudice to the provisions of paragraph 4.06 with reference to management (meaning the Executive Directors, as well as other employees with managerial qualifications), the Company, with reference to employees with managerial qualifications and the remaining personnel, reserves the right - with the aim of pursuing the purpose of rewarding significant contingent individual extra performances without generating permanent impacts on the fixed components of remuneration - to pay one-off bonuses, of a non-recurring and exceptional nature, objectively determined in relation to individual performances on the assigned objectives if significantly higher than the defined targets. In such circumstances, the amount of the bonus falls within the scope of predetermined values, expressed as a percentage of the fixed remuneration, in any case not exceeding 10%.

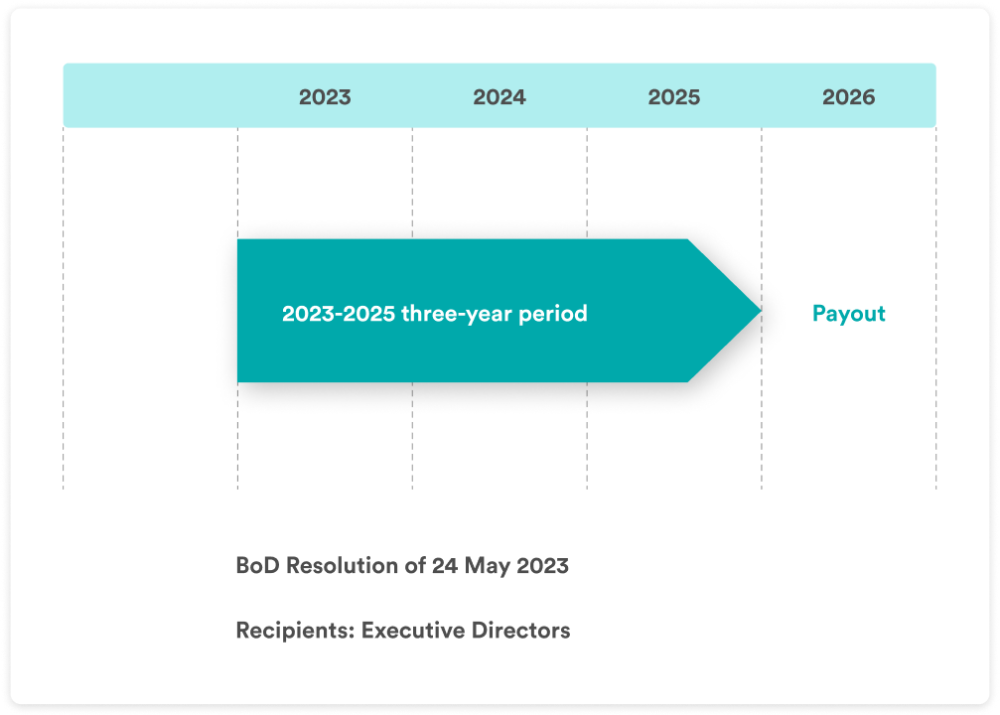

The medium-long term variable component of the remuneration is linked to a deferred monetary plan, approved by the Board of Directors following an evaluation of a series of elements:

- since the establishment of Hera, the Group has grown significantly in terms of company size, territory and final results;

- from the point of view of its management, the Group has reached a composition that is the result of a careful balance between the entry of new skills from the market and specific value-added skills already present;

- The Group enjoys a strong reputation and visibility on the market and, consequently, it is appropriate to adopt very selective retention actions for those executive resources who hold strategic roles, have high performance and high market risk.

| Recipients | Executive Directors – certain directors and managers |

| Targets |

The Group’s strategic objectives are based on three targets: Economic value added (EVA) or the cumulative target value of the three-year period, equal to the difference between the NOPAT(Net operating profit after taxes) and the WACC (Weighted average cost of capital) for the invested capital; the ratio of the end of the financial year to the last year of the three-year period between net debt and Ebitda; the percentage of Creating shared value (CSV) on Ebitda at the end of the financial year to the last year of the three-year period With the exception of Executive Directors, for the remaining recipients of the plan, the result achieved on the three targets is weighted on the basis of individual performance objectives and managerial capabilities |

| Incentivation level |

Executive Directors: the maximum three-year incentive provided for reaching 100% of the objectives is equal to 120% of the Gross Annual Salary. For other recipients of the plan: the maximum three-year incentive provided for reaching 100% of the objectives is equal to 100% of the Gross Annual Salary (therefore the corresponding theoretical annual quota is equal to 33% of the Gross Annual Salary) or to 50% of the Gross Annual Salary (therefore the corresponding theoretical annual quota is equal to 16.67% of the Gross Annual Salary). |

Recipients

The retention plan applies to Executive Directors in relation to the multi-year duration of their mandate, as well as to a limited number of directors and executives.

