Y2020 Results

The results of a multi-business strategy and long-term value creation, rising to tomorrow’s challenges today

Online report Y2020

Y2020 Results

The results of a multi-business strategy and long-term value creation, rising to tomorrow’s challenges today

"The Hera Group’s 2020 financial statements prove, once again, our solidity and the effectiveness of our strategies, but also our close relations with local areas and stakeholders."

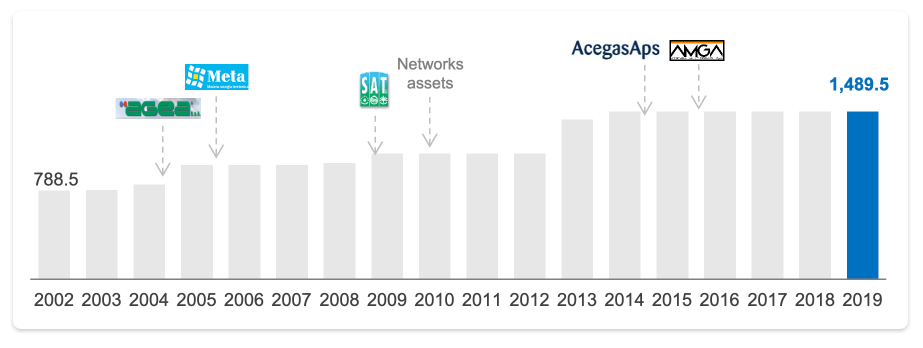

"The growth achieved by the Hera Group was strongly supported by its partnership with Ascopiave, which enabled the Group to expand further in the Triveneto region."

"The Hera Group’s 2020 financial statements prove, once again, our solidity and the effectiveness of our strategies, but also our close relations with local areas and stakeholders.

These results indeed reflect our uninterrupted activities, in spite of the pandemic, supporting the economic fabric in which we operate. Quarter after quarter, we succeeded in meeting the challenges posed by the emergency, reacting quickly to reorganise our work and find solutions to protect our assets on the one hand, and customers on the other.

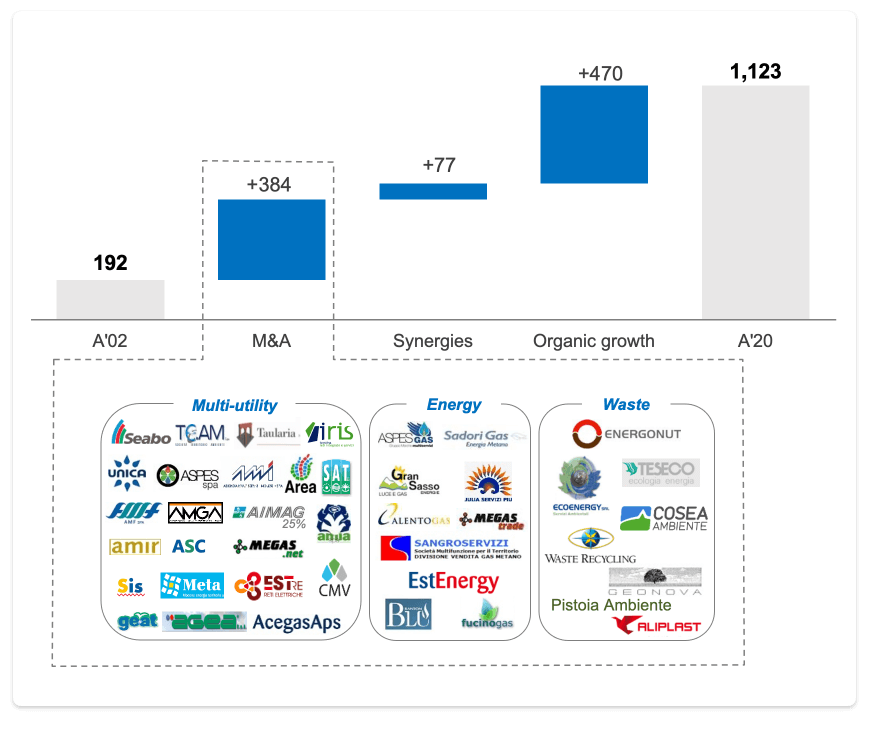

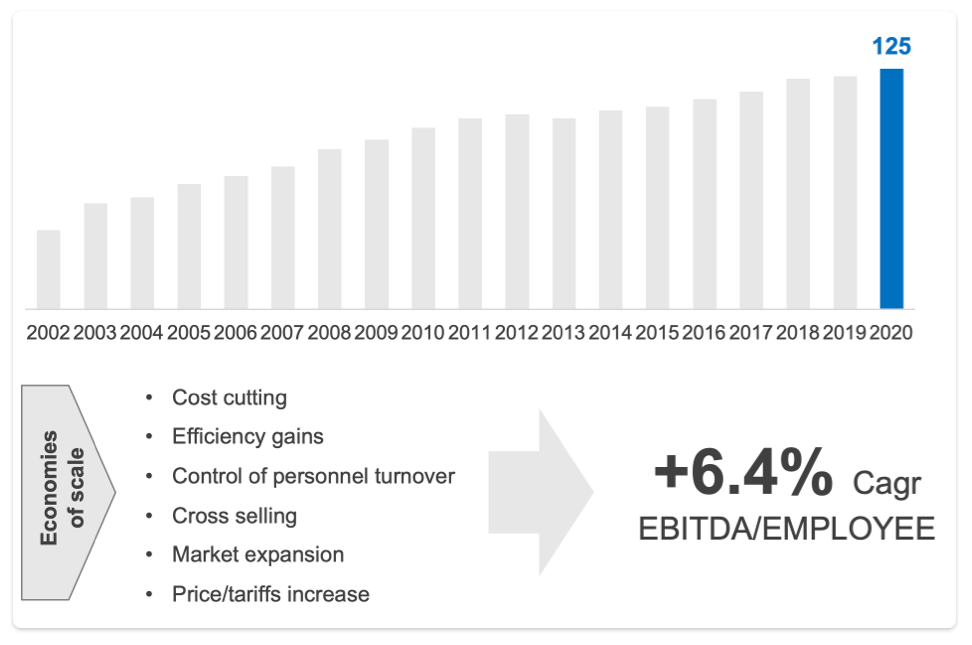

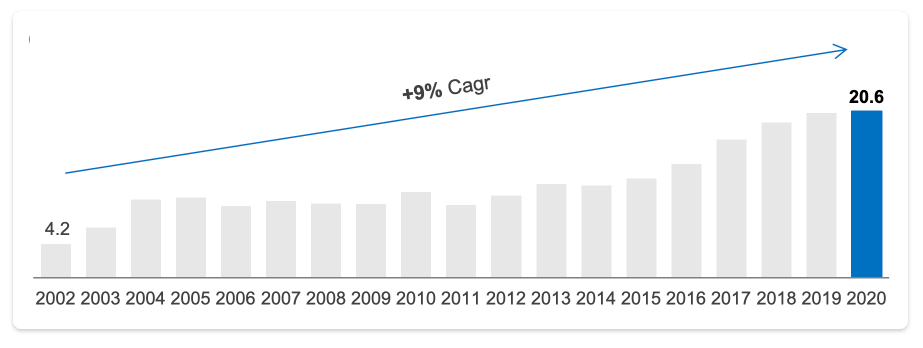

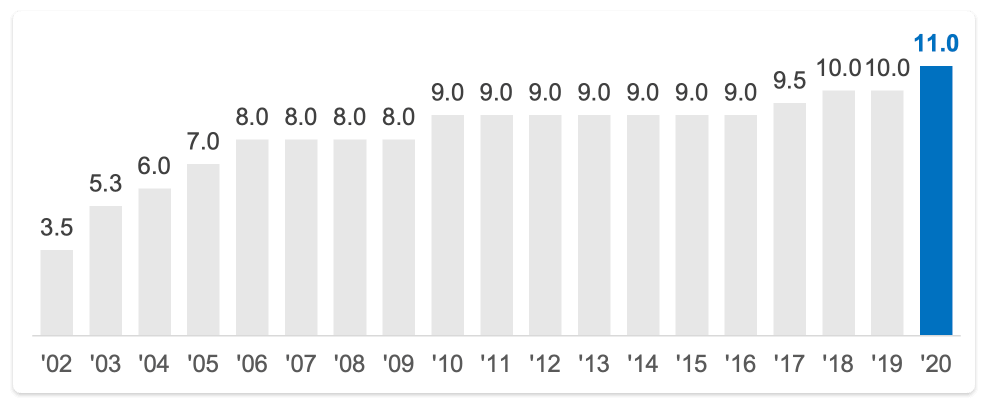

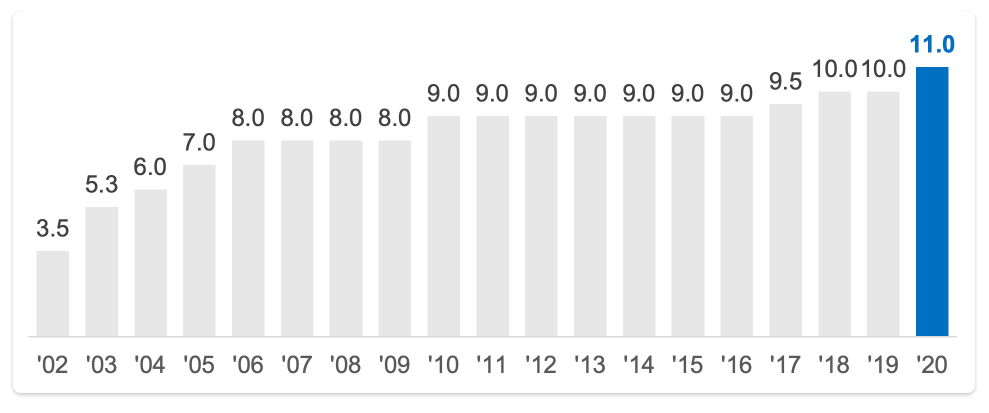

In a complex context, we defined new projects and signed agreements with outstanding partners, and in the second half of 2020, gaining speed in particular towards the end of the year, we benefitted from the overall recovery seen in economic activities in the areas we serve. These positive results were reflected in all main indicators and are all the more significant in light of the difficulties caused by the health emergency: we thus confirmed our track record of 18 years of growth and further improved our financial solidity, with positive consequences for our public and private shareholders, to whom we have decided to pay, already this year, an increased dividend coming to 11 cents per share. The good cash generation seen in 2020, furthermore, will allow us to fully cover our policy of increased dividends through to 2024."

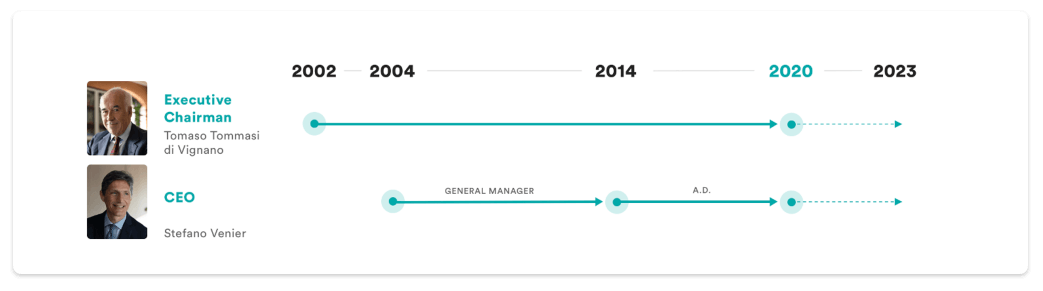

Tomaso Tommasi di Vignano

Executive Chairman

"The growth achieved by the Hera Group was strongly supported by its partnership with Ascopiave, which enabled the Group to expand further in the Triveneto region.

Despite the complex context, we were able to immediately extract a significant part of the expected synergies, thus giving a crucial contribution to the increase in our cash flows in 2020.

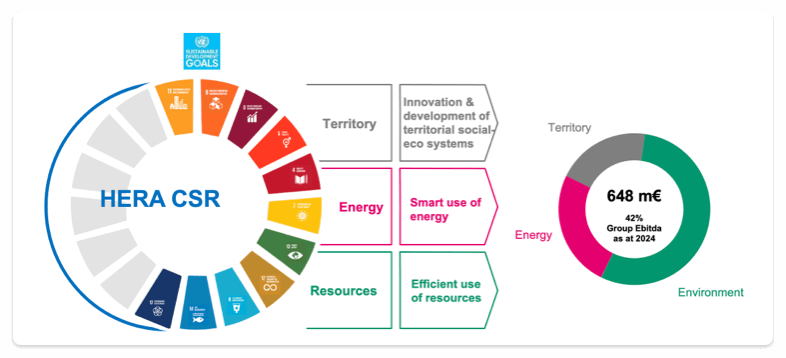

The year was also dedicated to further progress in fully integrating sustainability into our business strategies: we are committed to promoting further development in this direction, with projects for circularity, carbon neutrality and technological innovation, respecting European policies and the goals on the UN’s 2030 Agenda.

This also includes a few collaborations recently launched, such as the one with Snam for developing hydrogen. Green gases, in fact, are a particularly interesting frontier for us precisely because we operate in more than one business: by providing our wide range of expertise and our broad infrastructures, we can create innovative examples of carbon neutral circularity between supply chains.”

