Hera BoD approves 1Q 2020 results

Hera Custom Facet Publish Date

Custom Facet

Hera Custom Facet Publish Date

Search Bar

Asset Publisher

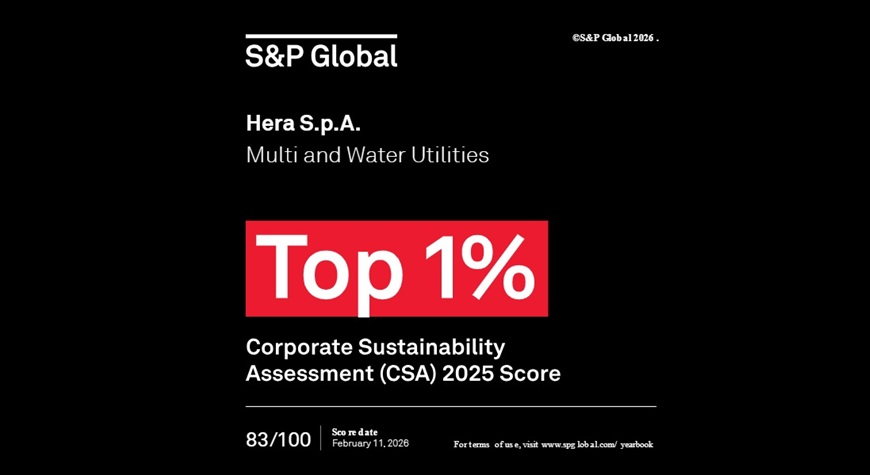

For the sixth consecutive year, Hera has been included in the S&P Global Sustainability Yearbook, ranking in the “Top 1%” of the world’s best-performing companies in its sector,with outstanding results particularly in governance and social performance

According to Standard & Poor’s, we are the world’s leading company in the Multi & Water Utility sector and has once again earned a place in S&P Global’s Sustainability Yearbook. This achievement follows an in-depth assessment of our performance across environmental, social and governance (ESG) dimensions.

In particular, we ranked first globally in our reference sector with a score of 83 out of 100, compared with an industry average of 37 out of 100.

The multi-utility is recognised as an international best practice across several areas:

- Governance: Hera stands out for the transparency of its reporting, its careful and effective risk management – including cyber risk – and its exemplary approach to managing the supply chain in a sustainable way;

- Environmental performance: the Group achieved top results in efficient energy management within its internal processes and in safeguarding biodiversity in the areas where it operates. It also excelled in the reporting and management of risks and opportunities related to climate change;

- Social dimension: Hera obtained the highest global score for respect for human rights, the development of its employees’ human capital, customer relations, privacy protection and engagement with local communities.

S&P Global’s analysis therefore portrays a forward-looking company that leads a benchmark made up of the sector’s top performers worldwide.

These highly positive assessments – released shortly after the publication of the new Business Plan – confirm our ability to pursue a sustainability strategy based on continuous commitment across the entire value chain, while keeping a close eye on international best practices. The evaluations also highlight the key strengths identified by analysts: a company that continues to deliver significant shared value creation, reflected in a forecast double-digit average annual Total Shareholders Return.

For further information

Press release

Asset Publisher

Hera BoD approves 1Q 2020 results

The consolidated quarterly report at 31 March shows growth in results, thanks to the contribution coming from the Group's main business areas. Value continues to be created in the areas served, while Hera has proactively introduced numerous measures supporting stakeholders while facing the Covid-19 emergency currently affecting the country.

