Investor proposition

Browse Hera’s Investor Case

A tool useful to evaluate the Group’s investment case and thus allow those interested in investing in Hera to do so with a full awareness of the return expected by this company from its investment plan and a clear idea of the policy adopted in profit distribution.

Content and data refers to financial results as at 31 December 2022 and the strategy outlined in the Business plan to 2026. It provides an overview of and provides an overview of its various businesses, along with the factors involved in its growth and its sustainable approach towards society, aimed at the creation of shared value.

Hera’s Business model

Hera presents a multi utility business model.

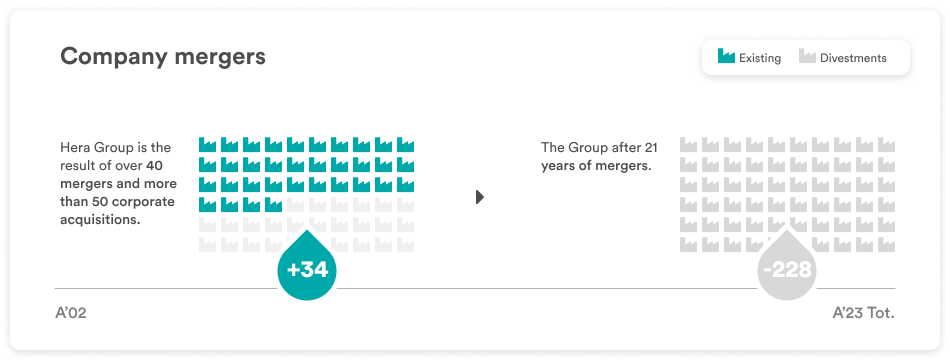

By putting customers first, as a trustworthy provider of services and safety, the company take advantage of cross-selling to become competitive in free markets even when competing with big players that run mono business models. This is a distinctive model, when compared to its peers, as Hera has been the first company in Italy to systematically exploit the highly fragmented primary services Italian market. Indeed, the Group counts already 45 mergers and acquisitions since its establishment in 2002.

Another distinctive aspect is that by focusing all efforts on customers, the Group is rewarded by their loyalty and their predisposition for choosing Hera as a multi-service supplier. Furthermore, unlikely its peers, by concentrating business activities in a specific territory (four regions in North-Eastern Italy, the wealthiest of the country) inhabited by more than 5 million citizens, the Group has a strong presence in the served areas and is able to extract synergies and take advantage from economies of scale.

Finally, the Group’s multi-business nature allows to distinguish itself from peers also in terms of offers to both retail and business customers: Hera can offer turnkey integrated cross-business solutions and a range of complete services, thanks to the expertise gained in the design of networks and plants, in the management of the integrated water system, in waste collection and waste treatment, in the distribution and sale of energy but also in public lighting and telecommunications.

This said, Hera’s growth has developed always with a strong focus on sustainability and shared value creation both in regulated activities and free market services. This has not only led Hera to increase by six times the Group’s capitalisation, but also to undergo processes of profound changes and transformation, always guaranteeing strategic consistency and ever-growing results to the benefit of all stakeholders.

Hera stands out on the market and within its own peers’ sector for the clarity of its equity story, based on the following cornerstones:

