Governance report

Governance report

- Group

- Governance

- Governance System

- Governance report

In compliance with the Corporate governance code promoted by Borsa italiana, Hera has prepared an annual report on its Corporate governance system, which provides an in-depth illustration of the operations and decisions taken by the corporate bodies during 2024.

2024 Corporate Governance Report

The Hera Group was founded in 2002 as the integration of 11 Emilia-Romagna public service companies, and in the subsequent years continued its geographical growth in order to expand its core business, in particular through the subsequent merger of important companies (Agea Spa, Meta Spa, Sat Spa, Acegas Aps Spa and Amga Azienda Multiservizi Spa), and most recently through its partnership with Ascopiave Spa in the commercial energy sector.

Hera is one of the leading Italian multi-utilities in the environmental services, water, gas and electricity businesses, with more than 9,000 employees, counting both open-ended and fixed-term contracts. The Company, the majority of whose share capital is owned by the state, has been listed on the Mercato Telematico of Borsa Italiana Spa. since 26 June 2003 and operates mainly in the Emilia Romagna region in the territories of Bologna, Ravenna, Rimini, Forlì, Cesena, Ferrara, Modena, and Imola as well as the Veneto, Friuli-Venezia Giulia, Marche and Abruzzo Regions. Hera is an Issuer that uses the traditional governance system and its organisational structure is versatile and capable of adapting to an economic, business and regulatory, technological, environmental and human capital context that is increasingly volatile and affected by significant changes.

The Hera Group’s entrepreneurial and organisational model, unique in this sector, makes it possible to combine strong territorial roots with the need to grow in size and value, in order to offer increasingly efficient services while remaining open to new partners. Since its inception, Hera has developed a trajectory of growth both organic and along external lines.

Its development strategy entails actions to support organic growth in the businesses already served, but also consolidation and acquisition operations to expand the current perimeter of operations, maintaining the Group’s solid financial structure in the context of a shared industrial vision.

On the internal front, Hera addresses all possible opportunities for developing activities in its businesses, leveraging innovation, efficiency and excellence.

The strategy for external lines of growth is based on three cornerstones:

- merger and consolidation operations with other multi-utilities, an activity in which the Group has a long track record of success;

- the acquisition of assets in the individual supply chains served, with the aim of accelerating the growth of the customer base and the completion of the plant-industrial assets;

- participation in tenders for the award of concessions for the operation of regulated services.

Over the years, the Hera Group has, however, implemented a plan to rationalise its shareholdings, reducing their number significantly and more effectively merging the various companies by business area and geographical contiguity.

Hera is also committed to acting every day to enhance the experience and develop the skills of its employees, and to promote cooperation and the exchange of knowledge, so that work is a source of satisfaction and pride for everyone involved as well as an important factor for the success of the company.

Hera’s goal is to become the best multi-utility in Italy for its customers, workforce and shareholders. It aims to achieve this through further development of an original corporate model capable of innovation and of forging strong links with the areas in which it operates, while respecting the local environment.

As early as 2003, Hera included Corporate Social Responsibility in its strategy, a concept which has since evolved into the broader perspective of shared value, understood as a tool for increasing competitiveness and a key factor for achieving sustainable success, in keeping with the guidelines identified by the United Nations.

During the shareholder’s meeting of 28 April 2021, Hera amended Article 3 of the Articles of Association, integrating it with the corporate purpose that the Company aims to achieve in carrying out its business activities.

Therefore, by making this aim explicit, the Company has confirmed and outlined its commitment to developing a business model geared towards creating value for its shareholders by creating shared value together with its stakeholders.

In this regard, as more fully detailed in the sustainability reporting pursuant to Legislative Decree 125/2024, available on the website www.gruppohera.it in the “Investors Section”, Hera organises and carries out its business activities also with the aim of fostering social equity and contributing to the achievement of carbon neutrality, the regeneration of resources and the resilience of the managed services system for the benefit of customers, the reference territorial ecosystem and future generations.

In compliance with Principle I of the Corporate Governance Code referred to below, therefore, Hera means to reaffirm its commitment to corporate social responsibility and sustainability, principles that have constituted a distinctive factor of the Company’s relationship with all its stakeholders since its establishment, with the awareness that the points of intersection between business activities and the local ecosystem represent opportunities for the creation of shared value and, therefore, of lasting prosperity for the Group. In this respect, Hera was the first Italian multi-utility to be included in the Dow Jones Sustainability Index, a global stock market index for assessing social responsibility.

Hera has further strengthened its commitment to the energy transition and circular economy through innovation and digitalisation, as well as its engagement in promoting social equity. Hera believes that creating shared value in these areas represents a guarantee for achieving its “Purpose” and for continuing to act as a company capable of “leaving a mark and not a footprint”, prioritising the three parameters of “Planet, People and Prosperity” at the top of its business model as the fundamental rationale behind its development.

The Mission and Values outline the guidelines for corporate behaviour already contained in the Code of Ethics and shape every action taken by and relationship maintained by the Group. Mission, values and shared conduct represent the strategic and cultural framework within which the business plan is formulated, results are reported transparently through its sustainability reporting, and economic planning is defined on an annual basis.

Hera pays special attention to dialoguing with its stakeholders and the local area in which it operates, consolidating positive results achieved in terms of creating value and demonstrating the Group’s ability to grow despite the current complex economic conditions.

The Board of Directors is guided in its activities by the pursuit of sustainable success and is supported in this by the Ethics and Sustainability Committee, which has the task, among others, of supervising the sustainability aspects of the company’s business.

It should be noted that, in 2024, the Board of Directors approved the Climate Transition Plan, with which Hera is committed to achieving Net Zero emissions by 2050. With such a process, the Hera Group will enrich its strategy towards sustainable development, aligning it with the new decarbonisation demands coming from the external context, allowing it not only to effectively respond to global environmental challenges, but also to boost its competitive position and create long-term value for all stakeholders.

Hera Spa falls, according to the Corporate Governance Code’s classifications, within the sphere of large companies with unconcentrated ownership, having recorded a capitalisation of more than 1 billion euro on the last trading day of the years 2022, 2023 and 2024.

Also note that, with regard to the organisational structure of the Company with indications of its top management, all information can be found on the website www.gruppohera.it under the section group/about us/organisational structure.

a) Share capital structure (pursuant to Article 123-bis, paragraph 1, letter a) of the TUF)

The share capital is EUR 1,489,538,745, fully subscribed and paid-up and is represented by 1,489,538,745 ordinary shares with a nominal value of EUR 1 each.

Share Capital Structure

| TYPE OF SHARE | NUMBER OF SHARE | N. OF VOTING RIGHTS | LISTED | RIGHTS AND OBLIGATIONS |

|---|---|---|---|---|

| Ordinary shares | 749,718,330 | 749,718,330 | MTA Italian Bourse | Ordinary shares grant their holders the property and administrative rights stipulated by law |

| Ordinary shares with increased voting rights | 739,820,415 | 1,479,640,830 | MTA Italian Bourse | Ordinary shares that have been registered for a continuous period of at least 24 months in the special list shall entitle holders to cast two votes for each share held, with regard to the resolutions of the Shareholders' Meetings concerning: i) amendments to articles 6.4 and/or 8 of the Articles of Association, ii) the appointment and/or revocation of the Board of Directors or its members, and iii) the appointment and/or revocation of the Board of Statutory Auditors or its members. |

| Total | 1,489,538,745 | 2,229,359,160 |

b) Restrictions on the transfer of securities (pursuant to Article 123-bis, paragraph 1, letter b) of the TUF)Art. 7 of Hera’s Articles of Association provides that the majority of the voting rights of the Company are held by Municipalities, Provinces, Consortia established pursuant to art. 31 Legislative Decree 267/2000 or to other bodies or public authorities, or to Consortia or limited companies of which Municipalities, Provinces, Consortia constituted pursuant to art. 31 Legislative Decree 267/2000 or other public bodies or authorities also indirectly hold the majority of the share capital. Art. 8.5 of the Articles of Association provides, for each of the shareholders other than those indicated above, that the right to vote cannot be exercised for shareholdings exceeding 5% of the capital of the Company.

