Hera stock

On 26th June 2003, Hera was listed on the Milan stock exchange. Since 1st June 2009, Hera share has been listed in other indexes, including the FTSE Italia All-Shares and the FTSE Italia Mid Cap.

As of 18 March 2019, Hera has been listed on the FTSE MIB, Borsa Italiana’s main Index, which includes the 40 largest stocks in Piazza Affari by capitalization, liquidity and trading volume.

These achievements have been supported by a path of growth that began 22 years ago and is based on a multi-business model that combines internal and external growth and presents a mix of activities showing resilience to the scenario’s main macro-variables.

Its tickers are:

- Bloomberg: HER IM

- Reuters: HRA.MI

The Hera share is also traded on the following alternative markets: Turquoise and Bats/Chix.

| ISSUER | DESCRIPTION | REPORT | RATING |

|---|---|---|---|

| S&P Global | Environmental, Social, And Governance Evaluation |  |

81/100 |

| COMPANY' | RATING | COMMENT |

|---|---|---|

| 80 | Hera achieved an overall score of 80/100, a result which place it as the best Multi & Water Utility at a global level (35/100 the sector average). Hera also achieved the best score in both the dimensions Governance & Economic and Social. | |

Low Risk |

Sustainalytics has included the Hera Group among the Top-Rated Companies globally for its excellent management of ESG (environmental, social, and governance) risks specific to its sector. | |

|

Advanced | Hera was ranked in the Advanced category, a preliminary condition for entry into the Borsa Italiana index 'Mib Esg' which is based on the assessments carried out by Vigeo. |

|

A | Hera confirmed the A rating from MSCI. In particular, the score shows a strong outperformance in the 'Carbon Emissions' category with a score of 10/10. |

|

A | In 2025 Hera was assigned with A level which is in the Leadership band. This is higher than the Europe regional average of B, and higher than the Energy utility networks sector average of B. |

| 2° place | Hera was ranked second in 2025 and for the fifth consecutive year, the Group is on the podium of the overall index ranking of ESG.ICI (formerly the Integrated Governance Index), which rewards Italian companies that stand out for integrating ESG factors into their governance. | |

| TOP 10 Utilities sector |

In 2025, the Group entered directly into the global Top 10 in the Utilities sector, securing 9th place overall for ESG performance among more than 6,000 companies assessed worldwide. Thanks to this rating, Hera received the Equileap Gold Seal 2025. | |

| Top 100 global |

In 2025, Hera became the world’s leading multi-utility in the FTSE Diversity Inclusion Index, managed by LSEG Data & Analytics (formerly Refinitiv), for its promotion of diversity, inclusion, and people development. Hera ranks 1st among Italian companies, is in the global TOP 10, and confirms its place in the top 100 for the 10th consecutive year. | |

|

80.1/100 | With a score of 80.1%, in line with last year and better than the average of both its sector and the Italian companies analysed, Hera is one of the 484 listed companies included in the Bloomberg GEI 2023, selected out of over 11,700 companies. |

The Hera Group's attention to ESG factors, which the company has included in its mission since its establishment in 2002, is an increasingly central issue for investors as well. The inclusion in authoritative sustainable indices, drawn up by independent agencies, represents further confirmation of the good sustainable strategy pursued by the Group that constitutes its founding approach.

The ESG indices consider that companies with a sustainable management from an environmental point of view, relationships with stakeholders and corporate governance achieve in the long term better and higher results than their competitors. Sustainable indices therefore have also the function of facilitating the investment choices of socially responsible funds (SRI) in companies committed to the assessed issues.