…. confirmed by a long track record of constant growth

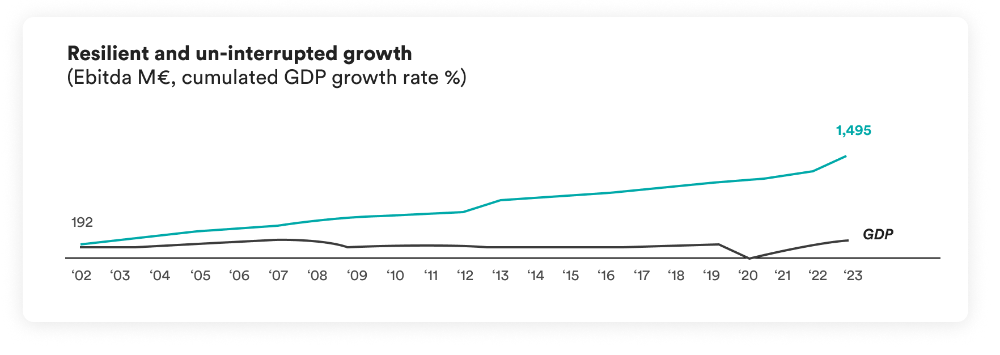

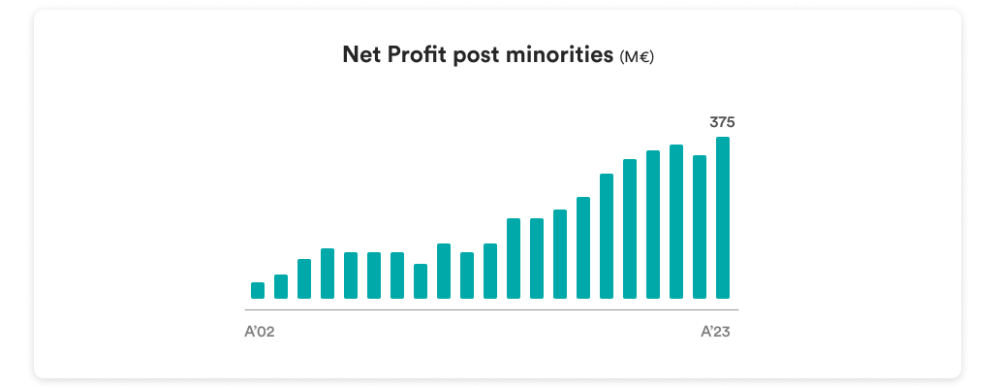

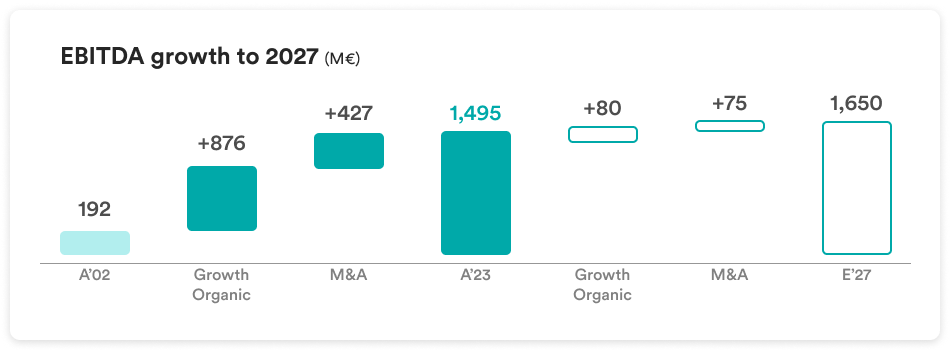

Ever since its establishment, Hera set out along a path of growth, without interruption and without pause, increasing to over five times its original size, thanks to its particular business model, based on a resilient asset portfolio and the ability to grow both internally and externally.

In this way, the Group has been able to overcome all adverse macro-economic, political and regulatory conditions seen along its path, from 2002 to today.