c) Significant equity interests (pursuant to Article 123-bis, paragraph 1, letter c) of the TUF)The persons who participate, directly or indirectly, in an amount exceeding 3% of the share capital of the Company represented by shares with voting rights, are the following, based on the communications made pursuant to art. 120 TUF, as well as any additional data held by the Company:

| DECLARER | DIRECT SHAREHOLDER | % OF THE SHARE CAPITAL | PERCENTAGE ON VOTING CAPITAL |

|---|---|---|---|

| Municipality of Bologna | Municipality of Bologna | 8.402% | 8.402% |

| Municipality of Imola | Con.Ami | 7.293% | 7.293% |

| Municipality of Modena | Municipality of Modena | 6.519% | 6.519% |

| Lazard Asset Management LLC | Lazard Asset Management LLC | 5.043% | 5.043% |

| Municipality of Ravenna | Ravenna Holding Spa | 4.916% | 4.916% |

| Municipality of Trieste | Municipality of Trieste | 3.731% | 3.731% |

| Municipality of Padova | Municipality of Padova | 3.097% | 3.097% |

d) Shares that confer special rights (pursuant to Article 123-bis, paragraph 1, letter f) of the TUF)The Shareholders Meeting of 28 April 2015 resolved to introduce art. 6 of the Articles of Association of the institution of increased voting, pursuant to which the subjects who are registered for a continuous period of at least 24 months in the special list established from 1 June 2015, will be entitled to two votes for each share held in the resolutions of the Shareholders meeting concerning: i) the amendment of articles. 6.4 and/or 8 of the Articles of Association, ii) the appointment and/or dismissal of the Board of Directors or its members, iii) the appointment and/or dismissal of the Board of Statutory Auditors or its members.

On 13 May 2015, Hera’s Board of Directors, in order to regulate the criteria and procedures for keeping the special list, approved the regulation of the special list for entitlement to the benefit of the increased vote, in implementation of the provisions of applicable legislation and Hera’s Articles of Association.

e) Restrictions on voting rights (pursuant to Article 123-bis, paragraph 1, letter f) of the TUF)

Art. 8.6 of the Articles of Association provides that the voting rights of persons, other than public entities, who hold a shareholding in the share capital of more than 5% shall be reduced to a maximum of 5%.

f) Shareholder agreements (pursuant to Article 123-bis, paragraph 1, letter g) of the TUF)

In accordance with Article 122 of the TUF, the following Voting Trust and Share Transfer Rules Agreements are in existence:

-

First-level Shareholders Agreement, between 111 public shareholders, concerning the procedures for exercising voting rights and the transfer of the shareholdings held in Hera by members, renewed on 23 May 2024, with a duration of three years, from 1 July 2024 to 30 June 2027, in continuation of the previous agreements, in particular the one entered into on 28 April 2021 effective from 1 July 2021 until 30 June 2024, of which the existing structures and balances expressed in that agreement are maintained unchanged;

-

Second-level Shareholders agreement between 34 public shareholders of Hera, belonging to the Bologna area, concerning the regulation of the exercise of voting rights, the transfer of shareholdings held in Hera by the adherents, as well as the designation of members of the Board of Directors, entered into on 4 June 2024 and with a duration of three years, from 1 July 2024 to 30 June 2027, as a continuation of the previous agreements, in particular the one entered into on 10 February 2022 effective until 30 June 2024, of which the existing structures and balances expressed in that agreement are maintained unchanged;

-

Second-level Shareholders agreement between 42 public shareholders of Hera, belonging to the Romagna area, concerning the procedures for consultation and joint decision-making by the parties in relation to their shareholding in Hera, as well as the procedures for the circulation of the shares bound by this agreement, entered into on 8 June 2024, with a duration of three years, from 1 July 2024 to 30 June 2027, as a continuation of the previous agreements, in particular the one entered into on 27 May 2021 and effective until 30 June 2024, of which the existing structures and balances expressed in that agreement are maintained unchanged;

-

Second-level Shareholders agreement between 20 public shareholders of Hera, belonging to the Modena area, concerning the regulation of the exercise of voting rights, the transfer of shareholdings held in Hera by the adherents, as well as the designation of members of the Board of Directors, entered into on 21 June 2021 and with a duration of three years, from 1 July 2021 to 30 June 2024, as a continuation of the previous agreements, in particular the one entered into on 26 June 2018 effective from 1 July 2018 until 30 June 2021, of which the existing structures and balances expressed in that agreement are maintained unchanged;

-

Sub-agreement between the municipalities of Padua and Trieste, having as its object the constitution of a consultation and voting syndicate functional for the realization of some provisions regarding the corporate governance of Hera in implementation of the provisions of the first level Shareholders Agreement, stipulated on 5 June 2024 with a duration of three years from 1 July 2024 to 30 June 2027, in continuation of the previous agreements, in particular the one entered into on 12 July 2021 of which the existing structures and balances expressed in that agreement are maintained unchanged.

The main identifying elements of the aforementioned Agreements can be found in the “Governance/ Shareholders’ Agreements Disclosures” section of the company’s website at www.gruppohera.it and in the Corporate Governance report 2024 (pages 8-15).

Hera, by resolution of the Board of Directors of 11 November 2020, has implemented the requirements of the Corporate Governance Code (hereinafter the Code), which contains an articulated set of recommendations regarding the methods and rules for the management and control of listed companies, in order to increase clarity and concreteness of figures and roles, in particular of independent directors and internal committees of the Board of Directors.

Although the adoption of the Code’s recommendations is voluntary, the Company has decided, in keeping with its previous adherence to the Corporate Governance Code, to adhere to the Code’s recommendations, in order to reassure investors that it has a clear and well-defined organisational model in place, with adequate allocation of responsibilities and powers and a correct balance between management and control, as an effective tool at the disposal of the Board of Directors for the pursuit of sustainable success.

The full text of the current Code is publicly available on the Corporate Governance Committee website at:

The full text of the Code currently in force is available to the public on the Committee for Corporate Governance website, at: https://www.borsaitaliana.it/comitato-corporate-governance/codice/2020.pdf

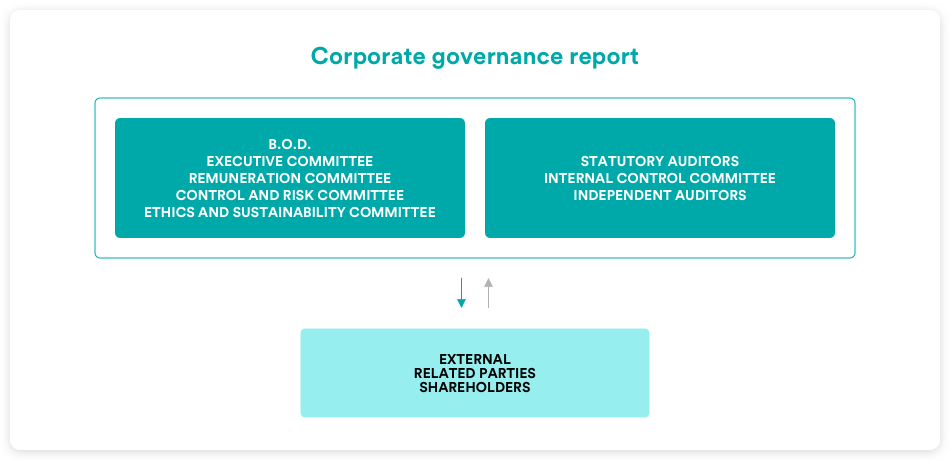

Hera is endowed with a system of ordinary/traditional governance. The following paragraphs explain the role, composition and functioning of the Board of Directors.

