Scenario and Megatrend

Scenario & Megatrend

- Group

- Investors

- Hera Strategy

- Scenario and Megatrend

Utilities Scenario

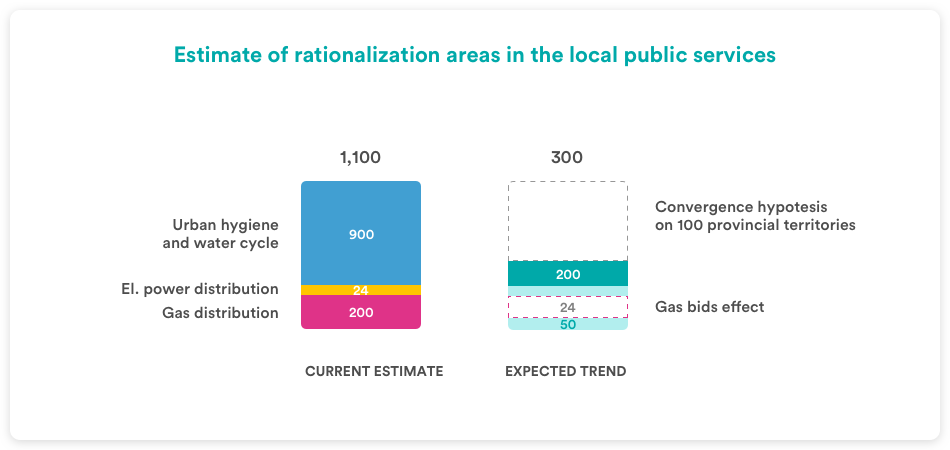

Through the Cottarelli Plan, in 2014 the Government showed that there is a clear, substantial surplus of operators in the local public services, entailing major efficiency / rationalization margins as well as growth opportunities for the largest and most efficient operators in the industry.

Irrespective of some perimeter variances, a recent study by Utilitatis confirms the size of the industry (about 1,100 providers) as well as the current rationalization margin. Surveyed companies generate a global turnover of about € 50 billion and employ more than 200,000 direct and indirect resources. In view of the consolidation expected from the gas bids and from channelling water cycle and urban sanitation into provincial ambits, the streamlining is estimated to involve about 800 operators. Assuming an eventual alignment of current underperformers to best practices, a 1.5 billion € overall benefit is estimated.

This excessive fragmentation opens significant room for changes leading to company grouping in all public utility sectors, with benefits coming from the economies of scale, efficiency and improved service quality gained .

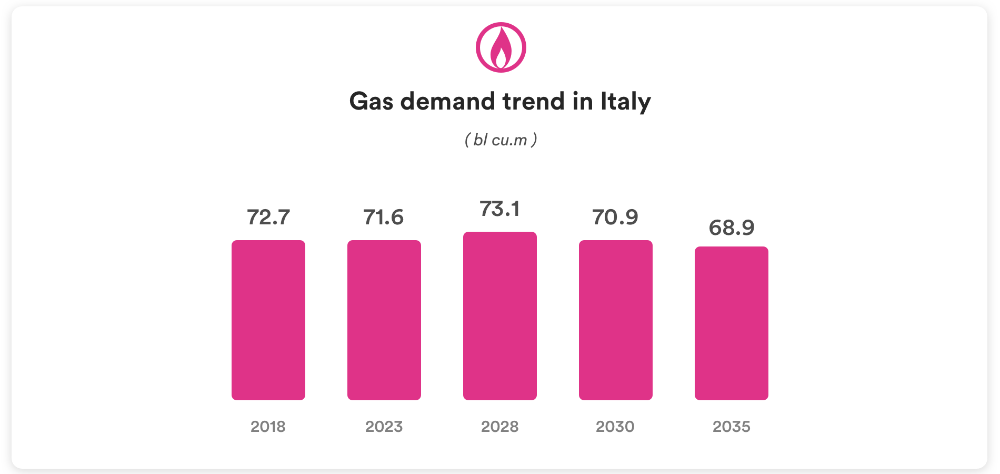

The scenario outlined by Snam in its forecasts for gas supply and demand from 2018 to 2035 is based on an assumption of GDP growth expected to reach 0.9% over 2018-2035. In this context, gas demand in Italy will likely decrease by an average of roughly 0.3% per year in between 2018 and 2035, due to energy efficiency investments in the residential sector and to the development of renewable energy that will reduce the use of thermal power plants.