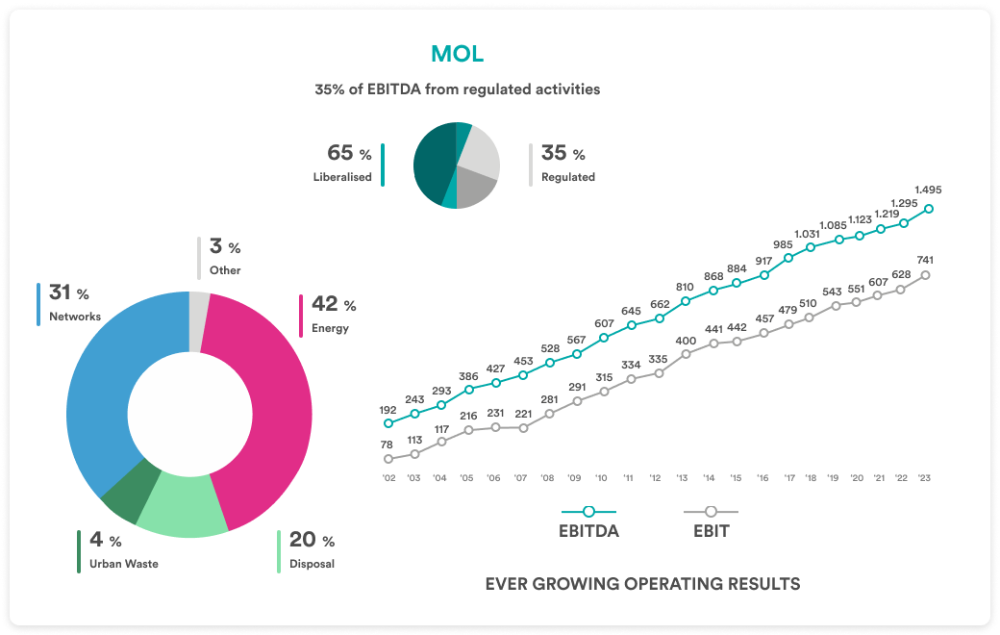

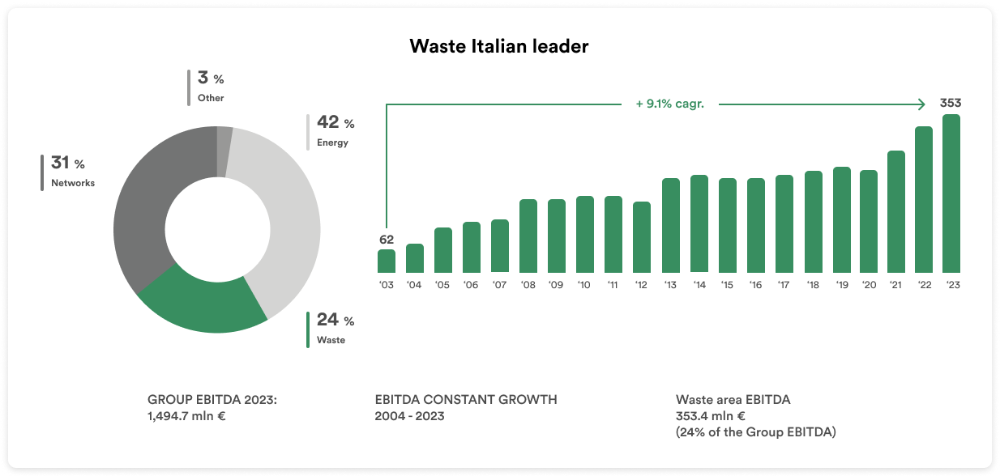

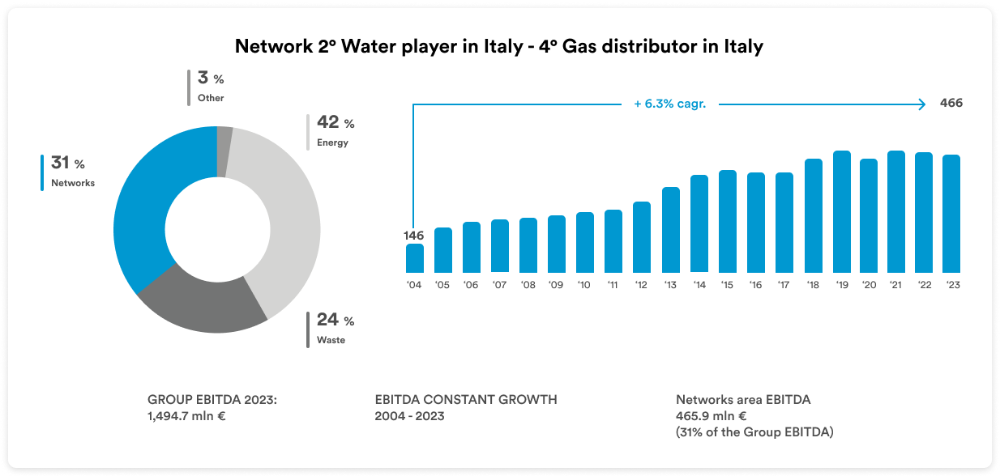

The resilience shown by this business portfolio comes from its integrated and synergic asset management, making the most of the complementary aspects of its businesses. All areas in which the Group operates (waste management, networks and energy) have thus contributed to its growth.

This growth is furthermore due to the low risk profile it has maintained, thanks to a considerable portion of regulated activities (gas, electricity and water distribution, district heating, and urban waste collection), which are managed as local monopolies based on public grants, and the competitive advantages gained by the Group in free-market activities.

The growth drivers for regulated activities are: extracting synergies from mergers, investments and the bonuses obtained for high service quality (extra return). These activities are also protected from macro-variables (inflation, GDP, spread, changes in customer demand).

In free-market activities, the growth drivers are: expansion in market share, customer cross selling and enlarging plant capacity.

Expansion occurring through M&A opportunities, portfolio synergies, economies of scale, internal expansion policies for “freely competitive” markets, along with cross selling and the significant amount of investments made every year, have all allowed the Group to achieve constant growth involving all businesses, thus creating value.