Role of the Board of Directors

The Board of Directors is the collegiate body responsible for the administration of the Company. In accordance with the recommendations of the Code, the Board of Directors has the task of guiding the Company in pursuing its sustainable success (principle I), defining its strategies (principle II), including for the reference Group, in line with the pursuit of sustainable success and monitoring its implementation.

The administrative body also defines the system of corporate governance most functional to the conduct of business and the pursuit of its strategies (principle III) and promotes, in the most appropriate forms, dialogue with shareholders and other stakeholders relevant to the Company (principle IV).

The Articles of Association provide that the Board shall meet at least quarterly and whenever deemed necessary by the Chairman or when requested by at least 1/3 of its members or by the Board of Statutory Auditors. It is also provided that the Board of Directors is vested with the widest powers for the ordinary and extraordinary management of the Company without limitations, with the right to perform all acts deemed necessary or appropriate for the achievement of the corporate purposes, excluding only those that, strictly speaking, by law or by statute, are reserved to the competence of the Shareholders Meeting.

In particular, in accordance with the Articles of Association, in addition to the definition of the Group structure, the Board has the exclusive competence to decide on:

I. appointment and/or dismissal of the Chairman and Vice Chairman;

II. appointment and/or dismissal of the Chief Executive Officer and/or General Manager;

III. establishment and composition of the Executive Board, appointment and/or dismissal of the members of the Executive Board;

IV. determination of the powers delegated to the Chairman, the Chief Executive Officer and/or the General Manager and/or the Executive Board and their modifications;

V. approval and amendments of any multiannual plans or business plans;

VI. approval and amendments to the Group’s regulations, if adopted;

VII. recruitment and/or appointment, on the proposal of the CEO, of the managers responsible for each functional area;

VIII. proposal to place on the agenda of the Extraordinary Shareholders Meeting the amendment of Articles. 6.4 (shares and increased vote), 7 (public majority shareholding), 8 (limits on share ownership), 14 (validity of meetings and right of veto) and 17 (appointment of the Board of Directors) of the Articles of Association;

IX. assumption and disposal of shareholdings with a value exceeding 500 thousand euros;

X. purchase and/or sale of real estate with a value of more than 500 thousand euros;

XI. issuance of sureties, pledges and/or other collateral with a value exceeding 25 million euros;

XII. purchase and/or sale of companies and/or business units;

XIII. appointment of directors of subsidiaries and/or investee companies;

XIV. participation in public tenders and/or procedures involving the assumption of contractual obligations in excess of 25 million euros.

Specifically, the Board is tasked with:

- the examination and approval of the Issuer’s and its Group’s business plan, also on the basis of an analysis of the issues relevant for long-term value generation (Recommendation 1, a);

- periodic monitoring of the implementation of the business plan, as well as evaluation of the general management performance, periodically comparing the results achieved with those planned (Recommendation 1, b);

- the definition of the nature and level of risk compatible with the Issuer’s strategic objectives, including in its assessments all elements that may be relevant to the Issuer’s sustainable success (Recommendation 1, c) (for further details on this see “Section 9”);

- the definition of the corporate governance system of the Issuer and the structure of the Group headed by it (Recommendation 1, d, first part);

- the assessment of the adequacy of the organisational, administrative and accounting structure of the Issuer and its strategically important subsidiaries, with particular reference to the internal control and risk management system (Recommendation 1, d, second part) (for further details see “Section 9”);

- the decision on transactions of the Issuer and its subsidiaries that are of significant strategic, economic, capital or financial importance to the Issuer, establishing the general criteria for identifying transactions of significant importance (Recommendation 1, e);

- the adoption, on a proposal from the Chairman, in agreement with the Chief Executive Officer, of a procedure for the internal management and external communication of documents and information concerning the Issuer, with particular reference to inside information (Recommendation 1, f) (for further details on this see “Section 5”).

Specifically, the Board of Directors:

- following the adoption of the “Policy for the management of the Dialogue with the generality of Shareholders and Bondholders” (which took place during the 2021 financial year), in the financial year 2024 the Executive Chairman, as director in charge, reported on a half-yearly basis, on the development and relevant contents of the dialogue with shareholders and bondholders, as well as on the most significant requests received from other stakeholders (for further details on this see “Section 12”);

- approved the business plan on 23 January 2025;

- approved the transactions concerning Hera and the Group companies in execution of the strategies contained in the business plan.

As regards further powers to the Board in the areas of composition, operation, appointment, self-assessment, remuneration policy, internal control and risk management, please refer to the following sections of this report.

For more information on the roles and responsibilities of the Board of Directors regarding sustainability, see the section “Governance” in the chapter “General information” of the sustainability reporting.

Appointment and replacement (pursuant to Article 123-bis, paragraph 1, letter l) of the TUF)

List voting

For the appointment of the Board of Directors, the list voting mechanism is provided, in order to ensure the presence within it of directors designated by minority shareholders, in compliance with current legislation on gender balance.

More specifically, the articles. 16 and 17 of the Articles of Association govern the terms and conditions for filing and publishing the lists, as well as related documentation, in accordance with current regulations.

In this regard, it is recalled that the Shareholders Meeting of 28 April 2022 approved an amendment to the Articles of Association to adapt the number of independent directors to the indications introduced by the Code.

In view of the above, the current Articles of Association provide that the lists submitted by shareholders must include at least two candidates who meet the independence requirements established for auditors by art. 148 paragraph 3, of Legislative Decree no. 58/1998, as well as at least half of the candidates who meet the independence requirements provided for in the Code drawn up by the Committee for Corporate Governance, together with the candidates’ resumes, the irrevocable acceptance of the office and the attestation of the non-existence of causes of ineligibility and/or forfeiture, good repute, as well as the possible declaration of being in possession of the independence requirements established for auditors by art. 148 paragraph 3 of the TUF and those provided for by the Code. In this regard, it should be noted that the Board of Directors currently in office consists of 11 out of 15 independent directors.

The lists must be filed, pursuant to art. 17.5 of the Articles of Association, at the registered office at least 25 days before the Shareholders Meeting, and made available to the public at the registered office and on the website www.gruppohera.it at least 21 days before the meeting.

The terms and procedures for filing the lists are indicated by the Company in the notice convening the Shareholders Meeting. Each shareholder may submit or participate in the submission and voting of only one list. Adhesions and votes cast in violation of this prohibition shall not be attributed to any list.

Eligibility to submit lists and their composition

The Articles of Association do not provide for the possibility of the outgoing Board of Directors presenting a list.

Shareholders representing at least 1% of the share capital entitled to vote at the Ordinary Shareholders Meeting may submit lists for the appointment of the members of the Board of Directors, unless otherwise provided for by current legislation, to be indicated in the notice of convocation.

In this regard, it is specified that, on the occasion of the last renewal of the administrative body which took place with the Shareholders Meeting of 27 April 2023, the shareholding required for the presentation of the lists of candidates for the election of the current administrative body was identified by Consob (with determination no. 76 of 30 January 2023) in the amount of 1%, equal to the percentage provided for by art. 17.4 of the current statutes.

In order to prove ownership of the number of shares necessary for the presentation of the lists, shareholders must file with the registered office, within the deadline for publication of the lists by the Company, the appropriate certification proving ownership of the number of shares represented.