In the gas distribution sector, concessions have expired across the country and tenders are currently being held, called by the Authority ARERA, for reassigning local monopoly concessions. The newly defined areas concerned by the concessions are larger than the previous ones, with the aim of increasing the average size of operators. The process involved in the tenders is thus expected to lead to a reduction in the number of operators, because the most efficient company, that wins the tender, is expected to acquire all activities from the losing companies. This process will thus offer opportunities for growth for the most efficient and largest operators.

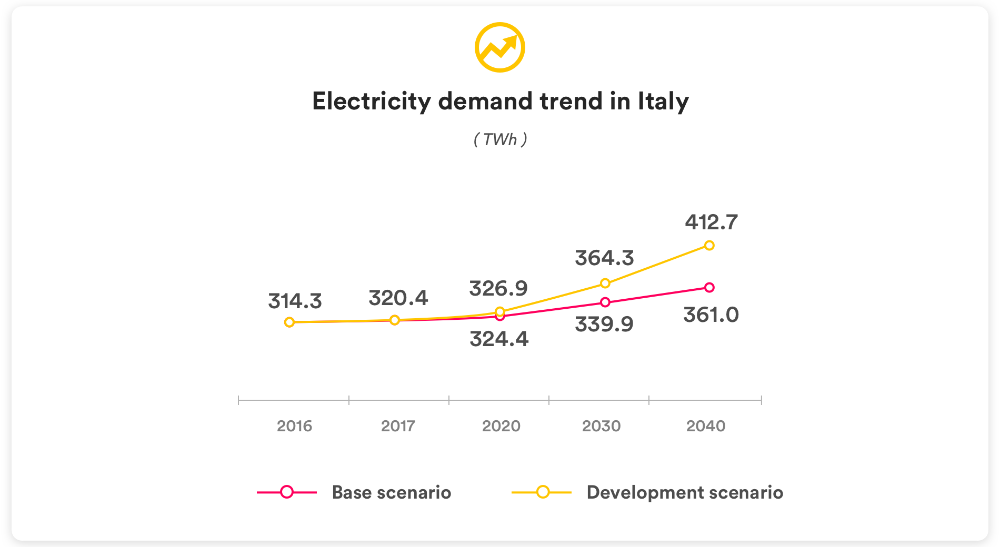

From a linear expansion of recent trends in electric intensity, which take into account the impact on the past of recently introduced measures in energy efficiency, Terna has developed two scenarios for future changes in demand:

- “Basic scenario”, which begins with an estimated 0.5% growth in GDP and takes into account the effect of a full implementation of energy efficiency policies, leading electric intensity to be increased by 0.5% in the 2017-2040 period;

- “Development scenario”, which corresponds to a high estimated growth in GDP (+1.3%) and takes into consideration both a different degree of application of energy efficiency policies and a gradual spread of e-mobility, leading electric intensity to be reduced by 2.5% in the 2017-2040 period.

In the period from 2017 to 2040, the development scenario foresees trends in energy demand to reach an average annual increase of +1.1%, corresponding to 412.7 billion kWh (TWh) in 2040.

The basic scenario, obtained through estimates of a more modest electricity demand, expects an average annual growth of +0.5%, with electricity demand coming to 361 billion kWh in 2040.

On 1 January 2022, a complete liberalisation of the electricity sales sector is expected to begin. The market currently consists in 36 million customers, of which 20 million still have protected types of contracts, regulated by ARERA. Doing away with these contracts will require higher competition (currently blocked) and no operator will be able to begin with a dominant market position (above 50%), according to the Antitrust rules. This scenario represents an opportunity for growth for smaller operators, who will be able to compete in acquiring “formerly protected” customers, who will no longer be able to be served by the current incumbent player.

