Components of remuneration

Components of remuneration

- Group

- Governance

- Remuneration policy and objectives

- Components of remuneration

Pay for performance

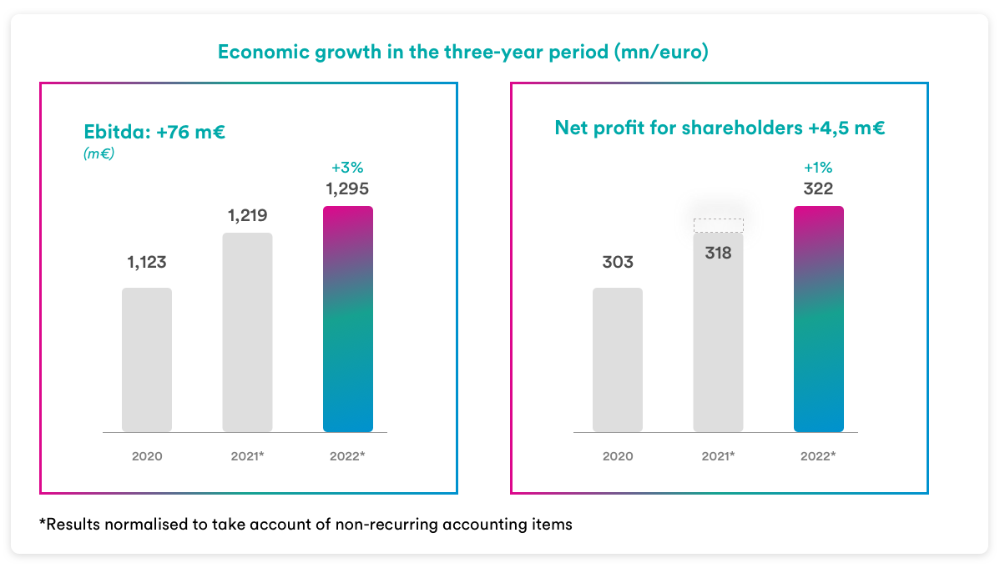

During the year that has just ended, even in a context affected by both the pandemic and the outbreak of the conflict in Ukraine, the Group was able to ensure continuity in the services delivered and investments made, registering further growth and one of the highest increases in its almost 20-year history to date.

This performance is even more noteworthy considering that all portfolio businesses achieved positive results, with growth being driven by organic and sustainable development of the Group’s liberalised businesses; indeed, these business areas have benefited from the growing demand for services associated with the pursuit of carbon neutrality, such as energy efficiency, and the circular economy, with the recovery of materials.

Earnings before interest, taxes, depreciation, and amortisation increased by 6.2%. During the year, the Group laid the foundations for growth in the years to come, thanks in part to the completion of a number of acquisitions that are expected to generate significant synergies with the Group’s diversified platform of plants.

Equity strength was confirmed, with the ratio of net debt to EBITDA still below 3.3 at year-end, down from 3.62 in the third three-month period thanks to the gradual emptying of gas storage that had been filled to ensure the energy supply required for sales activities during the winter season. In addition, all planned investments were implemented, up from the previous year, as was the regular payment of dividends, 9% higher than in 2021.

These annual financial results exceeded the targets set for the 2022 financial year and exceeded the widely-held expectations of the financial analysts covering Hera stock. Such performance is all the more impressive considering that it builds on the significant progress already made uninterruptedly since the Group’s inception.

In 2022, the stock market suffered from strongly negative sentiment on rising interest rates, hitting the utility sector in particular, and also preventing Hera from matching its solid fundamentals in the share price. Furthermore, the year-end does not capitalise on the results achieved in the fourth three-month period (which are published with these financial statements), which were particularly solid and supported by the positive sales results of the Energy business. The performance of the Hera share, with a share price drop of 31.1%, was nevertheless higher than the average performance of its peers, with an outperformance of 300 basis points. The proposed dividend of 12.5 cents per share represents, compared to the share price achieved at 31 December, a yield of approximately 5%.

Despite the challenges posed by the external environment, the business model has shown strong resilience with progress in all areas of the profit and loss account up to the net profit, compared to the comparable figure of the previous year. These solid results exceeded the expectations of all analysts, who maintained a valuation of Hera’s stock growth margin of 35.5%.

