The role of Consob

Words to understand

- Group

- Media

- Words to understand

- The role of Consob

The role of Consob

CONSOB regulates, authorises, supervises and controls Italian financial markets in order to protect investors and ensure the efficiency, transparency and development of the securities market. In order to achieve these goals, the Commission, through regulations, self-regulate its organisation and operation with the sole constraint of the legitimacy check carried out by the Presidency of the Council of Ministers.

Consob: What it does

A brief outline of its history

The history of CONSOB (National Commission for Companies and the Stock Exchange) started in 1974, the year in which it was established by State law including duties and functions that until then had been attributed to the Department of Treasury. These were essentially powers of supervision on the securities markets. CONSOB's range of action was initially therefore much more limited than it is today. With a law dating to 1983, its powers were extended to protect public savings and two years later CONSOB was given legal status and autonomy. In 1991, it was given powers of control over Stock-Broking firms and insider trading.

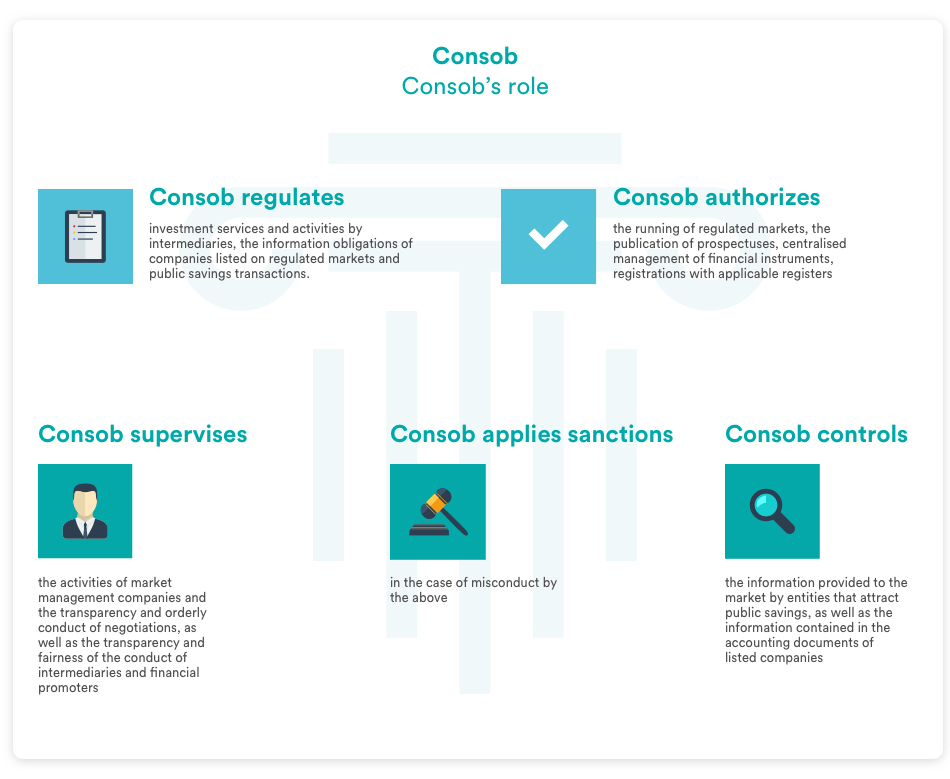

The role of Consob

regulates investment services and activities by brokers, the information obligations of companies listed on regulated markets and public savings transactions;

authorises the running of regulated markets, the publication of prospectuses, the centralised management of financial instruments, registrations with registers;

supervises the activities of market management companies and ensure the transparency and orderly conduct of negotiations, as well as the transparency and fairness of the conduct of intermediaries and financial promoters;

applies sanctions in the case of misconduct by the above;

controls the information provided to the market by entities that attract public savings, and the information contained in the accounting documents of listed companies;

ascertains any anomalous trading trends on listed securities and checks any cases of infringement of the rules on market manipulation (a case currently applicable in the case of listed companies), insider trading and illegal speculation.

Brief outline of its organization

The top management of the company is a board consisting of a chairman (who is currently Paolo Savona, and whose predecessors include prominent figures such as Luigi Spaventa, Enzo Berlanda, Franco Piga) and four members, appointed by decree of the President of the Republic on the proposal of the President of the Council of Ministers, who remain in office for seven years and may not be reconfirmed. The operating structure has a general management department, to which 10 divisions (issuers, intermediaries, markets...) and 41 offices (corporate controls, tender public offers and ownership structures, supervision and register of promoters, insider trading, derivative markets...) report, with offices located between Rome and Milan.

Examples of intervention by Consob

Typical interventions of CONSOB include, for example, the authorisation to run investment services and activities by Brokerage Firms, the approval of the prospectus offering financial instruments and products to the public, the removal of financial promoters from the applicable register.