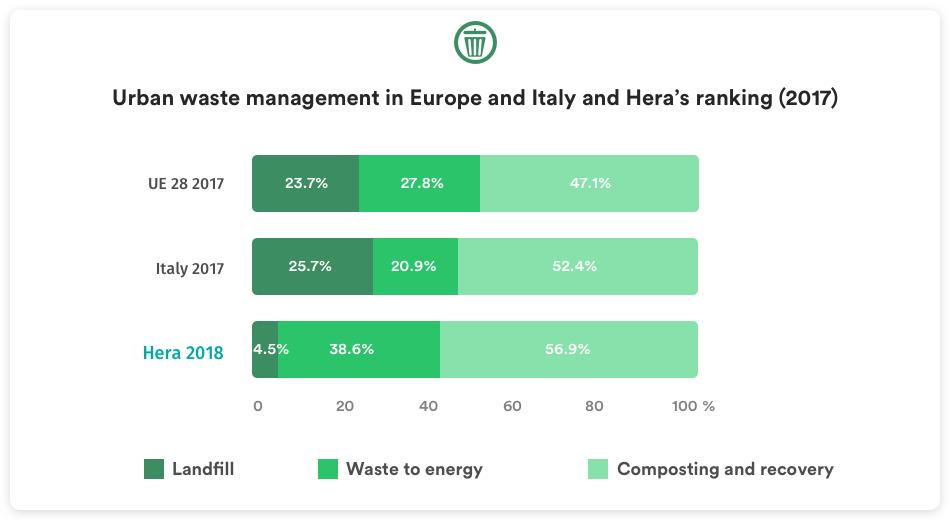

In the environment industry, Italy is still burdened with severe infrastructure shortages against European benchmarks, and the way to recovery is still very uncertain. The downward trend in the use of landfills for municipal waste disposal is ongoing Europe-wide; in the EU-28, the value equals 23.7%. Landfills are instead the main method of disposal in Italy: 25.7% of municipal waste disposed of in 2017 was landfilled, whereas 20.9% was channelled into waste-to-energy.

To reduce the gap that has Italy ranking behind the rest of Europe, the government adopted a number of key measures, aimed at an optimal use of the existing infrastructure system. Article. 35 of L. Decree no. 133/2014, which was converted - through amendments to Law 164/2014 - into the so-called "Unlock Italy" decree, aims to achieve an adequate, integrated system of solid waste management nationwide, as well as to meet all of the waste collection and recycling targets.

It also aims to ensure national security in terms of self-sufficiency and, as a result, to overcome and to prevent further infringement procedures ensuing from failure to implement European industry standards. C urbing waste landfilling is another key target. In this scenario, the use of waste-to-energy as an alternative to landfill disposal ensues from several sanctions imposed to the Italian State by the European Court of Justice. The latest –December 2014 - amounted to 42.8 million euros for every 6 months of non-compliance and was due to a protracted failure to comply with the European directive on authorization, for 198 landfills in the Italian territory.

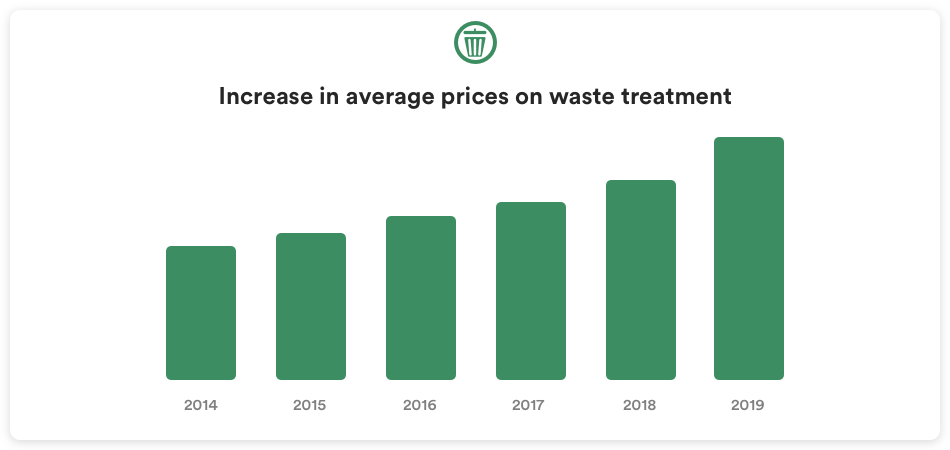

The critical situation described above has led to a strong rise in prices for waste treatment all across Europe, while in Italy prices have risen by 47% in the last 5 years, with an uninterrupted progression.

As regards urban waste collection and street sweeping services, the Authority ARERA has recently approved the first “national” tariff system, recognising a return on invested capital that is closer to the ones for other services regulated by ARERA. This will level out the differences between the nation’s various localities, and increase the visibility of regulation over the medium term.

