Words to understand

Asset Publisher

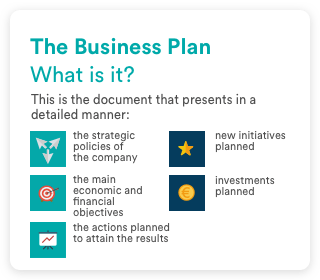

Business Plan

The business plan (or strategic plan) is the document that presents in a detailed manner the strategic policies of the company, the main economic and financial goals, the actions that are to be taken to attain the expected results, new initiatives or planned investments and the related impacts on company performance.

Code of Ethics

A Code of Ethics is one of the instruments of a company’s corporate responsibility.

The Code describes the obligations and responsibilities Hera employees are expected to assume in carrying out their duties for the company.

It aims to direct the management of such activities according to the ethical values and operating principles defined to build a positive corporate reputation through unequivocal behavior and the satisfaction of stakeholder needs.

Company boards

The term “company boards” means the entities of a company, that are responsible for the management and control of the company.

Control and Risk Committee

The Internal Control Committee monitors the efficiency of the internal control system and company transactions, the reliability of the financial data, compliance with laws and regulations and the protection of company assets. The Committee also maintains relations with related parties and expresses opinions, including binding opinions, in the case of transactions involving high amounts.

Corporate Governance Models

Corporate governance is defined as the set of instruments, rules, relationships, processes and business systems used to ensure the correct and efficient management of the company, intended as a system that compensates the (potentially divergent) interests of minority shareholders, controlling shareholders and directors of a company.

Ethics and Sustainability Committee

The Ethics and Sustainability Committee promotes the dissemination and implementation of the principles of the Code of Ethics, and may carry out investigations if reports of breach are received, and reports periodically to the Board of Directors.

As regards sustainability, the Committee promotes and monitors the commitment in terms of sustainable development, in line with the approach integrates sustainability in business activities, above all with respect to the objectives of sustainable development and the creation of shared value.

Finally, at the request of the Board of Directors, the Committee provides an opinion on specific sustainability issues.

Executive Committee

The Executive Committee expresses a prior opinion, on particularly important matters such as the annual Business Plan, Budget, draft Financial Statements, proposals for the appointment of First Level Managers, before presentation to the Board of Directors.

The Committee also has a role in decision-making processes involving matters with economic and financial implications for amounts above the limits provided for the Chairman and the Chief Executive Officer.

Internal auditing

Internal Auditing is an independent and objective assurance and consulting activity, whose purpose is to improve effectiveness and efficiency of the company. Internal Auditing assists the Company in the pursuit of its objectives through a systematic professional approach, that generates added value given that it aims at assessing and improving the control, risk management and corporate governance processes.

Internal dealing

The Internal Dealing procedure regulates how financial transactions carried out by persons holding specific positions within the issuing company are communicated to the market.

Lobbying policy

When we talk about a lobbying policy we refer to the activities with which an organized group of people or companies (in the English lobby) exerts pressure on the political system.

The interest group works in such a way as to influence political decision-makers from the outside, whether they are representatives of the legislative or executive bodies, the Authorities and control bodies or the implementation function carried out by the public administration.

Role of Consob

CONSOB regulates, authorises, supervises and controls Italian financial markets in order to protect investors and ensure the efficiency, transparency and development of the securities market. In order to achieve these goals, the Commission, through regulations, self-regulate its organisation and operation with the sole constraint of the legitimacy check carried out by the Presidency of the Council of Ministers.

Self-Regulatory Code

The Self-Regulatory Code establishes the principles of the control and risk management system.

Share Swaps

A share swap means establishing the number of shares (or quota in the case of a limited liability company) that the acquiring company or the company resulting from the merger must recognise to the acquired company or the merger participants in exchange of the old shares (or quota) held.

Shareholders' Meeting

The shareholders' meeting is the decision-making body of a corporation. The shareholder’s meeting has very important duties such as approving the financial statements or electing the board of directors. Substantially, the shareholders’ meeting represents the requests of the owner, in other words, of the shareholders of the company.

Stages of the corporate merger process

A merger is one of the most common methods used to join companies.

Stakeholders

Stakeholders are stakeholders or groups of stakeholders that depend on the company to attain their objectives.

Stock options

Stock options are incentive tools that are usually granted to top management and board members of a company or employees.

These plans entitle the employee to purchase or subscribe securities representing the company's risk capital.

Whistleblowing

The term whistleblowing is intended as the reporting of any suspected violation of the organization and management model, in line with the ethical principles provided by the Code of Ethics. The scope is to prevent corruption, alleged crimes, fraud, corruption or any other type of illegal activity, relevant or otherwise within the meaning of the liability pursuant to Legislative Decree 231/2001.