The definition of the scope of recipients is determined by applying the general criteria indicated below:

- identification of a small number of managers based on the weight of their organizational position, performance evaluation obtained within the development process and age;

- periodic evaluation mechanism for access and renewal / non-renewal of the allocation of the monetary plan, based on the criteria set out above;

- responsibility of the Executive Directors in choosing the beneficiaries also in relation to the evaluation elements based on the actual market risk of the individual professional profile.

Structure of the targets

From the point of view of aligning remuneration with performance, the retention plan incentivizes a commitment to the development of managerial skills, the level of individual performance and the achievement of the Group’s strategic objectives in a three-year perspective. The system provides for the assignment of an individual card to each recipient, containing a component evaluating individual performance and managerial skills and a component of strategic objectives of the Group.

The component for the evaluation of individual performance and managerial skills takes into account the positioning achieved by the recipients in the three-year period within the development process matrix (see par.4.02).

The component relating to the achievement of the Group’s strategic objectives aims to enhance the ability to create and share value, as well as further consolidate the culture of financial solidity of the Group in the medium-long term and further pursue the interests of stakeholders. This component includes three indicators of equal weight:

- Economic value added (EVA) or the cumulative target value of the three-year period, equal to the difference between the NOPAT (Net operating profit after taxes) and the WACC (Weighted average cost of capital) for the invested capital;

- the ratio of net debt to Ebitda at the end of the three-year period;

- the percentage of Creating shared value (CSV) on the Ebitda at the end of the financial year in the last year of the three-year period.

The following tables show the three-year plan currently in force and the related trend of the KPI targets with reference to the Executive Directors:

| Weight | KPI | 2023-2025 |

|---|---|---|

| 33.3% |

EVA (mn€) |

226 (with WACC at 5.8%) |

| 33.3% | Net debt/Ebitda (previous year) | 2.98 |

| 33.3% | Contribution to CSV (previous year) | 59% |

Measuring targets

The level of Group KPIs achieved can range from 0% up to 120% according to the following scheme:

Each indicator is evaluated separately. The overall achievement percentage will be determined by calculating the weighted average of the percentage values resulting from the results of each individual indicator. Any indicator that records a final result lower than class D results in the value of the premium linked to the indicator being reset to zero.

The evaluation parameter of the development process is given by the average of the evaluations in the three-year period on performance and managerial skills or by the annual positioning of each beneficiary within the following matrix which determines the relative weighting:

The evaluation parameter of the individual managerial capacity development process does not apply to Executive Directors, as the same evaluation elements are considered to be already expressed by the level of achievement of the Group KPIs.

Incentivation

For the Executive Chairman and Chief Executive Officer, the maximum three-year incentive value provided by the retention plan upon reaching 100% of the objectives is equal to 120% of the Gross Annual Salary.

For the rest of the Group’s management benefiting from the plan, the maximum three-year incentive, upon reaching 100% of the objectives, is equal to 100% of the Ral (therefore the corresponding theoretical annual quota is equal to one third of the Gross Annual Salary, or 33% of the Gross Annual Salary) or to 50% of the Gross Annual Salary (therefore the corresponding theoretical annual quota is equal to one third of the gross annual fixed remuneration, or 16.67% of the Gross Annual Salary), determined on the basis of the general criteria defined for the identification of the recipients.

The maximum value of the medium-long term remuneration is determined on the basis of the following calculation system for each three-year cycle:

| Three-year benchmark period |

Recipients | Benchmark RAL [A] | Maximum incentivation [B] | KPI level reached [C] | |

|---|---|---|---|---|---|

| 2023-2025 |

Executive |

RAL as of 30 April 2025 | 120% | 0%-120% range | [A] x [B] x [C] |

The incentive is paid in May of the fourth year - that is, the year following the completion of the three-year period of the medium-long term plan - provided that the beneficiary is still on the staff. With reference to beneficiaries confirmed as eligible in a subsequent long-term incentive plan, in order to limit the risk of abandonment after the bonus has been paid, the payment is expected in May of the second year as an advance (returned in the event of termination of the relationship) of the theoretical sum accrued for the first year of the three-year period, or to the target defined ex ante (advance of the first year equal to one third of the overall three-year bonus). The payment of the remaining amount (equal to two thirds of the bonus) is then expected in May of the fourth year. In the event that at the end of the period (at the end of the three-year period) the performance achieved results in a variable remuneration lower than the amount already paid as an advance, the difference will be deducted from the remuneration of the current year (fourth year).