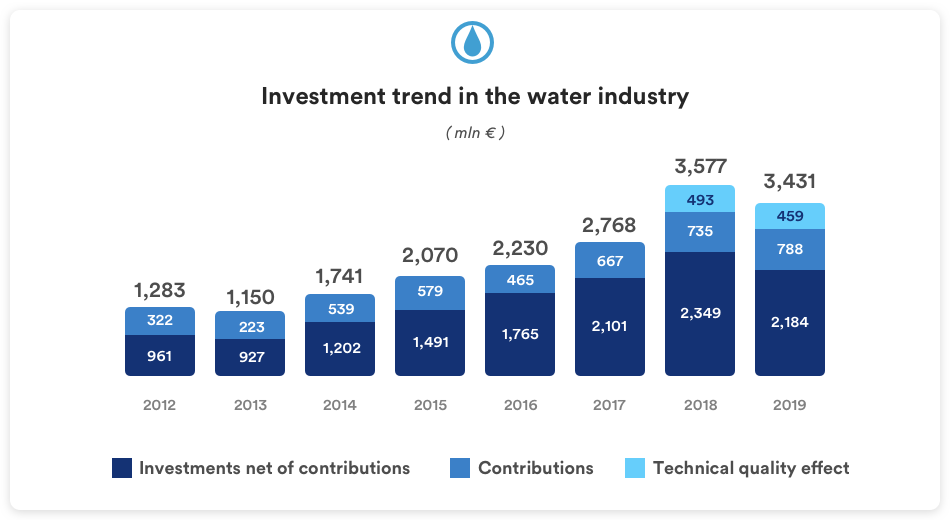

The Italian water industry has inherited a very disjointed industrial scenario from the past, with large industrial companies coexisting with small and medium businesses, which are often in economic disruption and therefore unable to meet the necessary investment needs.

Furthermore, the failed coverage of the costs incurred over the years has generated low investment levels. For this reason, the rates in some areas of the country - whose values are among the lowest in Europe - indicate that service quality and stability are relatively poor (e.g. large network losses and low degree of purification).

Comparing the investment expense of other more compliant European countries, if we aim to improve service quality and boost the sector development, a national average investment totalling at least € 5 billion a year is estimated, equalling € 80 per inhabitant.

Transferring tariff accountability into AEEGSI in 2013 was a key turning point towards restoring credibility and perspective in the industry. The results achieved in the first six years are positive.

Concessions for this service in the Emilia-Romagna region are all close to expiry. In this region, tenders have taken place in Ravenna and Cesena (awarded to Hera) and Modena. The others are expected to begin within the next 4 years.

The Authority, ARERA, has approved a revision of tariffs for the Water service, confirming stability in the system, introducing a few changes whose effects are expected to be positive and giving higher visibility to return over the medium term.

may call for a revision of current models, broadly understood (Business models, consumer models, ...)

Technological advances

The evolution of technology will have an increasingly rapid effect on utilities as well, both directly, with the technical solution adopted by companies throughout the sector, and through changes in customers' habits and expectations.

Hera has an Innovation Department since 2014, constantly committed not only to Research and Development but also to bringing into the various business areas the use of the most sophisticated technologies selected from the world's best providers, such as Artificial Intelligence, Machine Learning, and other technological applications to provide ever higher quality services to customers, increase asset resilience, and optimize financial returns. The 2028 plan includes investments in innovation and technology amounting to approximately 1.3 billion euros, or 25% of the total.

Climate and resource scarcity

A growing awareness of the issues created by resource management models used in the previous millennium poses new challenges for utilities, who manage resources that are both scarce and essential for everyday life.

Thanks to a long track record of positive results and investments aimed at enhancing processes and infrastructure to enable the development of circular business models and, consequently, reduce natural resource consumption, Hera aims to further strengthen its leadership by planning to invest 2 billion euros in its 2028 plan, representing 39% of the total planned investments.

Demographic growth

The demographic explosion seen in some areas of the planet will lead to problems involving infrastructures and their ability to serve a large part of the population, providing opportunities, for development to those who prove able to rise to such challenges.