The international sustainability indices that include the Hera stock are:

| INDEX | FEATURES | TO LEARN MORE |

|---|---|---|

| Equileap |

Equileap, an independent provider specializing in gender equality measurement, supplies data and insights on gender parity and workplace equality. Equileap assesses around 6,000 companies worldwide based on 19 key criteria, and its data are used by pension fund managers and asset managers to align their investments with their values. In 2025, it ranked the Hera Group among the global Top 10 in the Utilities sector, awarding it the 2025 Gold Seal. |

|

| Dow Jones Sustainability Index Europe & World |

The Hera stock is included in the Dow Jones Sustainability Index both World and Europe Index. The DJSI are a family of indices that tracks the stock performance of the world's leading companies in terms of ESG criteria. The DJSI is based on an analysis of the ESG performance of companies, evaluating aspects such as governance, risk management, branding, climate change mitigation, standards in supply chain management and work processes. |

|

| FTSE Diversity & Inclusion Index |

Hera is included in the FTSE Diversity & Inclusion Index of the FTSE Russell series, managed by LSEG Data & Analytics, which recognizes companies most committed to promoting diversity, inclusion, and people development. This index evaluates companies’ performance based on multiple ESG (environmental, social, and governance) factors, with a focus on four areas: diversity, inclusion, people development, and media controversies. |

|

| Bloomberg Gender-Equality Index |

Hera has been included in this index since 2020, which measures gender equality and awards companies committed to promoting and creating equal and inclusive workplaces. The Hera Group stands out in particular for its transparency in providing information on these issues and its harassment prevention and sanctioning policies. |

|

| ECPI INDICES: | The ECPI sustainability indices assess companies based on their environmental, social and governance (ESG) performance, thanks above all to the solidity of its operational management practices and the positive work in addressing social and environmental needs. |  |

| Euro ESG Equity | The Hera stock is included in the ECPI Euro ESG Equity, an index that includes the 320 companies in the Eurozone with the greatest capitalization that meet the ECPI criteria in the ESG field. | |

| Global Blue Gold GD Equity | The ECPI Global Blue Gold GD Equity Index is an equally weighted equity index designed to offer investors exposure to the positively ESG-rated companies belonging to sectors expected to benefit from the water related challenges as water scarcity, population growth and urbanization, food security requirements and pollution. | |

| STOXX INDICES: | The STOXX index range represents a standard set of basic and innovative indices with a consistent and globally applicable methodology. | |

| STOXX Climate Awareness Indices | These indices include companies with a CDP Performance Band A to C- (pre-2016 Performance Band A to C). In addition to the description above of Band A and B, Band C and C- identifies companies who have looked at implications of climate change for, and on, their business and recognizes a high level, contextual knowledge of environmental issues. |  |

| STOXX Climate Impact Indices | The STOXX Climate Impact include companies with CDP Performance Bands A to B- (pre-2016 Performance Band A to B). Band A and A- includes companies that are seen as leading companies in terms of climate change: these companies are disclosing particular “actions” which mark them as leaders, as well as high scores across all other levels of the CDP Scoring matrix. | |

| STOXX Climate Transition Indices | The STOXX Climate Transition Benchmark Indices track the performance of liquid securities from a selection of STOXX Benchmark Indices. The indices are designed to help investors in the transition to a low-carbon economy by adopting a decarbonization trajectory. | |

| STOXX Europe ESG-X Indices | STOXX Europe 600 ESG-X index is to reflect the STOXX Europe 600 index with standardized ESG exclusion screens applied for Global Standards Screening, Controversial Weapons, Thermal Coal and Tobacco Producers, with the aim of taking responsible investment criteria into account. | |

| STOXX Global ESG Impact Indices | The STOXX ESG Impact Indices offer a broad market exposure that is tilted towards companies among STOXX Global 1800 Index that score better with respect to a small set of environmental, social, and governance (ESG) KPIs. | |

| STOXX Global ESG Leaders STOXX Global ESG Social Leaders STOXX Global ESG Governance Leaders |