The provisions of art. 17 of the Articles of Association, as amended by the Extraordinary Shareholders Meeting of 29 April 2020, in implementation of the Law 160 of 27 December 2019, also ensure compliance with current legislation on gender balance in the administrative and control bodies of listed companies.

If the instrument of voting list does not ensure the minimum gender quota required by law, the candidate of the most represented gender placed last in the ranking of candidates elected from the most voted list will be replaced by the candidate of the less represented gender who was first among the non-elected of the same list and thus to follow up to the minimum number of directors belonging to the less represented gender. If, even if this criterion is applied, the minimum number of directors belonging to the less represented gender is still missing, the replacement criterion indicated will apply to minority lists, starting with the most voted one.

Appointment mechanism

The appointment of the members of the Board of Directors takes place in accordance with current legislation and in accordance with the provisions of articles. 16 and 17 of the Articles of Association, and therefore:

- the Company is administered by a Board of Directors composed of 15 members;

- the appointment of the members of the Board of Directors takes place on the basis of lists in which the candidates are marked with a sequence number and are in any case no more than the number of members to be elected;

- from the list that obtained the highest number of votes, 11 members of the Board of Directors are drawn according to the progressive order in which they were listed, of which at least four are of the less represented gender;

- for the appointment of the remaining four members, the votes obtained from each of the lists other than that of the majority, and which have not been submitted or voted by members connected in accordance with the pro-tempore rules in force with the shareholders who have submitted or voted on the same majority list, shall be divided successively by one, two, three and four. The quotients thus obtained shall be assigned progressively to the candidates of each list, in the order laid down in the list. The candidates are then placed in a single descending ranking, according to the quotients assigned to each candidate. Candidates will be elected who have reported the highest quotients up to the competition of the remaining members to be elected of which at least one of the less represented gender.

Replacement of directors

Pursuant to art. 17.10 of the Articles of Association, if, during the course of the financial year, one or more directors appointed on the basis of list voting should cease to hold office, their place shall be co-opted, pursuant to Art. 2386 of the Italian Civil Code, the first non-elected candidates of the list to which the departing directors who had not yet joined the Board of Directors belonged, in compliance with the principles of gender balance provided for by law. If, for any reason, no names are available, the Board shall, in compliance with the principles of gender balance provided for by law, provide for the co-option of a director, as provided for by Art. 2386 of the Italian Civil Code. The directors, thus appointed, remain in office until the next Shareholders Meeting which will deliberate in the manner provided for the appointment.

For information on the role of the Board of Directors and the committees of the Board in the processes of self-assessment, appointment and succession of directors, refer to “Section 7”.

Composition (pursuant to Article 123-bis, paragraph 2, letter d) and d-bis, of the TUF)

In line with the requirements of Principle V of the Code, the Board is composed of executive and non-executive directors, all with professionalism and skills appropriate to the tasks entrusted to them.

Principle VI of the Code is also respected, since 11 of the 13 non-executive directors are independent and the number and competences of the same are such as to ensure significant weight in the assumption of board resolutions and to ensure effective management monitoring.

The Shareholders Meeting of 27 April 2023 appointed for three financial years a Board of Directors, currently in office until the approval of the financial statements for the financial year 2025, composed of 15 members, of whom:

- 11 members taken from the list that obtained the most votes according to the order in which they were listed, of which four are of the less represented gender;

- four components taken from the lists other than the list having the highest number of votes and which were neither submitted nor voted on by members connected with the members who submitted or voted on the majority list, of which two were of the less represented gender

This appointment thus took place through the list voting system, in order to ensure the minority list the right to appoint at least 1/5 of the directors in compliance with the provisions of art. 4 of Legislative Decree 332 of 31 May 1994 converted by the Law 474 of 30 July 1994.

At the Shareholders Meeting of 27 April 2023 mentioned above, three lists of candidates were presented and are available at the AGM 2023 webpage.

The current composition of the Board of Directors is indicated below, referring to Table 2 – Structure of the Board of Directors at the end of the financial year – attached to this report, for more detailed information on the composition of the Board of Directors and the length of office since the first appointment of its members, as well as to the specific section on the Company’s website where the personal and professional characteristics of each director are available.

It should be noted that, compared to the composition of the Board of Directors at the date of appointment, the following changes have occurred.

- following the resignation of Mr. Lorenzo Minganti from the position of non-executive and independent Director, effective June 19, 2023, the Board of Directors, on September 27, 2023, resolved to appoint by co-option, as a Director, Mr. Enrico Di Stasi, subsequently confirmed to the position by the Shareholders Meeting of 30 April 2024;

- the Shareholders Meeting of 30 April 2024 appointed Mr. Tommaso Rotella Attorney at Law to the position of non-executive and independent Director, replacing Vice Chairman Mr. Gabriele Giacobazzi, who resigned on 3 March 2024. Subsequently, at its meeting on 14 May 2024, the Board of Directors appointed Mr. Tommaso Rotella as Deputy Chairman of the Board of Directors of Hera, who will remain in office until the natural expiration of the administrative body.

| NAME AND SURNAME | OFFICE HELD | QUALIFICATION |

|---|---|---|

| Cristian Fabbri | Executive Chairman | Executive Director |

|

Orazio Iacono |

Chief Executive Officer |

Executive director |

| Tommaso Rotella | Vice Chairman | Non-executive Independent Director |

| Fabio Bacchilega | Director | Non-executive Independent Director |

| Gianni Bessi | Director | Non-executive non-Independent Director |

|

Enrico Di Stasi ** |

Director | Non-executive non-Independent Director |

|

Grazia Ghermandi |

Director | Non-executive non-Independent Director |

|

Alessandro Melcarne |

Director | Non-executive Independent Director |

|

Milvia Mingozzi |

Director | Non-executive Independent Director |

|

Marina Monassi |

Director | Non-executive Independent Director |

|

Monica Mondardini |

Director | Non-executive Independent Director |

|

Francesco Perrini |

Director | Non-executive Independent Director |

|

Paola Gina Maria Schwizer |

Director | Non-executive Independent Director |

|

Bruno Tani |

Director | Non-executive Independent Director |

|

Alice Vatta |

Director | Non-executive Independent Director |

*appointed director by the Shareholders Meeting of 30 April 2024, and subsequently Vice Chairman by the Board of Directors of 14 May 2024.

For more information on the composition and competences of the Board of Directors regarding sustainability, see the “Governance” section in the chapter “General information” of the sustainability report.

Diversity criteria and policies in Board composition and corporate organization

Hera has applied criteria of diversity, including gender, in the composition of the administrative body, whose members are in possession of adequate skills and professionalism.

In particular, the appointment of the Board of Directors took place during the Shareholders Meeting of 27 April 2023, following the presentation of three lists, one majority and two minority, which guaranteed, in accordance with the

compliance with the current gender balance regulations, that at least 2/5 of the members of the Board of Directors were the less represented gender (six members of the less represented gender out of a total of 15 directors).

Of the current 15 directors in office, three are between the ages of 30 and 50, six are between the ages of 51 and 60 and six are over 60, for a total average age of about 59.

The directors have proven expertise in financial, economic, legal and sustainability, social and environmental issues.

Hera also maintains the priority objective of ensuring equal treatment and opportunities between genders, including within the entire company organization, on the basis that:

- diversity of gender, culture and origin is universally recognised as a value and must be better managed;

- when people feel equal and included, cooperative behaviours are generated at work and organisational coexistence is fostered, which is conducive to sharing corporate culture more effectively.

Already in 2011, in order to further promote the development and dissemination of a company policy on equal opportunities and equality at work, the Diversity Manager was established with the aim of promoting the implementation of this company policy on equal opportunities and enhancement of diversity.