Thanks to the launch of sustainable market offers involving energy from renewable sources and CO2-free green gas, Hera is supporting the development of two important infrastructure projects for energy production in areas with strong demographic pressures. More information here: Hydro Alkumro and Solar Charanka (documents available in Italian only). To reduce emissions in highly populated areas, the Hera Group, in collaboration with Saipem, has developed a CO₂ capture project, the first industrial-scale example of CCS (Carbon Capture and Storage) applied to a facility of this kind in Italy. The project involves capturing carbon dioxide from the chimneys of waste-to-energy plants and storing it in depleted natural gas reservoirs, significantly reducing plant emissions and contributing to the decarbonization of the territories.

Evolving economic balances

The world’s economies now find themselves in a delicate phase of transition, and the balances yet to be created will impact the direction of new flows of capital, from flourishing economies to the most promising ones.

At this stage of transition towards economic models increasingly focused on environmental, social and governance (ESG) dimensions, capital flows will also play a fundamental role as facilitators of the process, rewarding the companies and initiatives that are best able to transfer the created value to all stakeholders. Hera has set itself ambitious targets to create shared value that by 2028 will reach over 1.100 million euro that represents about 66% of total Ebitda.

Rapid urbanisation

The world’s population is becoming increasingly concentrated in urbanised areas, which show a rising need for services tailored to these trends and able to optimise management of the use of infrastructures and information.

The Hera Group's reference territories are also undergoing profound changes that require resilient, state-of-the-art infrastructures to support the transformation of our cities towards evolved smart city models. The business plan to 2028 includes investments of approximately 2.4 billion euros, representing 47% of total investments, aimed at enhancing the resilience of managed assets and activities to address increasingly frequent and intense external events.

involved in the changing models and their new necessities

Customer/Consumers

- Higher attention given to energy efficiency and each product's carbon footprint

- A call for smart, innovative, digitals solutions for one's own daily requirements

- Accustomed to levels of service with increasing qualitative standards

- Promotion of innovative investments in service management

- Regulations supporting a paradigm shift in terms of service sustainability and the use of resources

Companies (Utilities)

- Definition of new business model able to bring together customers' requirements, requests coming for the institutions involved, and industrial needs

- Preparation for a higher degree of competition in each business area

is a universal standard

For Hera, technological and digital transformation along the lines of “Industry 4.0” is an opportunity to reinforce its own sustainable economic model, within a strategy that includes developing cloud, mobile, analytics and big data technologies.

Our goal is to plan new intelligent and “transformative” solutions, not only in the area of energy networks and infrastructures, but also in light of future challenges. This includes introducing new sales support tools, increasing the speed of procedure implementation and becoming able to swiftly adjust approaches to business, thanks to processes that are perfectly integrated among themselves.

Internal digitalization

- Digital workplace

- Community data analytics

- Smart working

- HEUREKA+ and Digi e Lode

- Cybersecurity

Customer digitalization

- Online services

- Applications for tablets and smartphones e-billing

- Whatsapp channel

Business intelligence

- Data management ad AI

- Fiber optic broadband network

- Technological implementations

- Process digitalization

The ongoing innovation and development plan will allow us to have a positive impact on the local areas and communities served, introducing new potential services linked to a circular economy, environmental sustainability and safety.

Given that digital transformation is a process that calls for continuous technological innovation and the enhancement of information system performance, Hera is committed to staying in line with these megatrends. It will thus complete a technological renovation of the entire infrastructure and continue to facilitate the introduction of technologies able to transform the energy model into a more efficient, safe, sustainable and flexible system.

A process that began some years ago

Innovation is one of the Group's five strategic levers (agility, efficiency, growth, innovation, excellence). The model we use is based on widespread innovation: each department is responsible for its own individual innovation initiatives, from the review of processes to the identification of new services, from instruments for improving efficiency to the launch of new operating models.

The main innovation areas within the Hera Group, also in line with its business plan, can be summarised as follows:

- circular economy, aimed at environmental sustainability, the optimisation of materials, and maximising the recovery of waste and scrap;

- customer experience, aimed at understanding the needs and wishes, whether expressed and not, of consumers in order to shape actions to improve their satisfaction level;

- digitalisation and data analytics (Utilities 4.0), with activities linked to implementing new technologies, mainly IT, for the digitalisation, automation, and flexibility of processes, and the enhancement and efficient use of data;

- smart cities, to introduce technologies that can improve living conditions in cities, and the services supplied to the general public.

