FY2022 Results

The results of a multi-business strategy and long-term value creation, rising to tomorrow’s challenges today

Online report Y2022

FY2022 Results

The results of a multi-business strategy and long-term value creation, rising to tomorrow’s challenges today

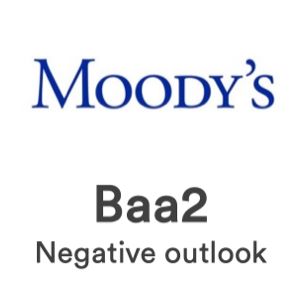

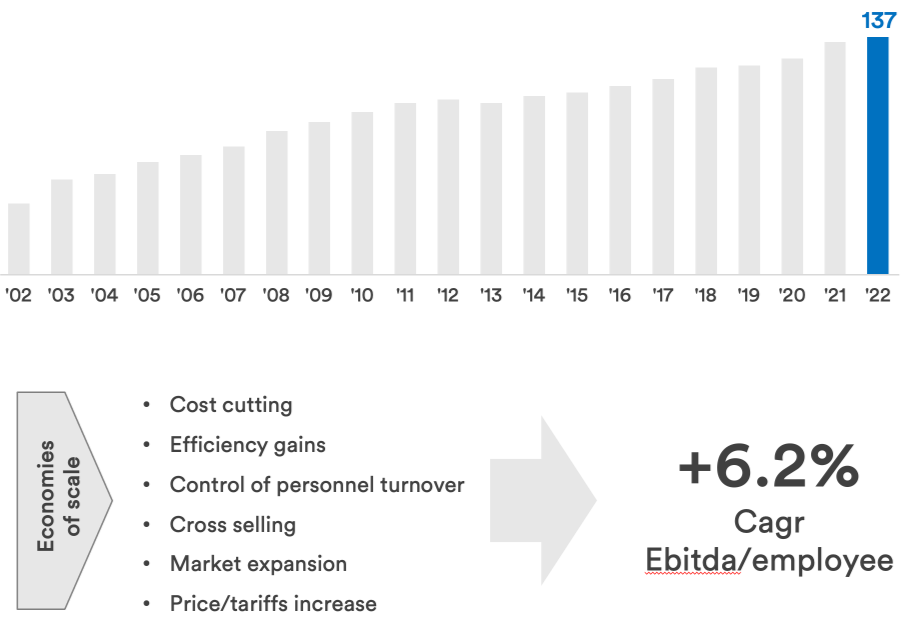

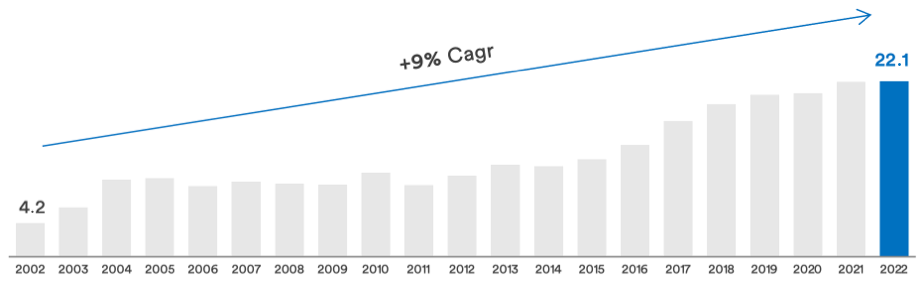

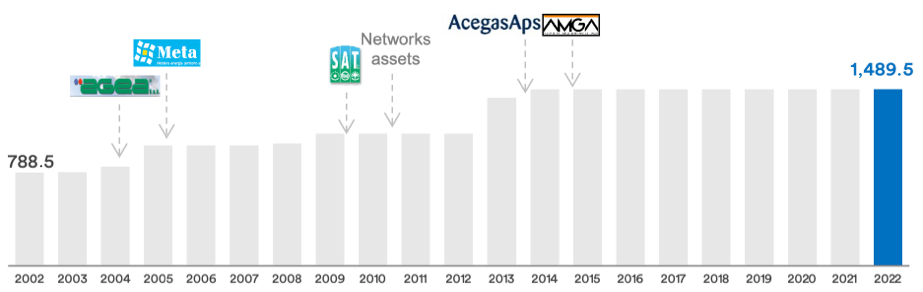

"The 2022 financial year closed positively, with results exceeding expectations and fully consistent with previous quarters. After 2021, this is one of the best growth rates recorded in more than twenty years by the Hera Group, all the more appreciable in light of the external context in which it was achieved."

"The positive results achieved allow us to face the future with confidence, continuing to invest to grow and increase the resilience and digitisation of our infrastructure."

"The 2022 financial year closed positively, with results exceeding expectations and fully consistent with previous quarters. After 2021, this is one of the best growth rates recorded in more than twenty years by the Hera Group, all the more appreciable in light of the external context in which it was achieved.

Relying on the strength of our consolidated business model and our risk-averse policies, we have once again confirmed our commitment to creating value for the company and for all our stakeholders.

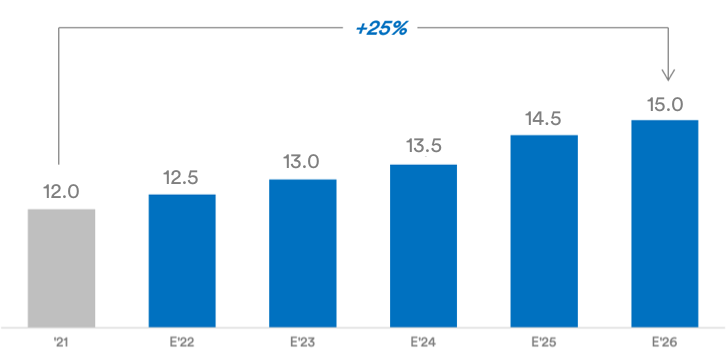

The proposed increase in dividends, coming to 12.5 cents per share and in line with the communications made when presenting the Business Plan to 2026, also goes in this direction.

On the one hand, we have continued to make investments, in order to face the energy crisis and ensure that all our assets remain resilient and performing, thus ensuring that our strategic plans are carried out and the quality of the services managed stays high. On the other, we have pursued the company’s development along external lines, with M&A transactions in the energy and waste management sectors, with the goal of consolidating our position in the reference markets and further improving the competitiveness and efficiency of the solutions we offer to our customers."

Tomaso Tommasi di Vignano

Executive Chairman

"The positive results achieved allow us to face the future with confidence, continuing to invest to grow and increase the resilience and digitisation of our infrastructure. Our efficient financial management, along with cash flow generation, allowed us to close the financial year 2022 with a net debt/Ebitda ratio coming to 3.28x, which, excluding the gas storage investments now falling back into line, drops to below 3x, in line with the Group’s historically prudential policy.

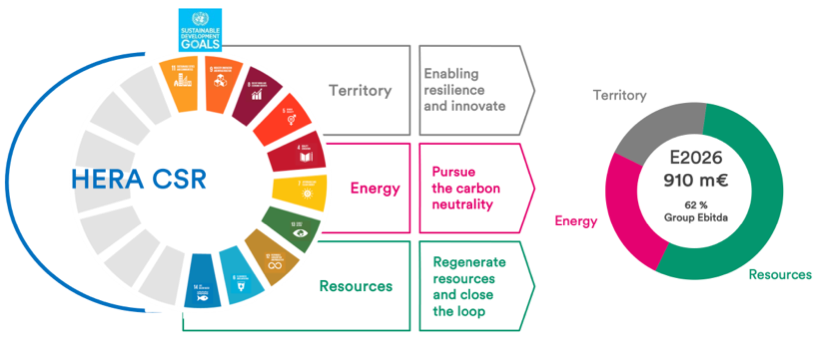

Shared-value Ebitda rose to 670 million, 51.8% of total Ebitda, and showed growth outpacing that of overall Ebitda, which proves that we are progressively making our operations more and more sustainable.

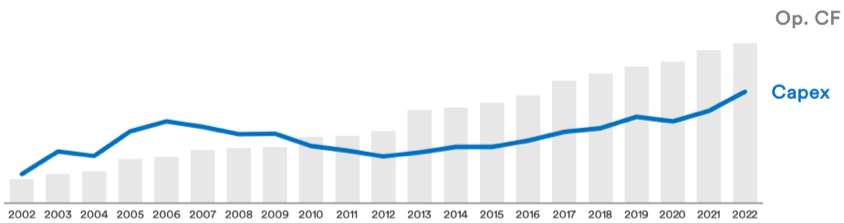

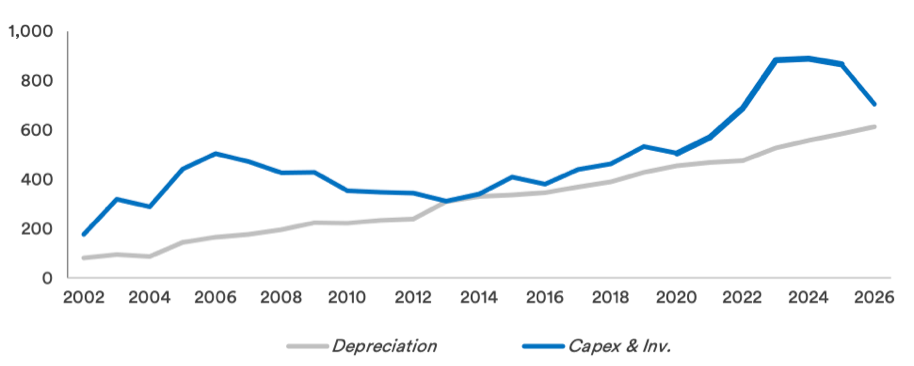

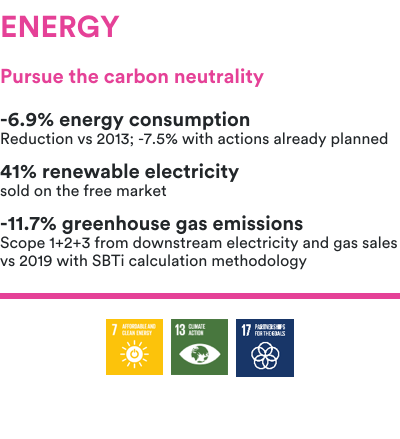

2022 was also a record year for investments, which came to over 700 million euro, 62% of which were put in place to pursue carbon neutrality, promote the circular economy, enable resilience and innovate.