Starting in 2017, with the aim of further strengthening the retention of the Group’s management, a welfare plan linked to the achievement of Group corporate objectives was introduced, intended for all employees with managerial qualifications, which provides for a payment in welfare quotas that can be spent within the services present within the existing corporate welfare program. The payment is directly linked to the level of achievement of the Group KPIs already used as an overall weighting of the results of the BSC system according to a scheme that, for each individual indicator, provides access to the bonus exclusively in the event of exceeding the relative defined target.

Each indicator is evaluated separately. The overall result is determined by calculating the weighted average of the percentage values resulting from the results of each individual indicator. The maximum value upon reaching 100% of the objectives of this plan is equal to 6% of the theoretical individual variable and precisely:

- Executive Directors: a maximum welfare bonus equal to 6% of 50% of the total Gross Annual Salary is foreseen (equivalent to 3.0% of the Gross Annual Salary);

- directors: a maximum welfare bonus equal to 6% of 30% of the Gross Annual Salary (equivalent to 1.8% of the Gross Annual Salary) is foreseen;

- managers: two distinct levels of maximum welfare bonus are foreseen, equal respectively to 6% of 22% of the Gross Annual Salary (equivalent to 1.3% of the Gross Annual Salary) and to 6% of 17% of the total Gross Annual Salary (equivalent to 1% of the Gross Annual Salary).

Furthermore, starting from 2016, in line with the implementation of the Group welfare plan launched in 2016, access to a flexible benefit plan has been defined for all Group employees, which determines the assignment of an individual quota of 395 euro in 2024. Finally, with reference to the entire non-managerial population of the Group, the possibility of converting up to 50% of the company performance bonus into goods and services included in the company welfare program is foreseen.

In line with best practices, the following main insurance coverages are provided: Directors & Officers (D&O) Liability for third party civil liability, professional and extra-professional accidents, death and permanent disability due to illness. Furthermore, the allocation of a company car for mixed use is foreseen for figures with managerial qualifications.

Not applicable to Executive Directors

Performance bonus

The performance bonus is a well-established instrument in the Hera Group. It is the subject of negotiation with the national trade union organizations that deal with the sectors in which the Hera Group operates (mainly the sectors relating to the gas-water, electricity and environment collective bargaining agreements). With the national trade unions, the specific indicators of the Company/Unit budget are defined year by year and for every three-year period, within the scope of the Group supplementary contract (second level agreement), the amount of the potential target bonus that is due to the employees, following the achievement of the pre-established results, is established. The current Group Agreement regulates the premium for the years 2025-2027.

The amount of the Bonus is divided into four parts and takes into account the profitability of the Hera Group, i.e. consolidated gross operating margin (Ebitda), shared value Ebitda and Ebitda/employees, as well as being conditioned by the achievement of specific objectives relating to increases in productivity, quality, efficiency and innovation.

It is expected that the employee will have the possibility, on a voluntary basis, to replace the cash performance bonus with company welfare services, within the limits and under the conditions established by law, for a maximum value of 50% of the annual bonus.

The agreement benefits from the decontribution, pursuant to art. 1 of Law 28 December 2015 n. 208, paragraph 189, as amended by the Legislative Decree April 24, 2017 n. 50, as a system of equal involvement of workers in the organization of work is foreseen, implemented starting from 2017, through the creation of working groups aimed at improving and/or innovating production areas and/or organizational/production models.

The agreement is also subject to the application of the preferential tax regime, pursuant to art. 1, paragraphs 182-189, of the Law 208/2015, as amended by Law 232/2016, and of the Ministerial Decree 25/03/2016.

Incentive systems for commercial professionals (Commercial Policy)

The commercial incentive policy aims to guide the personnel involved towards the achievement of predetermined objectives by ensuring a competitive economic incentive offer aligned with market practices. It applies to executives and employees of business areas and companies that have organizational roles directly linked to commercial duties.