In the area of innovation, BP to 2025 has allocated 950 M€ for projects intended to enhance innovative technologies involving the development of smart cities, circular economy, Utility 4.0 and customer experience.

Learn more: Innovators by nature

OUTLOOK 2025

In 2025, the Hera Group is committed both to its usual focus on efficiently managing the services provided and to searching for opportunities for growth through external lines, as well as to the continuing actions towards increasing shared value, in line with European policies and the objectives on the UN’s 2030 Agenda.

Industrial growth, through a balanced management of commercial development, the circular economy, not only as a statement of social commitment but also as a strategic driver of sustainable growth, and risk management, across the board and proactive, both in corporate strategy and integrated into the corporate culture, are the commitments that the Hera Group has made to achieve its new objectives, also turning to digitalisation and innovation as levers to support resilience.

Also in 2025, Hera will pursue the strategic lines addressed by the business plan, presented at the beginning of the year, managing the various dynamics that will arise in the various business areas:

-

Networks: supported by a substantial investment plan of 2.5 billion euros over the plan period, resilient results are expected in line with the regulated nature of the activities and thanks to planned investments and efficiencies as well as the development of "smart solutions" and innovative projects in synergy with the other assets in our portfolio

-

Environment: growth is expected thanks to both our leadership position, based on a single, large, modern, sustainable and diversified plant base which represents a solid "platform" and to the commercial development, driven by demand which requires more and more advanced solutions in terms of sustainability, circularity and waste valorisation that can become a resource

-

Energy: the business will continue to benefit from the development of value-added services offer, commercial expansion and cross-selling activities. Regarding energy sales to end customers, starting from July 2024, after winning 7 lots (the maximum allowed out of 26) in the tender for the gradual protection service for residential customers, nearly 1 million customers have joined the Group’s portfolio, further strengthening its position as the third-largest operator in the national market.

In economic-financial terms, the forecast of an increase in shareholder remuneration, consistent with the targets set by the recent business plan, and the maintenance of financial solidity are confirmed.

The debt structure towards which the Hera Group is oriented responds to its business needs, not only in terms of the duration of loans, but also in terms of interest rate exposure. The Group’s financial strategy, in turn, is aimed at maximising its return profile while maintaining a prudent risk strategy.

Since the beginning of the year, the Hera Group has obtained good performances in all business areas, as is demonstrated by the operating data for volumes sold and disposed of.

The trend in the first nine months for the four business areas is presented below:

Outlook Gas 2025

The total volumes of gas sold increased in the first nine months of the year, mainly due to higher trading activities. Conversely, the volumes supplied to end customers declined, reflecting both the normalization of the energy scenario in last-resort markets and the impact of energy-saving behaviors adopted by customers in traditional markets, as well as a reduction in their number.

For the rest of the year, the Group expects substantial stability in the customer base, with forecasts of volumes sold which may depend on the temperatures seen during the upcoming months.

Outlook Electricity 2025

Electricity sales volumes increased, driven by higher volumes in the Safeguard Market and by the change in scope in the first half of the year related to customers under the Gradual Protection Scheme (launched in July 2024).

Thanks to a larger customer base year-on-year and the expansion of the Safeguard Market’s scope, the Group expects a positive trend in sales volumes for the full year, with forecasts subject to change depending on temperatures and consumption levels in the final quarter.

Outlook Water 2025

The results as of September 2025 for the Integrated Water Cycle area show growth compared to the same period of the previous year.

Compared to September 2024, the number of water customers increased, confirming a moderate trend of organic growth in the Group’s reference areas.

Thanks to the investments planned over the course of the business plan, this area will become even more efficient and resilient in the coming years. The Group will work on several fronts to reduce water consumption, decrease network losses, and increase the reuse of wastewater.

Outlook Waste 2025

In the first nine months of 2025, total waste treated increased. Within the mix, while municipal waste showed a decline, market waste grew—mainly in the Recovery and industrial markets—thanks also to the consolidation of existing commercial relationships and the expansion of the customer portfolio.

Thanks to the further strengthening of its plant network and the consolidation of existing commercial relationships, including initiatives to expand the customer portfolio, the Group expects solid growth prospects for the Environment area in the remaining months of 2025.