The set of results outlined here are also concrete evidence of the effectiveness of Hera’s remuneration and incentive system, both short and long term, aimed at promoting management geared towards the achievement of targets aligned with the interests of shareholders and stakeholders.

The following graphs illustrate the main results for the last three years.

Remuneration components

The structure of the remuneration package envisaged for the various offices is defined with a view to balancing the fixed and variable components, taking into account the specific risk profile of the company as well as the desire to maintain a close alignment between the level of company and individual performance and remuneration by effectively incentivising commitment, professional growth and the adoption of behaviours deemed functional for achieving the Group’s corporate objectives. The total remuneration contains a balanced mix of fixed components, variable components and benefits, with a focus on identifying the metrics deemed most effective to reflect the Group’s long-term prospects.

The fundamental components of remuneration for Hera Group managers are:

| COMPONENT | OBJECTIVE AND CHARACTERISTICS | IMPLEMENTATION |

|---|---|---|

| Fixed compensation |

Compensates technical, professional and managerial skills |

Compensation position assessed on the basis of performance, experience, level of responsibility, and internal alignment with the evolution of the organisation as well as market benchmarking |

| Short-term variable compensation |

It encourages the achievement of strategic and financial objectives as well as the adoption of behaviours consistent with the company’s leadership model |

Assignment of individual objectives connected with the Group’s balanced scorecard system for managers and executive directors |

| Deferred variable compensation for retaining managers |

Retention measures for executive assets in strategic, high performance and high market-risk roles |

Three-year reporting period. |

| Non-monetary benefits |

An integral part of the remuneration package, these are primarily welfare and pension-related |

Defined in accordance with industry standards and applicable company policies |

| Compensation |

Severance payment to protect the interests of the Company |

In the event of early termination or revocation of the director’s appointment |

The Hera Group’s remuneration policies, in addition to defining guidelines and methods for remunerating management, also regulate the processes and tools to be applied to the rest of the workforce, uniformly across all areas of the organisation. More specifically, in this case as well, the Group policy is constantly compared to market levels in terms of both the fixed remuneration components and the variable components and benefits, and consequently the most suitable measures are adopted as part of a structured process aimed at rewarding the individual’s contribution to creating added value, as well as guaranteeing fair and sustainable working conditions.

The remuneration components defined for management and their related purposes and characteristics are thus applied homogeneously to the entire company population, following a logic of full harmonisation and dissemination of the underlying principles, taking into account the working conditions of all employees and in full compliance with principles of equality among individual demographic characteristics (gender, age, geographical origin, etc.).

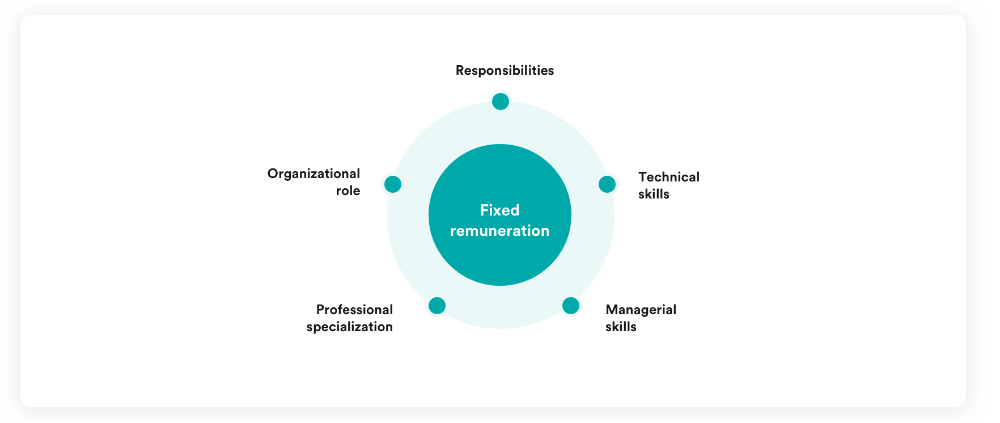

The fixed component of compensation is usually determined by the professional specialisation and the organisational role along with related responsibilities. It is therefore a reflection of technical, professional and managerial skills.