A number of innovative initiatives in the area of renewables also moved in this direction: for example, in 2022 we expanded our biomethane production capacity by around 50% with the construction of a second plant, and we were the first in Italy to introduce a hydrogen-natural gas blend into a city’s network intended for households. Partially thanks also to this latter operation, our gas distribution networks have become fully aligned to the European Taxonomy.”

Orazio Iacono

CEO

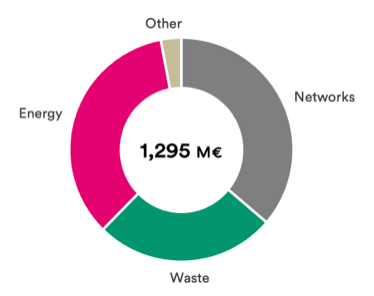

| M/€ | 2021 | |

|---|---|---|

| Revenues | 10.555,3 | |

| EBITDA | 1,219.4 | |

| Net income | 369.5 | |

| Investments | 570.3 | |

| Net Debt/EBITDA | 2.67 |

| M/€ | 2022 | |

|---|---|---|

| Revenues | 20,082.0 | + |

| EBITDA | 1,295.0 | + |

| Net income | 372.3 | + |

| Investments | 688.7 | + |

| Net Debt/EBITDA | 3.28 |

| Consensus | Hera's results | Δ % | |

|---|---|---|---|

| Ebitda (mln €) | 1,284.5 | 1,295.0 | +0.8% |

| Ebit (mln €) | 644.2 | 627.9 | (2.5%) |

| Net profit post min. (mln €) | 332.7 | 322.2 | (3.1%) |

| Net Financial Position (mln €) | 4,264.5 | 4,249.8 | (0.3%) |

| Preview | Post Results | ||||

|---|---|---|---|---|---|

| Analyst | Broker | Rating | Target Price (€) | Rating | Target Price (€) |

| Francesco Sala | Banca Akros | Buy | 3.20 | Buy | 3.20 |

| Davide Candela | Banca Intesa Sanpaolo | Buy | 3.40 | Buy | 3.40 |

| Dario Michi | BNP Paribas Exane | Buy | 3.30 | Buy | 3.30 |

| Roberto Letizia | Equita SIM | Hold | 3.30 | Hold | 3.30 |

| Federico Pezzetti | Intermonte | Neutral | 3.00 | Neutral | 3.00 |

| Emanuele Oggioni | Kepler Cheuvreux | Hold | 2.90 | Buy | 3.00 |

| Javier Suarez | Mediobanca | Outperform | 3,60 | Outperform | 3.60 |

| Average | 3.24 | Average | 3.26 | ||

| Broker | Analysts' comments on financial results |

|---|---|

| Banca Akros | "The company’s 2022 results showed resiliency in a challenging energy scenario and against volatile gas and electricity prices. Recommendation and target confirmed." |

| Intesa Sanpaolo | "Hera’s FY22 results came in broadly in line with our and Bloomberg consensus expectations, with no major surprises, also due to the company having released preliminary figures during the 2022-26 Business Plan presentation in February. We see deleveraging trend as the main driver for the stock at this time: in this respect, we expect 1Q23E results to show emptied gas inventories to positively affect net debt figures. In view of the lower energy prices, we also expect fewer negative items. For these reasons, we confirm our positive stance on the stock." |

| BNP Paribas Exane | "Hera has unveiled its Q4 2022 results, which were in line with the preliminary figures unveiled early in February when the company announced its new business plan: EBITDA + 23% YoY, EBIT +36%, net income +315%. The net financial position reached 4.25 bn€, with a net debt/EBITDA ratio of 3.28x (ca. 2.9x if we exclude the impact of the stored gas costs of ca. 504 m€). The 2023 outlook is positive, considering that in the waste sector Hera is due to take advantage of the M&A performed and the normalisation of the energy costs, coupled with the renegotiations of the expiring contracts, should provide the company with a further upside YoY. We maintain our current valuation range of €3.10/€3.50, which is based on a DCF and on a peer-multiple methodology." |

| Equita Sim | "With preliminary figures already communicated during the presentation of the BP to 2026, Ebitda, Debt and DPS are substantially in line with our expectations. Net profit slightly lower due to higher D&A and financial expenses. We reduce our 2023 Net profit estimates by about -3% to account for higher 2022 D&A and the expected higher financial expenses. We confirm our neutral view." |

| Intermonte | "Hera released 4Q22 final results that are broadly in line with estimates at most levels as preliminary EBITDA and net debt had already been released at the beginning of February. Hera managed to close FY22 with a solid set of numbers despite the exceptional volatility of the energy market (Chairman Tommasi called 2022 the “most challenging year of his tenure”), which confirms the ability of the group to navigate even the most complex environment. Hera’s valuation looks increasingly appealing (the group is trading at 5.9x 2023E EV/EBITDA, at a slight discount to its peer group and at a 12.1x 2023E P/E or at a slight premium) but we confirm our Neutral recommendation as within the sector we continue to prefer players that are more leveraged to the structurally higher energy prices environment." |

| Kepler Cheuvreux | "We think the company’s outlook has improved. We see good visibility for 2023, and we are above consensus on net profit and net debt. We refreshed our SOP model, which remained almost unchanged: our target price is slightly up to €3.00 (from €2.90). After the share price weakness, we currently see an upside of c. 20%, which leads us to upgrade our rating from Hold to Buy. Hera is a defensive company after the normalisation of energy price volatility." |

| Mediobanca | "‘22 numbers showed the resiliency of the business model with Underlying EBITDA growing at +6%, and some increase in the contribution from the supply activity. Reported numbers were impacted by accounting of natural gas inventories, an effect that should be fully reverted by end of 1Q23. We highlight as well that the increase in Net Debt is mainly related to strategic gas purchases, with volumes that are either forward sold or hedged. We update our model to reflect the final ’22 numbers, while maintaining our TP at €3.60/share and rating unchanged. We continue to see Hera exposed to secular trends such as the adoption of circular, green and sustainable models in the waste and water businesses. With the stock trading at c7x EV/EBITDA, we see value and reiterate our Outperform." |

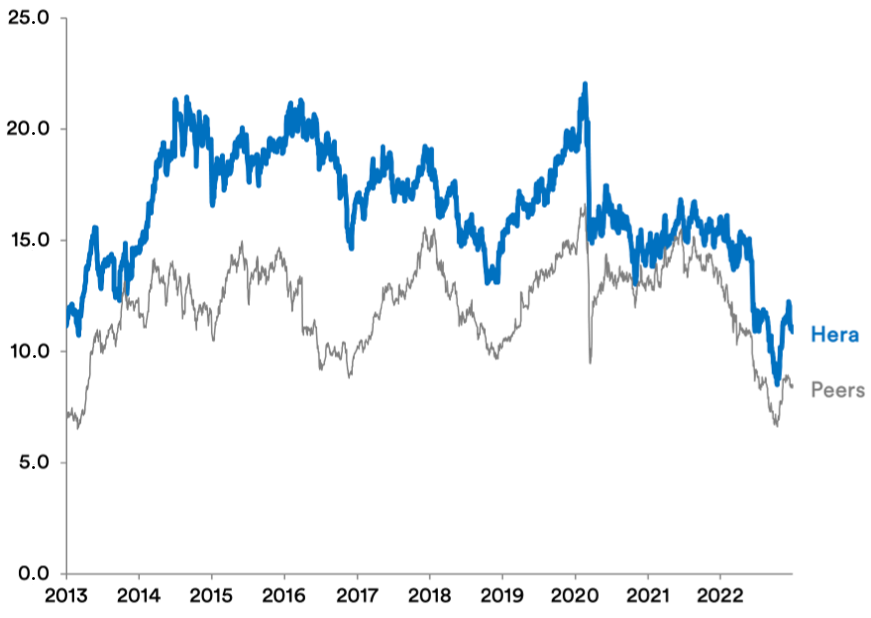

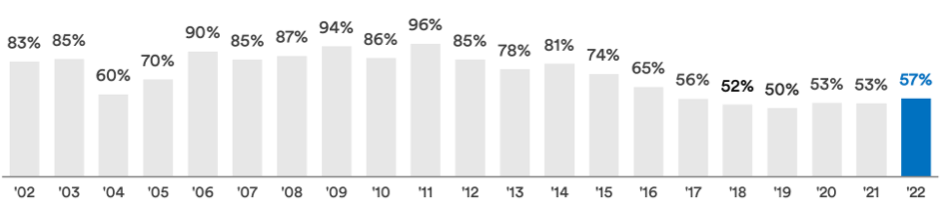

With an official price of 2.529 euro at 31 December, Hera stock was down 31.1%, showing however a more resilient performance than the reference sector. The utilities sector, on the other hand, saw a more pronounced drop than the Italian stock market, due to its higher sensitivity to the effects of the rise in interest rates by the European Central Bank and tensions in the energy markets.