…Hera is the main aggregating operator in the sector

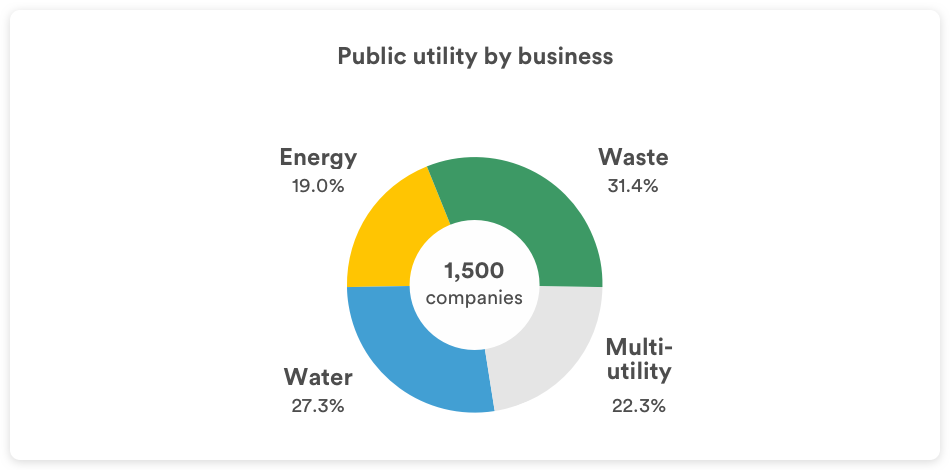

In Italy, the primary public service sector is highly fragmentary and contains a large number of companies (the “Cottarelli report” identified around 1,500 of them).

With a track record of over 50 M&As, the Hera Group is the sector’s leading aggregating operator in Italy.

Expansion through M&As of “multi-utility” businesses takes place in the areas bordering on the reference area, to allow merger synergies to be extracted faster.

M&As can also come about in strategic areas across the nation, when they are pursued to reinforce “single businesses”, above all in free-market activities such as waste treatment and energy sales. The results of this strategy appear in the Group’s constant increase in profits per share, which shows an average annual rate of growth coming to 10%.

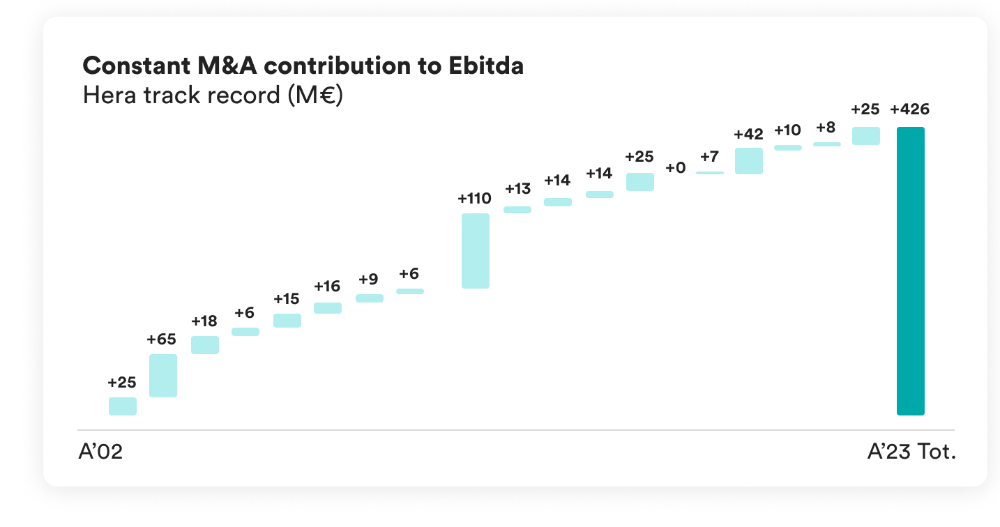

M&As have made a constant contribution to Hera’s history of growth, amounting on average to 20 million euro per year in terms of Ebitda.

Since these markets are still highly fragmentary in Italy, the constant pursuit of M&As is given ample room in all of the Group’s five-year Business Plans.

