"In good waters": Hera's transparency on the water cycle

Hera Custom Facet Publish Date

Custom Facet

Hera Custom Facet Publish Date

Search Bar

Asset Publisher

For the seventeenth consecutive year, we are confirmed among the leading organisations for human resources management

We have once again been ranked among the best Italian companies for people management and development policies, obtaining the Top Employer certification for the seventeenth year running.

The award recognises the Hera Group’s strategic commitment to continuous learning and organisational wellbeing, in a landscape where career longevity, talent attraction and generational inclusion are increasingly critical.

With over 10,500 employees, 96% of whom are employed on permanent contracts, we distinguish ourselves through an HR model founded on flexible welfare, 360-degree wellbeing, professional growth, the enhancement of uniqueness and a strong cultural identity. Furthermore, our multi-business nature represents a significant benchmark on the national stage, offering diverse career paths and the opportunity to develop new skills within the same organisation.

For us, continuous training is a cornerstone of its ‘people strategy’: thanks to an annual investment of approximately €15 million, over 97% of employees participate in at least one training initiative, averaging 30 hours per capita. A central role is played by HerAcademy, our corporate university, which aims to support the energy, environmental, digital and technological transitions through innovative programmes and ongoing dialogue with academia.

On the welfare front, we allocate €23 million annually to its Hextra system, which involves 99% of the workforce. The scheme offers, among other opportunities, initiatives for parenting support, health and pension services, and programmes dedicated to psychological and financial wellbeing.

For further information

Press release

Visit “Working at Hera group” web area

Asset Publisher

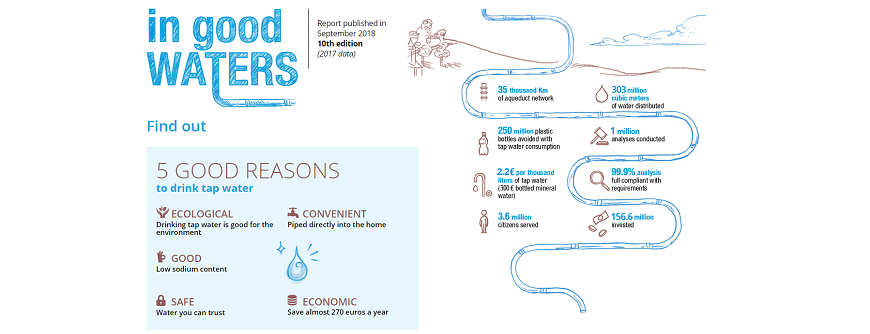

"In good waters": Hera's transparency on the water cycle

Tenth annual appointment with the Group's report on an essential service. The value of the multi-utility's investments in the sector continues to increase: over 156 million euro in 2017 compared to 130 million last year. Excellent quality of the resource supplied, guaranteed by over a million analyses, of which more than 134,000 in the Bologna region alone

"In buone acque" turns 10 years old

It's the tenth birthday of the "In Good Waters" report that Hera Group prepares to provide detailed and easy-to-read information on the water cycle it manages in 231 municipalities of Emilia-Romagna, Marche, and Triveneto. As the second-largest operator in Italy by volume of water supplied (303 million m3 per year), Hera Group serves over 3.6 million citizens.

This report is for them, the everyday users of the water resources the multi-utility manages, to fully inform them on the quality of the water coming out of their taps; a quality that is ensured by strict monitoring.

This is proven by the number of analyses carried out last year throughout the company's entire service area: a total of over a million, more than 2,800 per day, on average.

The analyses, 38% of which were carried out in the Group's laboratories, also concerned the presence of pesticides and non-regulated aspects, such as emerging pollutants and asbestos fibres. Of the checks carried out, 99.9% yielded results compliant with regulatory limits, confirming the safety of the water Hera distributes.

Bologna's water: 134.000 quality assurance analyses

In 2017, over a million Bologna residents used a water resource the quality of which was certified by more than 134,000 analyses carried out in the laboratories of the Hera Group and the ASL (local public health authority).

The possibility of using tap water on a daily basis depends on the plant resources used by the company to distribute the service: in the Bologna area, tap water comes from 660 sources and travels through more than 9,000 km of aqueduct network, into which 108.4 million m3 of water are fed every year. This ensures a constant and adequate supply.

Hera: water-related investments 32% above the Italian average

Not only aqueduct but also purification and sewerage; managing the water service means taking care of the entire water cycle, meaning not only its distribution in homes but also the sewerage service and wastewater treatment. This is why the Hera Group has always focused most of its investments in the water sector: in 2017 they exceeded 156 million euro, compared to 130 million euro the previous year (+19%). More specifically, it invested 41% in the mains water network, 32% in the sewer system, and 27% in water treatment.

Compared to a national average of 37 euro invested per inhabitant, in the area served by the Hera Group investments in 2017 were about 49 euro per inhabitant. The magnitude of this commitment has allowed Hera to work on more than 35,000 km of its aqueduct network, about 18,600 km of sewerage, 469 water treatment plants and 422 production and drinking water purification plants. All this against a cost of just two euro per thousand litres of tap water, about half of what consumers pay in other European nations.