During 2022, the main stock exchanges in Western countries performed negatively, following a downward revision of economic growth prospects, a consequence of the geopolitical tensions that arose with the outbreak of the conflict in Ukraine. As mentioned in previous paragraphs, this conflict exacerbated tensions on energy markets, particularly affected by a reduction, in the present or expected in the future, of gas supplies from Russia. Difficulties in raw material procurement, with supply chains struggling to regain lost ground, also persisted after the disruptions caused by the pandemic. The combination of the conflict and the effects of the pandemic thus triggered an inflationary spiral that led central banks to revise their expansive monetary policies, putting an end to asset purchases on the market (quantitative easing) and raising interest rates.

Against this backdrop, the Italian FTSE All Share index fell by 14.1 per cent during the reporting period, showing the worst performance among major European stock exchanges.

With an official price of 2.529 euro at 31 December, Hera stock was down 31.1%, showing however a more resilient performance than the reference sector. The utilities sector, on the other hand, saw a more pronounced drop than the Italian stock market, due to its higher sensitivity to the effects of the rise in interest rates by the European Central Bank and tensions in the energy markets.

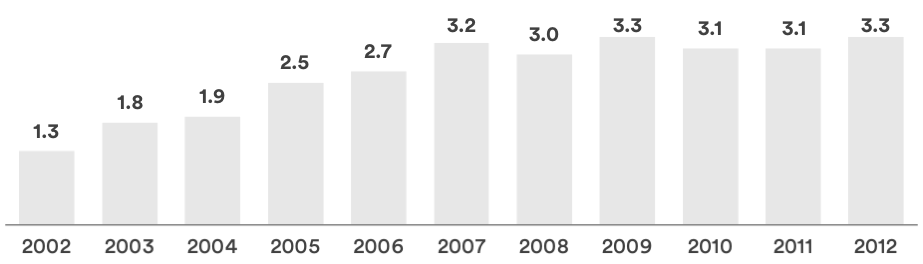

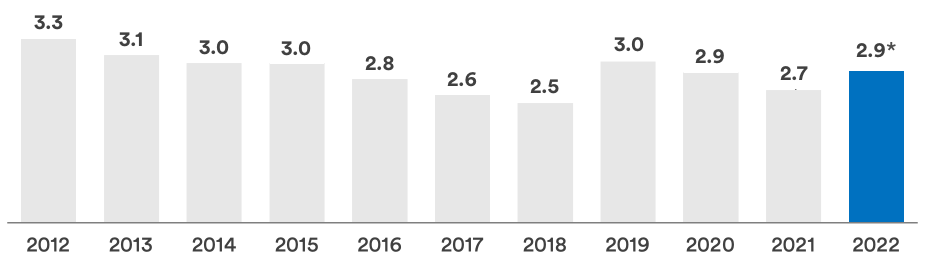

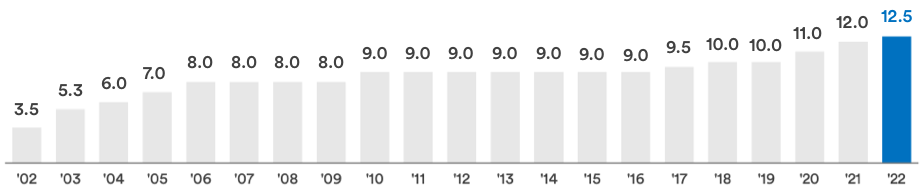

On 20 June 2022, Hera’s twentieth dividend was paid. The coupon, amounting to 12 cents per share, increased by 9% year-on-year, respecting the indications set out in the business plan. Hera thus confirmed its ability to remunerate shareholders thanks to the resilience of its business portfolio, which has allowed it to pay steady and growing dividends since its listing.

| euro | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dps | 0.035 | 0.053 | 0.06 | 0.07 | 0.08 | 0.08 | 0.08 | 0.08 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.095 | 0.10 | 0.10 | 0.11 | 0.12 |

The joint effect of continuously remunerating shareholders through dividends and a rise in the price of the stock over the years allowed the total shareholders return accumulated since the IPO to remain consistently positive and to stand at over +234.9% at the end of the reporting period.

The financial analysts covering the stock (Mediobanca, Exane Bnp Paribas, Intermonte, Intesa Sanpaolo, Kepler Cheuvreux, Equita Sim) expressed positive or neutral opinions, with a target price that continued to show significant potential for improvement. At the end of the year, the consensus target price came to 3.60 euro, showing a 42.4%upside potential.

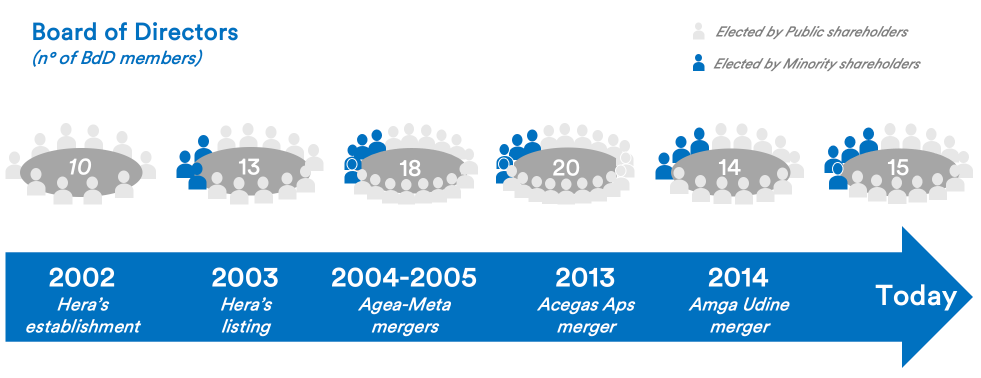

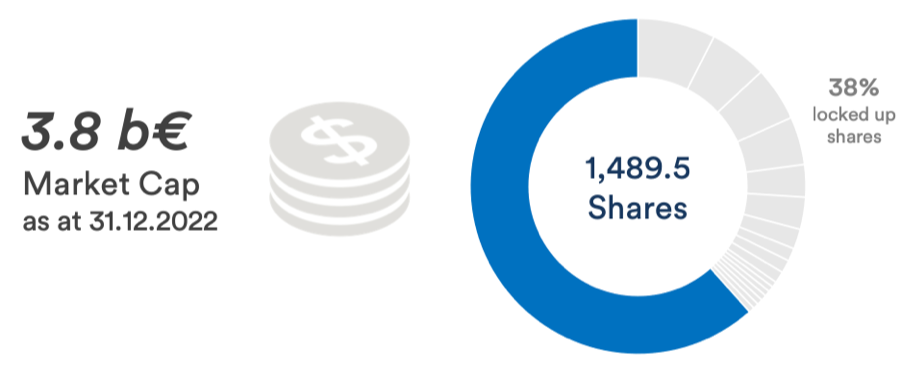

At 31 December 2022, the shareholding breakdown showed its usual stability and balance, with 45.8% of shares belonging to 111 public shareholders located across the areas served and brought together by a stockholders agreement, renewed for three further years and effective from 1 July 2021 to 30 June 2024, and a 54.2% free float. The shareholding structure includes high number of public shareholders (111 municipalities, the largest of which holds shares amounting to less than 10% of the total) and a large number of private institutional and retail shareholders.

Since 2006, Hera has adopted a share buyback program, most recently renewed by the Shareholders Meeting held on 28 April 2022 for a further 18 months, for an overall maximum amount of 240 million euro. The purpose of this program is to finance M&A opportunities involving smaller companies, and smoothing out any abnormal market price fluctuations vis-à-vis those of the main comparable Italian companies. As of 31 December 2022, Hera held 38.5 million treasury shares.

The Group continued to engage in intense communications with financial market players in 2022. After presenting the 2021-2025 business plan, the Executive Chairman and the CEO took part in a road show with investors in the main financial centres to update them on business trends and future prospects. Further occasions for contact came about by participating in the sector conferences organised by the brokers covering Hera stock. The intensity of the Group's commitment to dialogue with investors contributes to strengthening its reputation on the markets and constitutes an intangible asset to the benefit of Hera's stock and stakeholders. The intense dedication shown by the Group towards dialoguing with investors contributed to reinforcing its market reputation and represents an intangible asset benefiting Hera stock and stakeholders.

As regards the information required by article 2428, paragraph 3, subparagraphs 3 and 4 of the Italian Civil Code, concerning the number and nominal value of the shares constituting the share capital of Hera Spa, the number and nominal value of the treasury shares held at 31 December 2022, as well as the changes in these shares during 2022, see note 25 of paragraph 3.02.04 and the statement of changes in equity in paragraph 3.01.05 of the Parent Company’s separate financial statements.

Hera makes ongoing efforts to interpret the signs coming from the contexts in which it operates, in an attempt to obtain an overall view of what lies ahead for the Group and its stakeholders. In order to anticipate future developments, the main drivers of change and their essential interrelations are identified below. In particular, the macro-trends of the Group’s reference contexts are described, as are its main management policies, i.e. its industrial strategy and the related sustainability factors (concerning the environment, technology and human capital).

Macroeconomy and finance

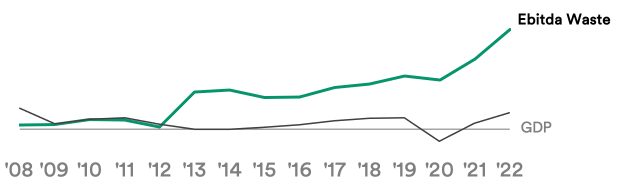

In 2022, the world economy decelerated with respect to the trend of recovery that began in 2021. According to the International Monetary Fund (IMF), global GDP growth stood at 3.4%, as against 6.2% in 2021. The causes of this slowdown lie mainly in the outbreak of the conflict in Ukraine and the ensuing increase in inflation worldwide, driven by energy commodity prices. Furthermore, the lockdowns imposed in China late in the year additionally hindered recovery in the global supply chain.

This slowdown, compared to the previous year, affected all major global economies, with China’s growth falling from 8.4 % in 2021 to 3.0 % in 2022, while the growth rate of the US economy went from 5.9% in 2021 to 2.0% in 2022.

