The stages of the corporate merger process

Words to understand

- Group

- Media

- Words to understand

- The stages of the corporate merger process

The stages of the corporate merger process

What is a merger?

A merger is one of the most common methods used to join companies.

There are two possible forms of integration. The first is through the establishment of a new company (NewCo) and the simultaneous termination of the previous legal entities. The other form is the incorporation into a company of one or more companies, and in this case the individuality of the participating companies is maintained.

The purposes of a merger are for economic/industrial reasons. Joining two or more companies indeed makes it possible to create synergies at a cost level (administrative, production and quotation) and also ensures greater territorial coverage (with a positive impact on revenues and the possibilities of further development and growth).

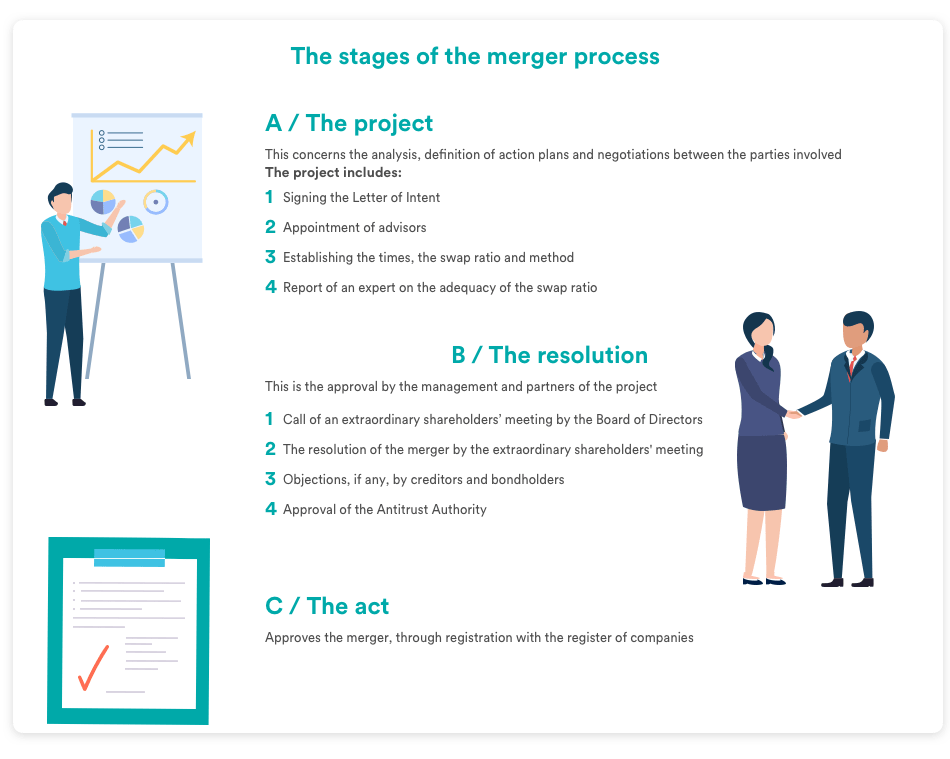

The stages of a merger

A merger has three main stages: the project, the resolution and the act.

- The project, which represents the most complex part of the merger operation, includes all the different aspects of the analysis, definition of the action plans and negotiations between the parties involved. Once this first and important phase, whose duration is variable, has been completed, the merger process is considered to be well underway.The project includes:

- Signing the letter of intent, which establishes the start up of the negotiation;

- Appointment of advisors, who act as consultants and who examine not only the strengths and weaknesses of the merger but also the threats and opportunities;

- Details of the times (term), conditions (swap ratio) and method (merger by incorporation or through the incorporation of a new company).

- Report of an expert on the adequacy of the swap ratio (for each company)

- The resolution is simply the approval by the management initially and, later, by the project partners. The resolution procedure includes:

- A Board of Directors meeting that calls an extraordinary shareholders’ meeting with the proposed merger as the item on the agenda;

- Extraordinary shareholder’s meeting called to decide the item on the agenda;

- Any objections from the merger of creditors and bondholders (within 60 days from the resolution);

- Approval of the Antitrust, the authority that guarantees competition, which assesses the impact of the merger, determines whether and with what obligations, to approve the merger.

- The act is practically the final part of the merger transaction and provides the registration with the Companies Register of the merger deed. Typically, medium/large mergers take about a year from the start of the negotiation through to the closing of the transaction. This is because, besides the times actually required to complete the transaction, it is also necessary to take into account problems related to the swap rates between the shares of the companies being merged, which are rarely accepted by the various parties without lengthy negotiations. During the merger process shareholders will see their shares adjusted to the respective swap rates. On the day of the effective date of the merger, the brokers upload the new securities with the new quantities in the dossiers. The shareholders will be able to trade the new shares without constraints and enjoy all the rights (dividends, voting rights).