Stefano Venier

CEO

| Consensus | Hera's results | Δ % | |

|---|---|---|---|

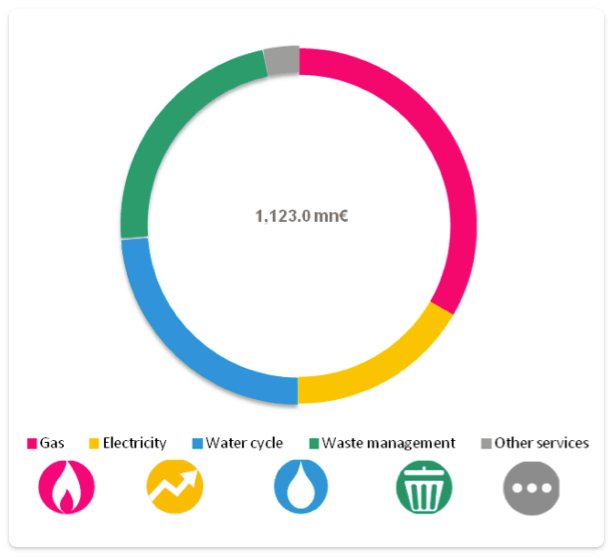

| Ebitda (mln €) | 1,121.0 | 1,123.0 | +0.2% |

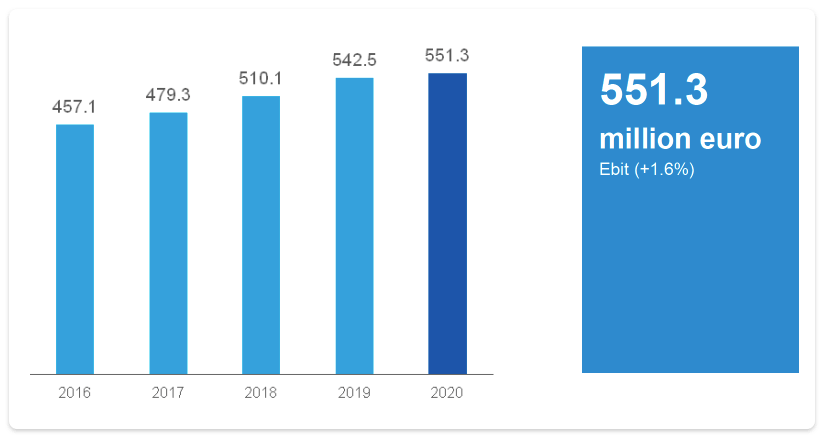

| Ebit (mln €) | 554.5 | 551.3 | (0.6%) |

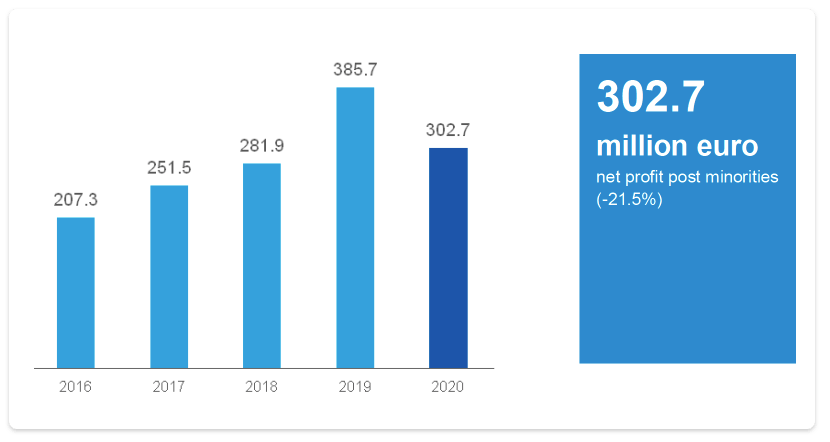

| Net profit post min. (mln €) | 307.4 | 302.7 | (1.5%) |

| Net Financial Position (mln €) | 3,248.8 | 3,227.0 | (0.7%) |

| Preview | Post Results | ||||

|---|---|---|---|---|---|

| Analyst | Broker | Rating | Target Price (€) | Rating | Target Price (€) |

| Emanuele Oggioni | Banca Akros | Buy | 4.00 | Buy | 4.00 |

| Davide Candela | Intesa Sanpaolo | Buy | 4.70 | Buy | 4.70 |

| Roberto Letizia | Equita Sim | Hold | 3.50 | Hold | 3.50 |

| Federico Pezzetti | Intermonte | Outperform | 4.20 | Outperform | 4.20 |

| Claudia Introvigne | Kepler Cheuvreux | Buy | 3.60 | Buy | 3.60 |

| Javier Suarez | Mediobanca | Outperform | 4.00 | Outperform | 4.00 |

| Enrico Bartoli | Stifel | Buy | 3.70 | Buy | 3.70 |

| Average | 3.96 | Average | 3.96 | ||

| Broker | Analysts' comments on financial results |

|---|---|

| Banca Akros | "The dividend proposed at the shareholders' meeting is EUR 0.11 per share (+10% YoY), slightly higher than our forecast of EUR 0.105 per share. This will, furthermore, benefit the shareholder remuneration policy in the current business plan, since this new starting point will be applied, thus arriving at a dividend of EUR 0.13 per share by 2024 (vs EUR 0.125 previously targeted). According to the management, this should be considered as a floor, with further potential upside." |

| Intesa Sanpaolo | "Management is confident in Hera recovering at least half of the EUR 31M of Covid-19 impacts on 2020 reported EBITDA in the current year, whilst further contributions should come from organic growth in the Energy Supply and Waste businesses, and from potential M&A. In this respect, the company is currently assessing a few dossiers and minorities’ buy-outs, that according to management could also be finalised through asset-for-share transactions so as to not burden the net debt. Lastly, management stated that the current (and revised upward) dividend policy should be seen as a floor, with any overperformance in the coming years potentially to be distributed as a dividend, as in 2020. We appreciate the improved dividend policy, powered by a solid cash generation, as well as the continued and solid commitment of Hera on sustainability." |

| Equita Sim | "Hera showed a good resilience in 2020 with results in line with expectations despite difficult conditions in Q4 and thanks to the contributions of M&A and efficiencies. Considering 2020 results and qualitative indications, we don't make any significant change to our 2021 estimates and we confirm our neutral view." |

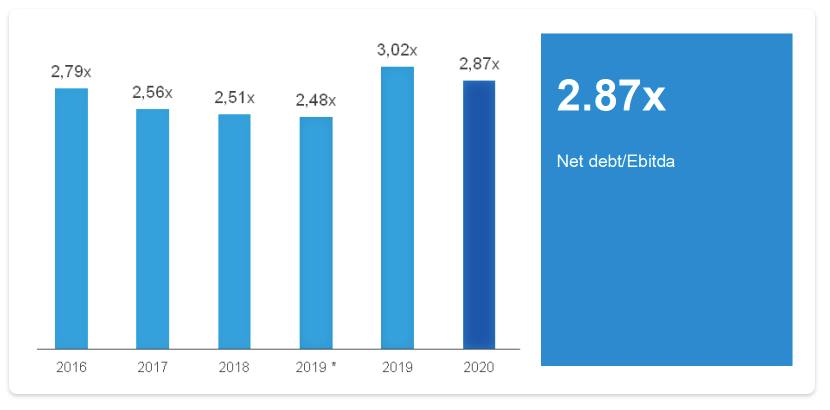

| Intermonte | "DPS at Eu0.11 (+10% YoY) was above the Eu0.105 guidance given at the beginning of the year, a decision that benefited from the excellent cash generation demonstrated, evenin what has been an extraordinarily tough year. Thanks to the dual impact of increased EBITDA and reduced NFP, thenet debt/ EBITDA ratio came to 2.87x, a marked improvement on the 3.02x posted at theend of 2019. Following FY20 results and the dividend proposal, we continue to believe that the group is well placed to benefit from the growth of the Energy supplycustomer base, leadership in the Waste business and a strategy built around the concepts of resilience and environmental and digital transition. The group is trading at 6.6x 2021EEV/EBITDA, a multiple that we consider undemanding, potentially opening the door to a re-rating in the wake of the stock’s 2020 underperformance." |

| Kepler Cheuvreux | "HERA’s final 2020 data is better than pre-closing, both at operating level, with EBITDA up 3.5% YOY, and at dividend level, with DPS up 10% YOY. The dividend policy has been improved until 2024. We reiterate our positive stance on the stock, in view of its appealing potential upside and solid and diversified business profile." |

| Mediobanca | "The company has delivered strong CF generation, with the Net Debt to EBITDA below the 3x threshold. We believe this is the consequence of optimization of the billing process, and that should remain as structural, since it is the consequence of technology improvements. Management has indicated that the dividend Policy is a floor. And therefore, since there has been an outperformance, that has been reverted to shareholders. This is what has happened this year, and as a consequence Hera has revised upwards its DPS policy. We included Hera in our list of core holdings, based on the solidity of its business model and exposure to the secular trend of adoption of circular, green & sustainable models." |

| Stifel | "Hera reported a solid set of 2020 results, confirming once again the single-digit growth trend consistently reported in the past twenty years and the strength of its business model and the cautious approach taken by its management. The company more than offset through organic business development, cost efficiencies and external growth the difficult business environment determined by lockdown measures related to the Covid pandemic. We expect that the company will partially recover those negative impacts in 2021 and that it will continue its usual growth path. Hera represents a low risk growth story almost immune to the impact of Covid 19 and the current economic downturn. Hera's share price has only partially recovered since the sell-off of the market in March 2020. We think that the low-risk growth offered by the company and the high quality of its management are underestimated by the current share price." |