The eurozone was the most heavily affected by the war in Ukraine, due to its proximity to the conflict zone and its dependence on gas supplies coming from Russia. Highly volatile energy commodity prices accentuated the rise in inflation that had already begun in late 2021, bringing inflation in the eurozone to 9.2 % in December 2022. The IMF has observed that growth in the eurozone came to 3.5% in 2022, down from the 5.3% seen in 2021.

The IMF’s most recent estimates for the next two years point towards a scenario strongly influenced by current geopolitical conditions. The global economy is expected to increase by 2.9% in 2023, while for 2024 the increase has been projected at 3.1%. Growth in the eurozone is expected to settle at 0.7% in 2023 and 1.6% in 2024, influenced above all by the additional increases in interest rates announced in advance by the ECB.

The most recent analyses carried out by the Bank of Italy indicate growth in the Italian economy in 2022 among the best in the euro area, at roughly 4% year-on-year, despite the slowdown witnessed in the last three months of the year, mainly caused by the persistence of high energy prices and the slowdown in post-pandemic recovery.

Inflation remained very high in December, standing at 12.3% year-on-year. Energy commodity and food prices remained at historically high figures, even while falling in the latter part of the year.

Although the consumer confidence rate remained lower than prior to the pandemic, it rose in the latter part of the year due in part to an improvement in opinions and expectations concerning the overall economic situation, particularly regarding unemployment.

Industrial production, which had increased in the second and third quarters, declined in the last part of the year due to energy costs, still high, and a fall in demand. The slowdown in production also effected foreign trade, bringing growth in exports to a halt in the last quarter of the year, compared to the strong expansion seen in the first nine months (0.1% compared to the third quarter).

For the upcoming years, the most recent IMF estimates indicate growth at 0.6% in 2023 and 0.9% in 2024. As concerns inflation, the Bank of Italy’s projections set this indicator at 6.5% in 2023 before falling to 2.6% in 2024. These forecasts take into account a macroeconomic framework still strongly influenced by the ongoing war in Ukraine.

The global financial context felt the effects of the negative developments following the trade and tariff wars between the US and China, the pandemic and slowdowns along the supply chains, as well as the Russia-Ukraine conflict and the increased pressure on energy resources that caused the major inflationary shock mentioned above. During one of the worst years for financial markets around the world, in 2022 Wall Street experienced its most significant drop since the 2008 financial crisis, with the S&P 500 index plummeting by 19.4%, the Nasdaq falling by 33.10%, and the Dow Jones containing its losses at 8.7%.A similar trend was seen in Europe, where the main stock exchanges lost around 12% year-on-year (including the Milan Stock Exchange, which lost 12.6%); London managed to limit the impact of the crisis with a positive, albeit modest, closure of 0.9%.

The Federal Reserve (Fed) and the Bank of England (BoE) began a process of monetary tightening during the first half of 2022, which continued with further interest rate hikes in the following months as well. The European Central Bank (ECB) also adopted a restrictive policy and announced that it would continue in the early months of 2023 as well; in December, the reference interest rate reached 2.5%. Also note that the ECB, as part of its asset purchase programme to inject liquidity into the system (quantitative easing), confirmed the beginning of quantitative tightening as of March 2023. Securities purchases will thus be reduced by 15 billion euro per month until June, with the pace of reductions during the following months to be defined at a later date. Reinvestments of government bonds will be ‘partial’, respecting the defined proportions for redemptions (by nation and national and supranational issuer). The portion of maturing corporate bonds to be reinvested will be focused only on ‘green’ bonds. In order to avoid risks of malfunctions in the monetary policy transmission mechanism, the flexibility to re-invest maturing bonds under the Pandemic emergency purchase programme (PEPP) will remain unchanged, meaning that this portfolio will be reinvested at least until the end of 2024.

The increase in eurozone interest rates accelerated during the second half of 2022, leading to an upward shift in the interest rate curve on all maturities by more than 300 basis points (bps) on average, year-on-year. The implicit forward rate curve forecasts a further rise for 2023 on short-term rates coming to roughly 3%. On medium- to long-term maturities, no further increases are expected, only slight downward adjustments coming to roughly 10 bps on average.

Over the year, in Europe, fears that a reduction in monetary stimuli could be accompanied by the reappearance of fragmentation in markets, resulting in a sovereign debt crisis, led to an increase in government bond yields. In order to ensure the effective transmission of monetary policy as part of the normalisation process, a new anti-fragmentation instrument, the so-called TPI (Transmission Protection Instrument), was introduced by the ECB. This instrument allows the ECB to make secondary market purchases of securities issued by countries experiencing an unjustified deterioration in financing conditions. The size of the purchases, which are not constrained ex ante, depends on the severity of the risks involved and a list of eligibility criteria to assess whether those countries where the ECB can make purchases under the TPI pursue sound and sustainable fiscal and macroeconomic policies.

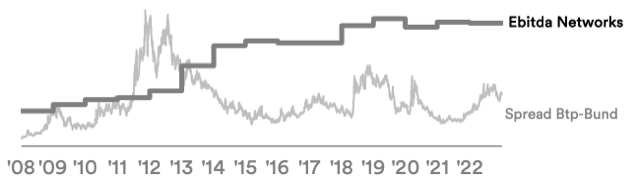

On 31 December 2022, the spread between the yield on the ten-year BTP and the yield on the equivalent German bond closed at 212 bps, up 77 bps from 31 December 2021. After reaching a peak of 251 bps in September and experiencing pressure in the last month of the year, 2023 opened with a downward trend coming to roughly 180 bps.

Unlike in the past, in 2022 the spread of bonds issued by Hera followed the upward trend of government bonds, narrowing this spread. During the second half of the year, the recovery in Hera’s spread, i.e. the increase in this spread, confirmed the return of investor confidence in the Group’s creditworthiness. At 31 December, the ten-year spread, in particular, was 82 basis points lower than the BTP-Bund spread having the same duration.

Businesses and regulations

During 2022, the high volatility of energy commodity prices, coupled with the threat of possible reductions in the availability of gas, caused a decline in domestic electricity and gas consumption.

In August 2022, European gas prices at the Dutch Title transfer facility (TTF) reached peaks of over 300 euro/MWh, more than ten times the benchmarks seen in 2021.

According to the first estimates processed by the Energy Market Operator (GME), in 2022 gas consumption decreased by 9.5% compared to the previous year, totalling approximately 69 billion cubic metres and returning to the amount seen in 2020. The drop in consumption was spread out over the entire year, but was particularly concentrated in the last four months, during which the recessionary effects of the war in Ukraine were compounded by milder weather. The industrial and civil sectors recorded the most significant drops, down 15.2% and 13.2% respectively, while in the thermoelectric sector the reduction was more moderate (3.1% compared to 2021).

As regards electricity, the data compiled by the national transmission company (Terna) indicates total national consumption at 316.8 TWh for 2022, down 1.0% compared to 2021. Approximately 86% of energy demand was met by domestic production, in line with the previous year.

In 2022, net national production from renewable electricity sources decreased by 13.1% compared to 2021, resulting in a portion of consumption met by renewables coming to 31.1%. In particular, the contribution of hydropower production declined sharply compared to 2021, with a reduction of about 11%, due to the drought conditions seen during the year. On the other hand, photovoltaic production and wind power production increased by 7% and 2% respectively, compared to the previous year.

With regard to the waste management and water businesses, since data referring to 2022 is not yet available, the most recent values defined by the main national institutes are provided below.

According to the latest calculations of the Institute for Environmental Protection and Research (ISPRA), the annual production of municipal waste in Italy in 2021 amounted to 29.6 million tons, equivalent to an average per capita production of about 500 kg, with values gradually realigning to those seen prior to the pandemic.

On the occasion of World Water Day 2022, ISTAT presented its new report on the statistics of the national water sector, updated to 2020 and focused on provincial capital cities. This report states that operators injected 2.4 billion cubic metres of water into the network (the volumes moved in the networks of the provincial capitals historically represent about 33% of total volumes distributed nationwide), with a reduction of more than 4% compared to the volumes seen in 2018 (the last available historical data). Of these, about 0.9 billion cubic metres, or 36.2% of the total amount injected, would seem to have been dispersed.

Increasing competition was seen in the activities carried out by Italian utilities, with a particular focus on free market businesses.

In the energy sector, strong commercial pressure persisted, especially in the retail market. This trend was confirmed by the churn rates, which remained very high and continued to rise, in sales of both electricity and gas. In 2021, in electricity sales the switching rate increased by 2.6 percentage points compared to the previous year, while for the gas sales the increase was 1.4 percentage points compared to 2020 (source: ARERA). In recent years, competition among sales companies has expanded to the offer of value-added services, complementing the supply of commodities, so as to compose commercial portfolios in line with customers’ needs, more oriented towards energy saving. Similarly, another factor that has affected competition in the market lies in the increasing use of digital channels by customers, both to choose offers and to interact with their energy and service supplier.

As regards the waste treatment and recovery business, the European context has witnessed for several years now a series of aggregation operations based on the synergies that can be extracted from the different businesses that fall within the scope of utilities, with a growing connection in particular between energy, waste and water. Examples of the most widespread partnerships include the production of biomethane from the organic fraction of municipal solid waste (FORSU) and from sewage sludge, as well as Waste to Material and Waste to Chemical procedures. Within Italy, moreover, for several years the focus of the main market players has gone towards expanding plant equipment, and this will be given further impetus thanks to the resources provided by the National Recovery and Resilience Plan (NRRP).

With regard to regulated businesses, competitive pressure has been introduced into the procedures for awarding service concessions and their subsequent management.

Considering the local areas in which the Group currently provides the water cycle service, the new management of the concession in the province of Rimini began in January 2022, with an expected expiry date coming at the end of 2039.