The incentive model is characterized by the following elements directly related to the assigned commercial roles:

- recognition of a short-term variable emolument related to the achievement of individual objectives and budget units;

- concession of a company car for mixed use.

The assignment of the short-term variable occurs on an annual basis and provides for an economic compensation calculated as a percentage of the Gross Annual Salary through the assignment of a sheet that includes individual and group objectives (85%) and the adoption of the behaviors of the leadership model (15%). The evaluation result is subsequently weighted by a corporate performance profile, which takes into account the performance recorded by the Group.

Furthermore, a variable incentive model is also foreseen for the front-end staff of the Group’s sales companies, which includes the assignment of a card with individual (85%) and team (15%) objectives. The overall result is weighted according to the service quality index (SQI)) and the average waiting time of customers at the counter (Average Waiting Time (AWT)).

Non-competition agreement

In consideration of the particular value of the employment businesses as well as the attractiveness of key figures such as commercial ones, for professional skills related to waste treatment or in the trading and energy services sector - which constitute not only a source of knowledge and professional skills but also a significant opportunity to acquire customers, programs, methods, policies, etc. - the non-competition agreement was applied as provided for by art. 2125 of the Italian Civil Code for a duration of 24 months.

The agreement, in exchange for the anti-competitive obligations of the employees (with relative determination of the object, place and time of the constraint), provides for the provision of financial compensation in favour of the former. The gross amounts identified are payable monthly. In the event of a breach of the agreement, the employee will have to pay the company a multiplier of the amount received up to the date of termination within a predetermined limit, without prejudice to any other ordinary civil remedies.

| Cases in which severance pay is applicable | Ante tempus dismissal without just cause and the termination of employment relationship Expiry of office and termination of employment relationship Dismissal following non-renewal Dismissal following premature revocation without just cause |

| Access gate |

The severance indemnity shall not be granted if, at the time of termination of the position and/or employment relationship, the results achieved in at least two previous financial years in the last three are objectively inadequate, or, for each financial year, they have been achieved to a degree lower than class D with reference to all indicators. |

| Basis of the Calculation |

Gross Annual Total Remuneration, including a) the gross fixed annual remuneration and/or the fixed compensation pursuant to art. 2389 of the Italian Civil Code and b) of the annual average of the short-term variable remuneration in the three preceding years or in the shorter period of duration of the relationships |

| Measure | Gross Annual Total Remuneration * 1 (one), for seniority not exceeding 12 months; Gross Annual Total Remuneration * 1.5 (one point five), for seniority of more than 12 months and not more than 24 months; Gross Annual Total Remuneration * 2 (two), for seniority exceeding 24 months. Mandatory cap equal to Total Gross Annual Remuneration * 2 (two) |

| Condition of payment | Signing of an agreement that regulates the termination of all existing relationships containing a general and novation transaction, signed pursuant to art. 2113 of the Italian Civil Code |

| Deferral mechanisms | Payments: 80% within sixty days of signing pursuant to art. 2113 of the Italian Civil Code of the above agreement; a further 10%, within six months of signing pursuant to art. 2113 of the Italian Civil Code of the above agreement; the remaining 10%, within twelve months of signing pursuant to art. 2113 of the Italian Civil Code of the above agreement |

| Ex-post correction mechanisms | Clauses that allow, in the event of serious violations of the rules or fraudulent or grossly negligent conduct that causes damage, both to the Company’s assets and reputation, to (i) request and obtain the return, in whole or in part, of variable components of the remuneration (claw-back) and/or (ii) not to pay them, withholding the components subject to deferral (malus). |

In accordance with the regulatory framework referred to in the Introduction and with the fundamental purposes and principles set out in paragraph 4.01, the Company reserves the right to enter into agreements, in view of or on the occasion of the termination of the employment relationship and/or office, which provide for the recognition of payments to the Executive Directors (by which this is understood to mean both the Executive Directors who do not have simultaneous subordinate employment relationships with the Company and the Executive Directors who do), the purpose of which is to mitigate the risks associated with the termination of all relationships with the Executive Directors, by flat-rate payment in advance of all costs and risks associated with it (Severance Indemnity).

The aforementioned agreements, where stipulated, take into account – among other things – the duration of the employment relationship and/or the position held, to be assessed on the basis of the peculiarities of the reference market.