… fully reflected by returns for shareholders and stakeholders

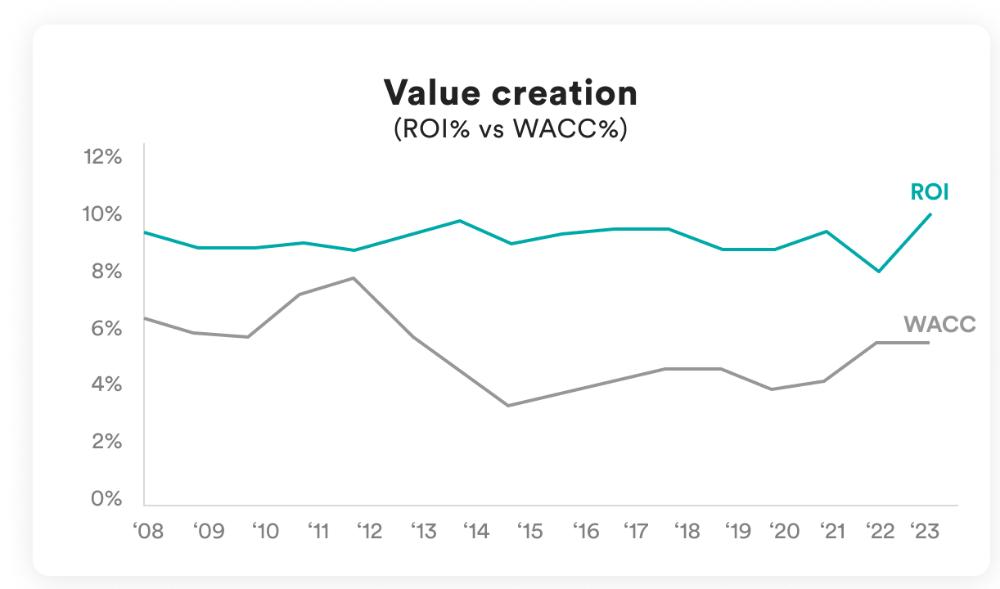

The value creation generated by this particular business model can be gauged by the difference between the business portfolio’s operating profitability and the cost of capital (wacc), which has constantly remained positive.

The value creation achieved over the past 20 years has been fully reflected in the profitability of investing in Hera: to date, the Total Shareholders Return ("TSR"), i.e. the percentage shareholder return that takes into account dividends and capital gains, has grown by roughly 8% per year, in line with the average growth rate of earnings per share, which stood at 9%.

Creating Shared Value for all stakeholders

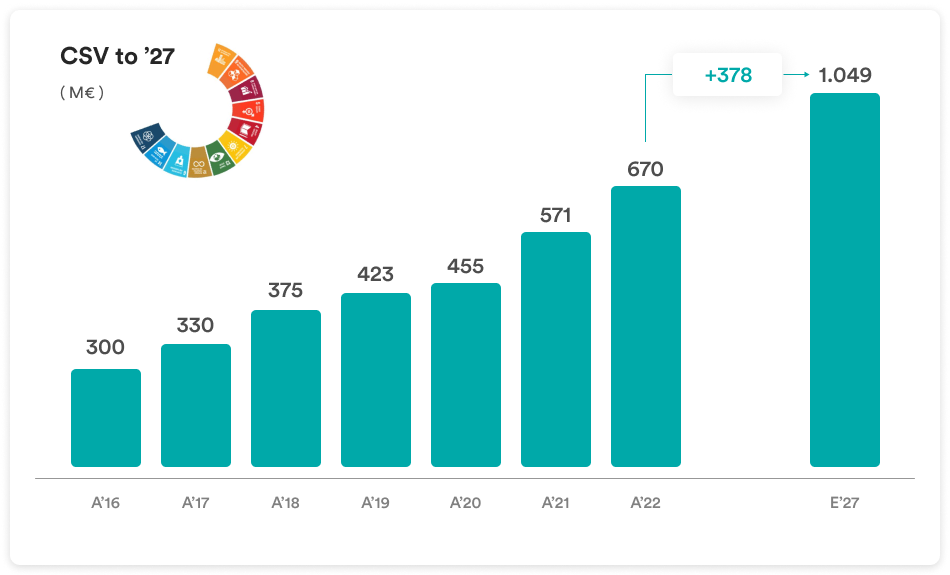

Hera Group creates shared value in all its activities that generate operating margins and meet the objectives of the UN’s 2030 Global Agenda, which have been guiding the Group's commitment towards fully sustainable development throughout the years.

By setting out its strategy in line with the guidelines of the EU policies and UN Agenda, the Group develops business activities that generate operative margins and provide response to “global agenda” drivers, the ‘‘calls to action’’ and change in the respective areas of competence indicated by international, European, national, and local policies.

Every year, since 2016, the Group carries out an accurate and improved analysis and a redefinition of the company's strategies and plans, so as to incorporate social and environmental needs into all businesses.

The 2022-2027 Group business plan targets a 2027 “shared value” EBITDA of over one billion, equal to 64% of the Group's overall EBITDA.

In line with this expected growth, CSV EBITDA for 2023 amounted to Euro 776 million (52% of the Group's total EBITDA), a 16% increase compared to 2022 CSV EBITDA.

The Group’s approach to shared value, drivers for change, expected investments and related goals are illustrated in the dedicated section (Creation of Shared Value)