Diversity management’s mission is expressed in some macro-points:

- disseminating the culture of inclusion between public, private and civil society, and sharing best practices with local institutions and companies to strengthen social networks;

- supporting the management and enhancement of plurality within the Company;

- strengthening the Hera Group’s role in developing a culture of appreciation for differences and work-life balance.

Disseminating a culture of diversity as well as introducing time-saving projects aimed at ensuring good work-life balance, health and well-being, and empowerment have been central themes in the trajectory pursued so far within the Company.

In particular, the commitment to raising awareness about and promoting the culture of diversity, both inside and outside the Group, continued in 2024, strengthening networking with stakeholders.

In continuity with the priorities of the Hera Group, particular attention is paid to STEM (Science, Technology, Engineering, Mathematics) issues and the gender gap often associated with them.

Lastly, on 19 June 2024, the representatives of the Hera Group and the Trade Union Organizations signed the “Good Work Pact – safety, procurement, inclusion, well-being and sustainability”, an agreement aimed at mapping out a sustainable path aimed at fostering not only economic prosperity but also at collective well-being and the protection of the planet, and based on five fundamental pillars (health and safety; integrated supply chains and procurement; equity and inclusion; well-being, professional development and productivity; sustainability and shared value).

For further information on the diversity of the Board of Directors, see the section ‘Governance’ in the ‘General Information’ chapter of the sustainability reporting and for reference to the diversity policy, see the section ‘Policies and Objectives’ in the ‘Own Workforce’ chapter of the sustainability reporting.

Maximum accumulation of positions in other companies

It should be noted that the Board of Directors, by resolution of 28 June 2023, aligned with the provisions of the Corporate Governance Code the orientation already expressed by the Board of Directors by resolution of 10 October 2006, providing for the limitation to one of the maximum number of director or statutory auditor positions in listed or large companies that can be considered compatible with the role of executive director and to two the maximum number of director or statutory auditor positions in listed or large companies that can be considered compatible with the role of non-executive director.

In this regard, the Board of Directors, at its meeting of 26 March 2025, considered compatible:

-

the position of director held by Ms. Mondardini in Hera, although she declared that she holds positions in three listed companies and in one company of significant size, given that three of these belong to the same corporate group;

-

the position of director held by Bruno Tani in Hera, although he declared that he holds positions in five listed companies of significant size, given that four of these belong to the same corporate group;

Functioning of the Board of Directors (pursuant to Article 123-bis, paragraph 2, letter d) of the TUF)

In compliance with the provisions of art. 3 - Recommendation 11 - of the Code, the Company has adopted a regulation on the functioning of the administrative body, approved by the Board of Directors on 11 November 2020, and last amended during the meeting of 26 February 2025, as well as regulations concerning the functioning of its internal committees.

The rules of the Board of Directors govern, in particular, the functioning of the body, the functions of the Executive Chairman and the Secretary, the pre-board disclosure and the duties of directors with specific reference to the diligence required to perform the task, as well as the protection of the confidentiality of data and information acquired.

With regard to the pre-Board disclosure, in order to ensure timeliness and completeness of the same, it is provided that the resolution proposals and/or supporting documentation for Board meetings are brought to the attention of each Director and Statutory Auditor with a dedicated information system, – accessible through confidential credentials for each member – at least three working days before the date of the Board of Directors, except in cases of urgency where the documentation is made available as soon as available and in any case, possibly, before the start of the Board meeting.

The Executive Chairman and the Chief Executive Officer shall ensure that the Board of Directors is also informed of the main legislative and regulatory changes affecting the Company and the corporate bodies.

After each meeting of the Board of Directors, a draft of the minutes shall be sent to all Directors and Statutory Auditors for any comments. The final text of the minutes is then drafted by the Secretary of the Board of Directors and, subject to the approval of the Chairman, shall be submitted for approval to the Board of Directors at the next meeting and, subsequently, transcribed on the appropriate company Minute Book. In case of urgency – in particular for resolutions adopted that require immediate document production and/or execution – the minutes, or part of them, may be approved immediately.

The Board of Directors, moreover, in accordance with the provisions of art. 23 of the Articles of Association and art. 150 of Legislative Decree no. 58/98, promptly reports to the Board of Statutory Auditors, at least quarterly and normally at the meeting of the Board of Directors or even directly with a written note sent to the Chairman of the Board of Statutory Auditors, on the activities carried out and on the transactions of major economic, financial and financial importance carried out by the Company or its subsidiaries, as well as on the transactions in which the directors have an interest, on their own behalf or on behalf of third parties, or which are influenced by the person exercising the activity of management and coordination. The director, pursuant to art. 2391 of the Italian Civil Code, gives notice to the other directors and the Board of Statutory Auditors of any interest that, on behalf of itself or third parties, has in a given transaction of the Company, specifying its nature, terms, origin and scope; if it is a Chief Executive Officer, it must refrain from carrying out the transaction by investing the same in the collegiate body.

The Board of Directors met 11 times in 2024: five meetings were attended by all the directors while the remaining six meetings were attended by almost all the directors; seven meetings were attended by all the regular auditors, while four sessions were attended by almost all the regular auditors. Meetings of the Board of Directors lasted on average about three hours and 15 minutes.

Also in the financial year 2024, as already noted since 2019, a high attendance of directors at meetings of the Board of Directors (equal to over 95%) is confirmed, slightly higher than the average level of attendance recorded in companies belonging to the Ftse Mib Index.

In accordance with principle XII of the Code, each director has accordingly ensured that adequate time is available for the diligent performance of the duties assigned to him.

The Central Legal and Corporate Affairs Director, in his quality as secretary of the Board of Directors, was present at all eleven meetings.

Meetings of the Board of Directors were attended, upon express request, by the executive managers responsible for the corporate functions to provide insights into the matters of competence placed on the agenda.

Below are the presences of the managers invited to attend the meetings of the Board of Directors:

- the Director of Central Administration, Finance and Control attended six meetings;

- the Director of Central Strategy, Regulation and Local Authorities attended two meetings;

- the Director of Central Innovation Director attended one meeting;

- the Central of Central Personnel and Organization attended two meetings;

- the Director of Central Corporate Services attended one meeting;

- the Director of Shared Value and Sustainability attended two meetings;

- the Central Director of Communication and External Relations attended one meeting;

- the Director of Internal Auditing attended one meeting;

- the Manager of the Consolidated and Tax Financial Statements of the Central Administration, Finance and Control Department attended one session;

- the CEO of Hera Comm Spa attended one meeting.

As regards the current financial year, three meetings of the Board of Directors have been held as at 26 March 2025: two meetings were attended by virtually all members and one meeting was attended by all members. At this date, eight meetings of the Board of Directors have already been scheduled for the remainder of the year.

Role of the Chairman of the Board of Directors

In line with the provisions of Principle X of the Code, the Chairman receives requests and contributions from the Company’s independent non-executive directors through the Lead independent director, who represents a point of reference and coordination.

The Chairman, moreover, pursuant to art. 2381 of the Italian Civil Code, convenes the Board of Directors, sets the agenda, coordinates its work and ensures that adequate information on the matters on the agenda is provided to all Directors, in the manner set out in art. 7.

More specifically, the Chairman, as provided for in the regulations on the functioning of the Board of Directors and in compliance with Recommendation 12 of the Code, with the help of the Secretary, ensures that:

-

that the pre-board information and additional information provided during meetings are suitable to enable Directors to act in an informed manner in the performance of their role;

-

that the activity of the committees of the Board with preliminary, proposal and advisory functions is coordinated with the activity of the board of directors;

- that the directors of the Company and those of the Group companies, who are responsible for the relevant corporate functions, may attend board meetings to discuss the points within their competence; these are in any case required to observe the confidentiality obligations provided for board meetings;

- that all members of the administrative and control bodies may participate, after the appointment and during the mandate, in induction sessions;

- the adequacy and transparency of the self-assessment process of the administrative body.