Severance pay is applicable in the following cases:

(i) ante tempus dismissal from the position of executive director without just cause, with the necessary simultaneous termination of the employment relationship, where it exists;

(ii) natural expiry of the office of executive director without renewal, also in this case with the necessary simultaneous termination of the employment relationship, where it exists;

(iii) resignation from the employment relationship - where existing - (a) occurring within three months following the failure to renew the position of executive director and (b) motivated by a change in activity substantially affecting the position held overall;

(iv) resignation from the employment relationship - where it exists - (a) occurring within three months following the early revocation from the position of executive director and (b) motivated by a change in activity substantially affecting the position held overall.

If none of the above-mentioned circumstances apply, the provisions of law and collective bargaining agreements applicable to the termination of office and of the subordinate employment relationship may apply.

In any case, the Severance indemnity will not be granted if, at the time of the termination of the office and/or of the subordinate employment relationship, the results achieved in at least two previous financial years in the last three financial years are objectively inadequate, meaning the results, for each financial year, were achieved in a degree lower than class D with reference to all the indicators from time to time envisaged for the short-term variable remuneration.

For the purposes of calculating the Severance indemnity, where applicable, only the gross annual total remuneration is taken into consideration, including a) the gross annual fixed remuneration and/or the fixed compensation pursuant to art. 2389 of the Italian Civil Code, granted to the person concerned at the time of termination of the employment relationship and/or office, and b) the annual average of the amount actually paid as short-term variable remuneration in the 3 (three) years preceding the time of termination of the employment relationship and/or office or in the shorter period of duration of the relationships (Gross total annual remuneration).

Severance, where applicable, is determined as follows on the basis of the duration of the longer of the employment relationship or the position:

(v) Gross annual total remuneration * 1 (one), for seniority not exceeding 12 months;

(vi) Gross annual total salary * 1.5 (one point five), for seniority of more than 12 months and not more than 24 months;

(vii) Gross annual total salary * 2 (two), for seniority exceeding 24 months.

The Severance indemnity, determined as above, may not, in any case, exceed the maximum mandatory amount of the Gross Annual Salary * 2 (two).

Severance pay absorbs - except as provided in the following paragraph 7.03 - Effects of termination of employment and/or office on incentive systems - any claim arising from all relationships with the Company and other companies in the Group, including notice or any compensation in lieu, the supplementary compensation provided for by the collective agreement applied for the unjustified dismissal of the manager and all possible damages, whether financial or otherwise, arising from the termination of the relationships, without prejudice to the right to payment of the severance pay and anything else due by law for the termination of the employment relationship (holidays, additional monthly payments, etc.).

Any Severance indemnity shall be granted only in the light of and within the scope of an agreement - signed pursuant to and for the purposes of art. 2113 of the Italian Civil Code - which regulates the termination of all relationships (both subordinate employment and administration) with the Company and with other companies of the Group and which provides, among other things:

a) the right of the Company to bring liability and/or compensation actions for facts/behaviors constituting fraud and/or gross negligence, not known at the time of termination of the employment relationship and/or office;

b) the waiver by the interested party of the variable remuneration quotas, both short-term (BSC) and medium-long term (LTI), which have been accrued, but not yet paid, except as provided in the following paragraph 7.03 - Effects of the termination of the relationship and/or office on the incentive systems;

c) the waiver by the person concerned of any future claim, action or demand against the Company and possibly against other companies of the Group, including for compensation, within the scope of a general novation transaction pursuant to articles. 1975 and 1976 of the Italian Civil Code, both with reference to the position and with reference to the subordinate employment relationship.

Any Severance indemnity shall be subject to:

(i) to deferral mechanisms, as described below: the Severance will be paid, as to 80%, within sixty days from the signature pursuant to art. 2113 of the Italian Civil Code of the above agreement, as to a further 10%, within six months of signing pursuant to art. 2113 of the Italian Civil Code of the above agreement, as for the remaining 10%, within twelve months of the signing pursuant to art. 2113 of the Italian Civil Code of the above agreement;

(ii) to ex post correction mechanisms, as described in the following paragraph 7.02 – Ex post correction mechanisms

Ex-post adjustment mechanisms

In relation to the variable components of remuneration (both short and medium-long term), as well as to Severance indemnity, the application is envisaged - within the limitation periods established by the current laws and regardless of the termination of the employment relationship and/or the position - of ex post correction clauses that allow the Company to (i) request and obtain the return, in whole or in part, of variable components of remuneration (claw-back) and/or (ii) not to pay them, retaining the components subject to deferral (malus). With reference to the Severance indemnity, these clauses shall be applied by the Company, following a determination by the Board of Directors against individuals who have engaged in conduct in serious breach of company rules (with particular regard to the Code of Ethics and the Organizational Model pursuant to Legislative Decree. 231/01), contractual or legal, or who have carried out fraudulent or grossly negligent conduct to the detriment, both financial and reputational, of the Company.

