Governance overview

Governance Overview

- Group

- Investors

- Hera Overview

- Governance overview

The Group has adopted a traditional governance model, based on a Board of Directors marked by:

- an integrated system, strongly oriented towards sustainability (mission, code of ethics, Ethics and sustainability committee, strategy and planning);

- stability and continuity in management;

- an organisational-governance structure geared towards careful risk management;

- a system of remuneration oriented towards performance and in line with stakeholder interests;

- a stable shareholder breakdown, balanced between private investors and public shareholders (the first Italian multi-utility whose amount of public shareholders is lower than 50%).

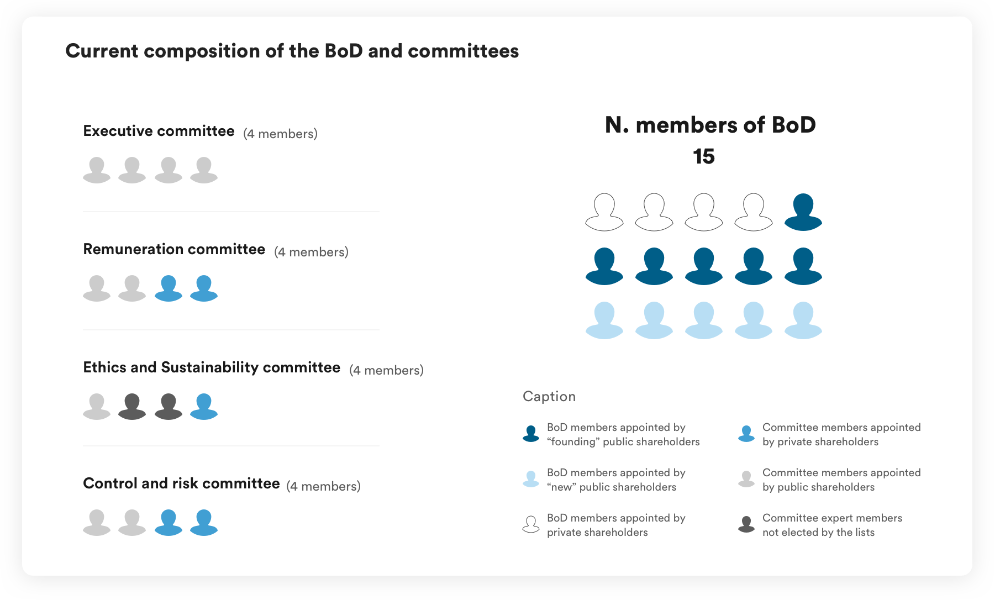

Representation in the BoD

Hera’s Board of Directors is made up of 15 members, including 2 executive members (the Executive Chairman with operating mandates and the CEO) and 13 non-executive independent members.

All members of the BoD are elected at the same time, every three years, through a voting mechanism based on lists, during the Shareholders meeting.

Two or more lists can be presented: 1) a majority list, responsible for electing 11 members; 2) one or more minority lists, responsible for electing 4 members.

Some elected members are then appointed as members of various committees, according to their individual skills and the lists they belong to.

Remuneration of executive members

Remuneration of Top management and coordination with stakeholder interests

In line with its mission, Hera’s system for remuneration has always proven to be highly effective in satisfying both investors and the other main stakeholders.

The accumulated total shareholders return has indeed always remained positive since being listed (in 2003), so much so that it has even offset the periods of crisis witnessed by financial markets over these years (Lehman Brothers, European sovereign debt crisis for outlying nations, National political crises, crisis in Ukraine, liberalisation of the gas sales market, referendum on water, seasons with an abnormal climate, delays in gas tenders, revisions of tariffs, reductions of incentives on renewable energy, Robin Tax, restrictions in constructing new waste treatment plants).

Total shareholders’ return from 2003 (year of Hera listing on the stock exchange) (€)

| year | Capital Gain (€) | Dividend (€) | Total return (€) | Return in percentuale (vs Prezzo IPO) | TSR cumulate dall'IPO |