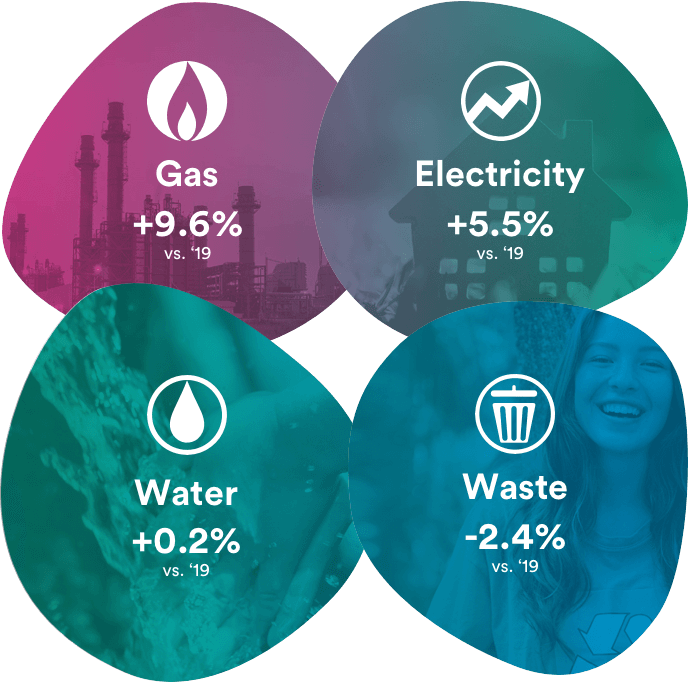

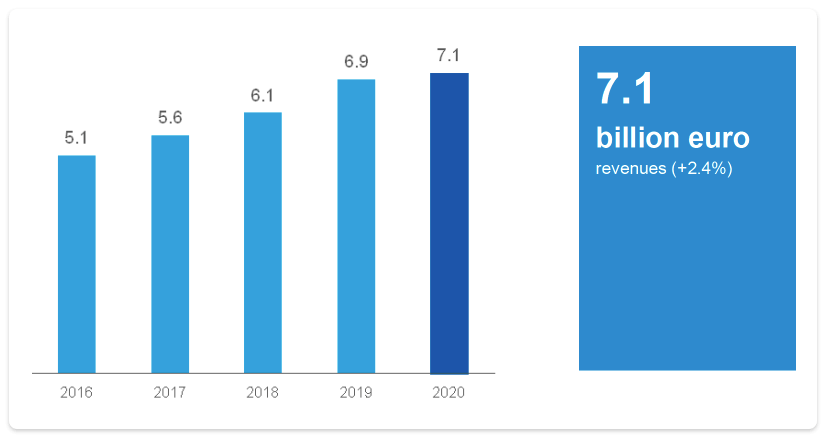

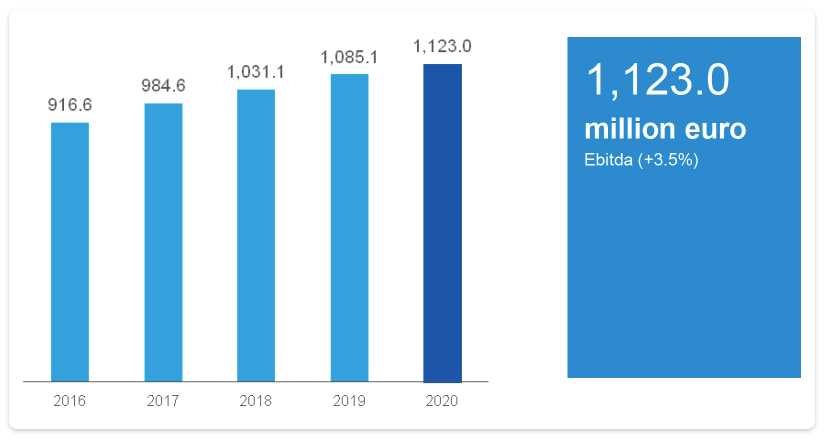

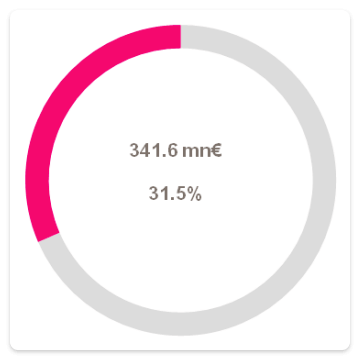

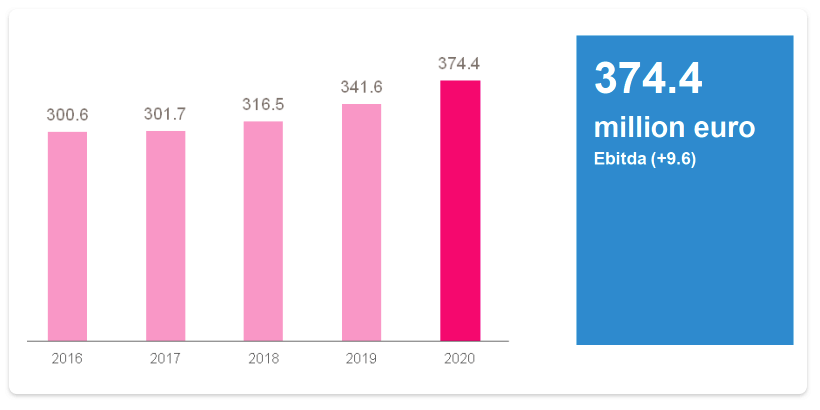

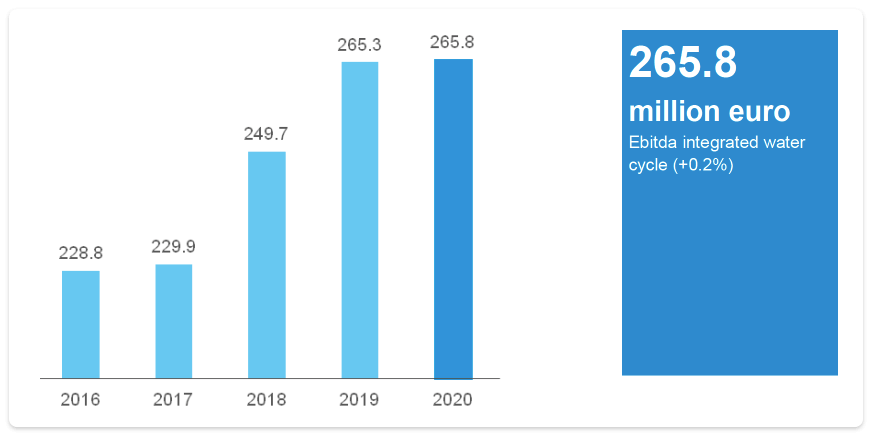

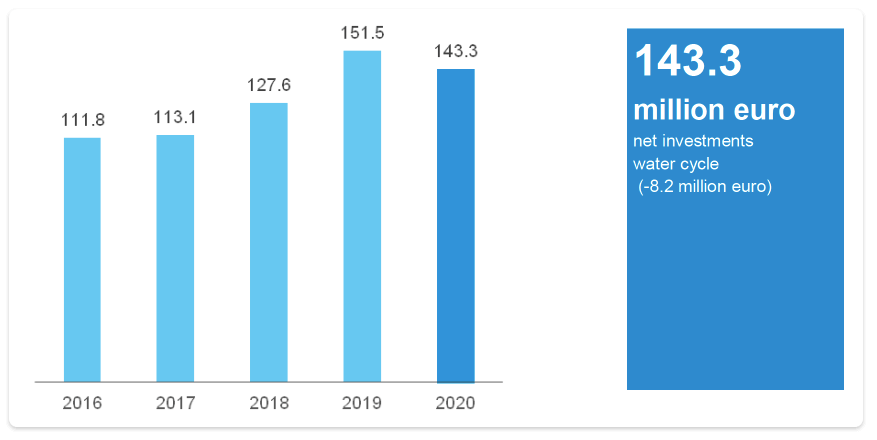

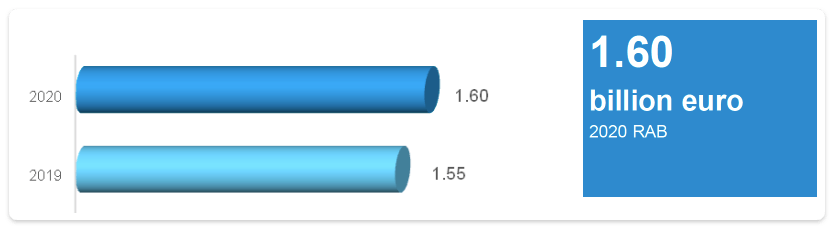

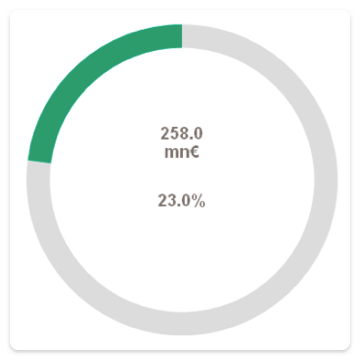

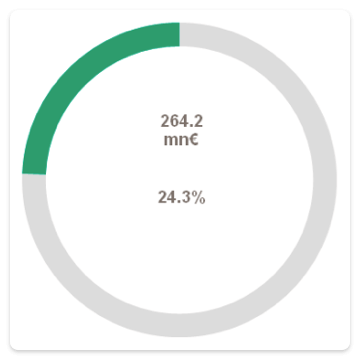

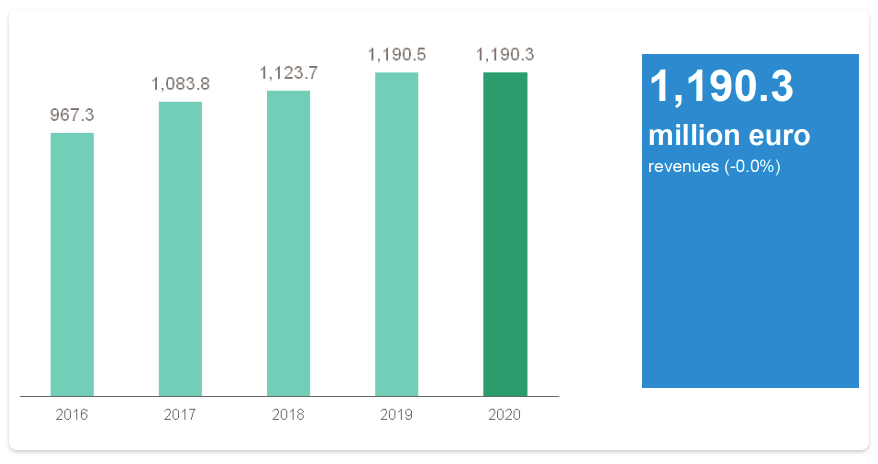

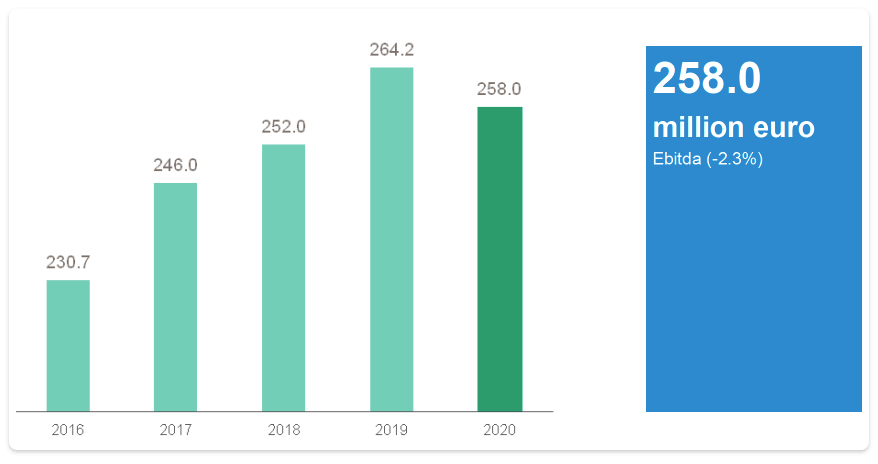

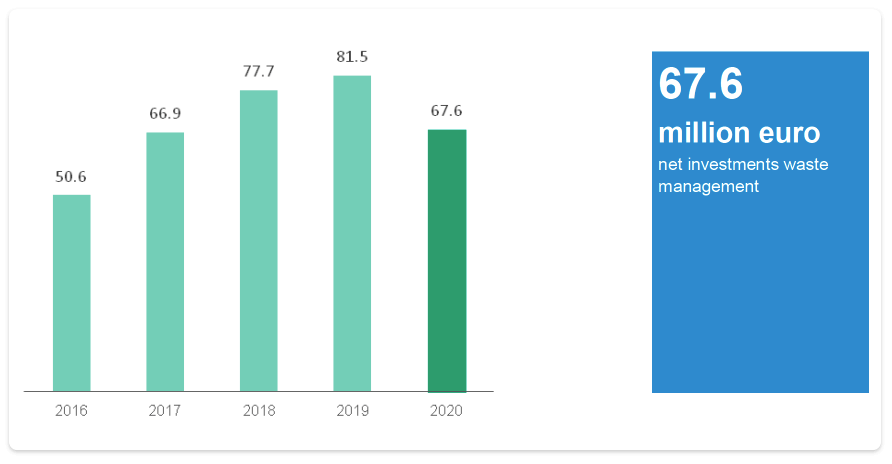

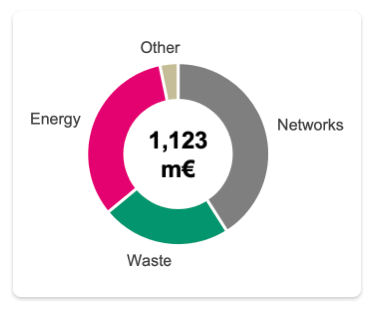

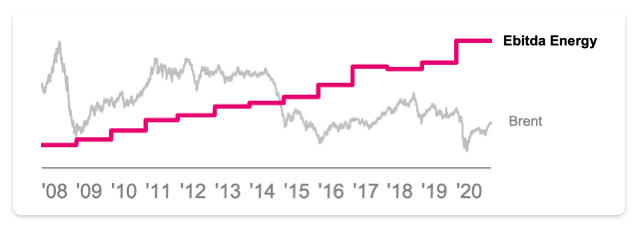

TOTAL EBITDA GROUP 1,123.0 M€, +3.5% vs. ‘19

Gas

+9.6%

vs. ’19

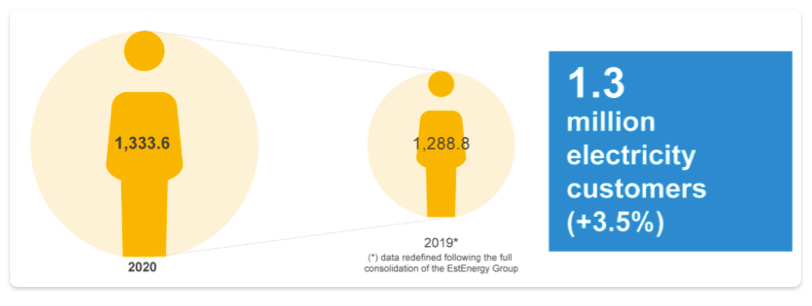

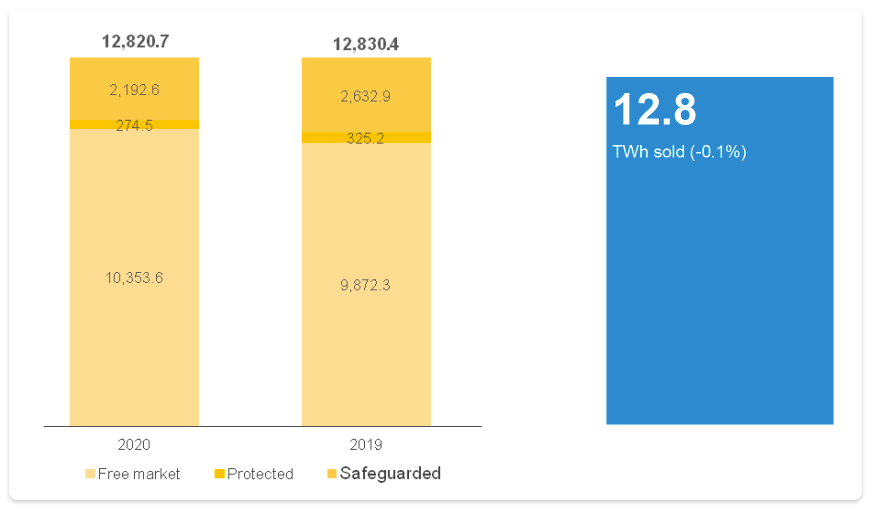

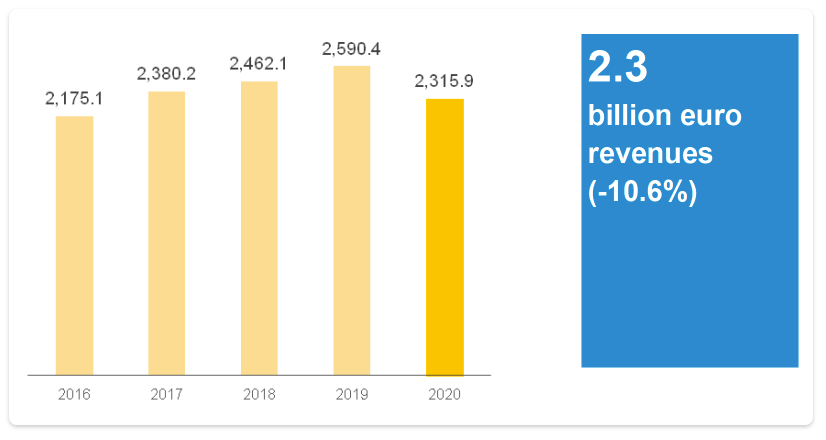

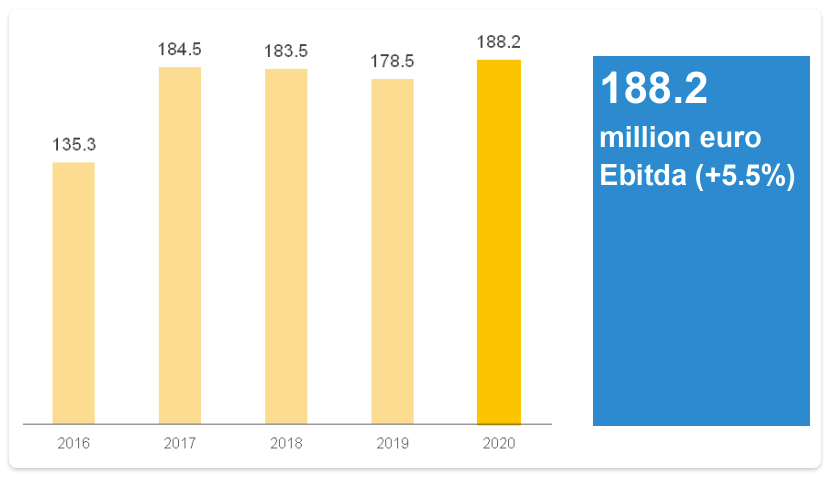

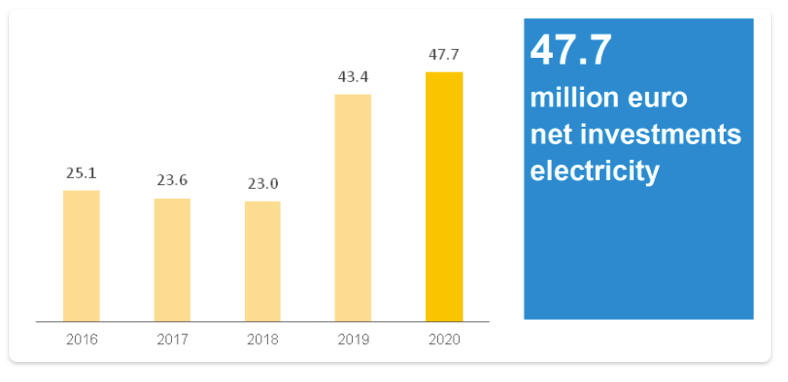

Electricity

+5.5%

vs. ’19

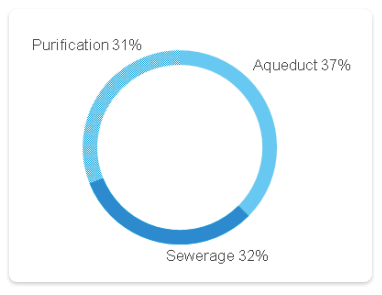

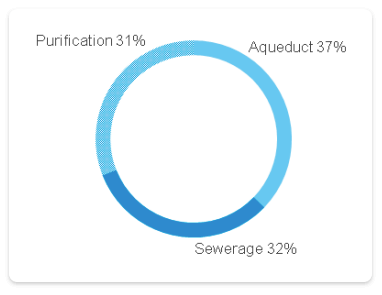

Water

+0.2%

vs. ’19

Waste

-2.3%

vs. ’19

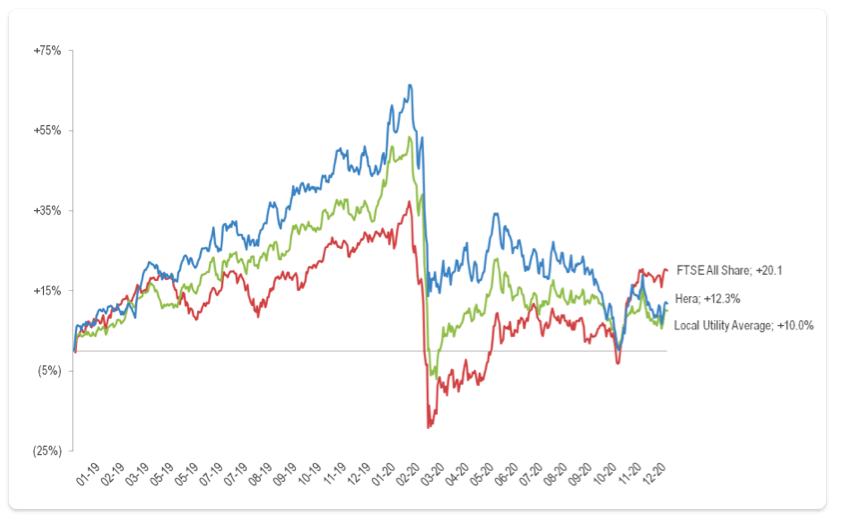

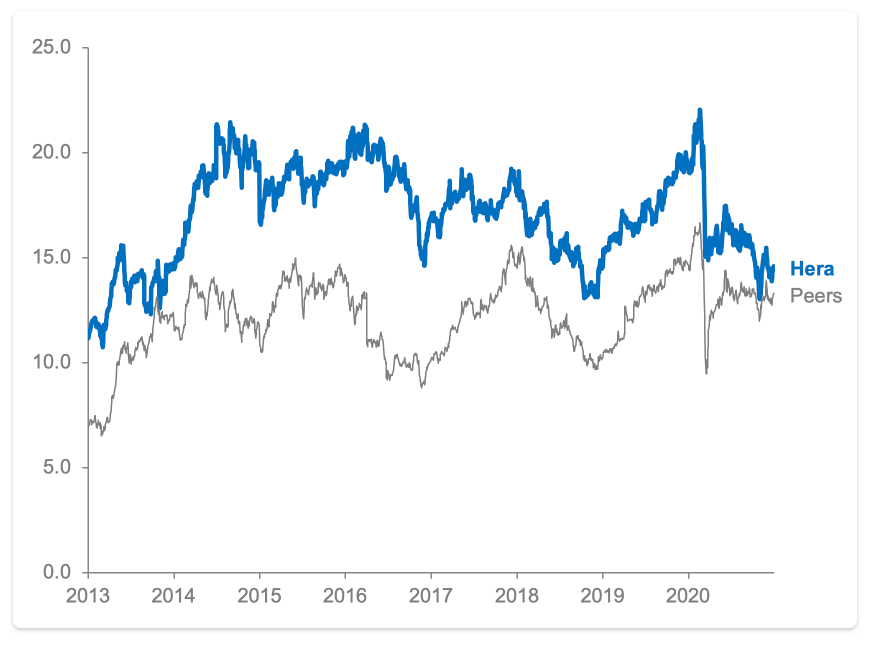

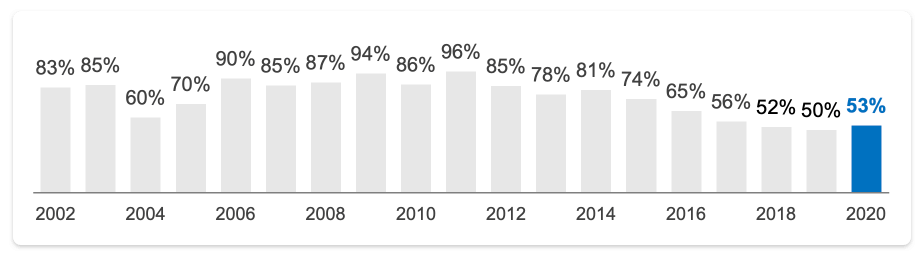

In 2020, the Italian Ftse All Share index showed a performance coming to -5.6%, after having reached its maximum fall of -36.2% in mid-March, in line with the average of the other main European stock exchanges. In this context of extraordinary uncertainty and volatility, Hera shares closed the period with an official price of 2.990 euro, down -23.5%, in line with the performance of the country’s main comparable stocks. Considering the 2019-2020 two-year period, Hera stock showed its usual resilience under these conditions as well, with a fall in share prices that was slower than the market. Throughout the period in question, it furthermore maintained a positive performance compared to values seen in early 2019, higher than the reference sector.

After 2019 came to an end with all global stock markets rising, supported by prospects of solid economic growth, the early months of 2020 also began on a positive note, ignoring the alarm coming from China about the spread of an unknown virus. In late February, when the first cases of Covid-19 came to light in Europe, the continent’s main governments introduced unprecedented social distancing measures, with extraordinarily negative implications for overall economic activity. Faced with an economic slowdown and uncertainty over the time required to return to normality, volatility increased on financial markets and sharp declines were seen on stock exchanges worldwide. The exceptional measures introduced by governments to support national economies, along with the almost unlimited liquidity guaranteed by central banks, led stock markets to gain confidence again. Beginning in mid-March, prices therefore recovered, also partially due to the slower spread of the virus during the summer months. As of the end of the third quarter, however, the number of infections began to rise rapidly again and governments were