Turning to legislative and regulatory factors, the most important aspects for the Group in 2022 include:

Beginning in the autumn of 2021, the government has introduced a series of measures to support citizens and businesses in coping with rising energy prices, both in the electricity and gas sectors. Following the outbreak of war in Ukraine and various price mitigation initiatives, a number of measures to ensure security of supply and a more rapid development of renewable energy sources also appeared.

The continuation of the war forced national governments to intervene constantly throughout 2022, updating the measures adopted according to the needs imposed by changes in the scenario. The first need to which the Italian government intended to respond was a mitigation of the impact of energy price increases on customers’ bills. To this end, a number of areas were identified for interventions: a reduction of system charges for both gas and electricity users, which was extended during the year, and a redefinition of social bonuses, with a wider number of beneficiaries and an increase in the amounts paid. In addition, Decree Law No. 115/2022, so-called Aid bis, suspended until 30 April 2023 the effectiveness of contractual clauses that allow a unilateral modification of the price conditions of electricity and gas supplies, if they fall outside the expected contractual notice periods. These measures were subsequently extended to 30 June 2023 by Decree-Law No. 198/2022, the so-called Milleproroghe, converted into Law 14/2023, which also clarified that the same did not apply to contractual clauses that allow suppliers to update contractual economic conditions upon expiry, in line, moreover, with the principles sanctioned by the State Council in the disputes brought by certain operators for the annulment of prescriptive measures adopted by the Antitrust Authority.

At the same time, tax credits for procurement by energy-intensive companies were first introduced and subsequently strengthened, and the way in which the GSE sells the electricity it possesses was regulated (by the so-called Energy Release, under Law Decree 17/2022).

In order to raise the resources required to sustain these measures, additional charges were introduced for those benefitting from the energy price increases. In particular, Decree-Law No. 4/2022 introduced a limit on revenues from electricity generated by certain types of renewable-source plants (including photovoltaic plants exceeding 20 KW), which was further extended by the Budget Law 2023 (Law No. 197/2022) on the basis of European Regulation 2022/1854, also including electricity generated by the combustion of waste. The same Regulation was also responsible for the provision of the solidarity contribution on the share of profits exceeding the average of the previous years, which the Budget Law applies to companies over 75% of whose revenues come from the energy sectors. This measure replaces the content of the “Price Cut” Decree (Decree-Law No. 21 of 21 March 2022), which had introduced, for the year 2022, an extraordinary levy of 25% to be paid by companies operating in the electricity and gas sectors.

In a context that saw an increasing risk of supply disruptions, the Government was called upon to intervene so as to ensure the resilience of the domestic gas system. Decree Law 17/2022, the so-called “Caro Energia”, entrusted the Ministry for the environment and energy security with defining the rules for optimising the gas cycle in national storage, through means including resorting to counter-flow injections during the supply season, to guarantee that the filling level is maintained. In addition, with the aim of containing consumption, with Ministerial Decree 383/2022 of 6 October the Ministry modified the terms of operation of thermal systems fuelled by natural gas, establishing a reduction in both the temperatures and the daily and seasonal duration of the ignition period, and regulating the modalities for filling storage and supply during the winter season.

In addition to these measures, aimed at providing immediate support to the economic system, the national regulatory framework acknowledged and implemented the European strategy that identifies the ecological transition as the main tool for reducing dependence on fossil fuels. For this purpose, the procedures for allocating NRRP resources were published during the year, and for some investments relating to utilities ' areas of responsibility the final awards have already been made. These include measures for developing the electricity and district heating network, as well as some lines relating to circular economy projects. In addition, a number of reforms related to the NRRP itself have been approved, including:

On 5 August 2022, the annual Law for the market and competition 2021 was approved, which contains measures for a number of areas of interest, including the awarding of tenders for the gas distribution service and the waste management service. More specifically, as regards the gas sector, among other measures, the possibility was given to local authorities to dispose of their assets through tenders on the basis of the Industrial residual value (VIR) instead of the Regulatory value (RAB). Furthermore, with regard to the reorganisation of the regulation of local public services, the Government received and implemented the delegation with the publication in the Official Gazette of the Unified text for local public services (TUSPL) on 30 December 2022. This legislative decree applies to all services of general economic interest, with the exception of electricity and gas distribution, and calls in particular for the requirement of a qualified justification for not turning to the market in the case of in-house awarding.

In regulating the economic conditions for the supply of natural gas in the protected service, note that ARERA, in order to ensure greater price stability and adherence to market conditions, introduced a new method for determining the component covering the costs of supply in wholesale markets, moving from a quarterly forward system to a monthly forward system. In particular, as of 1 October 2022, the new reference to be used in determining the CMEM component is set at the monthly average of daily prices at the PSV Day Ahead, published at closure by ARERA.

In regulating the terms and conditions for providing the last resort and default distribution services , note that Arera also intervened, with Resolution 372/2022/R/gas, with measures to compensate for the unforeseeable and excessive charges due to the extraordinary situation of the wholesale gas market price trend, and in particular:

With Resolution 586/2022/R/eel, Arera also postponed the date for the activation of the gradual protection electricity service for micro-businesses from 1 January 2023 to 1 April 2023, due to the postponement of the competitive procedures, which lasted until the end of 2022, and the technical need for at least three months after the publication of the results to carry out all the prodromal activities for the transfer of withdrawal points to the new service operators.

Arera, during 2022, began consultations for the guidelines on the new tariff regulation by expense and service objectives (ROSS) in the energy infrastructure sectors. The objective of this regulation is to efficiently direct resources, eliminating distortions in companies' investment choices. The process leading towards the new method will start with a simplified model, called ROSS-based, which as of 2024 will be applied to electricity distribution operators and as of 2026 to gas distribution companies. Consultation document 655/2022/R/com, published at the end of the year, contained Arera’s final guidelines on the criteria for determining the recognised cost when following the ROSS-based approach: the expense of distributors, total and no longer simply managerial, will be compared annually with a reference expense defined by the regulator , any efficiencies/inefficiencies achieved will be shared with users according to appropriate mechanisms, and the treatment of the capital stock existing at the date of transition to the new methodology will be guaranteed with continuity in the criteria applied. In the first few months of 2023, with the publication of the integrated TI-ROSS text, the new tariff regulation will be formalised (which should essentially constitute a methodological framework with indications of general regulatory principles and criteria), while for the actual completion of the ROSS-based scheme it will instead be necessary to wait for updates in the specific regulations for each infrastructure service .

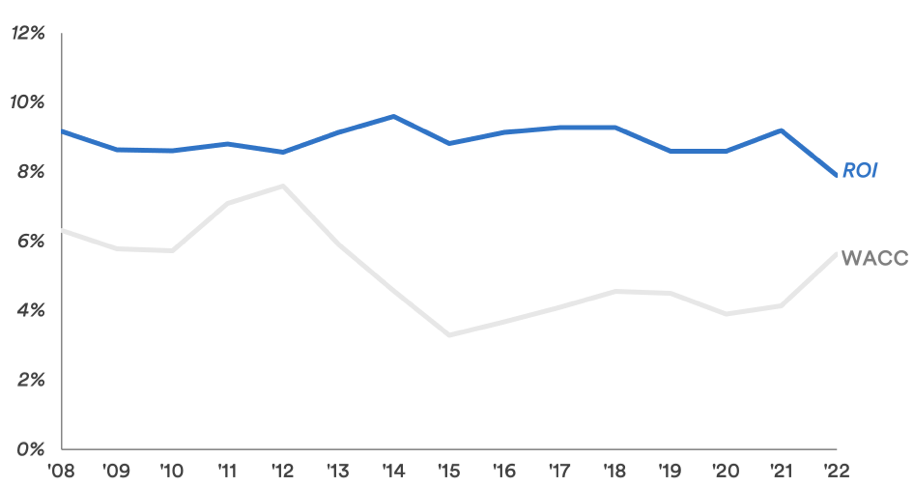

Arera, in late 2022, with Resolution 654/2022/R/com, established the rates of remuneration for capital in energy infrastructure services for 2023. The changes in the underlying financial parameters, while considerable, were not sufficient to trigger the updating mechanism provided for by the regulation. For 2023, therefore, the values of 2022 WACC were confirmed at 5.6% for the gas distribution and metering service and 5.2% for the electricity distribution and metering service.

With regard to the tariff regulations for gas distribution and metering (RTDG), in late December 2022 Arera updated its regulations for the second semi-period (2023-2025) of the fifth regulatory period. The main changes for 2023 concern: an update of the standard costs for electronic meters up to class G25, to be applied starting from investments; the introduction of a new parametric recognition method to cover the costs of remote management and concentrators equal to 1.59 euro/redelivery point (PDP), to be updated for inflation for the following years; and a differentiation in the cost recognised for switch readings taken on PDRs equipped with a smart meter compared to PDRs equipped with a traditional meter. As regards the recognition of operating costs, pending the outcome of the appeals against Resolution 570/2019/R/gas, the Authority decided that it was appropriate not to change the productivity recoveries set at the beginning of the regulatory period, but also considered introducing a mechanism for adjusting the allowed revenues to cover operating costs if a reduction in redelivery points emerges. ARERA also resolved to recognise the residual depreciation of G4-G6 smart meters installed from 2012 to 2018 and decommissioned before the end of their useful life.

In order to support the process of energy transition and decarbonisation of the gas sector, with Resolution 404/2022/R/gas and subsequent Decision 9/2022, the Authority prepared a special bonus tariff mechanism aimed at providing incentives for pilot projects optimising the management and innovative use of infrastructures in the natural gas sector. In particular, three specific project areas were defined, the first relating to methods and tools for the optimised management of networks, the second concerning innovative uses of existing infrastructures, including the use of hydrogen and Power-to-Gas in the area of sector coupling, and the third relating to energy efficiency interventions in gas infrastructure management. A total of 35 million euro was earmarked for financing these trial projects (each of which may have a maximum duration of three years), which will be allocated through a selective scoring procedure based on specific assessment indicators.