The levels of the fixed component of remuneration are established with respect to the specific nature of the company and its risk profile, so as to guarantee the ability to attract and retain talent with the professionalism the Group requires.

For each executive, the reference salary level is determined on the basis of the weight of the organizational position held, on the basis of which a benchmarking comparison is carried out in relation to selected external markets. The benchmarking, carried out by an external company, takes into consideration a total of 278 companies, 36% of which are Italian and 64% foreign. Of the companies, 15.9% have more than 5,000 employees.

These benchmarks are drawn from specialized, sector companies that carry out remuneration surveys, surveys in which the Group participates. On the whole, the remuneration level chosen as a reference point is in the medium band for the market (first quartile/median). These market references, combined with an evaluation of performance and managerial ability, form the basis of individual compensation reviews.

The Balanced Scorecard system (BSC)

The short-term variable component of remuneration is linked to the achievement of individual and Group objectives that derive directly from the Company’s strategic priorities through the adoption of the balanced scorecard model.

Recipients

The scope of application of the BSC system consists of all Hera Spa and Group subsidiary company directors, managers and supervisors. With respect to the population of directors and executives, for the year 2022, the scope includes 41 directors and 110 managers. A similarly arranged evaluation form is also envisaged for the Executive Chairman and the CEO.

Individual objectives definition process

The short-term incentive system involves assigning an individual BSC for each of the recipients. Each BSC includes a series of objectives belonging to three evaluation areas:

-

target projects, defined on the basis of the Group’s strategic map, derived from the business plan and consistent with the medium/long-term policies and objectives on all the ESG dimensions; this area has a relative weight which, for directors, varies from 50% to 80%, for managers from 40% to 70% of the score card total;

-

the economic objectives of the individual budget units, assessed by means of economic-financial indicators; this area has a relative weight that for directors and managers varies from 10% to 40% of the score card total;

-

Each area is divided into a series of pre-set objectives, each with a specific performance indicator. The relative weight of each area under the scope of the individual BSC is different for Directors and Managers, and corresponds to the total of the weight of the individual objectives belonging to the same area.

-

assessment based on the degree to which the individual has adopted the behaviours envisaged by the Group’s leadership model; this area has a relative weight of 10% for directors and 20% for managers of the score card total.

Each area is divided into a series of pre-set objectives, each with a specific performance indicator. The relative weight of each area under the scope of the individual BSC is different for Directors and Managers, and corresponds to the total of the weight of the individual objectives belonging to the same area.

Performance measurement

The BSC system entails a series of quali-quantitative assessments for the directors/managers/supervisors listed below.

-

a quarterly assessment that is also shared in the management review (Management Committee);

-

the most important strategic projects are evaluated in terms of the progress made, the obstacles that might cause a possible slowdown of the project and what might be done to resolve them;

-

any instances of outperformance are taken into consideration during the revised budget;

-

the assessment of projects is quali-quantitative

-

the appraisal of behaviours envisaged by the leadership model includes 360-degree observations that can be applied across the entire organization and takes place by involving the heads of the individual teams who assess the following competencies envisaged by the model:

-

Energy and decision

-

Realization

-

Cooperation

-

Influence

-

Exellence and simplification

-

Complexity management

-

Innovation

-

Valorization of people

-

A target is established at the beginning of each reference period and for each objective. Individual performance is assessed on the basis of the achievement of the objectives actually pursued (result) and the specific weight of each individual objective, as follows:

-

objective projects: each assigned project is evaluated by the direct supervisor using 11 levels of evaluation (0%, 10%, 20%, 30%, 40%, 50%, 60%, 70%, 80%, 90%,100%) chosen on the basis of whether the indicators present in each project have actually been attained;

| Project target achieved (assessment level:100%) |

Project target almost entirely achieved (assessment levels: 90%-80%-70%) |

Project target partially achieved (assessment levels: 60%-50%) |

Signficant deviations from project target achievement (assessment levels: 40%-30%-20%-10%) |

Project target not achieved (score 0%) | |

|---|---|---|---|---|---|

| indicators | All relevant targets achieved* or surpassed: 100% targets achieved |

Majority of relevant targets achieved*: 75% <=targets achieved<100% |

More than half or half of relevant targets achieved*: 75% <=targets achieved<50% |

Only some relevant targets achieved*: 50% <=targets achieved<10% |

None of the relevant targets met* |

* relevant targets are targets whose achievement is a necessary condition for the full fulfilment of the project objectives.

