Hera Group BoD approves 3Q 2023 results

Hera Custom Facet Publish Date

Custom Facet

Hera Custom Facet Publish Date

Search Bar

Asset Publisher

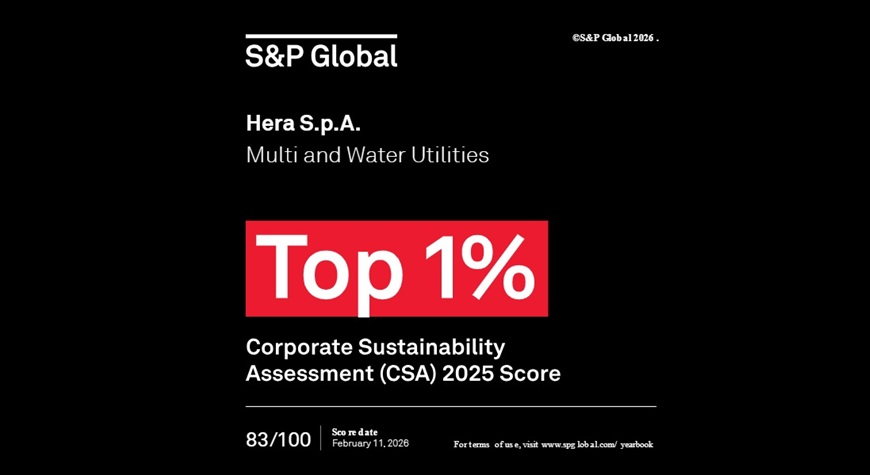

For the sixth consecutive year, Hera has been included in the S&P Global Sustainability Yearbook, ranking in the “Top 1%” of the world’s best-performing companies in its sector,with outstanding results particularly in governance and social performance

According to Standard & Poor’s, we are the world’s leading company in the Multi & Water Utility sector and has once again earned a place in S&P Global’s Sustainability Yearbook. This achievement follows an in-depth assessment of our performance across environmental, social and governance (ESG) dimensions.

In particular, we ranked first globally in our reference sector with a score of 83 out of 100, compared with an industry average of 37 out of 100.

The multi-utility is recognised as an international best practice across several areas:

- Governance: Hera stands out for the transparency of its reporting, its careful and effective risk management – including cyber risk – and its exemplary approach to managing the supply chain in a sustainable way;

- Environmental performance: the Group achieved top results in efficient energy management within its internal processes and in safeguarding biodiversity in the areas where it operates. It also excelled in the reporting and management of risks and opportunities related to climate change;

- Social dimension: Hera obtained the highest global score for respect for human rights, the development of its employees’ human capital, customer relations, privacy protection and engagement with local communities.

S&P Global’s analysis therefore portrays a forward-looking company that leads a benchmark made up of the sector’s top performers worldwide.

These highly positive assessments – released shortly after the publication of the new Business Plan – confirm our ability to pursue a sustainability strategy based on continuous commitment across the entire value chain, while keeping a close eye on international best practices. The evaluations also highlight the key strengths identified by analysts: a company that continues to deliver significant shared value creation, reflected in a forecast double-digit average annual Total Shareholders Return.

For further information

Press release

Asset Publisher

Hera Group BoD approves 3Q 2023 results

The first nine months of the year ended with strong growth in all economic and financial indicators, confirming the Group’s solidity and the effectiveness of its multi-business strategy

Financial highlights

- Ebitda* at 1,006.8 million euro (+15.1%)

- Net profit attributable to shareholders* at 235.5 million euro (+10.0%)

- Net investments and corporate acquisitions at 593 million euro (+18.7%)

- Net financial debt and net debt/Ebitda* ratio show considerable improvement, coming to 4,148.9 million euro and 2.91x respectively

- ROI also improves, rising to 9%

Operating highlights

- Significant contribution to growth coming from the energy sectors and the waste management area

- Ongoing growth in the energy customer base, now at 3.8 million, up 8.9% over 12 months

- Further initiatives for the green transition and increased investments in innovation, reinforcing the resilience of the assets managed

Today, the Board of Directors of the Hera Group, chaired by Cristian Fabbri, unanimously approved the consolidated results at 30 September 2023.