The STOXX® Global ESG Leaders Index is STOXX’s broadest benchmark tracking the highest achievers in ESG criteria. The index is a roll-up aggregate from individual gauges covering each ESG category. The STOXX Global ESG Leaders indices consist of one broad and three specialized indices for the areas environmental, social and governance. To be included in the Global ESG Leaders Index it is necessary to be included in at least one of the three specialized indices. Hera is included in the general index and in two of the three specialized ones. | |

| STOXX Industry Neutral ESG Indices | The STOXX Industry Neutral ESG indices track the performance of the leading companies with regard to Environmental, Social and Governance criteria, based on ESG indicators based on a transparent rating model as provided by Sustainalytics. | |

| STOXX Low Carbon Indices | The constituents for the STOXX Low Carbon family of indices will be selected from the STOXX Global 1800 universe, excluding coal companies. Companies are selected based on their Carbon Intensity Data (Scope 1 + Scope 2 Greenhouse Gas emissions (GHG) / Revenue ($million)). | |

| STOXX Low Risk Indices | The STOXX Low Risk Weighted Indices select and weight companies from their respective benchmark indices and provide access to a low volatility portfolio. | |

| STOXX Sustainability Indices | Components are selected from the STOXX Europe 600 indices according to their sustainability rating (combination of company and sector rating). Hera is included in this index too. |

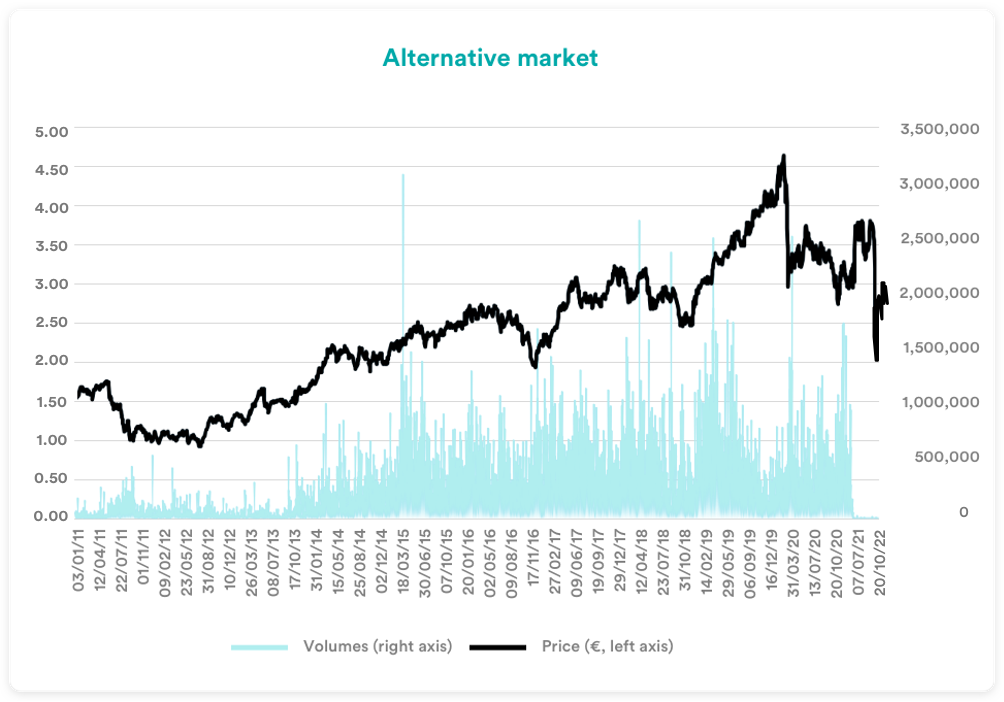

Hera stock is traded also on some multilateral markets such as Bats, Chi-x, OTC and Turquoise, reserved to institutional investors. The following chart shows Hera stock prices and volumes traded on alternative markets since the start of 2011.

Interactive chart and historical data (371 kb - XLS)

Would you like to stay updated on Hera Group’s financial results and strategic plans?

Subscribe to the InvestorNews newsletter.