Buy back

Strategy

Hera's strategy is aimed at creating value in a sustainable manner using all available mechanisms. The Group seeks to generate value for shareholders through a continuous quest for efficiency, expanding in the market using multiple means including external growth lines, and investing in profitable activities. This approach has resulted in a clear and transparent dividend policy with a track record of steady increase over the last 20 years.

Other mechanisms of value creation for shareholders concern the characteristics of listed financial instruments issued by the Group. Specifically, the characteristics of "volatility" and "liquidity" are particularly relevant for the ordinary shares that represent Hera's share capital.

Volatility

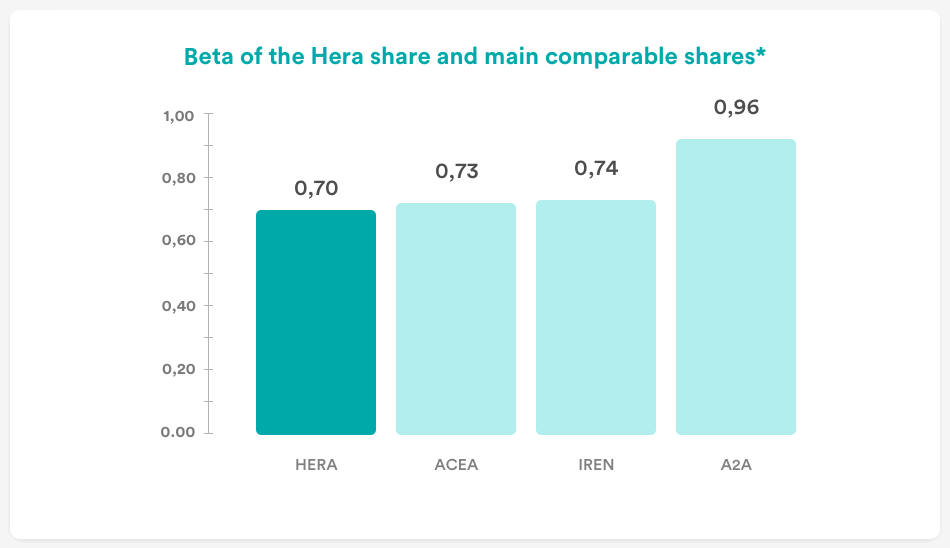

In order to support a continuous improvement in the characteristics of company shares, Hera has launched a buy-back plan aimed in part at financing potential opportunities for integrating small-sized companies with a view to reducing shareholder dilution. The plan also seeks to reduce the volatility of shares traded on the stock market by lowering the risk of strong intra-day price fluctuations (through purchases and sales counter to market trends at specific moments of volatility) and to normalize any fluctuations that are abnormal in relation to the main comparable national shares (A2A, Iren, ACEA).

* Beta 3 years

Source: Refinitiv

Liquidity

The plan is also designed to continuously support the liquidity of daily transactions through purchase and sale operations in response to the demands of market-based, including during periods of low trade activity. Improving volatility and liquidity ensures a lower degree of distortion in the prices of shares on the Stock Exchange in comparison to the value of corporate activities as determined by the consensus of independent financial analysts.

To learn more about the analysts' consensus: explore the interactive tool

Best practices

The treasury share buy-back plan, which has been in place since 2006, was renewed at the Shareholders' Meeting of 27 April 2023, which approved a treasury share buy-back plan for an additional 18 months, for a maximum total of 60 million shares up to a maximum total amount of EUR 240 million.

The stock exchange transactions are carried out in accordance with the guidelines contained in the Italian Stock Exchange (www.borsaitaliana.it) and Consob (www.consob.it) regulations and in line with international best practices concerning maximum transparency and the proper manner of trading Hera shares on the market.

All operations are regularly reported to Consob and published in this section of the website on a monthly basis. Quarterly and annual financial statements illustrate the management of the buy-back plan and highlight the consistency of the shares in the company's portfolio.

It should be noted that daily purchases do not exceed 25% of the average daily volume of trading in Hera S.p.a . shares in the 20 trading days leading up to the purchase date, which is established as the maximum limit in the provisions of EC Regulation no. 2273/2003.

Number of treasury shares bought in March 2024: 715,000

Number of treasury shares sold in March 2024: 0

Page updated 2 April 2024