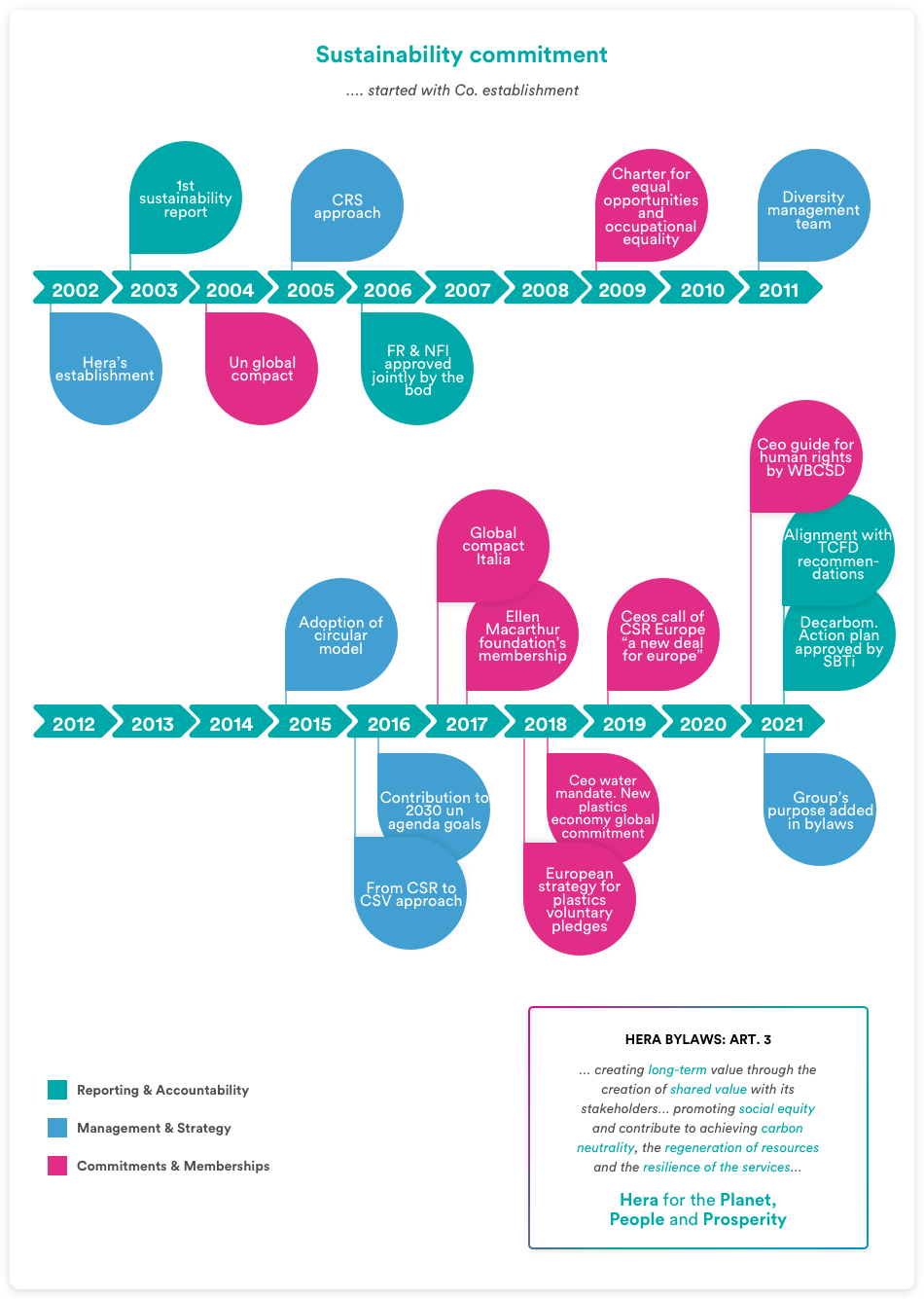

…. started with Co. establishment

Hera’s growth has developed with a strong focus on the aspects of sustainability with regard to regulated services (distribution of gas and electricity, water service and waste collection) and services managed according to free market criteria (hazardous waste disposal, sale of gas and electricity). Development was balanced across the sectors, creating shared value for the local area and placing sustainability and quality at the core of the services it manages.

Hera's commitment to sustainability has taken shape over the past years by joining leading international networks and taken specific actions.

In every business plan the Hera Group sets out its strategy in line with the guidelines of the European policy and, at the same time, maintaining coherence with the 2030 UN Agenda, which has been guiding the Group's commitment towards fully sustainable development throughout the years.

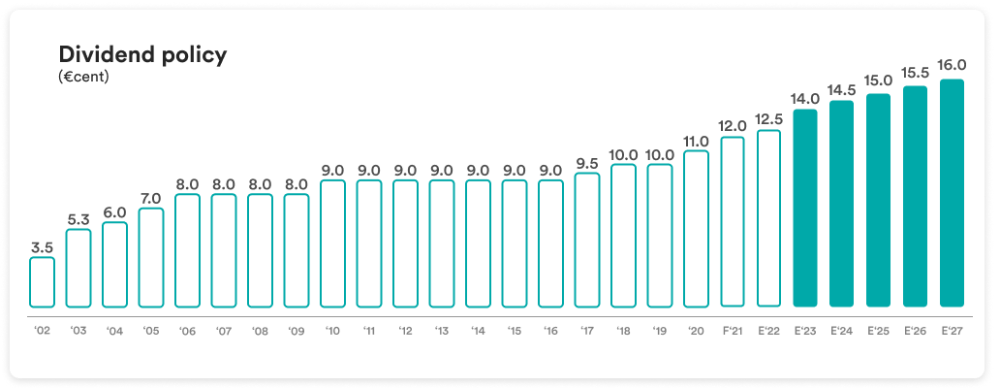

…stable and growing for over 20 years

Since 2003, Hera has always paid equal or increasing dividends. This feature, which few Italian companies can boast, has led the Group to be included in the “Aristocrats” basket managed by SPDR, which brings together the 40 European companies that have paid stable or increasing dividends for at least 10 consecutive years.