|---|---|---|---|---|---|

| 2003 | (0.01) | +0.000 | (0.01) | (0.7%) | (0.7%) |

| 2004 | +0.88 | +0.053 | +0.93 | +74.6% | +73.9% |

| 2005 | +0.14 | +0.057 | +0.20 | +15.8% | +89.7% |

| 2006 | +1.04 | +0.070 | +1.11 | +88.6% | +178.3% |

| 2007 | (0.24) | +0.080 | (0.16) | (12.8%) | +165.5% |

| 2008 | (1.57) | +0.080 | (1.49) | (118.8%) | +46.7% |

| 2009 | +0.13 | +0.080 | +0.21 | +17.0% | +63.7% |

| 2010 | (0.06) | +0.080 | +0.02 | +1.3% | +65.0% |

| 2011 | (0.46) | +0.090 | (0.37) | (29.8%) | +35.2% |

| 2012 | +0.13 | +0.090 | +0.22 | +17.4% | 52.6% |

| 2013 | +0.42 | +0.090 | +0.51 | +41.1% | +93.7% |

| 2014 | +0.31 | +0.090 | +0.40 | +31.6% | 125.3% |

| 2015 | +0.49 | +0.090 | +0.58 | +46.5% | 171.8% |

| 2016 | (0.26) | +0.090 | (0.17) | (13.3) | +158.5% |

| 2017 | +0.74 | +0.090 | +0.83 | +66.5% | +225.0% |

| 2018 | (0.26) | +0.095 | (0.16) | (12.9%) | 212.1% |

| 2019 | +1.23 | +0.100 | +1.33 | 107.9% | 319.0% |

| 2020 | (0.92) | +0.100 | (0.82) | (65.6%) | 253.4% |

| 2021 | +0.68 | +0,110 | +0,79 | +63,2%) | +316,7 |

| 2022 | (1.14) | +0.120 | (1.02) | (81.7%) | +234.9% |

| 2023 | +0.45 | +0.125 | +0.575 | +45.8% | +280.7% |

| 2024 | +0.45 | +0.14 | +0.59% | +47.0% | +327.7% |

| 22 years | +2.17 | +1.92 | +4.10 | +327.7% |

The average rate of growth in TSR (+7% CAGR) is in line with the average rate of growth in net profits (+9% CAGR) from 2003 to 2024;

The remuneration system incentivises:

- improvement in the Group’s operating-financial fundamentals, both over the short and the long term,

- a conservative management of the risk profile, which aims strategy towards a sustainable approach, in which the models of a circular economy and limiting the impact of climate change, protecting the group’s equity and assets, play a crucial role.

The short-term remuneration system depends on reaching the following operating and financial goals, each of which is assigned a specific weight within the overall set of objectives:

- 30% Ebitda

- 20% Net profit

- 25% Net debt/Ebitda

- 25% Customer satisfaction rate

Hera’s system for remuneration also includes a long-term variable portion (3 years, in line with the length fo the term of office) and is based on 3 parameters with an equal weight:

- 33% Enterprise Value Added (NOPAT-WACC)

- 33% Creation of Shared Value

- 33% Debt/Ebitda

Hera’s variable remuneration system is thus strongly tied to the company’s performance.

The system’s efficiency is also clear by observing the trends concerning results from management and sustainability KPIs achieved since listing.