The first nine months of the year saw rising investments and record results compared to previous years, showing remarkable resilience when faced with extreme weather events in the area served and a global context that remains uncertain and continues to show widespread increases in inflation and in the cost of money.

In particular, the significant investments reflect the Group’s commitment to boosting the resilience of the assets managed and its ongoing focus on projects designed to accelerate the green transition, fully respecting its corporate purpose.

Cristian Fabbri, Executive Chairman of the Hera Group:

“This period’s results show a relevant creation of value for all stakeholders. In the first nine months we reached over 1 billion of Ebitda, which shows a double-digit growth of 15%. We furthermore increased capex and investments by 19% and achieved a 9% return on invested capital, while continuing to reduce financial debt. All of our businesses contributed to this growth, more than 80% underpinned by Energy supply business due to a 9% increase in customer base, which reached 3.8 million, and further expansion of decarbonisation services. Another significant factor was the contribution coming from last resort markets, which we consolidated in September by winning 17 of the 18 available gas lots. Internal growth and the 5 corporate transactions carried out during these nine months were driven by innovation, resilience, decarbonisation and the circular economy. All of this contributed to an increase in shared-value Ebitda, now over 54% of total Ebitda, which continues to generate incremental benefits for all areas served. We are rapidly following the path for development set out in the business plan, by keeping our business portfolio balanced and seizing opportunities for creating value that allow us to accelerate its implementation.”

Orazio Iacono, CEO of the Hera Group:

“The effectiveness of our management decisions and our solid multi-business industrial strategy enabled us to achieve positive economic and financial results and, in particular, to further strengthen our leadership in the waste management sector, posting a raising Ebitda and on the back of larger volumes of waste treatments. In a partnership with ACR, which recently joined the Group, we won important concessions in the private oil&gas sector and are participating in tenders to access PNRR funds to reclaim public sites. Thanks to our positive cashflow and strong financial position, we achieved a net debt/Ebitda ratio coming to 2.91x, similar to the one seen before the sharp rise in energy prices. This financial soundness gives us all the flexibility we need to take advantage of new opportunities for development in our target markets. Finally, we are particularly proud of the recognition we received from Arera for the technical quality of our services, particularly in the water business, where we achieved the best performance nationwide.”

Revenues at approximately 11 billion

At 30 September 2023, revenues amounted to 10,955.0 million euro, slightly down from 14,320.1 million euro at the same date in 2022, mainly due to the decrease of energy commodity prices and lower volumes of gas sold on account of the mild weather in the first half of the year. An increase was seen, instead, in revenues thanks to the higher volumes of electricity sold, commercial development actions, Consip tenders, the safeguarded tenders awarded in electricity, “gradual protection service” lots awarded, higher revenues from “energy efficiency services” linked to incentives in residential buildings and increased activities in value-added services for customers, as well as revenues from the waste treatment business and, above all, to the M&A activity.

Ebitda* up sharply to 1,006.8 million

Ebitda* for the first nine months of 2023 rose to 1,006.8 million euro (+15.1%), as against 874.8 million euro at 30 September 2022. Of this increase, the contribution coming from the energy areas amounted to 111.8 million euro and the good performance of the waste management area accounted for 11.8 million euro, while 3.5 million euro came from the integrated water cycle and 4.8 million euro from the other services area.

Net operating result* rises to 504.6 million euro

The net operating result* for the nine months ended 30 September 2023 rose to 504.6 million euro, up 15.5% from 437.0 million euro in the first nine months of 2022, at same growth path signed by Ebitda.

Net profit post minorities* up by 10%

In September 2023, net profit* rose to 267.1 million euro (+7.5%), up from 248.4 million euro in the same period of 2022, and the tax rate improved to 26.8%. Net profit post minorities* rose to 235.5 million euro, up 10% from 214.1 million euro at 30 September 2022.