forced to take restrictive measures once more. The market reacted quickly, with intense sales of all risky assets. It was only in November, with the American elections and the announcement of positive results in testing for some vaccines, that world stock markets regained confidence that the economy would rapidly normalize in 2021, increasing exposure to cyclical stocks, the main beneficiaries of recovery in the economic cycle, to the detriment of more defensive stocks such as utilities. In 2020, the Italian Ftse All Share index showed a performance coming to -5.6%, after having reached its maximum fall of -36.2% in mid-March, in line with the average of the other main European stock exchanges. In this context of extraordinary uncertainty and volatility, Hera shares closed the period with an official price of 2.990 euro, down -23.5%, in line with the performance of the country’s main comparable stocks.

Considering the 2019-2020 two-year period, Hera stock showed its usual resilience under these

conditions as well, with a fall in share prices that was slower than the market. Throughout the

period in question, it furthermore maintained a positive performance compared to values seen in

early 2019, higher than the reference sector.

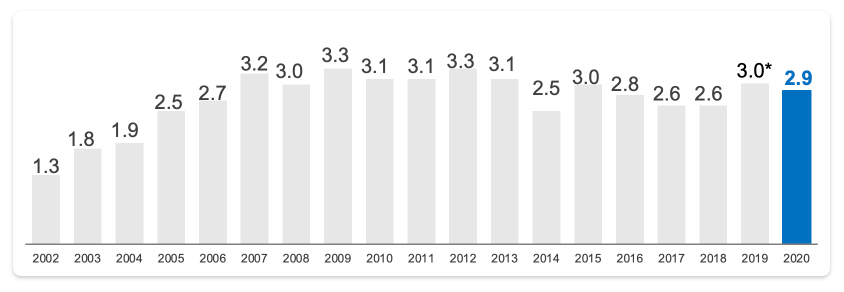

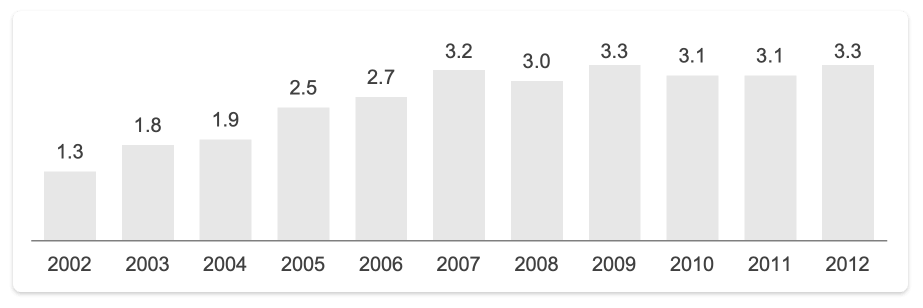

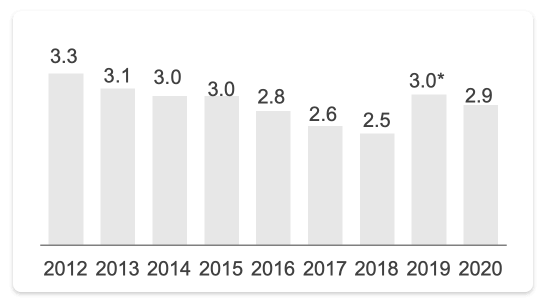

On 6 July 2020, following the indications contained in the business plan, Hera Spa paid a dividend coming to 10.0 cents per share, the eighteenth in a series of uninterrupted growth since being listed.

| euro | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dps | 0.035 | 0.053 | 0.06 | 0.07 | 0.08 | 0.08 | 0.08 | 0.08 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.095 | 0.10 | 0.10 |

The joint effect of continuously remunerating shareholders through dividends and a rise in the price of the stock led the total shareholders return accumulated since the IPO to remain consistently positive and to settle, at the end of the period in question, at over +253%.

The financial analysts covering the company (Banca Akros, Banca Imi, Equita Sim, Intermonte, Kepler

Cheuvreux, Mediobanca and Stifel) all expressed positive or neutral opinions, with no negative

opinion. At the end of the year, the consensus target price came to 3.93 euro, higher than the 3.87

euro recommended at the end of 2019.

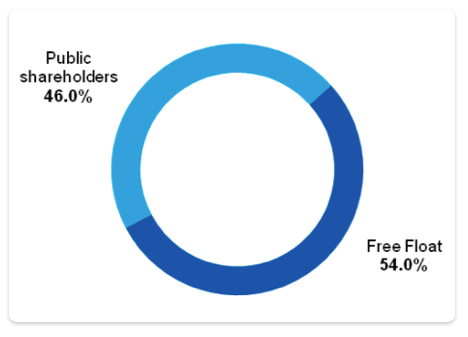

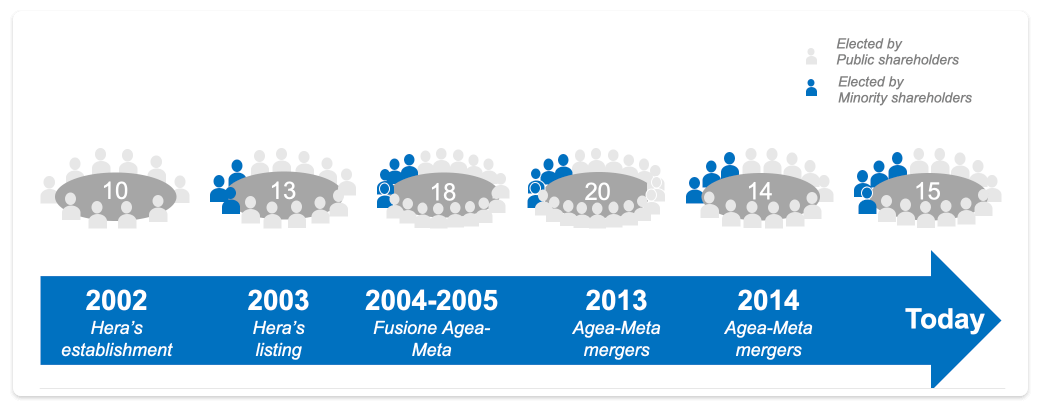

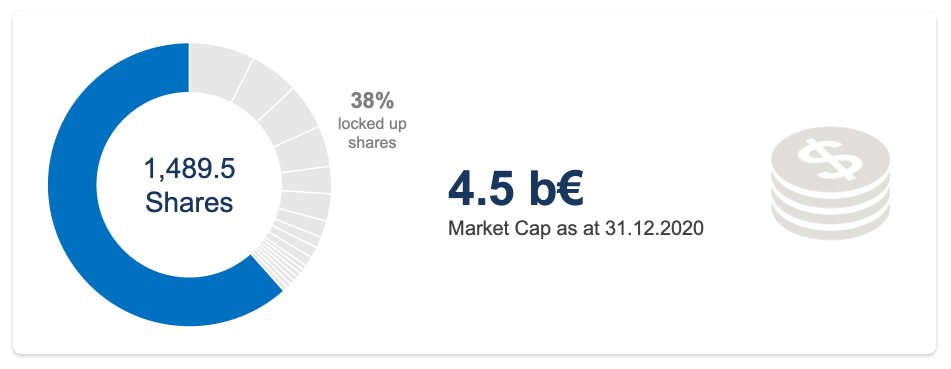

At 31 December 2020, the shareholder breakdown showed its usual stability and balance, with 46.0% of shares belonging to 111 public shareholders located across the areas served and brought together by a stockholders agreement effective from 1 July 2018 to 30 June 2021, and a 54.0% free float. The shareholding structure is highly fragmentary, with a high number of public shareholders (111 municipalities, the largest of which holds shares amounting to less than 10% of the total) and a high number of private institutional and retail shareholders.