-

economic objectives of individual budget units: the result is automatically assessed on the basis of the final figures shown in the statutory financial statements for the economic indicators assigned under an “achieved/not achieved” logic;

-

leadership model behaviours: this assessment is carried out on all the eight behaviours envisaged by the model and is calculated on the basis of the arithmetic average of the assessments of each behaviour; the target for each person being assessed is identified on an assessment scale from one to five and the target has been raised from 3 to 3.5 (see section 4.03) for all company positions, a value that represents how solidly individual behaviour has been modelled throughout the period in question; the percentage of behavioural target achievement is distributed over ten bands according to the following scheme:

-

- arithmetic average of the eight assessment areas >=3.5 result 100%

- arithmetic average of the eight assessment areas > 3.25 and < 3.5 result 90%

- arithmetic average of the eight assessment areas > 3.13 and <= 3.25 result 80%

- arithmetic average of the eight assessment areas > 3 and <= 3.13 result 70%

- arithmetic average of the eight assessment areas > 2.88 and <= 3 result 60%

- arithmetic average of the eight assessment areas > 2.75 and <= 2.88 result 50%

- arithmetic average of the eight assessment areas > 2.63 and <= 2.75 result 40%

- arithmetic average of the eight assessment areas > 2.5 and <= 2.63 result 30%

- arithmetic average of the eight assessment areas > 2.38 and <= 2.5 result 20%

- arithmetic average of the eight assessment areas > 2.25 and <= 2.38 result 10%

- arithmetic average of the eight assessment areas <= 2.25 result 0%

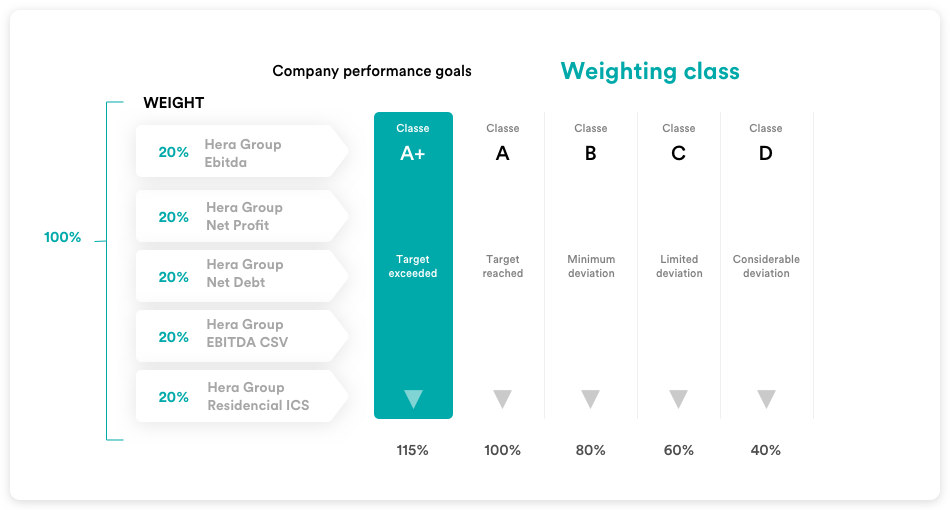

The result of the evaluation carried out using the aforementioned model is then weighted through a company results profile which takes into account the performance recorded by the Group referring, for 2022, to five parameters:

-

EBITDA;

-

Net Profit;

-

Net Debt;

-

shared value EBITDA (CSV);

-

Customer Satisfaction Index (CSI) households.