With reference to the short and medium-long term variable remuneration, these clauses shall be applied by the Company, following a determination by the Board of Directors:

(i) where it is ascertained that the variable components of the remuneration have been determined on the basis of circumstances and/or objectives whose existence and/or achievement are attributable to fraudulent or grossly negligent conduct of the person concerned or, in any case, carried out in violation of the reference rules (corporate, legal, contractual) or have been considered to exist and/or achieved on the basis of data which have subsequently been revealed to be manifestly incorrect, including cases in which the person concerned, with fraud or gross negligence, has altered the data used for the existence and/or achievement of the circumstances and/or objectives themselves;

(ii) against individuals who have carried out conduct in serious breach of company regulations (with particular regard to the Code of Ethics and the Organizational Model pursuant to Legislative Decree. 231/01), contractual or legal, or who have engaged in fraudulent or grossly negligent conduct to the detriment, both financial and reputational, of the Company.

The above provisions regarding malus and claw-backs shall be implemented with respect to the Executive Directors through specific individual agreements, without prejudice to any other action being brought or remedy permitted by law to protect the interests of the Company and other companies in the Group.

Effects of termination of employment and/or office on variable remuneration systems

General regulations

Generally speaking, in the event of termination of the employment relationship and/or office, the person concerned shall forfeit, for all purposes and effects, any right to payment of variable remuneration, whether short-term or medium-long-term, even if already accrued.

Specifically:

• with reference to the short-term variable remuneration system (BSC), if, on 31 December of the year of accrual, the employment relationship and/or the position of the person concerned have ceased and/or the notice period has expired, the person concerned shall forfeit, for all purposes and effects, any right deriving from the BSC system, including both the right to the relevant payment (not even pro rata temporis), and the right to compensation and/or reimbursement for such non-payment;

• with reference to the LTI variable remuneration system, if, on the date of expected payment of such remuneration (i.e. after the date of approval of the financial statements relating to the last year of the three-year cycle), the employment relationship and/or the office of the person concerned have ceased and/or in the notice period, the person concerned shall forfeit, for all purposes and effects, any right deriving from the Lti system, including both the right to the relative payment (not even pro rata temporis also with reference to any advances already paid), and the right to indemnities and/or compensation for such non-payment.

Specific regulations only applied in the event of severance pay actually due

Only in cases of the actual granting of the Severance indemnity as set forth above and subject to all the conditions provided for in Section 7.01 - Severance Indemnity (including the signing of the agreement pursuant to Art. 2113 of the Italian Civil Code referred to in paragraph 7.01 - Severance Indemnity), shall the following rules be exclusively applied.

Specific regulations only applied in the event of severance pay actually due as per cases II or III (non-renewal)

In the event of the termination of the office (and, where applicable, of the employment relationship), the person concerned shall forfeit, for all purposes and effects, any right to payment of the variable remuneration accruing, whether short-term or medium-long term LTI, without prejudice to the right to payment of the variable remuneration accrued only, as specified below.

Specifically:

(i) with reference to the short-term variable remuneration system (BSC), if, on the date of termination of the office (and, where applicable, of the employment relationship), such remuneration has already been accrued by the person concerned and, on the date of expected payment of such remuneration, the office (and, where applicable, the employment relationship) of the person concerned has ceased and/or the notice period has expired, the interested party will be entitled to the payment of such remuneration, with the application of all additional terms, conditions and constraints provided for this type of remuneration pursuant to the regulations applicable from time to time;