Since 2006, Hera has adopted a share buyback program, renewed by the Shareholders Meeting held on 29 April 2020 for 18 further months, for an overall maximum amount of 270 million euro. This plan is aimed at financing M&A opportunities involving smaller companies, and smoothing out any anomalous market price fluctuations vis-à-vis those of the main comparable Italian companies. At the end of 2020, Hera Spa held 28.9 million treasury shares, up 14.7 million compared to the end of 2019. The solid cash generation seen over the year, along with the market situation, made it possible to build up a portfolio of treasury shares covering almost all the shares that the Business Plan expects to pay out to counterparties in M&As, with the aim of counter-diluting shareholders by increasing earnings per share.

In 2020, Hera received an extraordinary international recognition: after an in-depth assessment of 28 criteria, subdivided into 141 questions related to environmental, social and governance issues, S&P Global declared Hera to be the best multi-utility in the world, assigning it the gold medal for sustainability and including it in the Dow Jones Sustainability Index, World and Europe, the two most prestigious global indices followed by sustainable investors. S&P Global furthermore rewarded the clear improvement in Hera’s rating, which rose by 19 points, by giving it the title of Industry Mover. Hera is additionally unprecedented in being included in the two above-mentioned indices after only two years of evaluation, considering that on average companies require 8.5 years to be included in this basket. This assessment provided an opportunity to highlight the sustainable approach shown by the Group’s strategy over the last 18 years, which is now a competitive advantage allowing it to grasp the market opportunities offered by the scenario. The Group can furthermore play a leading role in the areas of circular economy and carbon neutrality, also contributing to achieving the goals defined by the United Nations and European institutions, to which the capital made available by the Recovery Fund will also refer.

The Group’s top management continued to engage in intense communications with investors in 2020, by way of both physical meetings in the early part of the year and virtual ones at the end, in order to provide constant updates in the trends seen in its activities and future prospects. After Hera’s new 2019-2023 Business Plan was published, the Executive Chairman and the CEO took part in a roadshow that visited the main financial centres in Europe and the USA, to illustrate the Group’s growth targets to investors. In the third quarter, the Group’s activities in accurate communications continued, participating in the main conferences organised by Borsa Italiana (Sustainability Day and Infrastructure Day), which saw the participation of significant institutional investors. Hera also participated in a roadshow discussing the issue of shared value and a conference organised by an international broker dedicated to Italian Jewels, i.e. the Italian companies considered to show the highest quality. The intense dedication shown by the Group towards dialoguing with investors contributed to reinforcing its market reputation and represents an intangible asset benefiting Hera stock and stakeholders.

As regards the information required by article 2428, paragraph 3, subparagraphs 3 and 4 of the Italian Civil Code, concerning the number and nominal value of the shares constituting the share capital of Hera Spa, the number and nominal value of the treasury shares held as at 31 December 2020, as well as the changes in these shares during 2020, see note 24 of paragraph 3.02.05 and the statement of changes in equity in paragraph 3.01.05 of the Parent Company’s separate financial statements.

The reference scenario for the next few years presents

challenges and opportunities that Hera was able to intercept on time, basing its strategy

on them well in advance and in line with the objectives of the 2030 Agenda.

In 2020, thanks to its solid and efficient multi-business model, and to good

operational, financial and fiscal management, Hera managed to keep its results growing,

capitalizing on the efforts made so far and at the same time implementing a series of

support actions for its stakeholders.

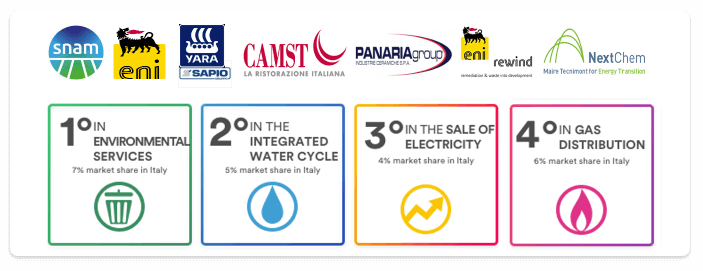

A range of partnerships, with one single aim: promoting a circular economy to fight climate change. This requires urgent measures to be taken, to achieve both the SDGs on the UN’s 2030 Agenda and the objectives set by the Paris Agreement and EU Directives.

In order to ensure these targets are reached on time, the Group has established partnerships that perfectly reflect the strategy defined in its Business Plan to 2024. These partnerships increase the Group’s agility in processes and guarantee a faster time-to-market, accelerating the achievement of its results. Moreover, this approach, in addition to reducing the Group’s risk profile, leads to a more sustainable performance over time, with a significant reduction in R&D costs.

At Hera, what makes the difference is the Group’s nature as a multi-utility and its diversified business portfolio, thanks to which intra-business synergies become a competitive advantage. This makes processes become circular as well, since what would be discarded in one business turns into a resource for another, producing a win-win situation that makes our company’s performance unique.

In the fight against climate change, collecting, processing and RECYCLING PLASTICS in a sustainable way is fundamental, considering the enormous quantity produced every day and released into the environment. Hera, the Italian leader in the WASTE TREATMENT SECTOR, has been dedicating a great deal of attention to this issue for years, investing both in Herambiente, to improve sorted waste collection, and its subsidiary Aliplast, to increase the amount of plastic materials recycled. A partnership with PANARIAGROUP now allows the Group to achieve a higher recovery and regeneration of plastic film (in 2020 alone, over 450 tons of CO2 emissions into the atmosphere were avoided), and a recent agreement with NEXTCHEM, a subsidiary of the Maire Tecnimont Group, aims at creating a high-quality recycled polymer production plant. This collaboration will allow the Group to expand even further in the sector of treating and recycling certain hard plastics that cannot be recycled in the standard recycling chain.

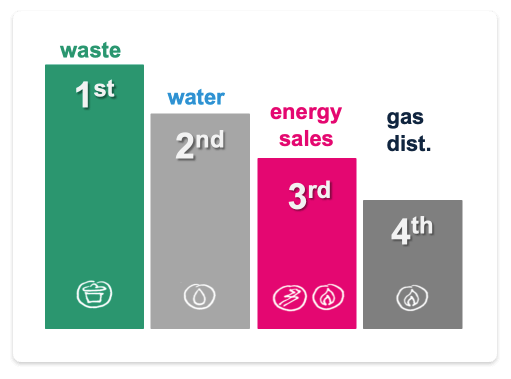

However, in HYDROGEN PRODUCTION, being an integrated operator such as Hera brings even more significant advantages. Here, it allows for economically competitive and sustainable production: in water electrolysis, the low-cost green energy (no longer covered by incentives) coming from WTE plants is used to separate water into hydrogen and oxygen. While oxygen is used in the wastewater purification process, part of the water cycle, in which Hera is Italy’s 2nd largest operator, hydrogen is stored or distributed to end customers through the gas distribution network (in which Hera ranks 3rd nationally), creating a renewable and environmentally harmless energy cycle. To enhance this process, the Group has recently launched partnerships with SNAM, YARA and SAPIO that will allow concrete solutions to be found in reducing the carbon footprint left by the industrial sector, mobility and individual citizens.

BIODIESEL PRODUCTION, too, finds advantages in a cross-business strategy. In order to further minimize disposal in favour of material and energy recovery, Hera has signed agreements with ENI, ENI Rewind and CAMST. The exhausted household vegetable oils collected by Hera, along with commercial oils from restaurants, will be processed in ENI’s biorefinery to be converted into HVO biofuel, a component that will then be used as a source of fuel for vehicles used by Hera to collect municipal waste. In addition, all organic waste produced by CAMST, a leading company in the Italian restaurant sector that serves close to 130 million meals per year, will be treated at the Group’s plant in Sant’Agata Bolognese to produce biomethane and compost.

This integrated approach is increasingly being applied to all Group projects, and reflects Hera’s commitment towards development and growth, through actions aimed at energy transition, environmental protection and technological evolution.

2020: the

first year of the Plan has set the groundwork for the future

2020: the

first year of the Plan has set the groundwork for the future

Companies are increasingly being asked to become aware of their social role, and to act accordingly. The degree to which ESG factors are integrated within its strategy and processes is therefore becoming an indicator of a company’s maturity in the area of social responsibility and sustainability.

The Hera Group, born out of an aggregation of several municipalized companies, has maintained the attention this sort of company typically shows towards local and social wellbeing, and towards protecting the common good while respecting the local area and its resources. In fact, at Hera, alongside projects dedicated to technological innovation, industrial research and economic development, aimed at creating new products, processes or services, initiatives with a strong social impact are conceived and expanded.

This begins with HERA FOR SCHOOLS and the project “THE GREAT MACHINE OF THE WORLD”, created over 15 years ago to encourage respect for the environment, a responsible use of resources and a knowledge of science among the younger generations.

Every year, students from 4 to 18 years of age are invited to practical workshops, team and role-playing games, competitions between classes with environmental objectives, along with guided tours, some of which are virtual, to Hera plants, and events concerning water, energy and waste. What the students discover, in a playful and interactive way, is the value of waste management and treatment, separate waste collection, the scarcity of natural resources such as water and the importance of saving energy, aiming at a circular economy and environmental sustainability. From 2013 to the present, more than 448 thousand students from 20 thousand classes and 6,400 schools in Emilia-Romagna have been involved.

For secondary schools, there is also “A WELL OF KNOWLEDGE”, a special program dedicated to scientific issues that, every year, proposes a topic around which to develop meetings with scientists and experts, researchers and innovative companies or start-ups, all involving issues related to the environment and technology. Experiential workshops on water, energy and waste are also held, as are debates between classes, designed to get children involved, raise their awareness and give them a leading role in the changing future that awaits them. To date, about 140 thousand students from 5,500 classes and 500 high schools have been involved.

On the topic of inclusive culture, the Group participates in the “INSPIRINGIRLS” project, promoted by VALORE D and aimed at middle school students, to encourage young women to pursue their aspirations, above and beyond gender stereotypes. Since 2017, the ‘role models’ have met with nearly 30,000 young people across the country.

Diversity and inclusion was also the focus of the first edition of “4 WEEKS 4 INCLUSION”, an intercompany program created in 2020, with the involvement of 27 Italian companies, including Hera. Together, they designed, for their employees, a calendar with 67 digital events held during one month, dedicated to topics such as disabilities, intergenerational communication, enhanced contributions coming from women and identity based on gender, ethnicity and religion. More than 300 Hera employees took part in this initiative.

Through HERACADEMY, the Group’s Corporate University, Hera also offers employees a full programme of training, workshops, experiences in cooperation and exchange of knowledge to develop new skills. Since 2011, 11 workshops have been organized with an average of roughly 200 participants per event.

At the same time, H-FARM, a university orientation initiative aimed at the children of employees who are about to enrol in university, has been held for years in collaboration with the University of Bologna. It is now at its 9th edition: to date, including the 2020/2021 courses, 434 courses have been co-designed and 284 implemented, involving students across Emilia-Romagna and, to a lesser extent, in the Veneto and Marche regions.

Also intended to support employees and their families, HEXTRA, the Group’s welfare system, renews each year its range of services based on the needs of the company’s workforce. This plan provides a certain amount of welfare, which now stands at €385, equal for all employees, with which each of them can put together their own package, choosing among services, discounts and a range of benefits in training and other fields. Since it was launched in 2016, it has benefited almost all employees, with almost 4 million euros used on average each year.

From the HEXTRA portal, employees can also participate in the HERASOLIDALE project, created in 2014 to promote support among workers for associations involved in solidarity programs. Since 2018, HeraSolidale is aimed at organizations operating nationally and internationally and, in addition to employees, also involves new Hera Comm electricity and gas customers, who can choose to allocate 1 euro, when signing a free market contract, to one of the associations involved. The Group is also committed to donating 1 euro to the project for every new customer acquired by Hera Comm. The fourth edition, which will run until December 2022, has already collected 83 thousand euro, while the three previous editions collected around 570 thousand euro, allocated to 25 non-profit organizations.

And the Group’s commitment to solidarity does not end here. Thanks to collaborations with numerous partners, since 2014 CHANGE THE ENDING has let Hera give new life to 3.6 thousand tons of bulky items and electronic waste in good condition, preventing their disposal. The challenge of this project is in fact to recover objects and give new life to the things and people of a community, helping the environment and those in need.