Financial highlights

- Revenues at 2,055.8 million euro (+5.9%)

- Ebitda at 349.2 million euro (+5.6%)

- Net profit at 130.3 million euro (+0.5%)

- Net financial position at 3,229.1 million euro

Operating highlights

- Good contribution to growth coming from main businesses, the energy and waste management sectors in particular

- Solid customers base in energy sectors, with a strong rise to 3.3 million customers, thanks to the recent partnership with Ascopiave

- A wide range of activities introduced to protect and sustain all stakeholders, first and foremost customers, with favourable conditions granted for paying bills

Today, the Hera Group’s new Board of Directors, which came into office on 29 April 2020 and is chaired by Tomaso Tommasi di Vignano, unanimously approved the Group’s consolidated operating results for the first quarter. Improvement was seen over the same period in 2019, thanks to the contribution coming from internal growth and M&As, which proved able to more than offset the effects of the mild winter temperatures and the health emergency that has struck the country.

The financial solidity that has always marked this multi-utility saw further improvement during the quarter, and allowed many measures to be proactively introduced, quite early, when the emergency had not yet affected the areas served. These measures are aimed at ensuring not only continuity in the Group’s services, but also support and protection for all stakeholders, above all employees, suppliers and customers, for example in the favourable conditions granted for paying bills.

In general, the results reached confirm the validity of the Group’s business model, which balances regulated and free market activities and, in line with the indications provided in the Business plan, promotes growth, sustainability and innovation, which have proven to be effective competitive levers in creating value for the areas served and all stakeholders.

The main changes in the Group’s scope of operations compared to the first quarter of 2019 include the acquisition last May of Cosea Ambiente, the company that manages the urban and assimilated waste service owned by 20 municipalities in the Tuscan-Emilian Apennine area, including a ten-year grant for managing the Cosea Consorzio landfill in Gaggio Montano; the acquisition in July of Pistoia Ambiente’s waste treatment plants in Tuscany; and, lastly, in December the finalisation of the partnership between Hera and Ascopiave, which acting through EstEnergy created the largest energy operator in North-Eastern Italy and at the same time led to a reorganisation of the two Groups’ gas distribution activities.

Revenues reach over 2 billion euro

In the first quarter of 2020, revenues amounted to 2,055.8 millioneuro, up compared to the 1,940.4 million seen in the same period of2019. This result was largely sustained by changes in the scope of operations, which more than offset lower revenues for electricity and gas trading, production and sales, heat management and district heating, as well as commissions in the water service. Revenues in the waste management sector increased.

Ebitda rises to 349.2 million euro

Ebitda went from 330.8 million euro in the first three months of 2019 to 349.2 millionat 31 March 2020, showing an 18.4 million(+5.6%) increase. This growth in Ebitda is due in particular to the performance seen in the energy areas, which were up by 17.2 million euro overall, mainly owing to the entry of the companies belonging to the EstEnergy Group, as well as the waste management area, while the water cycle area showed a slight drop.

Operating result increases and pre-tax profit remains stable

The net operating result also increased to 211.7 millioneuro at 31 March 2020, up compared to the 205.0 million seen at the same date in2019 (+3.3%). A 7.6 million euro change occurred in financial operationsat 31 March 2020, coming to 28.7 millioneuro, mainly due to the imputed costs involved in the put option concerning the amount held by Ascopiave and lower profits from joint ventures, mainly due to the consolidation of EstEnergy. Pre-tax profits came to 183.0 millioneuro, essentially in line with the 183.9 million seen in the first three months of2019.

Net profit rises to 130.3 million (+0.5%)

Net profit at 31 March 2020 increased to 130.3 millioneuro, up 0.5% over the 129.7 million seen one year earlier. Profits pertaining to Group Shareholders, instead, came to 124.4 millioneuro, with a slight increase compared to the 124.2 millionrecorded for the first quarter of2019. These results bear the effects of a28.8% tax rate, an improvement compared to the 29.5% seen one year earlier, thanks in particular to the Group’s commitment to making investments in technological and digital transformation, along the lines of Utility 4.0.

Over 118 million in investments; net financial position improves

Overall investments in the first three months of 2020 amounted to 118.6 millioneuro, as against 92.7 millionin the same period of the previous year, and mainly went towards interventions on plants, networks and infrastructures, in addition to investments concerning an intensive meter substitution and the purification and sewerage areas. Total investments also include financial investments coming to 27.2 million.