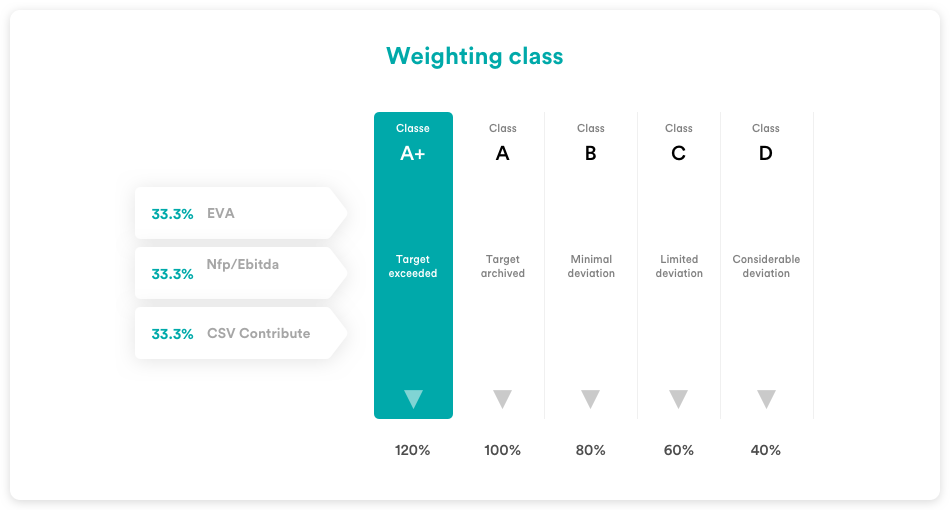

On the basis of the performance profile achieved by the Company on these five parameters, the weighting percentage to be applied to the individual results of managers up to 115% of the bonus (in the event of performance beyond that set out in the established company targets) according to the following scheme:

Each parameter is evaluated separately. The weighting percentage is determined by calculating the weighted average of the percentage values that come from the results of each individual indicator. Any indicator which registers a final balance lower than class D results in the value of the premium linked to the indicator being reset to zero.

For 2022, the target values of the four weighting parameters are:

-

Hera Group EBITDA: 1,254 mn;

-

Hera Group Net Profit: 375.9 mn;

-

Hera Group Net indebtedness: 4,240 mn;

-

Hera Group CSV EBITDA: 680 mn;

-

Hera Group Residential ICS: 72.

Incentive level

The short-term variable remuneration envisaged by the BSC system on meeting 100% of the individual objectives involves an amount expressed as a percentage of the gross annual fixed remuneration (AGR), divided by category of recipient:

-

Directors: 30% of the RAL

-

A-class managers: 22% of the RAL

-

B-class managers: 17% of the RAL

For Managers there is a maximum of two separate variable remuneration levels, based on the weight of the manager within the organisation and the strategic value of his or her duties.

With respect to 2022, depending on the results of the incentive system and the position held by the recipient, the following maximum salaries are established:

-

for the Executive Chairman and Chief Executive Officer: the policy sets a maximum variable remuneration equal to 57.5% of the total gross fixed compensation [(57.5%) = maximum individual variable (50%) x maximum company weighting (115%), corresponding to having outperformed all the established targets (class A+)];

-

for directors: the policy sets a maximum variable remuneration equal to 34.5% of the total gross fixed compensation [(34.5%) = maximum individual variable (30%) x maximum company weighting (115%), corresponding to having outperformed all the established targets (class A+) associated with company objectives];

-

for managers: there are two distinct levels of maximum variable remuneration based on the manager’s weight within the organisation and the strategic importance of his or her tasks, equal respectively to 25.3% [(25.3%) = maximum individual variable (22%) x maximum company weighting (115%) corresponding to having out-performed all the established targets (class A+) related to the company objectives] of the total gross fixed remuneration, and 19.6% [(19.6%) = maximum individual variable (17%) x maximum company weighting (115%), corresponding to having out-performed all the established targets (class A+) related to the company objectives] of the total gross fixed remuneration.

The following table shows a summary of the maximum variable compensation for the various categories of recipients in the event of maximum individual performance and outperformance of all corporate targets:

| POSITION HELD | Maximum company weighting (A) | Individual variable maximum (B) | Variable compensation maximum (AxB) |

|---|---|---|---|

| Executive Chairman and Chief Executive Officer | 115% | 50% | 57,5% |

| Directors | 115% | 30% | 34.5% |

| A-class executives | 115% | 22% | 25.3% |

| B-class executives | 115% | 17% | 19.6% |

The table below illustrates the mechanism for measuring the maximum bonus for a director:

| Component | Description |

Example of outperforming company targets and achieving the maximum individual assessment |

Example of meeting company targets and achieving the maximum individual assessment |

|---|---|---|---|

| A | Annual gross compensation (euro) | 100,000 | 100,000 |

| B | Target bonus (% RAL) | 30% | 30% |

| C | Target bonus (euro) = A x B | 30,000 | 30,000 |

| D | Individual pbjectives achieved (%) | 100% | 100% |

| E | Company performance weighting coefficient (%) | 115% | 100% |

| F | Value of the bonus paid (euro) | 34,500 | 30,000 |

With regard to transactions of strategic importance of an exceptional nature, with significant effects on the results of the company, the Board of Directors, following the proposal of the Remuneration Committee, can award discretionary bonuses to executive directors and management with strategic responsibilities.