In its five-year business plans, the Group transparently establishes its commitment in paying dividends per share, indicating the amount to be paid each year within the lapse of time covered by the plan and pursuing a dividend policy expressed in “absolute” terms.

These dividend policies are financially sustainable, given that the Plan’s projections in terms of cash flow generation are amply able to meet the commitments made towards investors.

… a unique feature in the sector

The Hera Group has always benefitted from its traditional (BoD) and stable governance, in terms of both management and shareholder breakdown. Since the latter is highly diversified, including all categories of investors, and well-balanced between public shareholders and private investors, it marks Hera as a true “public company”.

Over its history, Hera has always been able to count on stability in its top management, which has allowed it to continuously pursue a strategy that is linear and consistent over time.

Hera has a balanced portfolio that includes both regulated and free-market activities, concentrated on four main businesses (gas, electricity, water and waste management)

The Group confirmed its leading position in Italy in all businesses in which it operates and obtained the following ranking, compared to other listed companies:

-

1st operator in the environmental sector as for treated waste

-

2nd operator in the water cycle sector as for volumes of water supplied

-

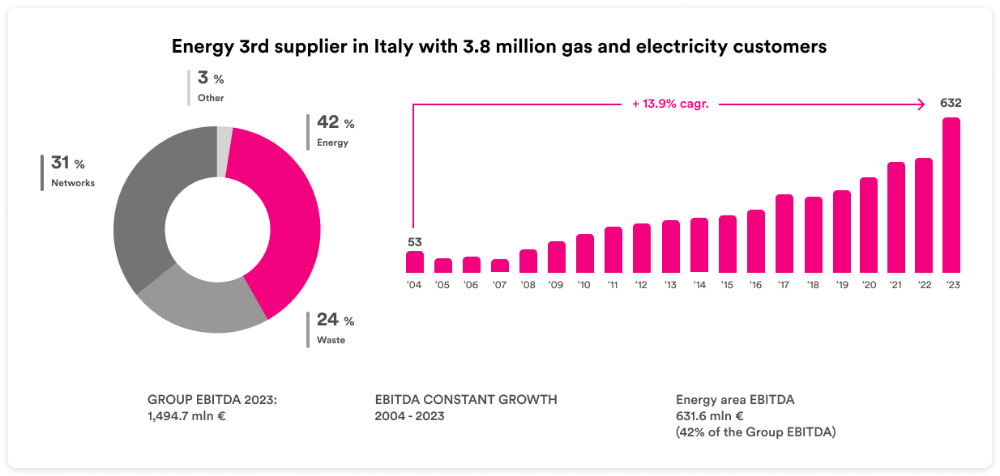

3rd operator in the sale of gas and electricity as for number of customers

-

4th operator in the distribution of gas as for volumes supplied

-

5th operator in the electricity distribution sector as for volumes distributed.

-

5th operator in the public lighting sector as for number of light points managed

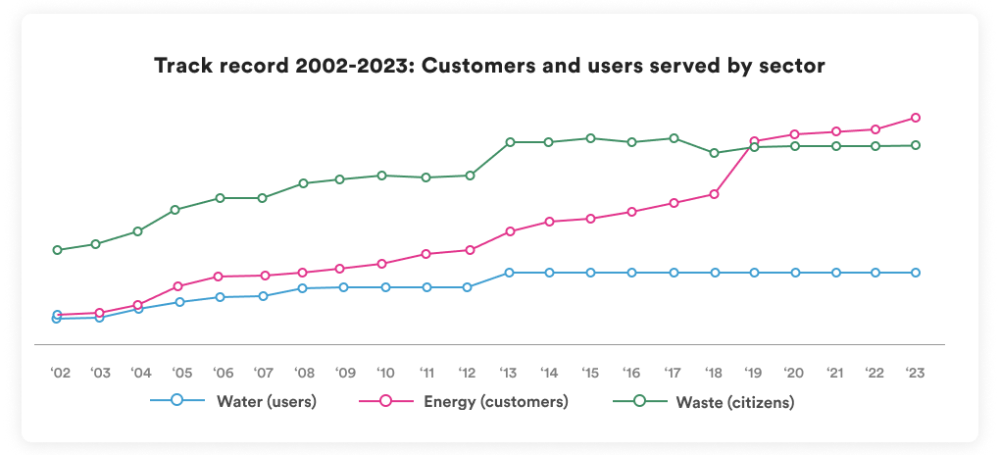

In 2023, the Hera Group again recorded an increase in its total number of customers.