As regards gas metering, at the end of the first half of 2022, ARERA approved a measure that defines more stringent expected output and performance levels for the service provided by smart gas meters. Indeed, Resolution 269/2022/R/gas establishes new obligations regarding the timing of smart meter commissioning, the frequency of metering data collection, the granularity of the same, and the timing with which the data collected is made available. The measures set out in this resolution also affect various aspects relating to billing and the determination of compensation for customers and sellers. The effective date of almost all the new provisions has been set at 1 April 2023.

Concerning regulations for electricity distribution, the reformed reactive energy regulations were completed in 2022. With regard to reactive energy fed into medium- and low-voltage grids, Resolution 232/2022/R/eel established the respective fees as of 1 April 2023. Instead, with regard to the regulation of the flow of reactive energy fed into high-voltage grids and interconnections, the sector had to wait until late 2022 for Resolution 712/2022/R/eel. ARERA decided that, once again as of 1 April 2023, a basic unit fee will be applied to the entire national grid and, only for the most critical areas, an increased fee. Moreover, adopting a gradual approach, under specific conditions (assessed ex post) and which demonstrate a fundamental absence of critical reactive flows, it is expected that the fees may be cancelled and, where necessary, refunded.

During 2022, with Resolutions 410 and 411/2022/R/eel, ARERA furthermore approved the Requests for admission to the recognition of investments in specifically 2G metering systems (RARI) made by Inrete Distribuzione Energia Spa and AcegasApsAmga Spa. The measures approved the 2G Metering commissioning plans and defined the mandatory performance of second-generation smart metering systems, confirming the reference expenditure forecasts submitted to ARERA by the two distributors.

Regarding the electricity metering service, ARERA, in late 2022, updated the 2G directives for the three-year period 2023-2025 for the recognition of the costs of second-generation smart metering systems. While introducing a few innovative elements with respect to the previous three-year period, the new directives guarantee essential continuity in the cost recognition mechanism for companies involved in a large-scale replacement of 2G electricity meters. The main new features include the introduction of a bonus for distributors who accelerate their meter replacement plan after obtaining public contributions of any kind.

As regards regulations for the integrated water service, the measures concerning 2022 with the largest impact for the Group involve incentive mechanisms for service quality and, as far as tariffs are concerned, the recognition of electricity costs due to the exceptional context of energy price volatility. On this matter, with Resolution 229/2022/R/idr the Authority established a number of extraordinary measures for water operators. More specifically, the possibility of requesting a financial advance from CSEA for electricity procurement in 2022 was introduced (which was later extended, by Resolution 495/2022, until 30 November 2022) as was the possibility of making an extraordinary request, in agreement with the area Authority in question, for the recognition of the cost pertaining to 2021, provided that it was accompanied by a plan of actions to contain consumption and energy costs.

Concerning the regulation of technical service quality, with Resolution 183/2022/R/idr, ARERA concluded its preliminary investigation, begun with Resolution 46/2020/R/idr, aimed at quantifying incentives (and penalties) relating to performance in 2018 and 2019. With this assessment, ARERA observed a generally positive performance shown by operators, who seem to have acted according to largely satisfactory criteria, with the exception of some cases, in which they were excluded from the mechanism due to violations of regulations. The penalties relating to 2018 and 2019 are to be treated as reserves and used for achieving the established objectives, in accordance with the reference regulations, while the bonus payments relating to the same years were disbursed by CSEA. With Resolution no. 107/2022/R/idr, the second preliminary assessment investigation was opened for the performance of technical quality in 2020 and 2021 and, at the same time, with Resolution no. 69/2022/R/idr, the first preliminary investigation was opened in the area of contract quality concerning the objectives for the two-year period 2020-2021. As a result of the latter preliminary investigation, with Resolution No. 734/2022/R/idr Arera published the methodological note adopted for the quantitative assessment of incentives/penalties, pointing out that, in addition to identifying some of the most serious cases of exclusion from the mechanism and thus from the bonuses, in the event of particular data inconsistencies/incompleteness, in-depth investigations may be requested from the operators concerned, with the possibility of justifying and possibly correcting the data sent, providing adequate supporting documentation.

With regard to regulations for the municipal waste management service, the measures with the greatest impact for the Group that ARERA finalised in 2022 concern regulations for the remuneration of capital , in order to promote the industrial development of the sector, and the initial elements of quality regulations , aimed at standardising service levels nationwide. More specifically, Resolution 68/2022/R/rif established the WACC for the years 2022-2025 , providing for a remuneration of capital coming to 5.6% for the collection service (to be adjusted when tariffs are set for 2024-2025, since until then it will remain at 6.3%). The WACC for the treatment service was instead set at 6.0%, recognising the higher level of risk associated with this phase of the municipal waste management chain. On the other hand, with reference to quality regulations, note Resolution 15/2022/R/rif, which introduces the first regulation of service quality, introducing a set of contract and technical quality obligations for the collection service, minimum and uniform for all managers, accompanied by quality indicators and the related general standards differentiated by regulatory schemes, identified in relation to the actual initial quality level guaranteed to users by the various managers. Lastly, note Resolution 413/2022/R/rif which, in light of the mandate given to ARERA by the annual Market and Competition Law 2021, initiated a procedure for defining technical and quality standards for carrying out waste disposal and recovery activities, proceeding to verify minimum quality levels and furthermore acquiring information on management costs and any other suitable element for monitoring the actual methods used in carrying out disposal and recovery activities and their impact on the fees applied to end users.

With reference to regulations for the district heating service (TLR), note that ARERA closed, with Resolution 547/2022/R/com, its investigation on the evolution of the prices and costs of the district heating service, begun with Resolution 80/2022/R/tlr. One factor that appeared, according to the Regulator, is that indexing district heating prices to trends in gas prices, whereas thermal energy is mainly produced by waste-to-energy plants and thermal power plants, seems to have led to a progressive gap between the costs and revenues of this service. This is because the increase in revenues was not followed by a corresponding rise in variable costs, with a consequent significant increase in margins for the remuneration of invested capital. ARERA, with Resolution 568/2022/I/tlr, therefore made a report to the Parliament and the government, essentially proposing the introduction of a cost-reflective regulation of prices for the district heating service, attributing the related powers to ARERA itself.

A timeline showing the main regulatory periods and related measures introduced by ARERA, pertaining to the Group’s sectors of activity, is provided below.

Tariff regulatory periods

Lastly, the table below indicates the main tariff references for each regulated sector, based on the regulatory framework in effect in 2022 and expected to remain until the end of the current regulatory periods.

| Natural gas distribution and measurement | Electricity distribution and measurement | Integrated water service | Integrated waste cycle | |

|---|---|---|---|---|

| Regulatory period |

2020-2022 2023-2025 |

2016-2019 2020-2023 |

2016-2019 2020-2023 |

2018-2021 2022-2025 |

| Regulatory governance | Single level (ARERA) | Single level (ARERA) | Dual level (Governmental authority Body, ARERA) | Dual level (regional authority, ARERA) |

| Recognised invested capital for regulatory purposes (RAB) |

Previous cost revised (distribution) Weighted average between actual cost and standard cost (measurement) Parametric recognition (centralised capital) |

Parametric recognition for assets up to 2007 Previous cost revised for assets since 2008 |

Previous cost revised | Previous cost revised |

| Regulatory lag for investment recognition | 1 year | 1 year | 2 years | 2 years |

| Return on investment (3) (real, pre-tax) |

2019 2020-2021 2022-2023 |

2019-2021 2022-2023 |

2018-2019 2020-2021 2022-2023 +1% for investments since 2012, covering the regulatory lag |

2020-2021 +1% for investments from 2018, covering the regulatory lag 2022-2025 (4)

6.0% Treatment |

| Recognised operating costs |

Actual average cost values by company grouping (size/density), based on 2011 (for revenues until 2019) and 2018 (for revenues from 2020) (5) Sharing for efficiencies achieved against recognised costs Upgrade with price-cap |

Average actual segment cost values on a 2014 basis (for revenues until 2019) and (2018 for revenues from 2020) Sharing for efficiencies achieved against recognised costs Upgrade with price-cap |

Efficient costs: 2011 operator’s actual values inflated Upgradable costs: actual values with 2-year lag Additional charges for specific purposes (provisional nature) |

Collection and treatment Actual operator costs with 2-year regulatory lag Additional costs for quality improvement and changes in the manager’s scope (previsional) Additional charges for specific purposes (previsional) |

| Annual efficiency operating costs |

Annual X-factor 2019 As of 2020: |

Annual X-factor 2019 As of 2020: |

Efficiency mechanism based on: Differentiated sharing level with respect to the distance between actual cost and efficient cost of the operator |

|

| Incentive mechanisms | Net revenue sharing from fibre transit in the electricity infrastructure |

Sharing of electricity costs based on energy savings achieved; Recognition of 75 per cent of margins from activities aimed at environmental and energy sustainability |

Collection Treatment |

|

| Annual limit on tariff increases |

On an asymmetrical basis and depending on: Mechanism to guarantee financial equilibrium |

Collection Treatment Collection and treatment Mechanism to guarantee financial balance |

(1) Resolution 443/19 is applied to managers in the integrated waste cycle, including treatment activities (for disposal or recovery) only if these activities are included in the operator’s corporate scope. On the other hand, the tariff regulation of the gate fees of the plants is postponed to a dedicated measure.

(2) Resolution 363/2021/R/rif updated the previous regulatory period and introduced tariff regulation for treatment where these are “minimum” plants, i.e. essential for closing the municipal waste cycle.

(3) For the energy and waste sectors, reference is made to the WACC methodology, while for the integrated water service the values refer to the coverage rate of financial and fiscal charges.