The long-term variable component of remuneration is linked to a retention plan applied to the Executive Chairman and the Chief Executive Officer in relation to the multi-year term of their office, and for a limited number of managers.

The Board of Director’s decision to adopt the retention plan stemmed from its evaluation of a series of elements:

-

since the establishment of Hera, the Group has grown significantly in terms of company size, area served and final results;

-

from the point of view of executive management, the Group has reached a composition that is the result of a careful balancing between bringing in new skillsets, coming from the market, and specific, valuable competencies already present;

-

the Group currently enjoys a strong reputation and good visibility on the market, and consequently it makes sense to engage in highly selected retention actions for those executives who hold strategic roles and display both high performance and high market risk.

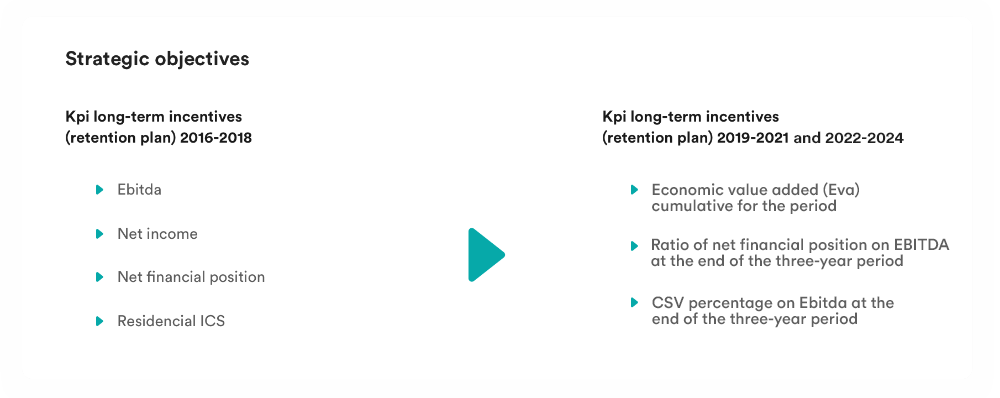

The plan involved an initial period of application in the 2016-2018 three-year period, with disbursement of the related award in 2019, and a second three-year period of application 2019-2021, with disbursement of the related award scheduled for 2022, under which, as established by the Board of Directors at its meeting on 19 December 2018, the plan was envisaged to evolve with the aim of further enhancing the ability to create and share value, as well as further consolidating the Group’s culture of long-term financial solidity and more effectively pursuing the interests of stakeholders. As resolved by the Board of Directors on 27 January 2022, the adoption of the plan was confirmed for the 2022-2024 three-year period, maintaining unchanged the model for the functioning of the system that had already been approved in previous three-year periods and updating the recipients in accordance with the general criteria outlined below:

-

identification of a limited number of managers based on the weight of their organisational position, evaluation of their performance in the development process, and age;

-

annual evaluation mechanism for accessing and renewing/not renewing the awarding of the monetary plan, based on the above criteria;

-

top management’s responsibility in choosing recipients, including in view of assessment criteria based on the actual market risk of the professional profile in question.

Starting from fiscal year 2020 and for the 2020-2022 three-year period, as resolved by the Board of Directors on 24 June 2020, the scope of the plan’s recipients also includes the Executive Chairman.

Objectives definition process

From the point of view of keeping remuneration in line with performance, the retention plan encourages a commitment to the development of individual managerial skills and the achievement of the strategic objectives of the Group in a three-year perspective.