Strong increase in capital expenditure and M&A

In the first nine months of 2023, the Hera Group made net investments including M&A coming to 593.0 million euro (+18.7% compared to the same period in 2022). Operating investments, including capital grants, amounted to 514.0 million euro, up 50.7 million euro year-on-year (+10.9%), and mainly for the development of plants, networks and infrastructures including the large-scale meter replacement in gas distribution and on the purification and sewerage infrastructures.

| Income statement (mn€) |

Sep 23 | % inc. | Sep 22 | % inc. | Abs. change | % change |

|---|---|---|---|---|---|---|

|

Revenues |

10,955.0 |

0.0% |

14,320.1 |

0.0% |

(3,365.1) |

(23.5)% |

|

Other operating revenues |

441.4 |

4.0% |

345.3 |

2.4% |

96.1 |

27.8% |

|

Raw and other materials |

(7,480.9) |

(68.3)% |

(11,642.5) |

(81.3)% |

(4,161.6) |

(35.7)% |

|

Service costs |

(2,421.9) |

(22.1)% |

(1,693.9) |

(11.8)% |

728.0 |

43.0% |

|

Other operating expenses |

(58.2) |

(0.5)% |

(56.6) |

(0.4)% |

1.6 |

2.8% |

|

Personnel costs |

(477.6) |

(4.4)% |

(449.8) |

(3.1)% |

27.8 |

6.2% |

|

Capitalised costs |

49.0 |

0.4% |

52.2 |

0.4% |

(3.2) |

+(6.1)% |

|

Ebitda * |

1,006.8 |

9.2% |

874.8 |

6.1% |

+132.0 |

+15.1% |

|

Amortization, depreciation and provisions |

(502.2) |

(4.6)% |

(437.8) |

(3.1)% |

64.4 |

14.7% |

|

Ebit * |

504.6 |

4.6% |

437.0 |

3.1% |

67.6 |

15.5% |

|

Financial operations |

(139.7) |

(1.3)% |

(89.5) |

(0.6)% |

50.2 |

56.1% |

|

Pre-tax result * |

364.9 |

3.3% |

347.5 |

2.4% |

17.4 |

5.0% |

|

Taxes |

(97.8) |

(0.9)% |

(99.1) |

(0.7)% |

(1.3) |

(1.3)% |

|

Net result * |

267.1 |

2.4% |

248.4 |

1.7% |

18.7 |

7.5% |

|

Attributable to: |

|

|

|

|

|

|

|

Shareholders of the Parent Company * |

235.5 |

2.2% |

214.1 |

1.5% |

21.4 |

10.0% |

|

Minority shareholders |

31.6 |

0.3% |

34.3 |

0.2% |

(2.7) |

(7.9)% |

| Invested capital and sources of financing (mn€) | sep-23 | Inc.% | Dec-22 | Inc.% | Abs. change | % change |

|---|---|---|---|---|---|---|

|

Net non-current assets* |

7,887.8 |

+102.1% |

7,522.3 |

+94.5% |

365.5 |

+4.9% |

|

Net working capital* |

517.1 |

+6.7% |

1,096.0 |

+6.7% |

(578.9) |

(52.8)% |

|

(Provisions) |

(677.8) |

(8.8)% |

(657.6) |

(8.3)% |

(20.2) |

(3.1)% |

|

Net invested capital* |

7,727.1 |

100.0% |

7,960.7 |

100.0% |

(233.6) |

(2.9)% |

|

Equity* |

(3,578.2) |

+46.3% |

(3,710.9) |

+46.6% |

132.7 |

+3.6% |

|

Long-term borrowings |

(4,492.1) |

+58.1% |

(5,598.5) |

+70.3% |

1,106.4 |

+19.8% |

|

Net current financial debt |

343.2 |

(4.4)% |

1,348.7 |

(16.9)% |

(1,005.5) |

(74.6)% |

|

Net debt |

(4,148.9) |

+53.7% |

(4,249.8) |

+53.4% |

100.9 |

+2.4% |

|

Total sources of financing* |

(7,727.1) |

(100.0)% |

(7,960.7) |

+100.0% |

233.6 |

+2.9% |

* Adjusted results

For further information

Press release

Investors web area

.jpg/956c43c0-1a00-2a4b-b8e9-3e48b9d1105b)