With regard to induction, the Chairman ensures that the members of the board of directors participate in initiatives aimed at deepening their knowledge of Hera’s business sector, its business dynamics and their evolution, as well as the regulatory framework.

As has already happened in the past, in the last financial year too, in-depth moments were prepared in order to ensure that the directors acquire adequate knowledge of the main issues concerning the Company as soon as possible.

In particular, during 2024, the in-depth focus was on the following topics: human resources, information systems and cyber security platform, CSV strategy and procurement process.

Also in 2024, the focus was on analysis – during Board meetings – aimed at providing directors with adequate knowledge of the main characteristics of the company (governance and sustainability), the results achieved in recent years, the elements of the business plan and the CSV strategy, as well as human resources, financial management and risk management, with in-depth analysis of the activities that the Group carries out on the innovation front (in particular on projects concerning renewable energy and the pursuit of carbon neutrality).

On the subject of stakeholders, an overview of the activities of local advisory councils (HeraLAB) was also provided.

With reference to sustainability, the board of directors took part – together with the supervisory body – in a specific training activity to update the relevant skills with respect to the Corporate Sustainability Reporting Directive, with a focus on the role of governance in sustainability issues and related responsibilities.

With regard to the energy scenario, updates were provided, in particular, on the Safeguards market, the Gradual Protection Service and the performance of Hera Stock.

As for the climate scenario, the Net Zero commitments of the Hera Group to 2050 were shared and the Climate Transition Plan was approved; several updates were then provided on the actions implemented by the Hera Group in response to the flooding events.

With reference to the National Recovery and Resilience Plan, the Board was informed about the state of the art of Hera Group projects to be financed under the aforementioned Plan.

In addition, insights into risk assessment, reporting for monitoring and managing financial risks and investments were carried out.

The regular reports of the Risk Committee and the Control and Risk Committee were illustrated.

Then evaluations were made of the recommendations of the Chairman of the Corporate Governance Committee.

In 2024 as well, additional analysis was carried out during the strategy day, as a moment of collegial reflection on the future of the Company, with the support of management.

In addition, various updates were provided on the state of the art of industrial relations in the Hera Group, most recently highlighting the signing by representatives of the Hera Group and the trade unions of the ‘Patto del Buon Lavoro - sicurezza, appalti, inclusione, benessere e sostenibilità’ (Good Work Pact - Safety, Tenders, Inclusion, Welfare and Sustainability).

In addition to this, visits to the Group’s facilities were organized, in particular to the Recycla Spa (industrial waste recycling) and Aliplast Spa (plastic recycling) plants.

The in-depth work will continue throughout 2025.

The Chairman, with the support of the Secretary of the Board of Directors, reports to the Board of Directors on a half-yearly basis, or by the first useful meeting, when significant events occur, on the development and relevant contents of the dialogue with shareholders and bondholders, as well as any contacts with other stakeholders.

The Board of Directors was informed about the meetings held in 2024 with investors and financial analysts, the road shows held in the main European (Milan, Geneva, London, Zurich, Paris, Brussels, Luxembourg and Amsterdam), American (New York, Chicago) and Australian (Sydney) markets, as well as the most significant requests received from other stakeholders.

For more information on the composition and competences of the Board of Directors regarding sustainability, see the paragraph “Governance” in the chapter “General information” of the sustainability report.

Secretary of the Board of Directors

In compliance with the provisions of Recommendation 18 of the Code, the Board resolves, upon the Chairman’s proposal, the appointment - also from outside the Board - and the dismissal of the Secretary of the administrative body, who must meet the requirement of professionalism as well as provide, with impartial judgement, assistance and advice to the administrative body on any aspect relevant to the proper functioning of the corporate governance system.

In the event of his/her absence or impediment, the duties of Secretary shall be temporarily entrusted by the Chairman to a person designated by him.

Also in compliance with the provisions of Recommendation 12, the Secretary has the following functions:

a) coordination and collection of documentation to be submitted to the Board of Directors;

b) assistance to the Chairman in conducting the meeting;

c) drafting of the minutes of the meeting;

d) preservation of the Minutes of the endorsed sessions and the documentation in the minutes of the meetings of the Board of Directors;

e) communication to the reference structures of the relevant resolutions adopted by the Board of Directors.

Executive Directors

The Board of Directors of Hera includes two executive directors, the Chairman and the Chief Executive Officer.

Neither of the two executive directors may qualify as the chief executive officer of the company, since are they both responsible for various company sectors and have specific management powers attributed to the latter..

Executive Chairman of the Board of Directors

The Board of Directors, which met on 27 April 2023 in full session following the renewal of the corporate bodies on the same date, unanimously resolved to grant the Executive Chairman the powers indicated below in their version subsequently updated at the Board of Directors’ meeting of 14 May 2024:

- preside over and direct the Shareholders Meeting;

- establish the agenda of the Board of Directors, also taking into account the proposals of the Chief Executive Officer;

- oversee the execution of the resolutions of the Company’s governing bodies, also on the basis of the periodic reports made by the Internal Auditing service;

- represent the Company before third parties and in court with the power to appoint attorneys and lawyers;

- as a matter of urgency, take jointly with the Chief Executive Officer take any decision falling within the competence of the Board of Directors, notifying the Board of Directors at the first subsequent meeting;

- jointly with the Chief Executive Officer, propose to the Board of Directors the appointment of the Company’s representatives in the administrative and control bodies of the affiliates and subsidiaries;

- represent the Company in relations with public shareholding entities;

- proposing to the Board of Directors the candidates as members of the Committees that the Board should decide to set up in compliance with the Stock Exchange regulations that the Company is obliged or intends to set up;

- implement the decisions of the Shareholders Meeting and the Board of Directors as far as their competence is concerned;

- supervise the performance of the Company for the achievement of the corporate objectives and make proposals concerning the management of the Company to be submitted to the Board of Directors;

- being responsible for the organisation of the services and offices falling under his responsibility as well as for the staff employed by him;

- sign the correspondence of the Company and the acts relating to the exercise of the powers conferred and the functions exercised;

- monitor the management performance of the Company and, to the extent of his competence, of the assigned affiliates and subsidiaries, reporting monthly to the Board of Directors;

- prepare multi-annual plans to be submitted to the Board of Directors; implement corporate and Group strategies, within the framework of directives established by the Board, and exercise delegated powers, and in particular those listed here, in accordance with these strategies and directives;

- propose to the Board all initiatives he deems to be useful in the interest of the Company, and the Group, and make proposals in matters reserved to the competence of the Board itself;

- represent the Company in the assemblies of companies, associations, bodies and organisations not constituting corporations, of which it is a member, with the power to issue proxies;

- make payments to the Company’s bank and postal current accounts, and endorse cheques and money orders for crediting to those accounts;

- represent the Company actively and passively before public and private bodies and offices, Chambers of Commerce, Stock Exchanges, the National Commission for Companies and the Stock Exchange, the Ministry for Foreign Trade and the Italian Foreign Exchange Office as well as any other public administration or authority; by way of example:

- sign communications, including those to Consob, and provide for the corporate obligations required by law and regulations;

- lodge complaints, lodge applications and appeals, apply for licences and authorisations;

- represent the Company in all active and passive lawsuits, at all levels of jurisdiction, before arbitration boards, with the broadest powers to

- bring cognitive, conservative, precautionary and executive actions, apply for and oppose injunctions and seizures, join civil actions, file petitions and appeals, lodge actions and complaints