Thanks to a positive cash flow generation, net financial debt, coming to 3,229.1 millioneuro, showed a roughly 45 millioneuro drop compared to December 2019. The Net debt/Ebitda ratio settled at 2.93x, confirming the Group’s financial solidity (2.44x excluding the EstEnergy put option). The average time to maturity of overall debt is more than 6 years.

| Profit & Loss (m €) |

31/03/2020 | Inc.% | 31/03/2019 | Inc.% | Ch. | Ch.% |

|---|---|---|---|---|---|---|

| Sales | 2,055.8 | 1,940.4 | +115.4 | +5.9% | ||

| Other operating revenues | 109.0 | 5.3% | 121.0 | 6.2% | (12.0) | (9.9%) |

| Raw material | (1,035.4) | (50.4%) | (1,024.6) | (52.8%) | +10.8 | +1.1% |

| Services costs | (627.2) | (30.5%) | (556.7) | (28.7%) | +70.5 | +12.7% |

| Other operating expenses | (12.5) | (0.6%) | (13.1) | (0.7%) | (0.6) | (4.6%) |

| Personnel costs | (147.3) | (7.2%) | (142.9) | (7.4%) | +4.4 | +3.1% |

| Capitalisations | 6.8 | 0.3% | 6.7 | 0.3% | +0.1 | +1.5% |

| Ebitda | 349.2 | 17.0% | 330.8 | 17.0% | +18.4 | +5.6% |

| Depreciation and provisions | (137.5) | (6.7%) | (125.8) | (6.5%) | +11.7 | +9.3% |

| Ebit | 211.7 | 10.3% | 205.0 | 10.6% | +6.7 | +3.3% |

| Financial inc./(exp.) | (28.7) | (1.4%) | (21.1) | (1.1%) | +7.6 | +36.1% |

| Pre tax profit | 183.0 | 8.9% | 183.9 | 9.5% | (0.9) | (0.5%) |

| Tax | (52.7) | (2.6%) | (54.3) | (2.8%) | (1.6) | (2.9%) |

| Net profit | 130.3 | 6.3% | 129.7 | 6.7% | +0.6 | +0.5% |

| Attributable to: | ||||||

| Shareholders of the Parent Company | 124.4 | 6.0% | 124.2 | 6.4% | +0.2 | +0.2% |

| Minority shareholders | 5.9 | 0.3% | 5.5 | 0.3% | +0.4 | +7.3% |

| Balance Sheet (m €) | 31/03/2020 | Inc.% | 31/12/2019 | Inc.% | Ch. | Ch.% |

|---|---|---|---|---|---|---|

| Net fixed assets | 6,876.5 | 108.7% | 6,846.3 | 108.9% | +30.2 | +0.4% |

| Working capital | 96.8 | 1.5% | 87.0 | 1.4% | +9.8 | +11.3% |

| (Provisions) | (650.0) | (10.3%) | (649.1) | (10.3%) | (0.9) | +0.1% |

| Net invested capital | 6,323.3 | 100.0% | 6,284.2 | 100.0% | +39.1 | +0.6% |

| Net equity | 3,094.2 | 48.9% | 3,010.0 | 47.9% | +84.2 | +2.8% |

| Long term net financial debt | 3,379.7 | 53.4% | 3,383.4 | 53.8% | (3.7) | (0.1%) |

| Short term net financial debt | (150.6) | (2.4%) | (109.2) | (1.7%) | (41.4) | +37.9% |

| Net financial debts | 3,229.1 | 51.1% | 3,274.2 | 52.1% | (45.1) | (1.4%) |

| Net invested capital | 6,323.3 | 100.0% | 6,284.2 | 100.0% | +39.1 | +0.6% |

.jpg/956c43c0-1a00-2a4b-b8e9-3e48b9d1105b)