With FARMACOAMICO, instead, medicine with at least 6 months before its expiry date is collected by Hera and donated to non-profit organizations, who use it in projects to assist the more vulnerable members of the community. From 2013 to 2020, the Hera Group has been able to prevent over 345,000 packages of medicines that can still be used from becoming waste, making it possible to recover and donate essential goods worth almost 4 million euro to local non-profit organizations.

Hera’s partner in this project is Last Minute Market, a social enterprise and spin-off company of the University of Bologna, which promotes reduced waste and environmental sustainability and also collaborates with Hera in the CIBOAMICO project, to recover meals prepared but not consumed in the Group’s canteens. This food is donated to 4 non-profit organizations that, on a daily basis, provide hospitality and assist people in difficulty. In addition to the social benefits (turning excess food into a resource) and environmental benefits (not wasting the water and energy used in preparation), this project also has economic value: since 2012, about 110,000 meals have been recovered, for a total value of over 452 thousand euro.

These are all initiatives in which the Group shows its involvement with local communities, to generate a positive, tangible and measurable environmental and social impact, create value and respond to the question: “What human, environmental and social need is the company, while pursuing its business objectives, able to meet at the same time?”

The Group's

projects to help reach the SDGs on the UN's 2030 agenda

The Group's

projects to help reach the SDGs on the UN's 2030 agenda

Hera’s mission defines the course of action adopted by the Group to achieve its strategic objectives: sustainability and creating value, quality and excellence in services, efficiency, innovation and continuous improvement are among the goals Hera sets for itself on a daily basis.

Each year, we make an effort to report on our operations in a transparent manner, cultivating communication with all stakeholders to ensure we can be proud of our business model, knowing that it has achieved its objectives and created value. This type of analysis cannot overlook our new commitments nor the awards we have obtained.

Since sustainability is part of the Group’s DNA, it is natural that a significant part of the goals achieved involve ESG factors, such as becoming part of the DOW JONES SUSTAINABILITY INDEX, WORLD and EUROPE, both managed by S&P Global. In 2020, this firm recognized the Hera Group as the best multi-utility in the world, counting it among 61 Industry Leaders in the respective sectors. This evaluation also led Hera to be included in the 2021 SUSTAINABILITY YEARBOOK, giving it GOLD CLASS status and special mention as an “INDUSTRY MOVER” which, taken together, represent the highest recognition that this authoritative international stock exchange index reserves for the companies it evaluates.

The Group’s ESG PERFORMANCE has also been positively evaluated by FTSE Russell, which in 2020 included Hera stock in the FTSE4GOOD INDEX SERIES, an important series of ethical indices created to encourage investments in companies that meet strict environmental, social and governance criteria. This is an important milestone, because it makes Group even better placed to capitalize on the benefits of responsible business conduct.

In the ENVIRONMENTAL AREA, the Hera Group made further progress in the CDP - CARBON DISCLOSURE PROJECT questionnaire. This organisation manages a system for measuring and disclosing data concerning the environmental impact of companies globally, and provides an excellent point of reference for investors and businesses. Hera obtained top rating (A) for its governance and emissions data, and achieved an overall score of A-.

Hera also stands out for its GOVERNANCE, firmly maintaining first place in the “sustainable finance” category over the past 3 years, and an outstanding ranking in the overall classification of Italian companies devised by the INTEGRATED GOVERNANCE INDEX (IGI). This project, developed by ETicaNews, is aimed at quantitatively assessing how deeply engrained ESG is in a company’s integrated governance model.

As regards SOCIAL FACTORS, the Group stands out for its strong promotion of diversity, inclusion and people development. This is demonstrated by two international awards and one certification: TOP EMPLOYER 2021, awarded by the Dutch Top Employer Institute to Hera for the 12th consecutive year, thanks to its excellent human resource management and organizational methods, that promote work agility and digitalization within the Group; TOP UTILITY DIVERSITY 2021, awarded by the public utilities think-tank that goes by the same name, for its commitment to policies in favour of diversity, inclusion and social responsibility; and, lastly, POTENTIALPARK 2021, a Swedish research company that sees Hera as “talent friendly” and has rewarded its skills in online and social communication aimed at young graduates seeking employment.

Hera has furthermore been confirmed in both Refinitiv’s 2020 DIVERSITY & INCLUSION INDEX, where it came in 12th in a global ranking of companies committed to promoting diversity, inclusion and people development, and in the 2021 BLOOMBERG GENDER-EQUALITY INDEX, which gives international recognition to the companies most committed to promoting and creating fair and inclusive workplaces.

This handful of awards for excellence drives us towards further improvement in our performance, because responding to the most urgent priorities and challenges for the planet’s sustainable development is the perspective that guides the Group’s way of doing business, moving towards economic growth capable of creating shared value for local areas and communities.

This is one of the reasons why, in 2020, the Hera Group became part of the ALLIANCE FOR A CIRCULAR ECONOMY, which already unites important companies that symbolise Made in Italy. This Alliance aims at continuously reinforcing improvement in sustainability through daily, demanding actions, to make innovation and sustainability an integral part of business and a strategic choice for competitiveness, including the effort to counter climate change.

![]()

Hera makes ongoing efforts to interpret the signs coming from the contexts in which it operates, in an attempt to obtain an overall view of what lies ahead for the Group and its stakeholders. In order to anticipate future developments, the main drivers of change and their essential interrelations are identified below. In particular, the macro-trends of the Group’s reference contexts are described, as are its main management policies, i.e. its industrial strategy and the related factors of sustainability (concerning the environment, technology and human capital).

Macroeconomy and finance

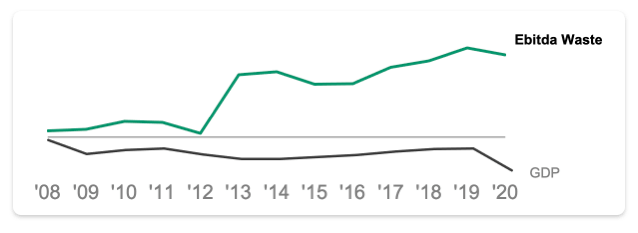

The global economy contracted sharply in 2020, largely owing to the effects of the Covid-19 pandemic on the economic and social fabric. The most recent estimates prepared by the International Monetary Fund (IMF) show a decrease in global wealth coming to 3.5% compared to 2019. Advanced economies accounted for much of this result (-4.9% compared to 2019), while the decline in developing economies was less pronounced (-2.4%). Particularly negative figures appeared in the Eurozone and the United Kingdom, which show reductions in GDP going from -7% to -10%, while the United States showed a -3.4% drop compared to the previous year. Positive figures were instead seen for China, which reported economic growth coming to 2.3% in 2020. The measures aimed at containing the spread of the epidemic over the year, at varying degrees of intensity, interrupted economic activities and obstructed the planning capacity of many players, bringing production and global trade almost to a standstill which was only partially unblocked by the notable recovery recorded over the summer months. This reversal in trends is due to the extraordinary measures adopted by all major world economies, intended to provide stimulus.

In the Eurozone, the economic downturn was significant (-7.2% compared to 2019) and

especially concentrated in the second and fourth quarters of the year. The drop in GDP was higher in

Spain, France and Italy, coming close to -10%, and more contained in Germany (-5.4%).

Household spending plummeted, as a result of the measures taken to contain the

virus and an increase in European households’ inclination to save. Exports also suffered, having to

deal with limitations on the flow of goods imposed by the restrictive measures introduced, in addition

to the drop in demand.

Average inflation for 2020 was negative and settled at -0.3%, weighed down by

the drop in energy prices and the weaker prices for services and non-energy industrial goods.

For the upcoming two years, the IMF has projected a general recovery worldwide (+5.5% in 2021 and +4.2% in 2022), still to be confirmed on the basis of the evolving health situation, the global distribution of vaccines and the effectiveness of the extraordinary economic and financial stimuli adopted in Europe. The Eurozone is expected to follow the same path of recovery: more specifically, growth rates coming to 4.2% in 2021 and 3.6% in 2022 are expected, which, however, will not make it possible to recover the amount of GDP seen at the end of 2019 within 2021.

Most of the considerations made regarding the Eurozone also apply to the economic situation in Italy: the restrictive measures, in fact, led to a significant reduction in GDP in the second and fourth quarters (by 13.0% and 3.5%, respectively, compared to the previous quarter), while the third quarter –during which the restrictive measures were eased, on the whole – saw a solid recovery (+15.9% compared with the second quarter). This, however, was not enough to prevent national GDP from contracting by around 9% over the entire year.

In 2020, exports fell by 9.7% and household consumption also dropped sharply. The employment rate, thanks to the extraordinary measures adopted by the Government, stood at 58.3% in November 2020, relatively close to the figure seen at the beginning of the year (58.9%): the freeze on redundancies and the extensive use of social welfare programs, in particular, made it possible to temporarily stop the negative impact coming from the external context.

The most recent projections prepared by the IMF estimate that Italy may see recovery coming to 3.0% in 2021 and 3.6% in 2022, provided, however, that the pandemic is effectively contained and that the extraordinary resources allocated at European level are used equally effectively.

Furthermore, 2020 was marked by uncertainty and volatility on global financial markets. Although the Covid-19 pandemic was undoubtedly the dominant event, the effects of the trade war between the US and China, as well as those related to the US presidential elections, should not be forgotten. In the first quarter of 2020, in particular, market volatility reached levels comparable to those recorded during the 2008 financial crisis, but had already fallen by the second quarter. As regards the main emerging economies, on the other hand, the Chinese stock market reacted more moderately, owing to certain structural characteristics of this financial centre and the robust monetary and fiscal measures adopted by Beijing to support economic activity.

Public debt felt the effects of the crisis, which appeared more immediately than in the past, thus

exposing countries to the need to deal with the combination of an increase in current spending and a

related reduction in tax revenues. The stock of debt in advanced countries averaged over 100% of GDP,

a sharp increase over the 74% recorded in 2007.

In order to cope with the economic recession and consequent deflationary spiral, central banks

adopted extremely expansive monetary policies, which reduced interest rates to zero

or to negative levels through credit easing and quantitative easing measures aimed at

providing liquidity to support loans to households and businesses. The growth rate of global liquidity

consequently increased from an annual average of 7% to over 26%.

Following the pandemic, in particular, the ECB immediately introduced an extraordinary program

for purchasing public and private securities (Pandemic Emergency Purchase Programme, PEPP), aimed at

restoring the correct functioning of European securities markets and ensuring the effective

transmission of monetary policy impulses. This measure, which will be in effect until the end of the

crisis, has eased tensions on secondary markets for government bonds, which showed a rapid reduction

in yields compared to the peak at the beginning of March. In this area, the ECB announced that it will

continue to provide economic and monetary support, while stressing the importance of coordinated

fiscal policies to cope with the contraction of the Eurozone economy, as well as the key role to be

played by the Next Generation EU fund, approved by the European Council, which will provide decisive

support (750 billion euro for recovery and resilience in European economies) by leveraging the Union’s

budget and lending capacity.

These monetary policies led the downward trend in interest rates to continue, concerning long-term maturities as well; the Euro swap interest rate curve, in particular, showed an average reduction of roughly 40 basis points compared to the previous year, reaching negative levels even on maturities up to 15 years, with a forward trend that does not point in an upward direction. The ECB, within a medium-term projection timeline, expects rates to remain at current levels or lower, until inflation outlooks converge sufficiently close to 2%.

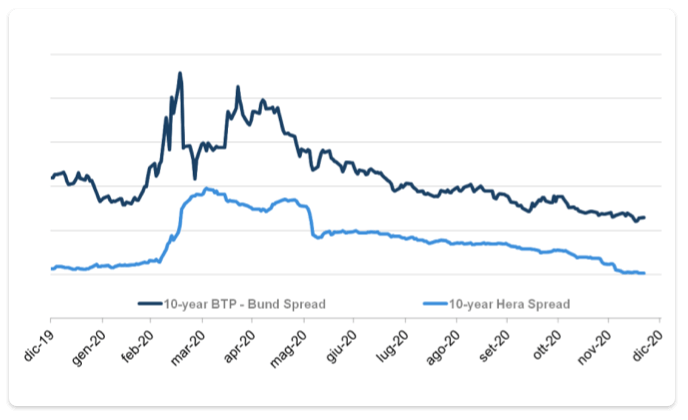

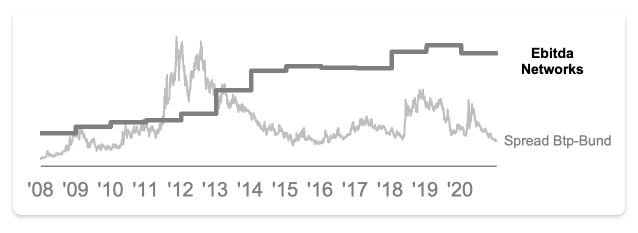

In this context, the Italian stock market showed similar trends to those seen worldwide. In the first half of 2020, the FTSE MIB indeed fell by 18%, but then slowly recovered following the announcement of significant measures to combat the crisis at European and national level. Furthermore, according to the content of the Bank of Italy’s Financial Stability Report, Italy’s public debt remains sustainable, also in view of the temporary nature of the expansionary budget measures. The national support measures adopted until present, including the expansion of payroll subsidies, a moratorium on loans, a postponement of tax compliance, non-repayable grants and guarantee mechanisms for new financing, are believed to contain situations of economic and financial stress for households and businesses. In March, bond markets began to discount the debt of companies in all sectors of activity, but the monetary policy measures introduced in the meantime met their need for liquidity and helped mitigate the economic consequences of the pandemic. The Italian market for bonds issued by private companies showed a fall in prices, and the increase in yields on Italian government bonds was particularly strong; yields on bonds with a 10-year maturity came close to 2.5%, up compared to the 1.3% recorded at the beginning of the year. The spread between yields on Italian government bonds with a 10-year maturity (BTP) and the German benchmark rose rapidly in mid March, reaching a peak of almost 300 basis points (from an average of around 145 basis points recorded during the previous two months); similar trends were observed with reference to credit default swaps (CDS) on sovereign debt.