(ii) with reference to the medium-long term variable remuneration system LTI, if:

a) on the date of termination of the office (and, where applicable, of the employment relationship), such remuneration has already been accrued in full by the person concerned (with overall accrual being understood as the successful completion by the interested party of the entire three-year cycle and the satisfaction of all the requirements provided for its accrual) and, on the date of expected payment of such remuneration (i.e. after the date of approval of the financial statements relating to the last year of the three-year cycle), the office and, where applicable, the employment relationship of the person concerned have ceased and/or with notice, the person concerned shall be entitled to the payment of such remuneration, with the application of all the additional terms, conditions and constraints provided for this type of remuneration pursuant to the regulations applicable from time to time, without any acceleration and, therefore, with possible payment after the date of approval of the financial statements relating to the last year of the three-year cycle;

b) at the date of termination of the office and, where applicable, of the employment relationship, such remuneration has not already been fully accrued by the person concerned (with overall accrual being understood as the successful completion by the person concerned of the entire three-year cycle and the satisfaction of all the requirements provided for its accrual), the person concerned shall forfeit, for all purposes and effects, any right deriving from the LTI system, including both the right to the relevant payment (not even pro rata temporis), and the right to compensation and/or reimbursement for such non-payment.

Specific regulations only applied in the event of severance pay actually due as per cases I or IV (revocation ante tempus)

In the event of termination of the office and, where applicable, of the employment relationship, the person concerned shall forfeit, for all purposes and effects, any right to payment of the variable remuneration accruing, whether short-term or medium-long-term, without prejudice to the right to payment of the variable remuneration accrued only, as specified below.

Specifically:

(i) with reference to the short-term variable remuneration system (BSC), if, on the date of termination of the office and, where applicable, of the employment relationship, such remuneration has already been accrued by the person concerned and, on the date of expected payment of such remuneration, the office and, where applicable, the employment relationship of the person concerned have ceased and/or under notice, the person concerned shall be entitled to the payment of this remuneration, with the application of all additional terms, conditions and constraints provided for this type of remuneration pursuant to the regulations applicable from time to time;

(ii) with reference to the medium-long term variable remuneration system LTI:

a) if the position and, where applicable, the employment relationship of the interested party are terminated and/or the notice period is terminated before the person concerned has successfully completed the first year of the three-year cycle, the interested party will forfeit, for all purposes and effects, any right deriving from the Lti system, including both the right to the relevant payment (not even pro rata temporis), and the right to compensation and/or reimbursement for such non-payment;

b) if the office and, where applicable, the employment relationship of the person concerned are terminated and/or in the notice period after the interested party has successfully completed at least the first year of the three-year cycle, the person concerned shall be entitled to the payment of such remuneration determined pro rata temporis on an annual basis based on the full years of the three-year cycle as well as based on the level of successful completion by the person concerned of the three-year cycle, with the application of all additional terms, conditions and constraints provided for this type of remuneration pursuant to the regulations applicable from time to time, without any acceleration and, therefore, with possible payment after the date of approval of the financial statements relating to the last year of the three-year cycle;

c) upon the date of termination of the office and, where applicable, of the employment relationship, such remuneration has already been accrued in full by the person concerned (with overall accrual being understood as the successful completion by the person concerned of the entire three-year cycle and the satisfaction of all the requirements provided for its accrual) and, on the date of expected payment of such remuneration (i.e. after the date of approval of the financial statements relating to the last year of the three-year cycle), the office and, where applicable, the employment relationship of the person concerned have ceased and/or in the notice period, the person concerned shall be entitled to the payment of such remuneration, with the application of all the additional terms, conditions and constraints provided for this type of remuneration pursuant to the regulations applicable from time to time, without any acceleration and, therefore, with possible payment after the date of approval of the financial statements relating to the last year of the three-year cycle.

If, at the time of occurrence of the events from I. to IV. referred to in paragraph 7.01 - Severance Indemnity, the person entitled to the Severance indemnity has received the payment of LTI advances, these will remain acquired and the person concerned will not have to restitute them to the Company.

Stock options

In line with its highly conservative risk profile, Hera has chosen not to make use of volatile financial instruments such as option rights or other similar instruments.

The Group does not use benefit policies involving the distribution of stock options to its own employees.

The table below summarises the remuneration components awarded to directors.

| POSITION | FIXED REMUNERATION | SHORT-TERM VARIABLE REMUNERATION | DEFERRED VARIABLE REMUNERATION FOR MANAGEMENT RETENTION | NON-MONETARY BENEFITS | COMPENSATION |

|---|---|---|---|---|---|

| Chairman |

|

||||

| CEO | |||||

| Vice Chairman | |||||

| Non-executive directors |

Page updated 24 Jun 2025

Creating shared value report 2024