The Share Swaps

Words to understand

- Group

- Media

- Words to understand

- The Share Swaps

The Share Swaps

A share swap means establishing the number of shares (or quota in the case of a limited liability company) that the acquiring company or the company resulting from the merger must recognise to the acquired company or the merger participants in exchange of the old shares (or quota) held.

It is therefore easy to imagine that, in the context of mergers between two or more companies, the definition of the terms of trade represents one of the most important aspects of the transaction.

The share swap ratio is the result firstly of studies and assessments of the experts appointed by the respective companies (advisors) and later of agreements between the parties. The estimate may be made either through a separate valuation of the companies, a forecast of the respective expected cash flows, or a “synergistic” approach, in other words, taking into account the expected post-merger results.

The value expressed by the market when companies are listed on the stock exchange should also be taken into account. It is in this very case that the average of the stock values recorded in a given period of time is really important in calculating the share swap ratio.

In general, the acquired company is granted a premium with respect to the economic value of the company and the average of the prices of the last six months (in the case of a listed company).

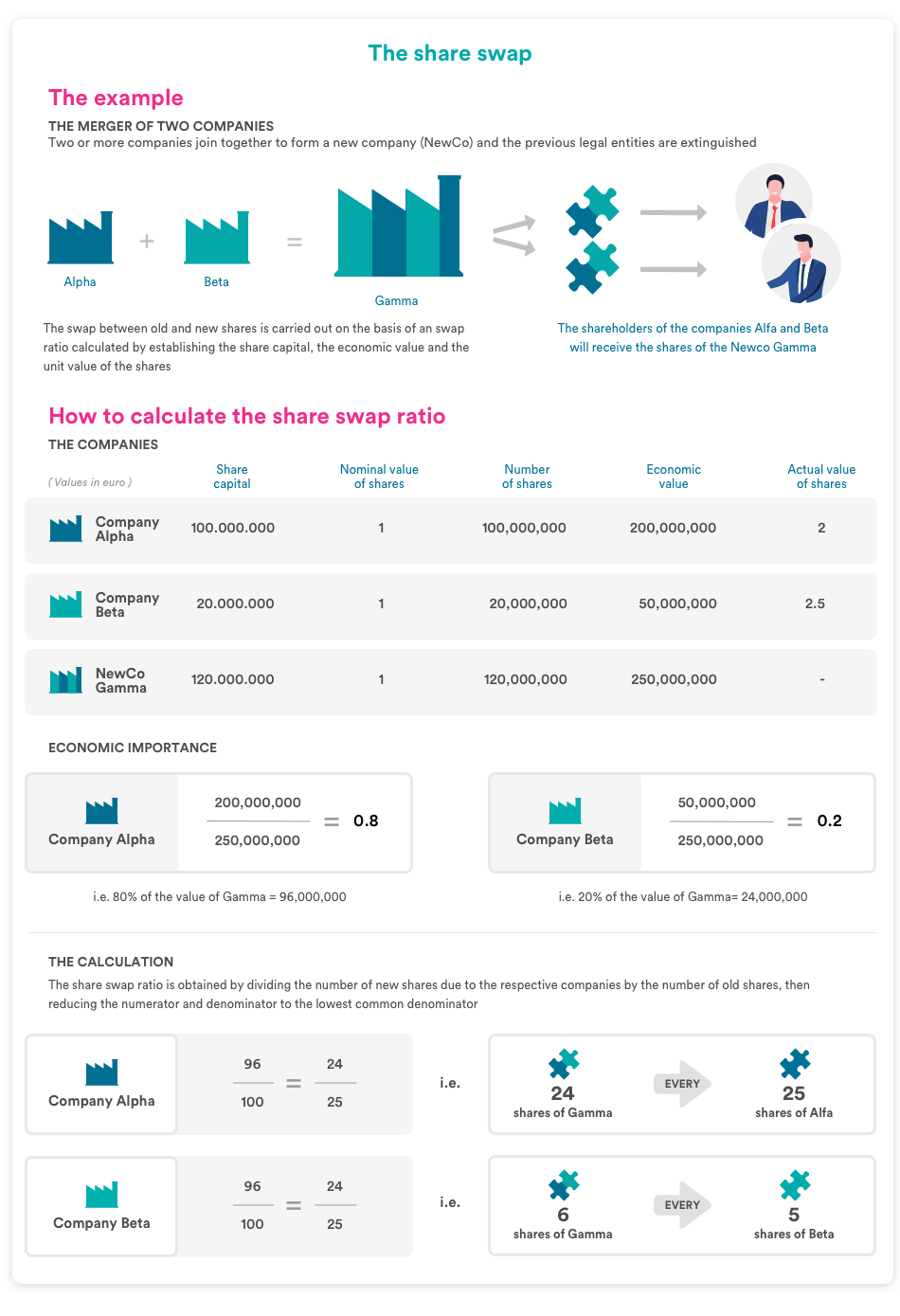

Let us consider the case of companies Alpha and Beta that decide to merge into a Newco, called Gamma.

The listed company Alfa has a share capital of 100 million Euros consisting of 100 million shares.

The listed company Beta has a share capital of 20 million Euros consisting of 20 million shares.

The economic value of the two companies obtained from the valuation of the advisors and the average of the prices of the last six months is respectively 200 million Euros for the company Alfa (actual unit value of 2 Euros) and 50 million Euros for the company Beta (actual unit value of 2.5 Euros).

The newco Gamma will have a share capital of 120 million Euros consisting of 120 million shares and an economic value of 250 million Euros.

The economic weight of Alfa will therefore be given by 200/250= 80% while the economic weight of Beta by 50/250= 20%

Alfa will therefore own 96 million shares of the new company Gamma, while Beta will own 24 million shares.

The share swap ratio is obtained by dividing the number of new shares due to the respective companies by the number of old shares, then reducing the numerator and denominator to the lowest common denominator.

For the company Alfa: 96/100=24/25 i.e. 24 shares of the new company Gamma every 25 shares of Alfa

For the Beta company: 24/20=6/5 i.e. 6 shares of the new company Gamma every 5 shares of Beta