Hera’s bond spreads were also affected by the pandemic, showing a rapid rise. The ten-year spread,

shown in the following graph, in fact reached a maximum of 150 basis points, with an increase of

roughly 100 bps compared to the previous year. However, thanks to the Group’s good credit rating, it

always remained at levels lower than the Btp-Bund spread with the same duration, while at the same

time showing less volatility.

Businesses and regulations

Among the health emergency’s effects on the national production system, a decline was also seen in

electricity consumption. The most recent estimates prepared by the national grid

transmission company (Terna) show nationwide energy demand coming to 302.8 TWh in 2020, down 5.3%

compared to 2019. Approximately 90% of overall demand was met by domestic production, down 3.8% from

the previous year, while the balance with foreign countries settled at 32.2 TWh.

In 2020, renewable sources accounted for 41.7% of total net electricity

generation, coming to 114.0 TWh, up 1% compared to 2019. This contribution corresponds to an increase

in the amount of final consumption met by renewable sources (up to 38%, more than 2 percentage points

higher than the contribution in the previous year): in this sense, a significant contribution was made

by photovoltaic production (+9.6% compared to 2019) and, albeit to a lesser extent, by hydroelectric

production (+0.7% over 2019). Taken together, these two sources more than offset the overall drop seen

in other renewable sources.

A similar trend occurred in natural gas consumption in 2020, with nationwide volumes in 2020 – according to the data provided by the Energy Market Management (GME) – decreasing by 4.4% compared to 2019, with a total of 70.7 billion cubic meters consumed. This trend is mainly due to the weaker demand recorded during the months when the lockdown was in effect. Consumption in the industrial and thermoelectric sectors stood at 24.4 and 13.2 billion cubic meters respectively (-5.7% and -6.1% compared to the previous year). Conversely, the decline in demand coming from the civil sector was slighter, settling at 31.0 billion cubic meters (-2.4% compared to 2019).

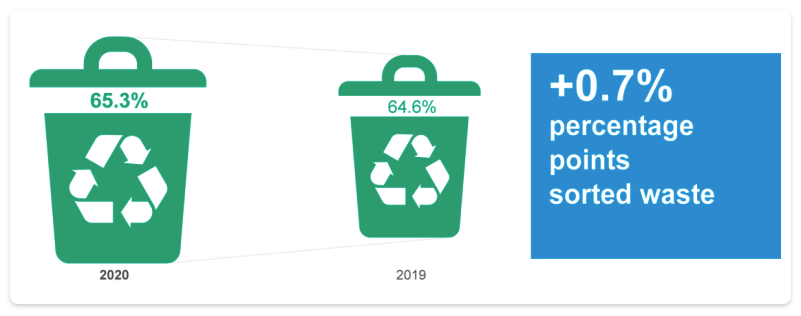

As regards the waste sector, the Istituto Superiore per la Protezione e la Ricerca

Ambientale (ISPRA) had estimated a national production of municipal waste coming to 30.1 million tons

in 2019, with a slight 0.3% drop compared to the previous year, and a national production of special

waste amounting to 143 million tons, up +3.3% over the previous year. Special waste came primarily

from the construction and waste treatment/redevelopment sectors (which respectively accounted for

42.5% and 26.5%), and 20% was covered by the manufacturing sector.

No data is currently is available regarding the production of municipal and special waste in

2020, but considering its correlation with traditional socio-economic indicators (above all GDP and

consumer spending) and the extraordinary effects of the health emergency, a decline in national

waste production can in all likelihood be expected.

The most recent ISTAT report containing statistics on the national water sector confirms a total usage coming to approximately 9 billion cubic meters of water, equivalent to 419 litres per day per inhabitant. Almost 85% of this resource is taken from groundwater, roughly 15% from surface water and a minor amount from sea and brackish water. The latest update of the Blue Book shows that about half of the water consumed in Italy is used for agriculture, which is thus confirmed as the most water-intensive economic sector, followed by industry. This clearly indicates the importance of interventions aimed at encouraging reuse of water resources in agriculture and industry.

The strong competitive pressure that has defined for several years now the sectors

typically served by utilities, as regards both free market and regulated businesses, was confirmed in

2020 as well.

In the energy market, intense competition among sellers to

increase their customer base is confirmed by increasingly high churn rates, as has been noted by the

Regulatory Authority for Energy, Networks and the Environment – Arera. In order to respond to the

challenges and difficulties caused by the pandemic, many companies have rapidly adopted new digital

solutions for customer management and relations, in many cases accelerating certain previously ongoing

trends. Sales companies have added value-added services sales to their offer of commodities. Lastly,

in the fall of 2020 tenders were held for the assignment of Last Resort services in

the gas sector (annually defined Default gas and Last resort gas suppliers) and in the electricity

sector (safeguarded services, defined on a two-year basis).

In the area of industrial waste treatment and recovery, the competitive scenario now includes major European players. The market for urban and special urban waste management and treatment is marked by a strong demand, linked above all to the emergency seen in central and southern Italy, capable of producing volumes that attract the attention of international competition. In the industrial waste market, currently existing treatment plants are often involved in acquisition strategies, following a trend that – in leading to a more pronounced industrialization of services – can be expected to benefit larger operators. In the recovery market, the sector is evolving towards a more industrial structure, which is the only way the challenging targets indicated by the EU can be adequately met.

As regards regulated businesses, Hera carries out its activities in the businesses falling under the

responsibility of the Regulatory Authority for Energy, Networks and the Environment, which defines the

conditions for access to and operating procedures within these businesses, in compliance with

obligations concerning transparency.

In 2020, activities continued in tender procedures for the assignment of gas

distribution, municipal waste and water cycle services. As far as gas distribution is

concerned, the number of tenders actually awarded nationwide is still small (mainly including the

Milan 1, Turin 2 and Belluno ATEMs), and almost all the tenders awarded have been subject to appeal.

Concerning the areas in which the Group currently provides services, Arera has completed the

assessment process for the tender documentation prepared by the granting authorities for the

Forlì-Cesena, Modena 1, Rimini and Trieste ATEMs, while the bids submitted for the Udine 2 ATEM are

still being assessed. With regard to the municipal waste business, a procedure was

completed with the service awarded to the Group in the Ravenna-Cesena area, while the procedures for

the Modena and Bologna areas are still open. Finally, in the water cycle, examination

is underway for the bids made by competitors participating in the tender for the integrated water

service in the province of Rimini, with the exception of the Municipality of Maiolo.

In regulated businesses, the measures approved in 2020 having the most significance for the Hera Group are as follows:

Faced with a situation of nationwide lockdown, Arera intervened with measures first in favour of end customers in energy and water services, and later in favour of sellers and distributors in energy sectors.

For the period going from 10 March to 3 May 2020, end users benefited from a temporary

suspension of the procedures for interrupting supply due to arrears, a form of support that

from 4 to 17 May 2020 was reserved solely for household users (resolution 60/2020/R/com and subsequent

supplements). In the energy sector, in order to mitigate the effect of the support granted to

customers experiencing difficulty, sellers were granted the possibility of partially paying the bills

issued by electricity and gas distributors due in the months of April-June (limited to a minimum of

70% and 80% respectively) and thus avoid non-fulfilment procedures introduced by distributors

(resolution 116/2020/R/com). Lastly, by way of resolution 248/2020/R/com, Arera established the

methods and terms through which sellers must pay the amounts still outstanding to distributors.

With resolution 190/2020/R/eel and in implementing the Relaunch Decree, Arera reduced

electricity bills for non-household users connected at low voltage with power greater

than 3 KW. In other words, in order to reduce the expense incurred by small businesses, tradespeople,

bars, restaurants, laboratories, professionals and other service providers, for the amounts pertaining

to the months of May, June and July 2020, the Authority provisionally redefined fees and tariff

components per unit. Through the Energy and Environmental Services Fund (CSEA), Arera has already

taken steps to compensate distributors for their lower revenues. With resolution 432/2020/R/com, Arera

then introduced non-recurring changes regarding output-based regulation of electricity and gas

distribution services. For electricity, the changes involve bonus-penalty regulations relating to the

duration and number of interruptions, resilience and modernizing obsolete transformers; for the gas

sector, the changes involve replacing sections of the network in non-compliant material, reducing the

replacement target within 2022 from 40% to 30% and, lastly, postponing requests for waivers. In other

words, for both sectors, Arera formalized the applicability of the force majeure clause for commercial

quality.

Finally, with resolution 501/2020/R/gas, Arera also intervened in obligations concerning the

installation of G4-G6 smart gas meters: achieving an 85% roll-out obligation was

postponed to 31 December 2021 for large companies (with more than 200 thousand delivery points) and to

31 December 2022 for medium-sized companies (with between 100 and 200 thousand delivery points).

As regards the integrated water service, resolution no. 235/2020/R/idr introduced a

number of exceptions to current regulations regarding both tariffs and service quality, in order to

safeguard operators’ economic and financial balance.

With regard to tariffs, the reduction in recognised financial charges for

assets under construction relating to non-strategic works was postponed to 2022, maintaining the

coverage rate equal to the one used for strategic works for the tariff years 2020 and 2021. For 2020,

specific components were also introduced to cover costs linked to the emergency, including those

involving deferrals and payments by instalments granted during the emergency period. Lastly, as part

of the efforts made towards higher tariff sustainability, regional authorities may postpone to

subsequent years (but not after 2023) the recovery of the portion of charges eligible for 2020 tariff

recognition, with the related possibility of a financial advance paid by CSEA.

With reference to service quality regulations, technical and contractual

quality objectives will be considered cumulatively over the two-year period 2020-2021.

As for the other sectors under its responsibility, with resolution 443/2019/R/rif Arera introduced changes and additions to the tariff regulations for the integrated waste service. In particular, to ensure the necessary continuity of waste services, it introduced a series of levers aimed at guaranteeing the social and economic sustainability of the tariff system. The deadline for defining tariffs and the Tari was extended to 30 June 2020 (Decree 18/2020, so-called Cura Italia, converted into Law no. 27 of 24 April 2020), creating, as an exception, the possibility of approving for 2020 – until October 31 – the tariffs or the Tari adopted for 2019. Arera also introduced tariff facilitation measures for non-household end users penalized by the closure of economic activities, reshaping the variable quotas for waste services, as well as other forms of protection for household users undergoing economic hardship (resolution 158/2020/R/rif). With resolution 238/2020/R/rif, in order to guarantee operators’ economic and financial balance, Arera then completed the emergency regulation framework by introducing temporary changes to the waste tariff method, guaranteeing mechanisms covering the economic and financial charges incurred to adopt the measures protecting users. In addition, the possibility was granted to acquire in advance, within 2020 tariffs, payment of the differential charges incurred to deal with the emergency.

Once again as a result of the health emergency, regulations for the technical quality of services in the district heating sector (resolution 548/2019/R/tlr), which should have come into effect on 1 July 2020, were postponed to 1 January 2021 (resolution 188/2020/R/tlr).

The national budget for 2020 (Law 160, 27 December 2019) introduced some significant measures for energy and water services. The cause of exclusion from the two-year statute of limitations for credits resulting from adjustments for consumption dating back more than two years, for example, was removed even in the case of ascertained responsibility of the customer in failure to measure. In regulations for the energy sectors, moreover, Arera subsequently implemented this legal provision with resolution 184/2020/R/com. The situation in the water sector is similar, where this measure was implemented with resolution 186/2020/R/idr, also introducing specific information obligations in favour of end users. Other interventions concern the notice period for suspension of supply due to arrears, which was increased to 40 days from receipt of the notice by the end user. For the energy sectors, the rules governing the indemnification system were strengthened in favour of operators in order to prevent customers from excessively changing provider, and at the same time this provision was implemented by Arera with resolution no. 219/2020/R/com. In turn, resolution 221/2020/R/idr, with which this measure was also applied to the water sector, provided for appropriately monitoring the effects resulting from its adoption, ultimately going towards the interest of operators’ economic and financial balance. Finally, Law no. 160/2019 provided for the introduction of specific penalties in favour of end users in cases of violations relating to the methods of recording consumption, execution of adjustments or billing by sellers or managers.

As regards the market framework for sales to end customers in energy supply chains, the methods for

eliminating protected prices are currently prefigured only for the electricity sector. With Decree

162/2019, so-called Milleproroghe, converted with Law 8/2020, the stages for

eliminating protection in electricity were redefined, postponing them to January 1,

2021 for small businesses and January 1, 2022 for household customers and micro-businesses.

Arera intervened within this legislative framework: with resolution 491/2020/R/ee, in fact, it

defined regulations for the economic and contractual conditions in service supply with gradual

protection intended for small businesses that do not have a contract on the free market and, as of 1

January 2021, the procedures for assigning the service itself. The parties providing the service must

be defined following competitive procedures (period of definitive assignment) and, considering the

time required to complete the procedures necessary to carry out the assignment, this period will be

preceded by a transitory period in which the supply is provided by operators providing protected

services (period of provisional assignment, running until June 30, 2021). The portions will be awarded

by means of a double round auction mechanism, awarding the area to the operator offering the lowest

price, within the limits of a minimum floor and a maximum cap on the price offered, established by

Arera.

In the provisional assignment phase, the economic conditions of the gradual protection service

will be essentially in line with those of the protected service, thus ensuring basic continuity in

remuneration for the provisional operators. In the definitive assignment phase, the end customer will

be charged a price corresponding to the sum of the following items:

Operators in the gradual protection service will therefore receive remuneration in line with the

price offered during the tender, by means of a specific equalization mechanism with respect to the

single price applied to the customer.

