Statement from Executive Chairman Tomaso Tommasi di Vignano

Hera Custom Facet Publish Date

Custom Facet

Hera Custom Facet Publish Date

Search Bar

Asset Publisher

For the seventeenth consecutive year, we are confirmed among the leading organisations for human resources management

We have once again been ranked among the best Italian companies for people management and development policies, obtaining the Top Employer certification for the seventeenth year running.

The award recognises the Hera Group’s strategic commitment to continuous learning and organisational wellbeing, in a landscape where career longevity, talent attraction and generational inclusion are increasingly critical.

With over 10,500 employees, 96% of whom are employed on permanent contracts, we distinguish ourselves through an HR model founded on flexible welfare, 360-degree wellbeing, professional growth, the enhancement of uniqueness and a strong cultural identity. Furthermore, our multi-business nature represents a significant benchmark on the national stage, offering diverse career paths and the opportunity to develop new skills within the same organisation.

For us, continuous training is a cornerstone of its ‘people strategy’: thanks to an annual investment of approximately €15 million, over 97% of employees participate in at least one training initiative, averaging 30 hours per capita. A central role is played by HerAcademy, our corporate university, which aims to support the energy, environmental, digital and technological transitions through innovative programmes and ongoing dialogue with academia.

On the welfare front, we allocate €23 million annually to its Hextra system, which involves 99% of the workforce. The scheme offers, among other opportunities, initiatives for parenting support, health and pension services, and programmes dedicated to psychological and financial wellbeing.

For further information

Press release

Visit “Working at Hera group” web area

Asset Publisher

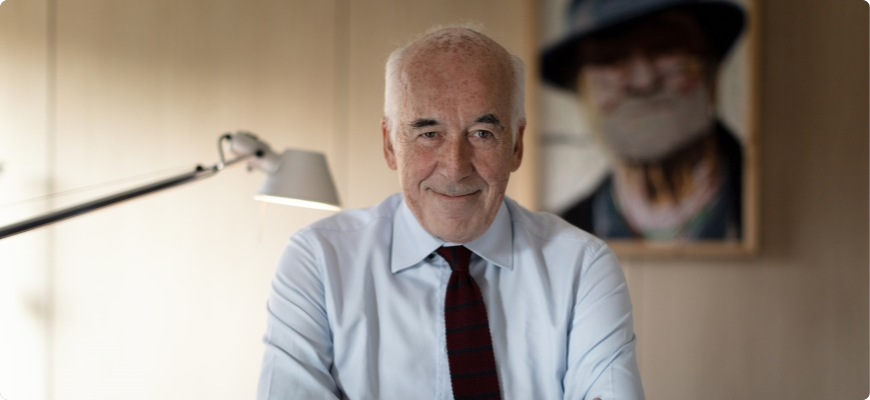

Statement from Executive Chairman Tomaso Tommasi di Vignano

The Executive Chairman of the Hera Group, Tomaso Tommasi di Vignano, after more than twenty years at the head of the company, believes that he has fulfilled his mandate, which expires on 27 April 2023, the date on which the Shareholders Meeting has been called.

“I am proud to have contributed to the history of the Hera Group”, states Chairman Tomaso Tommasi di Vignano, “and, working with a top-class management team, to have combined corporate growth with sustainable development. We have created an innovative model that remains ahead of its time, aimed at creating ever more value for our stakeholders and making the areas served increasingly competitive. I therefore wish Cristian Fabbri the best of luck with the important position he will soon cover, after the Shareholders Meeting held on 27 April. It provides recognition for the excellent work he has been doing within the Hera Group since 2006, and I am certain that he will continue to contribute to the company’s development and will also be able to turn future challenges into opportunities.”

Tomaso Tommasi di Vignano has been Chairman of the Group since November 2002, and oversaw its initial public offering in June 2003. His guidance has been fundamental in realising the far-sighted vision of the Hera Group’s founding public shareholders, and with his know-how and undisputable management skills, he has helped to guide the company along a path of development and success that has made it one of the most important multi-utility companies nationwide, consolidating its leadership in the sectors in which it operates. This path of uninterrupted growth was crowned in 2019, when Hera was included in the FTSE MIB among the 40 largest companies on the Italian stock exchange, and in 2020, when it was included in the prestigious international Dow Jones Sustainability Index. For more than twenty years, the Group has been committed to creating value for all stakeholders and, thanks to its solid corporate governance, it has confirmed itself over time as a reference point for the areas served and a highly reliable systemic operator.

For further information

Press release

Press release about Shareholders Syndicate Committee