- request and oppose any evidence, make the examination free or formal, elect domiciles, appoint lawyers, prosecutors and arbitrators and do whatever is necessary for the success of the cases in question;

- enter into and sign contracts and deeds for the acquisition and disposal of shareholdings, establishment of companies, associations, consortia with a value not exceeding €500,000.00 (five hundred thousand euros) per individual transaction;

- establish, in the interest of the Company, consulting relationships with external experts and professionals, setting times and methods of payment, all within the limits of € 300,000.00 (€ three hundred thousand) for each transaction;

- to the extent of his competence, enter into, amend and terminate commercial agreements with companies and entities;

- to the extent of his competence, to enter into, with all appropriate clauses, assign and terminate contracts and agreements in any way pertaining to the corporate purpose - including those pertaining to original works, trademarks, patents - also in consortium with other companies, up to an amount of € 2,000,000.00 (two million euros) for each individual act;

- provide for all expenses of the Company for investments, call for tenders, enter into, amend and terminate the relevant contracts, in particular for

- works, services and supplies necessary for the transformation and maintenance of buildings and plants up to an amount of € 20,000.000.00 (€ twenty million) for each single operation;

- purchases and disposals of furniture, equipment, machinery and movable assets in general, also recorded in public registers, up to an amount of €10,000,000.00 (ten million euros) for each individual transaction, as well as financial leases and rentals of the assets themselves, with an expenditure limit referring to the annual rent;

- purchases, including licenses for use with a spending limit referring to the annual fee, and orders relating to EDP programs;

- commercial information;

- intervene, to the extent of his competence, as representative of the Company, both as the parent company and as the lead company, in the constitution of joint ventures, ATIs (Temporary Associations of Enterprises), EEIGs (European Economic Interest Grouping), consortia and other bodies, giving and receiving the relevant mandates, in order to participate in tenders for the award of works, services and supplies;

- to participate, to the extent of his competence, as representative of the Company, also in ATIs (temporary associations of undertakings), EEIGs (European Economic Interest Groupings), consortia and other bodies, in tenders or concessions, auctions, private tenders, private negotiations, tenders-competitions and other public national, Community and international tenders, even admitted to contribution or competition by the State, for the award of works, supplies of plants, even turnkey and/or goods and/or studies and/or research and/or services in general to any national, Community and international, public or private entity; submit requests to participate from the prequalification phase; submit bids up to an amount of € 25,000,000.00 (€ twenty-five million) for each individual transaction, in case of urgency, for amounts exceeding € 25,000,000.00 (€ twenty-five million) will be taken, together with the Chief Executive Officer, the relevant decision, giving notice to the Board of Directors at the first following meeting; in the event of an award, sign the relevant deeds, contracts and commitments, including the issue of guarantees and/or the lodging of security deposits, with every broadest power to negotiate, agree and/or perfect all the clauses it deems necessary and/or appropriate and/or useful;

- stipulate, modify and terminate contracts for insurance policies with a spending limit referring to the annual premium, as well as arrange for the issuance of insurance surety policies up to the value of € 25,000,000.00 (€ twenty-five million) for each transaction (this limit will not operate for transactions related to participation in tenders);

- conclude, stipulate and execute acts of sale, purchase, transfer of immovable property, establish, modify or extinguish the rights in rem relating to the same property, with the right to perform all related and consequential acts, including paying and/or receiving, even in a deferred manner, the consideration and liquidate any damages and waive legal mortgages, up to an amount of € 500,000.00 (€ five hundred thousand) for each transaction;

- conclude, stipulate and execute acts of incorporation, modifications and extinguishment relating to active and passive servitude, voluntary or coercive, as well as activate the expropriation procedures of real estate, installations, equipment and facilities at the service of the networks, as well as any other and any act that may be necessary for the perfection of the servitude itself, with the right to perform all related and consequent acts, including paying and/or receiving, even in a deferred manner, the consideration and liquidating any damages and waiving legal mortgages, up to an amount of €500,000.00 (€ five hundred thousand) for each operation;

- assume and grant rental and sublease properties and enter into, amend and terminate the related contracts;

- deliberate the cancellation, reduction, restriction of mortgages and liens registered in favour of the Company as well as subrogations in favour of third parties, when the aforesaid cancellations and waivers are requested following or subject to the full settlement of the receivable

- constitute, register and renew mortgages and liens at the expense of third parties and for the Company’s benefit; allow cancellation and restriction of mortgages at the expense of third parties and for the Company’s benefit for restitution and reduction of obligations; waive mortgages and mortgage subrogations, including legal ones, and perform any other mortgage transactions, always at the expense of third parties and for the Company’s benefit, and therefore active, holding the competent registrars of real estate registers harmless from any and all liability;

- appoint lawyers and attorneys to litigation in any dispute for any degree of judgment; conclude settlements up to an amount of € 5,000,000.00 (€ five million) for each individual transaction, sign arbitration agreements and arbitration clauses, also appointing and appointing arbitrators;

- define the functional structures of the Company and its subsidiaries, within the framework of the general organisational guidelines established by the Board; establish the criteria for hiring and managing personnel in compliance with the annual budget; propose to the Board of Directors the hiring of the managers in charge of each functional area, subject to the opinion of the Executive Committee; hire, appoint and dismiss personnel, in compliance with the forecasts contained in the annual budgets; promote disciplinary sanctions and any other measures against personnel;

- represent the Company in all labour law cases including the right to:

- reconcile individual labour disputes covering all categories of staff;

- request and oppose any evidence, make the examination free or formal, elect domiciles, appoint lawyers, prosecutors and arbitrators and do whatever is necessary for the success of the cases in question;

- represent the Company before the offices and institutions for social security and assistance in relation to matters relating to the Company’s personnel, as well as before the Trade Unions in the negotiations for contracts, agreements and labour disputes, with the power to sign the related acts;

- conferring and revoking powers of attorney under the aforementioned powers, for individual acts or categories of acts both to employees of the Company and to third parties also legal persons;

- decide, within the scope of his competence, on the Company’s membership in bodies, associations, organisations of a scientific, technical, study and research nature in fields of interest to the Company, whose contributions do not represent equity investments of the same entity, and whose participation entails a cost commitment not exceeding € 300,000.00 (three hundred thousand euro) for each operation;

- the Executive Chairman is assigned the competences and responsibilities referred to in EU Regulation 2016/679 (General Data Protection Regulation - GDPR) and Legislative Decree no. 196 of 30 June 2003 on the processing of personal data and privacy, with the power of delegation;

- the Executive Chairman, within the scope and limits of his respective delegated powers and the operational lines of reporting by the various corporate structures, is entrusted,to the extent of his competence with the establishment and maintenance of the internal control and risk management system. To this end, ,to the extent of his competence:

- ensures that the Risk Committee identifies the main corporate risks, taking into account the characteristics of the activities carried out by the Company and its subsidiaries, and periodically submits them to the Board of Directors for review;

- executes the guidelines defined by the Board of Directors ensuring that the competent corporate structures provide for the design, implementation and management of the internal control and risk management system, constantly verifying its adequacy and effectiveness;

- deals with the adaptation of this system to the dynamics of operating conditions and the legislative and regulatory landscape;

- may request the Internal Auditing department to carry out checks on specific operational areas and on compliance with internal rules and procedures in the execution of business operations;

- promptly reports to the Control and Risk Committee (or to the Board of Directors) on issues and critical issues that have arisen in the course of its activities or of which it has been informed, so that the Committee (or the Board) can take appropriate initiatives.