The evaluation component of individual managerial skills considers the level achieved by recipients in the three-year period in relation to the eight skills identified by the leadership model:

-

Energy and decision

-

Realization

-

Cooperation

-

Influence

-

Exellence and simplification

-

Complexity management

-

Innovation

-

Valorization of people

The component based on the achievement of Group strategic objectives was updated at the time of the 2019-2021 second three-year application period as approved by the Board of Directors at its 19 December 2018 meeting and confirmed for the 2022-2024 three-year period.

The structure is designed to increase the value of the bonus in proportion to the level of achievement of the set objective and includes three indicators (weighted equally):

-

economic-financial indicator: Economic Value Added (EVA) or the cumulative target value for the three-year period, equal to the difference between NOPAT (Net Operating Profit After Taxes) and WACC (Weighted Average Cost of Capital) for the capital invested;

-

the year-end relationship, as of the last year of the three-year period, between the Net Financial Position and EBITDA;

-

the amount of Creating shared value (CSV) as a proportion of end-of-year EBITDA in the last year of the three-year period.

The following diagram shows the Group’s long-term strategic objectives for the retention plan as compared to those used in the version for the last three-year period:

Maximum incentive level, performance measurement and bonus accrual mechanism

For Executive directors, the maximum value of the three-year incentive bonus, upon achievement of 100% of the targets, amounts to 120% of the fixed annual remuneration (AGR)

For the 2022-2024 three-year period, the target values of the pre-set objectives (KPI) are:

-

EVA: 550 mln with a WACC of 4.5%;

-

PFN/EBITDA at 2024: 2.94;

-

%CSV at 2024: 55%.

For the rest of Group management covered by the retention plan, the maximum three-year incentive on achieving 100% of the objectives is 100% of the gross annual fixed compensation (therefore the corresponding annual quota is equal to one third of the fixed annual gross remuneration, or 33% of the fixed annual gross remuneration) or 50% of the gross annual fixed compensation (therefore the corresponding annual quota is equal to one third of the fixed annual gross remuneration, or 16.67% of the fixed annual gross remuneration). For the 2022-2024 three-year period, the reference salary is that of April 2025; differentiation in the amount of the incentive among the different recipients is based on the weight of the person’s organisational position, the evaluation of his or her performance within the development process, and market risk.

The level of achievement of Group KPIs may vary up to 120%, according to the following scheme:

Each indicator is evaluated separately. The overall achievement percentage is determined by calculating the weighted average of the percentage values that come from the results of each individual indicator. Any indicator which registers a final balance lower than class D results in the value of the premium linked to the indicator being reset to zero.

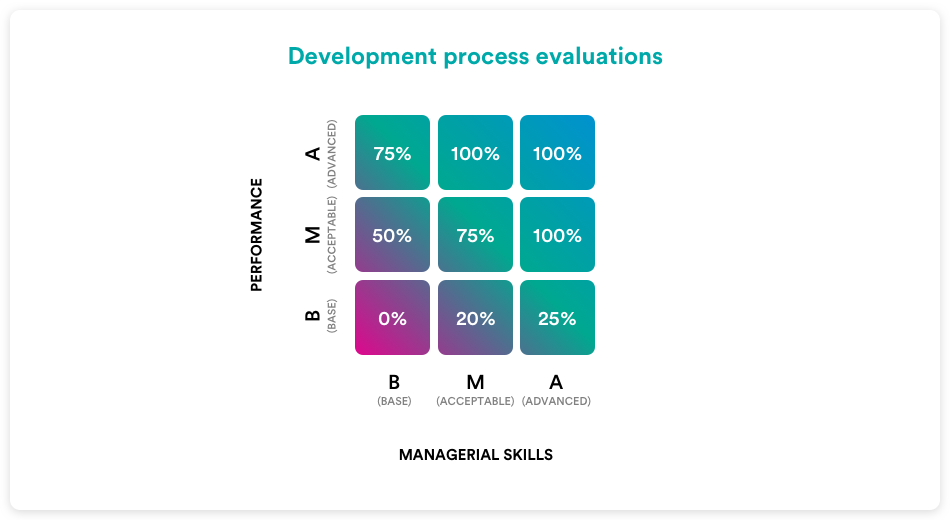

The parameter evaluating the development process is provided by the average of evaluations on performance and managerial capacity over the three-year period, or by the annual positioning of each recipient within the following grid that determines the relative weight:

The incentive is paid in May of the fourth year, provided that the recipient is still employed.

