Hera Overview

Hera pursues a growth strategy based on a multi-utility model, concentrated on four main businesses: gas, electricity, water and waste management. This allows us to maintain a balanced portfolio that includes both regulated and free-market activities, and that provides the foundation on which to proceed along our path of continuous and constant growth.

This multi-business strategy has always been linked to sustainability and focused on the creation of shared value, in line not only with the Mission but also with the 'Purpose', which in 2021 was incorporated into Article 3 of the Articles of Association: the Company organises and carries out its business activities also in order to promote social equity and contribute to achieving carbon neutrality, the regeneration of resources and the resilience of the services system managed for the benefit of customers, the ecosystem of its territory and future generations. (Hera for the Planet, People and Prosperity).

These are the business areas and the national ranking:

This multi-utility model has proven its effectiveness in pursuing growth both internally, through synergies and increased market shares, and through M&A transactions.

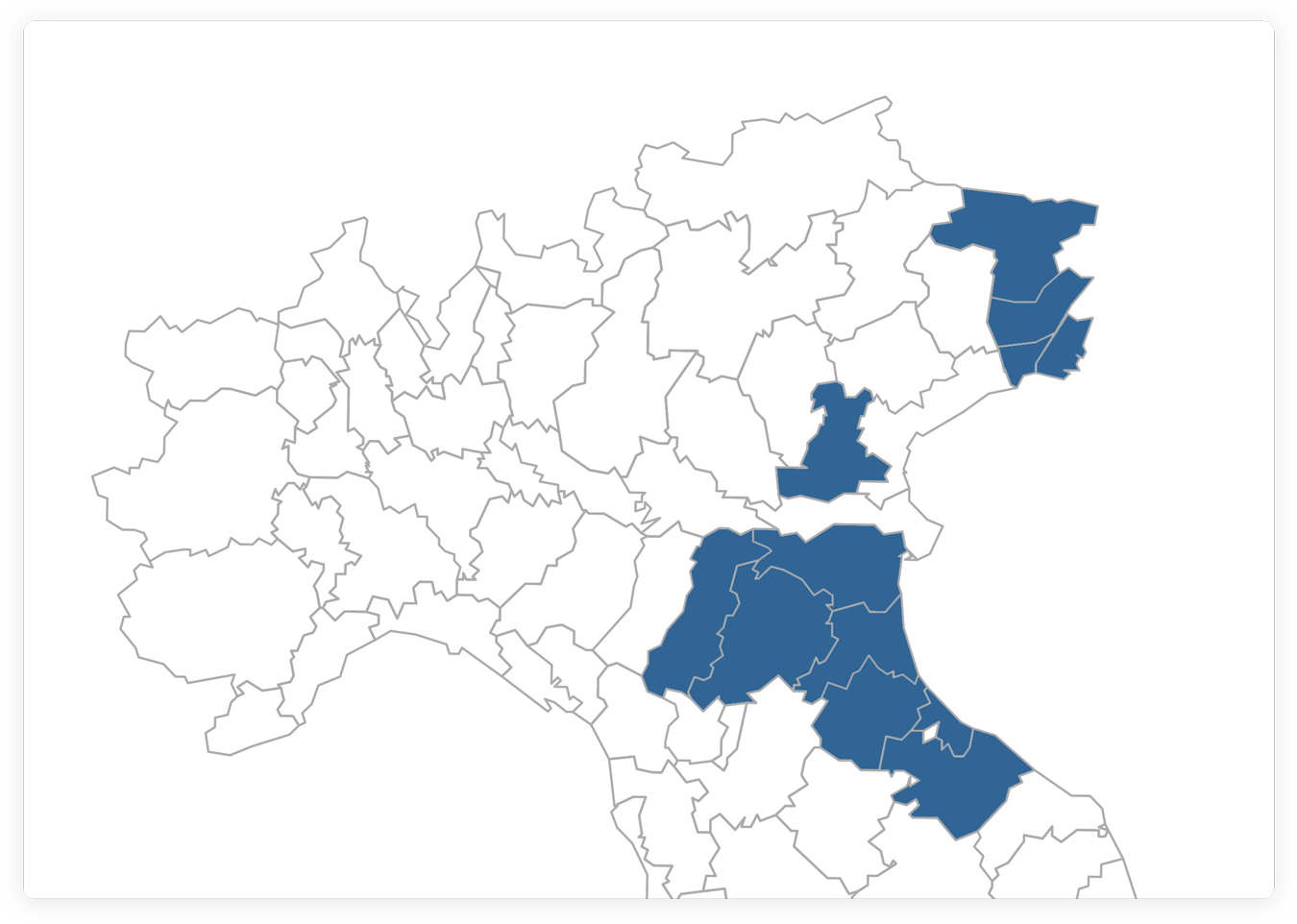

Born out of a merger between 11 multi-utilities, Hera has become the main aggregating figure in the sector. Thanks to approximately 40 M&A transactions carried out until present, it has expanded its presence in four regions in North-Eastern Italy, among the richest areas in the country.