In relation to the powers listed above, and in compliance with the provisions of art. 2 - Recommendation 4 of the Code, it should be noted that the Board of Directors has delegated management powers to the Chairman owing to the organisational complexity of the Hera Group and for a more effective implementation of business and corporate strategies. In this regard, the organisational structure envisages that the Central Legal and Corporate Affairs Department, the Central Market Department, the Central Personnel and Organisation Department, the Central Communication and External Relations Department, the Central Strategy, Regulation and Local Authorities Department, the Central Corporate Services Department, the Investor Relations Department, as well as the businesses related to the activities of the companies Marche Multiservizi Spa and AcegasApsAmga Spa, report to the Chairman.

Chief Executive Officer

- implement the decisions of the Shareholders Meeting and the Board of Directors as far as their competence is concerned;

- as a matter of urgency, take jointly with the Chairman any decision falling within the remit of the Board of Directors, notifying the Board of Directors at the first subsequent meeting;

- implement corporate and Group strategies, within the framework of directives established by the Board of Directors, and exercise delegated powers, and in particular those listed herein, in accordance with these strategies and directives;

- propose to the Board of Directors all the initiatives it deems useful in the interests of the Company, and of the Group, and make proposals in matters reserved to the Board of Directors;

- prepare the annual budget to be submitted to the Board of Directors;

- being responsible for the organisation of the services and offices falling under his remit as well as for the staff employed by him;

- report monthly to the Board of Directors, for matters falling under his remit on the assigned subsidiaries and affiliates;

- sign the correspondence of the Company and the acts relating to the exercise of the powers conferred and the functions exercised;

- stipulate, modify and terminate credit agreements, loans of any type and duration that involve a spending commitment of up to €1,000,000.00 (€ one million) for each individual operation;

- opening and closing current accounts with banks and credit institutions, withdrawing sums from accounts held in the Company’s name, issuing cheques or their equivalents for this purpose, and making transfers either from actual funds or from current account credit facilities;

- make payments to the Company’s bank and postal accounts, and turn over the same checks and money orders for crediting to current accounts; arrange for the management of activities relating to the collection of sums due and payments of the Company, including the issuing of quittance in full discharges;

- draw a bill of exchange upon customers, endorse also for discount promissory notes, bills of exchange, drafts as well as cheques of any kind and perform other consequential transactions;

- assign receivables and accept assignments of receivables claimed by suppliers (reverse factoring and/or indirect factoring contracts) of the Company without and/or with recourse up to a maximum amount of €250,000,000.00 (two hundred and fifty million euros) per individual transaction and operate with factoring companies and institutes by signing all the related deeds;

- represent the Company in the pursuit and defence of actions before the Financial Administration and Commissions of every order and degree as well as before the Cassa Depositi Prestiti, Bank of Italy, customs, postal and telegraphic offices; by way of example:

- sign the tax and VAT declarations as well as fulfil any other tax obligations;

- lodge complaints, submit petitions and appeals, apply for licences and authorisations;

- issue formal releases upon payment in full, more specifically for payment mandates in relation to claims subject to factoring transactions;

- carry out any operation at the Cassa Depositi e Prestiti, Bank of Italy, Customs, Postal and Telegraphic Offices for shipments, storage, release and collection of goods, values, parcels, and folds, registered and insured letters, issuing receipts and receipts for discharge;

- provide guarantees and grant loans as well as take out contracts relating to bank surety policies up to the value of € 25,000,000.00 (€ twenty-five million) for each transaction (this limit will not operate for transactions related to participation in tenders); issue, accept and endorse debt securities;

- intervene, to the extent of his competence, in his quality of representative of the Company, both as the parent company as well as the lead company, in the constitution of joint ventures, ATIs (Temporary Associations of Enterprises), EEIGs (European Economic Interest Grouping), consortia and other bodies, giving and receiving the relevant mandates, in order to participate in tenders for the award of works, services and supplies;

- to take part, to the extent of his competence, on behalf of the Company, also in ATIs (Temporary Associations of Companies), EEIGs (European Economic Interest Groupings), consortia and other organisations, in tenders or concessions, auctions, private bids, private negotiations, tender-contests and other national, EU and international public tenders, Community and international tenders, also admitted to State contribution or competition, for the award of works, supply of plants, also on a turnkey basis and/or goods and/or studies and/or research and/or services in general at any national, Community and international, public or private entity; submit requests to participate from the pre-qualification stage; submit bids up to an amount of € 25. 000,000.00 (twenty-five million euros) for each individual operation; in case of urgency, for amounts exceeding € 25,000. 000.00 (twenty-five million euros), the relative decision shall be made, jointly with the Executive Chairman, and communicated to the Board of Directors at the first subsequent meeting; in the event of awarding the contract, to sign the relative deeds, contracts and commitments, including the release of guarantees and/or the setting up of security deposits, with the broadest powers to negotiate, agree and/or finalise all the clauses that he deems necessary and/or opportune and/or useful;

- to the extent of his competence, enter into, amend and terminate commercial agreements with companies and entities;

- to the extent of his competence, to enter into, with all appropriate clauses, assign and terminate contracts and agreements in any case pertaining to the corporate purpose - including those pertaining to original works, trademarks, patents - also in consortium with other companies up to an amount of € 2,000,000.00 (two million euros) for each individual deed;

- establish, in the interest of the Company, consulting relationships with external experts and professionals, setting times and methods of payment, all within the limits of € 300,000.00 (€ three hundred thousand) for each transaction;

- conclude transactions up to an amount of € 5,000,000.00 (€ five million) for each individual transaction, sign arbitration agreements and arbitration clauses, also proceeding to the appointment and appointment of arbitrators;

- conclude, stipulate and execute acts of incorporation, modifications and extinguishment relating to active and passive servitude, voluntary or coercive, as well as activate the expropriation procedures of real estate, installations, equipment and facilities at the service of the networks, as well as any other and any act that may be necessary for the perfection of the servitude itself, with the right to perform all related and consequent acts, including paying and/or receiving, even in a deferred manner, the consideration and liquidating any damages and waiving legal mortgages, up to an amount of €500,000.00 (€ five hundred thousand) for each operation;

- conferring and revoking powers of attorney under the aforementioned powers, for individual acts or categories of acts both to employees of the Company and to third parties also legal persons;

- decide, within the scope of his competence, on the Company’s membership in bodies, associations, organisations of a scientific, technical, study and research nature in fields of interest to the Company, whose contributions do not represent equity investments of the same entity, and whose participation entails a cost commitment not exceeding € 300,000.00 (three hundred thousand euro) for each operation;

- the CEO is conferred the role of employer pursuant to and for the purposes of art. 2 of Legislative Decree no. 9 April 2008, 81 and subsequent additions and amendments, with the tasks provided for therein, with the power to delegate, to the extent permitted by law, the performance of any useful and/or necessary activity aimed at ensuring compliance with the law, with the exception of the following Sectors/Structures for which the role of instigator/employer is held as indicated below:

- Central Corporate Services Department (with the exclusion of the Purchasing and Procurement Department) Mr. Marcello Guerrini;

- Purchasing and Procurement Department Mr. Marco Del Giaccio;

- Central Networks Directorate (with the exception of the Water Department) Mr. Alessandro Baroncini;

- Water Department Mr. Emidio Castelli;

- Central Environmental Services and Fleets Department Mr. Giulio Renato;

- Central Innovation Department Mr. Salvatore Molè;

- Operations Development Function (within the Renewable Energies Business Unit) Mr. Salvatore Molé on an interim basis;

- Central Market Department (excluding the Production, Trading and District Heating Department) Mr. Cristian Fabbri Cristian Fabbri on an interim basis;;

- Production, Trading and District Heating Directorate Mr. Stavros Papageorgiou;

- the Chief Executive Officer is entrusted with the task of supervising the activities in the field of the Road Haulage Register with the power to delegate;