With reference to recipients confirmed in a subsequent long-term incentive plan, in order to limit the risk of them leaving their positions post-disbursement, disbursement is defined in May of the second year in the form of an advance (repaid in the event of termination) of the theoretical amount accrued for the first year of the three-year period (advance payment for the first year amounting to one third of the total three-year bonus).

The pay-out of the remaining portion (equal to two-thirds of the bonus) is instead scheduled for the month of May of the fourth year. If at the end of the period (at the end of the three-year period) the performance achieved merits a variable remuneration lower than the amount already paid as an advance, the differential will be deducted from the remuneration for the current year (fourth year).

In line with best practices, the plan also involves the following main forms of insurance coverage: D&O Liability against civil responsibility towards third parties, professional and extra-professional accidental injury, death, and permanent disability due to illness. Managers who hold specific organisational positions are also to be assigned a company car for business and personal use.

Furthermore, beginning in 2017, in order to further reinforce management retention within the Group, a welfare plan was introduced, linked to the achievement of the Group’s corporate objectives, that involves paying out welfare quotas that can be spent on the services included among those of the existing corporate welfare plan.

Disbursement is linked directly to the level of achievement of the Group KPIs already used as an overall weighting of the results of the BSC system according to a scheme that, for each individual indicator, stipulates access to the bonus only if the relevant defined target is exceeded.

Each indicator is evaluated separately. The overall result is determined by calculating the weighted average of the percentage values that come from the results of each individual indicator.

The maximum value, on achieving 100% of plan objectives, is 6% of the individual theoretical variable, namely:

-

executive members (Executive Chairman and Chief Executive Officer): there is a maximum social bonus equal to 6% of 50% of the total gross fixed remuneration (equivalent to 3% of the AGR);

-

directors: there is a maximum welfare bonus equal to 6% of 30% of the total gross fixed remuneration (equivalent to 1.8% of the AGR);

-

managers: there are two separate levels of maximum welfare bonus, equal to 6% of 22% of the total gross fixed remuneration (equivalent to 1.3% of the AGR) and 6% of 17% of the total gross fixed remuneration (equivalent to 1% of the AGR), respectively;

Furthermore, in keeping with the implementation of the Group welfare plan launched in 2016, access to a Flexible Benefit plan was established for all Group employees, involving the allocation of an individual quota of 450 euro in 2022.

Finally, the entire non-managerial population of the Group is allowed to convert up to 50% of the corporate performance bonus into the goods and services included as part of the corporate welfare plan.

Resignation, lay-off or termination of the employment relationship

Already with the previous renewal of the Board of Directors in 2017, a clause was inserted for Executive Directors establishing that, in case of removal from office (except for cases of just cause), he or she will be paid an amount, as compensation for damages, comprehensive of any other claim, equal to the sum he or she would have received as remuneration, pursuant to art. 2389 of the Civil Code in the amount of 18 monthly salaries.

As far as executive directors with a managerial contract are concerned, termination compensation includes the notice required by the national labour contract.

Claw-back clause

With effect from the previous renewal of the Board of Directors in 2017, a claw-back clause was also introduced that establishes mechanisms for ex-post correction of the remuneration system for executive directors.

This clause entails the obligation to return already paid-out variable components of remuneration (or to withhold sums subject to deferral) determined on the basis of data that subsequently proved to be incorrect, and is effective from the date of appointment throughout the entire duration of the term; the request to return funds can be made once the relevant assessments have been completed, within three years of disbursement in relation to the year in which the instance occurred.

Stock options

In line with its highly conservative risk profile, Hera has chosen not to make use of volatile financial instruments such as option rights or other similar instruments.

The Group does not use benefit policies involving the distribution of stock options to its own employees.

The table below summarises the remuneration components awarded to directors

| POSITION | FIXED REMUNERATION | SHORT-TERM VARIABLE REMUNERATION | DEFERRED VARIABLE REMUNERATION FOR MANAGEMENT RETENTION | NON-MONETARY BENEFITS | COMPENSATION |

|---|---|---|---|---|---|

| Chairman |

|

||||

| CEO | |||||

| Vice Chairman | |||||

| Non-executive directors |

Page updated 27 April 2023