The double vote

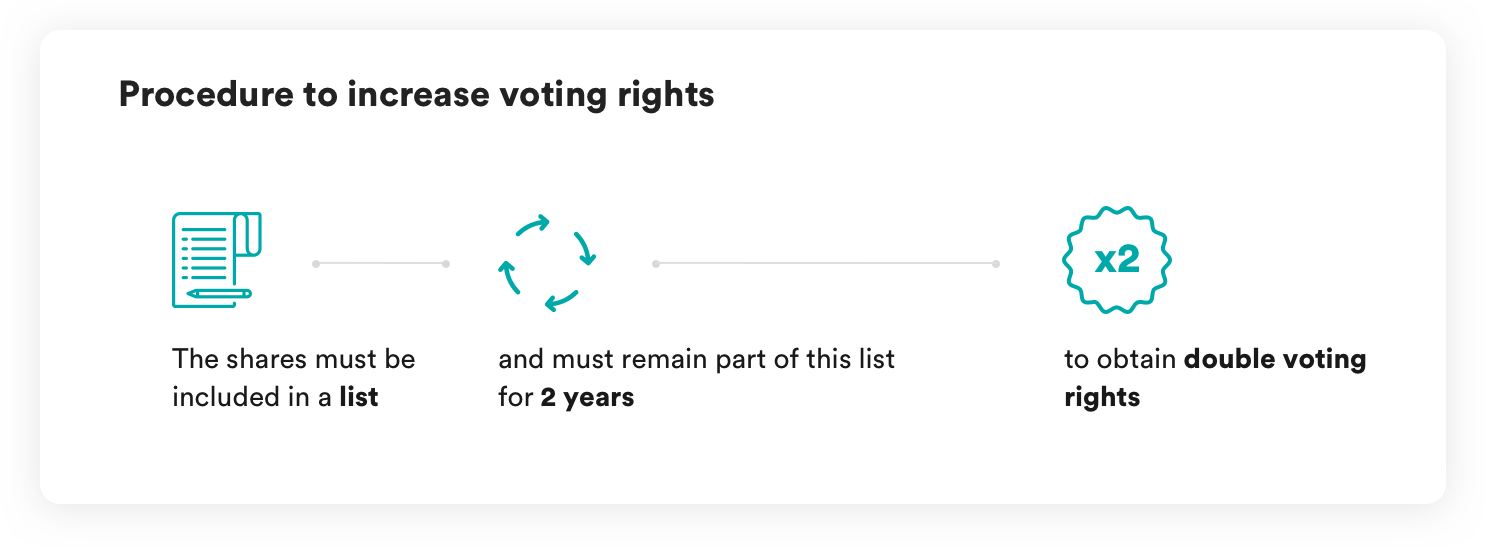

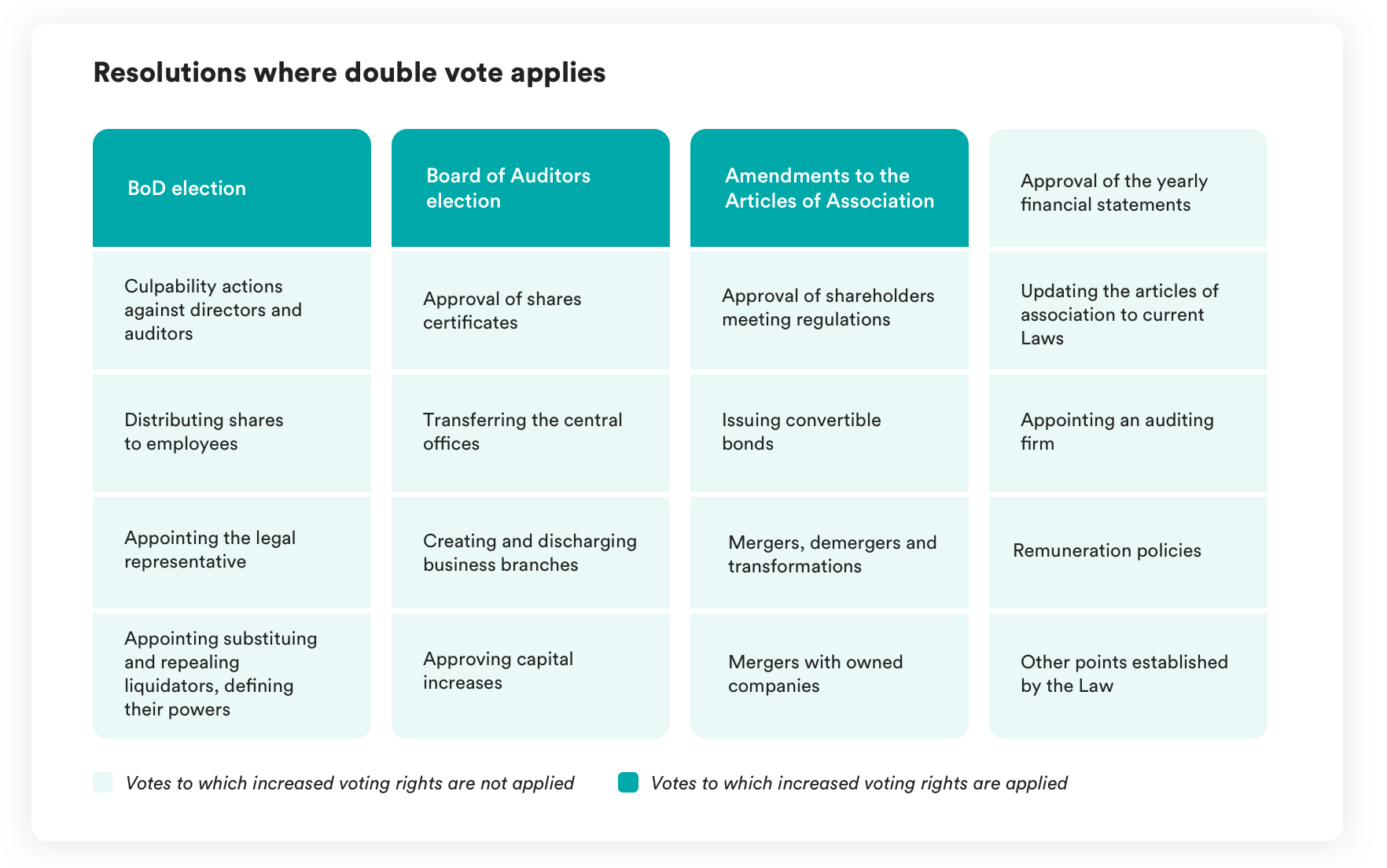

In order to encourage shareholders to adopt an investment policy covering a longer period of time, Hera has applied the mechanism of increased voting rights, provided for by law, for shareholders who maintain their shares for more than two years. If they so request, they are included in a special list of shares. After holding shares uninterruptedly for 24 months, each share is given 2 votes while voting on Shareholders Meeting resolutions, with the exception of resolutions regarding changes in the Articles of Association pertaining to increased voting rights and the maximum amount of shareholding foreseen.

Increased voting rights were introduced while calling for

- an increase in the number of members of the BoD (from 14 to 15), to increase the number of those representing private shareholders;

- a decrease in the minimum shareholding required (from 2% to 1% of the share capital) to present lists for the election of the company’s Auditors.

- Public entities control will stay unchanged and unchangeable

- Multiple voting rights: Restricted application, "1 share, 1 vote" the fundamental system

- Multiple voting rights imply no reduction in minorities' power to appointment the BoD members

- Increased BoD members of 1 person to the benefit of Minorities: up to 27% of BoD

- Purpose of introducing multi vote is to underpin further consolidation through mergers

Page update 26 March 2025