(4) For the years 2022-2025, the reference measure for the WACC in the waste sector is Resolution 68/2022/R/ref.

(5) In February 2020, Inrete Distribuzione Energia Spa, the Group’s main distributor, challenged the measure before the Lombardy-Milan Regional Administrative Court (TAR) with regard to the significant reduction in the recognition of operating costs introduced by Resolution No. 570/2019.

Climate and the environment

Regulatory and economic interventions aimed at managing climate change, and the concrete opportunities that derive from addressing the risks associated with it, have become priorities for international and national institutions, as well as those operating in all economic sectors. The Group’s main concerns in pursuing environmental sustainability coincide with the 17 goals on the 2030 Agenda for Sustainable Development (SDGs), as well as the indications contained in the Paris Agreement to limit global warming to below 2ºC, and the long-term climate strategy “A Clean Planet For All” (adopted by the European Union), intended to achieve carbon neutrality by 2050 and to limit the increase in temperature to below 1.5ºC. Further important elements moving in this direction include the change called for by the Green Deal, the European Commission’s plan for a Europe that is more competitive in the fight against climate change and increasingly capable of transforming the economy and society by setting them on a path of sustainable development and, in the wake of this, the circular economy action plan (CEAP). The actions taken by European and national institutions are coordinated and converge towards the goals of a fair, sustainable and inclusive transition. Adopting the Green Deal and related initiatives, aimed at tackling climate and environmental problems in order to achieve carbon neutrality and the transition to a regenerative and circular growth model, is aimed towards an industrial strategy that implements the circular economy in all sectors.

The Circular Economy Action Plan, presented by the Commission last year, has made it possible to outline a strategic framework for circular economic development in the European Union and, in so doing, is geared towards accelerating the transition and making the change foreseen by the Green Deal possible.

Incentive initiatives, reuse and recyclability in products, reduction of overpackaging and rules for bioplastics have become increasingly important in this respect. Above and beyond the plastics sector, the promotion of the circular economy is also encouraged with respect to water management, both in terms of reuse of purified wastewater for irrigation in agriculture and in terms of minimum requirements for the use of reclaimed water.

National policies are developing in a European context where priorities are defined and available resources allocated accordingly. In this sense, the National recovery and resilience plan (NRRP), which makes use of the European funds made available by the NextGenerationEU package supplemented by a complementary national fund, guides Italy in the implementation phase of the European Green Deal and, since there is an overall consensus concerning the need to introduce progressively more challenging climate targets, reinforced instruments have been made available to member states with the aim of:

In order to manage the energy crisis that began last year, the European Commission introduced in May 2022 a series of measures that can be launched in the short term (REPowerEU), including a common gas purchasing platform, a cap on gas and electricity prices, the diversification of supply and a reduction of gas demand through energy efficiency measures and electrification of consumption.

The drive to decarbonise the European economy has instead been entrusted to long-term measures, in particular the Fit for 55 package, which aims to reduce climate changing emissions by 55% within 2030 by focusing on an increase of renewable energies in the production mix. In terms of energy efficiency, the current 2030 targets, revised upwards to meet this ambitious emission reduction target, will be pursued by giving a leading role to public buildings in the process of making Europe’s building stock more efficient. In terms of renewable energies, whose increased production is crucial to replace fossil fuels and reduce carbon intensity, the electrification of consumption will require considerable investments along the entire supply chain and, as far as regional energy planning is concerned, it is expected that the recovery of waste heat from industrial processes will have significant potential. The development of renewable gases, including hydrogen, by constructing electrolysers powered by renewable energy sources, will also be a priority.

In early 2018, the European Commission published the Sustainable Finance Action Plan, which aimed to respond to three objectives: redirecting capital flows towards sustainable investments in order to achieve sustainable and inclusive growth; managing financial risks arising from climate change, resource depletion, environmental degradation and social issues; and promoting transparency and a long-term vision of economic and financial activities.

The first concrete action took the form of the EU’s own definition of a Taxonomy for sustainable investments, aimed at directing investors’ funds towards sustainable initiatives.

In order to be aligned with this Taxonomy, economic activities must comply with three principles identified by the Regulation:

Moreover, as of 1 January 2022, companies subject to the directive on non-financial reporting must indicate the amount of their activities that fall under the European Taxonomy.

As regards the Italian context, the six strategic missions of the NRRP are built around the six pillars of intervention set out in the European Regulation for Recovery and Resilience and are accompanied by specific sectoral reforms. Mission 2, “Green revolution and ecological transition”, the largest in terms of resource allocation, addresses the initiatives that most closely concern the Hera Group.

For the water cycle and waste sector, the NRRP aims to modernise networks and plants and reduce the infrastructure gap between the north and south of the country, assigning a central role to the national Plan for the water sector, for providing public funding, and to the national Programme for waste management.

In the energy sector, the NRRP focuses on developing renewable energy sources, modernising electricity grids (to increase their digitalisation and resilience against climatic events) and energy-saving solutions. Other key actions include the integrated development of the hydrogen supply chain, promoting production- and consumption-side projects at the same time and the principle of energy efficiency as the first zero-emission fuel.

All countries that signed the Paris agreement made a commitment to a strategy for reducing climate-changing emissions reaching 2050. The strategy will move towards improving knowledge of climate impacts, intensifying climate risk planning and assessment, accelerating adaptation actions and developing resilience to climate change globally. People are becoming increasingly sensitive to environmental and social inclusion issues and are thus driving the increase in demand for green & digital interventions, in line with EU recommendations on economic recovery and resilience. In order to get various stakeholders and civil society involved in the adoption of sustainable behaviour, the European Commission has created the European Climate Pact. This initiative offers individuals and organisations opportunities to learn about climate change and find solutions, and provides a space for individuals to interact and promote a European climate movement. Organisations can identify their own ambassadors with a focus on gender equality and, in order to support the beginning of concrete actions, the Pact’s platform makes it possible to share experiences, funding opportunities and know-how.

The inevitability of climate change, which has led the European Commission to anticipate its emission reduction targets to 2030, with the hope of achieving full decarbonisation by 2050, is also forcing local authorities to review priorities and courses of action. Moreover, the pandemic has made it urgent to implement actions to make cities and local programmes more resilient and has increasingly oriented regional policies towards circular economy initiatives, sustainable mobility, carbon neutrality and digitisation. This scenario is increasingly ambitious and offers new opportunities to the utility sector. All types of customers (household, industrial and public administration) will be called upon to introduce technological improvements that can reduce their energy needs.

Promoting and selling products and services for energy efficiency and supporting the energy efficiency of buildings are some of the initiatives being promoted.

Stakeholders, both financial and non-financial, who are increasingly interested in sustainability issues, are therefore also moving towards green financing, which can raise liquidity on the capital market at rates that are potentially lower than the alternatives.

Following a rationale based on value sharing between companies and communities, oriented towards finding solutions for the benefit of both, the engagement of the community and individuals is becoming increasingly important. The main megatrends are those built on the UN 2030 Agenda, theoretical references and successful experiences of shared value approaches and new business opportunities.

The new lines of development will continue to include the full exploitation of data (seen as a real corporate asset) and a greater focus on cybersecurity, to protect the company and its data. The speed of change makes it essential to define training plans that enable the corporate population to better manage change (first and foremost digital change). This includes training that may be fragmentary but is still able to provide the necessary continuity (self-development).

Technology and human capital

Digital technological evolution involves a continuous acceleration of some major ICT trends and, in addition to moving beyond the paradigms found in economic and social contexts with increasing speed, it alters entire market segments and social relationship patterns. The rise of Artificial Intelligence, automation, Robotic Process Automation, data collection and management (Internet of Things, data governance and data analytics), cybersecurity and, finally, cloud-based platforms favours an increase in the amount of data produced and the speed of its availability, generating further opportunities for companies. Utilities are actors capable of promoting a wider use of innovation thanks to their contribution to digitisation and technological development, giving attention to IT security as well. The Internet of Things and digital interaction between people (exemplified by the automation of more standardised customer relations through chatbots) favour a continuous and growing flow of data, which allows not only timely analyses of different situations (real time analytics), but also a more precise definition of decisions and actions to be taken, often with the support of artificial intelligence. In this direction, the EU Commission, adopting the communication “Digital compass for 2030: the European model for the digital decade” has confirmed the path for an ethical digital development in Europe, with clear targets to 2030 benefitting citizens and businesses. The main goals include:

The benefits of digitally-aware development have been defined in Italy by the “Strategy for Technological Innovation and Digitisation”, one of whose main challenges is to accelerate the transition to a digital society, prepared to achieve the above-mentioned European targets. This strategy intends to innovate by safeguarding the economic, environmental and social sustainability and guaranteeing equal opportunities for participation. In 2022, more than 45% of Italian companies adopted forms of remote working, allowing their employees to work from home at least one day a week.