The Ministry of Economic Development’s Decree 31 December 2020 sets out the methods for

encouraging an informed entry into the free market and those for eliminating regulated prices for

small businesses. It furthermore defines that each participant in the tender procedures must be

awarded a maximum amount of 35% of the assignable volume over the entire nation. In order to bring the

regulations into line with the aforementioned decree, with resolution 14/2021/R/eel the Authority

ordered the publication of the regulations for the tender for assigning the service by Acquirente

Unico Spa to be temporarily postponed until the end of January 2021.

With consultation document 445/2020/R/eel, Arera made known its final guidelines regarding the mechanism for recognising any failure to collect the tariff components covering general system charges (OGDS). This initiative is aimed at complying with the rulings of the administrative courts, which have established that sales companies do not have to bear economic charges relating to these charges which, after being paid to the distribution companies, have not been collected from end customers due to the latter’s arrearage.

Lastly, Arera has almost completed regulations for the district heating service (TLR), also approving the Integrated district heating measuring text (TIMT) with resolution 478/2020/R/tlr, which will come into effect on 1 January 2022 and will apply to the three-year period 2022-2024. These regulations deal with various issues including meter reading, methods of estimating and reconstructing meter data and quality standards, as well as automatic compensation.

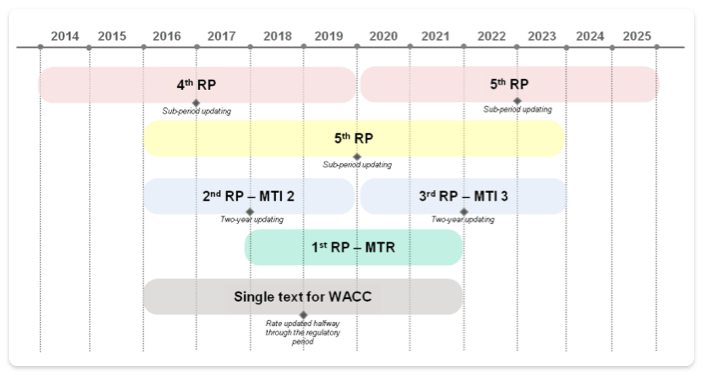

A timeline showing the main regulatory periods and related measures introduced by Arera, pertaining to the Group’s sectors of activity, is provided below.

Lastly, the table below indicates the main tariff references for each regulated sector, based on the regulatory framework in effect in 2020 and expected to remain until the end of the current regulatory periods.

|

|

Natural gas distribution and measurement | Electricity distribution and measurement | Integrated water service |

Integrated waste cycle |

|---|---|---|---|---|

|

Regulatory period |

2014-2019

2020-2025

|

2016-2019

2020-2023

|

2016-2019

2020-2023

|

2018-2021

|

|

Regulatory governance |

Single level (Arera) |

Single level (Arera) |

Double level (Ega, Arera) |

Double level (Regional authority, Arera) |

|

Invested capital recognised for regulatory purposes (Rab) |

Previous cost revised (distribution) Average between standard and actual cost (measurement) Parametric recognition (centralised capital) |

Parametric recognition for assets until 2007 Previous cost revised for assets as of 2008 |

Previous cost revised |

Previous cost revised |

|

Regulatory lag for investment recognition |

1 year |

1 year |

2 years |

2 years |

|

Return on invested capital (2) |

2019

2020-2021

|

2019-2021

|

2018-2019

2020-2021

+1% for investments as of 2012, covering the regulatory lag |

2020-2021

+1% for investments as of 2018, covering the regulatory lag |

|

Recognised operating costs |

Average value of actual costs by company grouping (by size/density), based on 2011 (for revenues until 2019) and 2018 (for revenues as of 2020) (3) Sharing for efficiencies achieved compared to recognised costs Update with price-cap |

Average values of actual sector costs, based on 2014 (for revenues until 2019) and 2018 (for revenues as of 2020) Sharing for efficiencies achieved compared to recognised costs Update with price-cap |

Efficiency-applicable costs: actual amounts for the manager in 2011, adj. for inflation Updatable costs: actual values, with 2-year lag Added charges for specific purposes (previsional) |

Actual costs for manager with 2-year regulatory lag (as of 2020 tariffs for 2018 costs) Added costs for quality improvement and change in manager’s scope (previsional) Balance for 2018-2019 based on 2017 costs (gradual) |

|

Annual efficiency factor for operating costs |

Annual X-factor 2019

As of 2020

|

Annual X-factor 2019

As of 2020

|

Efficiency-applicable mechanism based on:

Amount of sharing differentiated according to the discrepancy between actual costs and manager’s efficient cost |

|

|

Incentive mechanisms |

Sharing for net revenues coming from fibre optics transit in electricity grids |

Sharing for electricity costs, based on energy saving achieved. Recognition of 75% earnings from activities aimed at environmental and energy sustainability |

Sharing for revenues coming from sales of materials and energy (range 0.3-0.6) and Conai incentives |

|

|

Annual limit on tariff increases |

Asymmetric, based on:

Possibility of motion guaranteeing economic and financial balance |

Asymmetric, based on the presence of:

Possibility of motion guaranteeing economic and financial balance |

(1) Resolution 443/19 applies to operators in the integrated waste cycle, including

treatment activities (disposal or recovery), only if these activities are included in the operator’s

corporate scope. The specific measure to be introduced for tariffary regulation of compensation for

plants falling outside this scope has been postponed. This measure will be effective as of the 2020

tariff year, following the application procedure foreseen in the measure itself, without prejudice

to the derogations foreseen by Law Decree 18/2020 Cura Italia, commented on in the section with

further details.

(2) For the energy and waste sectors, the Wacc methodology is applied, while for the integrated

water service the amounts indicated refer to rate of coverage of financial and fiscal charges.

(3) Regarding the significant reduction in the recognition of operating costs introduced by

resolution 570/2019 in February 2020, Inrete Distribuzione Energia Spa, the Group’s main

distributor, like other operators in the sector, has filed an appeal at the Lombardy-Milan Regional

Administrative Court.

Climate and the environment

Regulatory and economic interventions aimed at facing climate change, and the concrete opportunities

that derive from taking on the risks linked to it, have become priorities for international and

national institutions, as well as those operating in all economic sectors. The Group’s main concerns

in pursuing environmental sustainability coincide with: the 17 goals on the 2030 Agenda for

Sustainable Development (SDGs); the indications contained in the Paris Agreement to limit global

warming to below 2ºC; and the long-term climate strategy “A Clean Planet For All” (adopted by the

European Union), intended to achieve total decarbonisation by 2050, through carbon neutrality, and to

limit the increase in temperature to below 1.5ºC. The changes called for by the Green Deal and, hence,

in the new Circular Economy Action Plan (CEAP), provide further significant indications moving in this

direction.

A further lever comes from civil society and consists in the growing number of people who,

showing increasing sensitivity to environmental issues and social inclusion, give voice to a rising

demand for green & digital interventions, in line with the European Union’s recommendations for

economic recovery and resilience.

The funds made available by the Next Generation EU to address the crisis caused by the Covid-19

pandemic can be accessed by member states provided that they submit a plan for recovery and

resilience that meets certain eligibility conditions.

The adoption of the Green Deal, i.e. the set of initiatives aimed at tackling

climate change and environmental problems in order to achieve carbon neutrality, is in turn subdivided

into eleven actions aimed at creating a society that manages resources in a fair and competitive way.

These actions include adopting an industrial strategy that implements circular

economy principles in all sectors, starting with the most resource-intensive ones, and

promoting clean energy, crucial to ensuring the supply of green, economic and safe

energy.

The new circular economy action plan, presented by the Commission in March 2020, outlines a renewed

strategic framework to bring together the economic development of the European Union in a circular

sense and, in doing so, accelerate the transition and make possible the changes towards which the

Green Deal is aimed.

Among the initiatives foreseen by the CEAP, particular significance goes to measures

encouraging not only reusable and recyclable products but also a reduction of “over-packaging”, as

well as rules for bioplastics.

The new CEAP also calls for developing additional policy measures that indicate minimum

recycled plastic content requirements for certain product categories and evaluate the possible

introduction of prevention (for packaging waste) and recycling measures (for additional categories of

plastic waste).

Waste management policies aimed at reducing the environmental impact of plastic

products, on the other hand, apply to stakeholders across the entire value chain, thus including the

design, production and consumption phases of these products, in order to achieve The target to be

achieved consists in putting at least 10 million tonnes of recycled plastics per year into new

products on the EU market by 2025.

Above and beyond the plastics sector, promoting circular economy principles is also encouraged

in the wastewater management area.

In order to promote a more sustainable use of water, as well as to alleviate

water shortages within the European Union, Regulation (EU) 2020/741 has been adopted, which contains

requirements for water reuse, encourages purified wastewater reuse for irrigation in agriculture and

defines minimum requirements for the use of reclaimed water.

European regulations have been incorporated into national legislation and substantial changes have

been made to the Consolidated Environmental Act, with the aim of improving

performance in waste management and increasing circularity. These changes include a new electronic

recording for waste traceability, an updated definition of municipal and similar waste based on

qualitative rather than quantitative criteria, and an extended producer responsibility, now having

minimum administrative, financial and data requirements. These measures are accompanied by the

implementation of European recycling and landfill targets for municipal waste, as well as a reform of

the landfill admissions system.

The innovations seen in this area will be accompanied by the adoption of a sustainable

management system for water resources that combines the need for storage and

conservation, efficient consumption and the possibility of reusing wastewater, while at the same time

allowing for the regeneration of natural ecosystems. The depletion of water resources is indeed one of

the main threats to economic growth, and energy production itself is one of the major causes of

freshwater resource consumption.

In order to achieve full decarbonisation of the energy sector by 2050, the European Commission has

released its system integration strategy, set out based on six pillars that aim to

overcome opposition between individual energy sectors, in order to introduce a virtuous system which

is able, as such, to make the different infrastructures communicate with each other.

The strategy adopted aims to develop:

The inevitable nature of climate change has led the European Commission to reconsider its targets for

reducing emissions by 2030, with the hope of achieving full decarbonisation by 2050. These global

trends, along with the health emergency and the ensuing economic-social crisis, have also forced local

authorities to reconsider their priorities and lines of action. The pandemic has made it all the more

urgent to implement initiatives capable of making cities more resilient and, for this very reason,

local programs are increasingly consistent with circular economy, sustainable mobility, climate

adaptation and digitalization initiatives. This scenario is challenging and offers new opportunities

to the utility sector. All types of customers will be called upon to introduce technological

improvements capable of reducing their energy needs: household customers, businesses and public

administrations.

The initiatives incentivised include promotion and sales of products and services for

efficiency in energy consumption, and support for the energy efficiency of buildings.

Stakeholders, financial and otherwise, are showing increasing attention to

sustainability issues and, therefore, also to companies’ sustainability ratings. It

follows that financing opportunities will be increasingly focused on green products, able to raise

money on the capital market at rates that are potentially lower than the alternatives.

When aiming at sharing value between companies and communities, oriented

towards a search for solutions that benefit both, the engagement of the community and individuals now

plays an increasingly important role. The main megatrends are those shaped around the UN’s 2030

Agenda, alongside theoretical reference points and successful experiences involving approaches based

on shared value and new business opportunities.

These new lines of development cannot disregard a full exploitation of data (understood as a

true business asset) and a greater attention to cybersecurity, to protect the company and its data.

The speed of change makes it essential to define training plans that enable the company’s workforce to

manage change (especially digital change) in the best possible way, including – where necessary –

training programs that, while provided individually, are able to guarantee the necessary continuity

("self-development").

Technology and human capital

The main trends in ICT consist in artificial intelligence, automation and therefore software, robotic process automation, data collection and management (Internet of things, data governance and data analytics), cloud platforms and, lastly, cybersecurity. These are all enabling elements, capable of accelerating digital technological evolution.

Technological evolution, in its most “disruptive” aspects, produces changing paradigms for economic

and social contexts. At an increasing speed, it thus alters entire segments of the market and patterns

for social relations. The risk underlying this accelerating trend is a widened gap between players who

keep pace with technological evolution and those who, due to resources or skills, are unable to do so

in all sectors.

Investments in telecommunications, networks, software and automation as well as

other technological infrastructures have become increasingly urgent, and must be accompanied by growth

in knowledge and training, which plays an enabling role for new technologies, which

in turn are oriented towards a sustainable and circular economy and revolve around

digitization and artificial intelligence. Metaphorically, these two

directions can be represented by green and blue: green for the environment, to be protected with

extensive and pervasive sustainability initiatives, and blue for electronics, which takes on all the

nuances of information & communication technology (ICT).

Robotisation and artificial intelligence can enhance the ability of human capital in terms of

efficiency and productivity, allowing people to be assigned enterprising and high value-added

activities, in which human thought proves to be the best possible resource. This undeniably includes

activities that must be undertaken to rethink organizational and methodological scenarios in the light

of new technologies, while taking challenging environmental and social objectives into account.

The advance of digital technologies has been accelerated by the pandemic, which has

increased the need for connection and security in remote working, making it no longer a negligible

right but as a strategic means to achieve flexibility, productivity and work-life balance. All this

has increased infrastructural needs, orienting the demand for investment towards connectivity and

remote collaboration tools. This has led the boundaries of an organization to be reconceived, no

longer reduced to the physical boundaries of a company’s offices or those of its business in a narrow

and logical sense. They now extend, rather, to the interrelationships that affect the organization

itself in relation to its objectives in sustainable development.

Utilities, in particular, are called upon to seize digital opportunities in terms of procedural

efficiency and workforce management, but also with respect to multi-channel interactions with

customers, without forgetting the management and “sensitization” of infrastructures across the area

served.

The widespread presence of digital technology now concerns all aspects of business operations,

extending the changes affecting them to the point of producing new, additional value-added services.

The need for IT security has become more acute with the spread of computerization,

and with the pandemic last year saw an exponential increase in attacks and their ensuing risks.

Operational technology (OT), or remote management, which in the past had developed as a niche area,