| COMPANY | BUSINESS/ACTIVITIES | PRESS RELEASE/PRESENTATION | % STAKE |

|---|---|---|---|

| Ambiente Energia Srl | Waste services | 22/07/2025 | 100% |

| EstEnergy | Electricity and gas sales | 16/12/2024 | 100% |

| TRS Ecology | Waste services | 30/07/2024 | 70% |

| SOELIA | Distribution networks | 11/06/2024 | 100% |

| ASCO TLC | IT-TLC | 27/09/2023 | 100% |

| Tiepolo srl | Energy efficiency | 06/07/2023 | 100% |

|

F.lli Franchini Srl |

Electricity services |

60% | |

|

A.C.R. di Reggiani Albertino Spa |

Waste services |

60% | |

|

Macero Maceratese |

Waste services |

70% | |

|

Con Energia S.p.A. |

Energy sales |

13/04/2022 |

100% |

| Gruppo Vallortigara | Waste services | 09/09/2021 | 80% |

| Recycla SRL | Waste services | 30/06/2021 | 70% |

| EstEnergy (Joint Venture with Ascopiave) | Electricity and gas sales | 19/12/2019 | 52% |

| Pistoia Ambiente | Waste management services | 30/07/2019 | 100% |

| Cosea Ambiente | Waste services | 09/05/2019 | 100% |

| CMV Servizi | Gas distribution | 26/02/2019 | 100% |

| CMV Energia e Impianti | Electricity and gas sales | 26/02/2019 | 100% |

| Sangroservizi | Electricity and gas sales | 20/03/2018 | 100% |

| Megas.net | Gas distribution | 07/03/2018 | 100% |

| Blu Ranton | Electricity and gas sales | 08/02/2018 | 100% |

| Teseco | Waste services | 30/01/17 | 100% |

| Aliplast | Waste services | 11/01/17 | 100% |

| Gran Sasso | Electricity and gas sales | 06/10/16 | 100% |

| Julia servizi più | Electricity and gas sales | 08/04/16 | 100% |

| Geo Nova | Waste services | 29/12/2015 | 100% |

| Waste Recycling | Waste services | 23/12/2015 | 100% |

| Alento gas | Gas sales | 26/01/2015 | 100% |

| Ecoenergy | Waste services | 27/11/2014 | 100% |

| Amga Udine | Multi utility | 25/06/2014 | 100% |

| Fucino gas | Gas sales | 13/01/2014 | 100% |

| Est Reti Elettriche | Electricity distribution | 12/12/2013 | 100% |

| Isontina Reti Gas | Gas distribution | 30/09/2013 | 100% |

| AcegasAps | Multi-utility | 25/07/2012 Analyst presentation |

100% |

| Sadori | Gas sales | 14/04/2011 | 50% |

| Enomondo | Biomass combustion plant | 11/01/2011 | 40% |

| Aimag | Multi-utility | 12/10/2009 | 25% |

| Tamarete Energia | CCGT | 17/12/2008 | 32% |

| Megas Trade | Electricity and gas sales | 28/07/2008 | 100% |

| SAT | Multi-utility | 16/10/2007 23/07/2007 08/08/2006 19/10/2006 |

100% |

| Marche Multiservizi | Multi-utility | 23/07/2007 | 41.8% |

| Aspes | Multi-utility | 28/06/2007 27/07/2006 |

49.8% |

| Enel electricity distribution grid in Modena | Electricity distribution | 27/06/2006 13/03/2006 |

100% |

| Geat Distribuzione Gas | Gas distribution | 29/06/2006 | 100% |

| Meta SpA | Multi-utility | 24/06/2005 Analyst presentation |

100% |

| Ecologia Ambiente | WTE | 06/07/2004 Analyst presentation |

100% |

| SET | CCGT | 15/12/2004 | 39.0% |

| Calenia Energia | CCGT | 28/09/2004 | 15.0% |

| Agea SpA | Multi-utility | 27/07/2004 Analyst presentation |

100% |

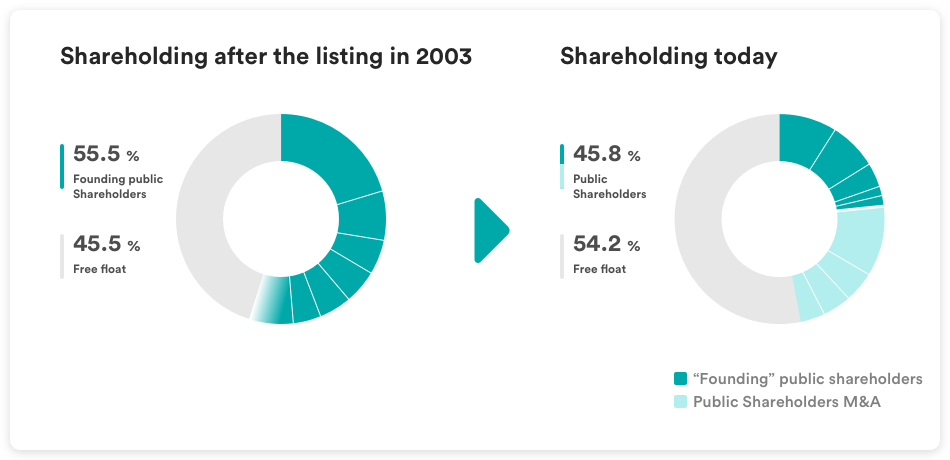

Mergers have been completed with multi-utilities held by public bodies, through share swaps with non-dilutive multiples. The entrance of new “partners” among shareholders has increased the number of the latter, almost doubling the amount of ordinary shares (from 787 million in 2002 to roughly 1.5 billion).

Thanks to the synergies extracted from these mergers, they have always created value for shareholders, who have benefitted from a progressive and more than proportional increase in profits per share.

Hera’s strong point in these mergers has always been its inclusive governance, which has favoured the entrance within the Group of public shareholders located in areas bordering those previously served.

Transactions involving acquisitions have mainly been carried out in free-market sectors (energy sales and waste management), following a rationale aimed at reinforcing the asset portfolio, and have been finalised with cash.

Making the most of economies of scale, broadening markets, boosting investments and evolving the management of activities towards increasingly sustainable and inclusive approaches: these are the drivers of the internal growth that represents the most important factor underlying growth in result.

Page update 12 november 2025