Italy also ranks third in terms of readiness for 5G. Investments in telecommunications, networks, software, automation and other technological infrastructures, which are essential for reaching European targets, must be accompanied by the spread of a culture and training that will enable the new technologies, which in turn are oriented towards a sustainable and circular economy, as well as hinging on digitisation and artificial intelligence. The NRRP intends to direct 22% of the available funds towards a major digital acceleration in the country, as a lever to give a decisive boost to the country’s competitiveness. By virtue of their relationship with the public administration and SMEs, utilities play an important role in supporting digital transformation, in particular through digital services for optimising the yield of production processes, but also through sensors installed for data collection and analysis, without forgetting connected machinery for automatic task performance and predictive maintenance. Examples of this can be found in the various applications in the relevant businesses, such as data-driven energy management solutions, thanks to connected and smart-sensor-equipped systems and devices inside public buildings, or sensors and smart devices distributed throughout the territory, coordinated and integrated by digital platforms that process the generated big data for resource planning and service optimisation. The widespread presence of digital technology affects all aspects of business operations, extending the changes to the point of translating into additional and new value-added services. The increase in infrastructural requirements, which continues to drive the demand for investment in connectivity and remote collaboration tools, for utilities focuses on the need for connectivity and security applied to remote working and also multi-channel interaction with the customer, without forgetting the management and sensitisation of infrastructures across the area served. The digitisation process is also fuelled by incremental investments in Artificial Intelligence and hyper-automation, Internet of Things and Internet of Behaviors (IoB), distributed cloud and 5G. Operation technology (OT) or remote management, which had developed over the past few years as a niche area limited to plant effectiveness and with little attention to cybersecurity aspects, requires companies to increase investments in order to reduce system fragility. In this context, it is essential to continue to deploy all available technological skills and resources to increase the level of protection and attention to cybersecurity risks, in order to counter threats and minimise possible consequences. Customers in all sectors, who are increasingly inclined to interact through digital channels, expect real-time responses and uninterrupted service availability, and therefore the advantage goes to the most proactive suppliers in terms of attention to behaviour and optimisation of consumption, but also, increasingly, additional services such as smart house and e-mobility.

Cloud platforms have made high-performance connectivity available and enabled significant infrastructural economies of scale for exponential technology development, optimising the use of time. The availability of processing power also drives the spread of Artificial Intelligence and Robotic Process Automation applications with integrated Artificial Intelligence (IRPA), which are useful for making the most appropriate decisions on actions to be taken. The identification and formalisation of managerial processes that combine human and automated activities, balancing them according to the value added to the process, is therefore one of the issues to which all organisations will have to pay particular attention, not only in terms of organisational design, but also from the point of view of training and managerial monitoring.

The enhancement of the human component is also fundamental for a balance between technology and people, focusing the organisation of resources on value-added activities, according to a pattern of intelligent integration, which is not limited to mere cost efficiency and purely replacements, but rather fits into the broader horizon of the Just Transition targeted by the European Union. The current historical moment has emphasised the need to address the priorities towards which corporate culture, leadership styles and models must be directed. The strong acceleration of the digital transformation confirms the need for an increasingly sensitive approach to relational aspects. When dealing with the consolidation of remote working, therefore, the ability of companies to develop distinctive and inclusive communities is a critical factor in their success, and its consolidation reduces the risk of the weakening of relational capital resulting from an irrational use of remote working. Repositioning individual priorities towards an all-round concept of individual well-being and the increased search for flexibility, combined with a growing need for work-life integration, are driving companies to seek constant alignment between individual and collective purpose. The digital workplace transformation and the interconnection on a single platform allow people to interact, share information and gain knowledge and skills. Research by the World Economic Forum in the energy and utilities sector, however, shows that 11.8% of workers are at risk of redeployment, with only 51% of them successfully re-employed. The socio-demographic evolution characterised by a lower birth rate and an increasing incidence of migration will also lead to an increase in the co-presence of different generations within organisations and an increasing focus on diversity and inclusion issues. The ongoing technological, energy and environmental transitions, together with the evolution of organisational models and ways of working, have an impact on the evolution of skills and learning models, but also on a concept of leadership based on authenticity, autonomy and transparency, on performance management beyond the boundaries of space and time, and on a greater search for agility and participation in work regulations. The emerging roles on which to focus training investments will depend on skills related to digital transformation, energy transition (with a focus on decarbonisation and renewable energies), the environmental transition (with a focus on circular economy, climate change and green finance) and, last but not least, problem solving and self-management, thus underlining the increased importance of “soft skills”. The technological ability to acquire huge amounts of data makes it even more important to invest in the human ability to read it and make it “speak”, so that it can generate the expected value. At the same time, while the increasingly pervasive adoption of remote collaboration tools has created a change in the way of working and measuring performance, the ability to provide an environment that is also connected in terms of human relations becomes, for this very reason, sought after and valued. The wider presence of performance management skills, through rooted trust, responsibility, motivation and autonomy, is necessary to ensure the achievement of objectives in a context in which the working time factor is becoming less and less important compared to the result, and has proved to be crucial. Employer branding, moreover, will be decisive in attracting and retaining talent; engagement and inclusion, interconnected by the idea that each person must be valued and encouraged to express his or her potential, are fundamental to maximising performance.

In order to generate value for people, it seems increasingly important to move towards structured data governance and to develop sustainable and circular behaviour. Enabling experiences and paths in training and development that are increasingly defined by a rationale of individual and collective responsibility will make it possible to face future scenarios that are changing and not always predictable. Flexible organisational models used to increase agility and resilience, individual empowerment actions, accompanied by a rethinking of working methods, the reinterpretation of space and time, and the well-being of people, are therefore drivers for the valorisation of human capital and as a consequence for increased productivity. In this respect, the creation of fair and inclusive environments is essential for the responsible financial community, and the commitment to promoting policies of inclusion and protecting diversity must increasingly translate into a fight against discrimination in the workplace.

Scenario analysis is a methodology for defining useful inputs for strategic plans to increase the effectiveness of the business model over time.

This type of analysis involves a process aimed at testing a strategy’s resilience under different assumptions describing possible future states. For the Hera Group, it is essential to analyse the potential impact, positive or negative, of various economic-financial, business, regulatory, competitive, environmental, technological and human capital scenarios that are different from each other, but equally plausible and internally consistent.

The study of scenarios has also been applied to climate change, in order to understand how physical and transitional climate opportunities and risks may plausibly affect business and its various areas over time.

The reference framework within which the Group’s strategy has been developed in the various areas consists of three areas:

Macroeconomy and finance

The debt structure towards which the Hera Group is oriented responds to its business needs, not only in terms of the duration of loans, but also in terms of interest rate exposure. The Group’s financial strategy, in turn, is aimed at maximising its return profile while maintaining a prudent risk strategy.

The scenario projected in the Plan expects the Group’s financial structure to maintain, in 2026, 20% of variable-rate debt and 80% of fixed-rate debt, within the limits of the financial risk policy. These projections are part of a well-pondered long-term planning of the necessary financial resources, which Hera carries out by analysing and monitoring cash flows, paying attention to maintaining a flexible and efficient debt structure. The average cost of debt, in particular, is constantly monitored, both through financial risk management activities which, in order to limit the risk of interest rate fluctuations, include the use of derivative instruments, and through assessments of liability management operations aimed at seizing favourable market opportunities and maintaining a debt repayment profile that is evenly distributed over time. One challenging objective for the upcoming years, falling under the Plan, within a scenario that includes rising rates and a highly volatile market, is to contain the average cost of debt through liability and financial risk management activities. The Plan confirms the Group’s desire to meet financial requirements through fixed-rate bond issues, including green and/or sustainable bonds, taking advantage of any opportunities for subsidised finance, in order to respond to the Group’s investment needs with further gains in efficiency and thus guarantee the implementation of innovative and sustainable projects in the environmental, water and energy sectors. The funding strategy is reflected by the actions included in the Business plan for projects to reduce greenhouse gas emissions and increase the amount of recycled plastic.

Most of the Group’s business is concentrated in Italy, and its rating is thus closely linked to the country’s rating, its macroeconomic trends and its political scenario. Hera’s actions and strategies remain oriented towards maintaining and improving adequate ratings; its usual communication with the rating agencies Moody’s and Standard & Poor’s (S&P) has confirmed positive feedback in terms of the solidity and excellent balance of its business portfolio, as well as in terms of excellent operating performance, efficient and proactive risk management and resilient creditworthiness indicators. In 2022, in particular, Moody’s and S&P ratings were confirmed respectively at BAA2, with an outlook going from stable to negative which reflects the worsening of the sovereign rating outlook (since, despite the Group’s business being recognised as sound and sustainable, a company’s rating cannot be 1 notch higher than that of the country in which it operates), and BBB+ with a stable outlook. The rating obtained is among the highest in the multi-utility sector at European level and is higher than the sovereign rating, confirming the path of growth implemented over the years and the results in line with multi-year expectations.

Over the period covered by the plan, the ongoing adoption of sustainable financial reporting best practices will support the Group’s green financing and ratings. Hera has already been committed to green funding for some time: it was the first Italian company to issue a green bond in 2014, which was followed by an ESG-linked loan in 2018. In 2019, it adopted a Green Financing Framework (GFF), accompanied by a further green bond issue. An expected further improvement in sustainability ratings, in turn, will make it even easier to access lines dedicated to sustainable financing, characterised by potentially lower costs than traditional credit lines. Consistently with these guidelines, the Group is also in the process of implementing the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD) coming from the Financial Stability Board, which foresee the definition of climate scenarios, risks and opportunities related to climate change, as well as processes for managing these risks, and the definition of targets for reducing climate-changing emissions.

In this context, becoming part of the Dow Jones Sustainability Index (DJSI), the first index to track the financial performance of the world’s leading companies in terms of sustainability, bears witness to the validity and credibility of the path taken by the Hera Group, opening up further developments. Recognitions of this type, in fact, act above all as a stimulus and allow Hera to identify the areas to be developed for further improvement in its performance and, at the same time, to include among its reference investors those who are engaged in socially responsible investing (SRI), a segment that, as mentioned above, is undergoing considerable and continuous expansion.

Business areas and industrial strategy

The Group’s 2022-2026 Business Plan, approved in February 2023, was drafted with respect to a complex external context, strongly disrupted by the geopolitical and energy crisis. Faced with such a challenging scenario, the Group’s strategy to 2026 confirms the strategic aspects of its previous planning, putting the focus back on its synergic relationship with its reference areas, thanks to significant investments in projects capable of effectively responding to the main macro-trends of the utility sector: ecological transition, innovation, cohesion and social development.

To orient the ecological transition, the Group’s plan focuses on reducing climate-changing emissions, the circular economy and resilience in services, to improve their quality and continuity.