By 2027 the Group set the goal of 4.3 million customers for free market businesses in the energy sector, a target that will be pursued by enhancing of the customer base in North-Eastern Italy and grasping the opportunities offered by the elimination of protected customers in the electricity market. In the integrated water cycle and waste management sector Hera expects to strengthen its facilities, particularly in areas on the fringes of served areas, where having a strong presence is essential for further geographical expansion.

|

Energy services |

Integrated water service |

Waste management services |

|

|---|---|---|---|

| Sale and distribution of gas and electricity, district heating, heat management and public lighting | Civil and industrial aqueduct, sewage and wastewater treatment | Collection, recovery, treatment and disposal of municipal and special waste | |

| Customers | Gas: 2.1 million Electricity: 1.7 million District heating: 13 thousand |

Water: 1.5 million | |

| Municipalities served | Gas distribution: 222 Electricity distribution: 26 District heating: 16 Public lighting: 210 |

Aqueduct: 227 |

Waste collection: 188 |

| Residents served | 3.4 million | 3.6 million | 3.2 million |

| Volumes |

Gas sold: 10.7 billion cubic metres |

Water supplied: 283.4 million cubic metres |

Waste collected: 2.3 million tonnes |

- Circular economy

- Water scarcity

- Energy efficiency

- Saving resources

- Protecting the environment

- Opportunities for growth

- Opportunities for growth through M&As

- Risk protection

- Alpha stock

- Beta stock

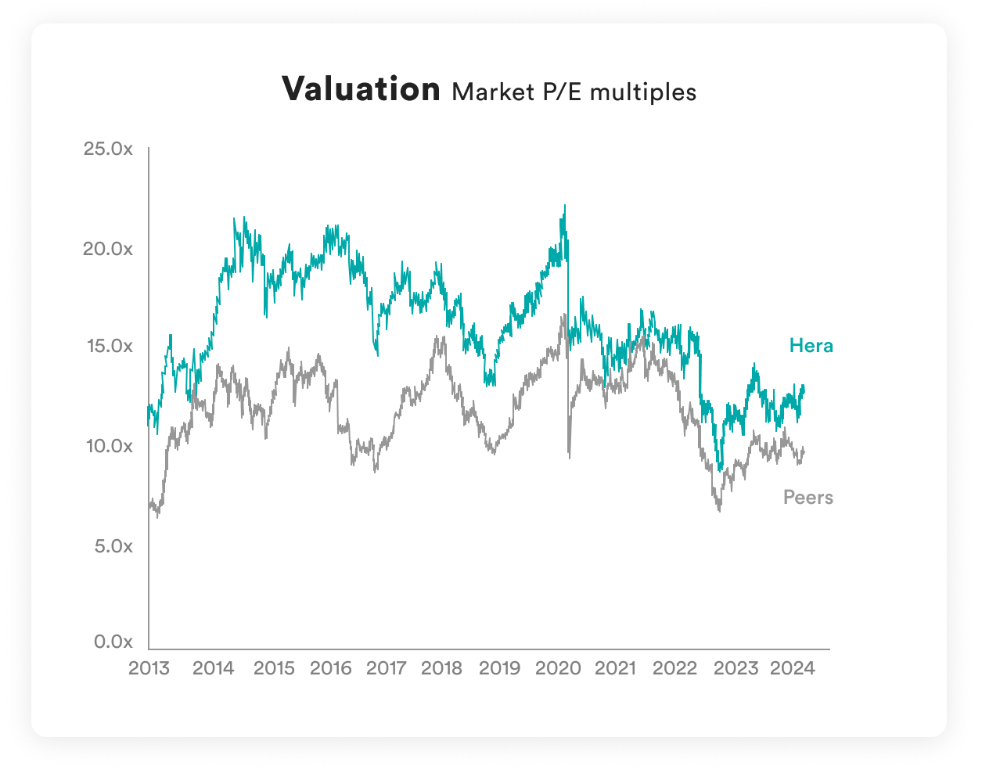

… low risk and growth opportunities rewarded

For many years now, the market has shown its willingness to assign a higher value (Bonus) to Hera stock than its peers. This is because the resilience of its business portfolio, its model for growth, the quality of its results and its stable governance give investing in Hera a lower level of risk compared to other shares in the same sector, with better prospective for growth.

Page update 26 March 2024