Results and Presentations

Hera BoD approves financial results as at 31 December 2023

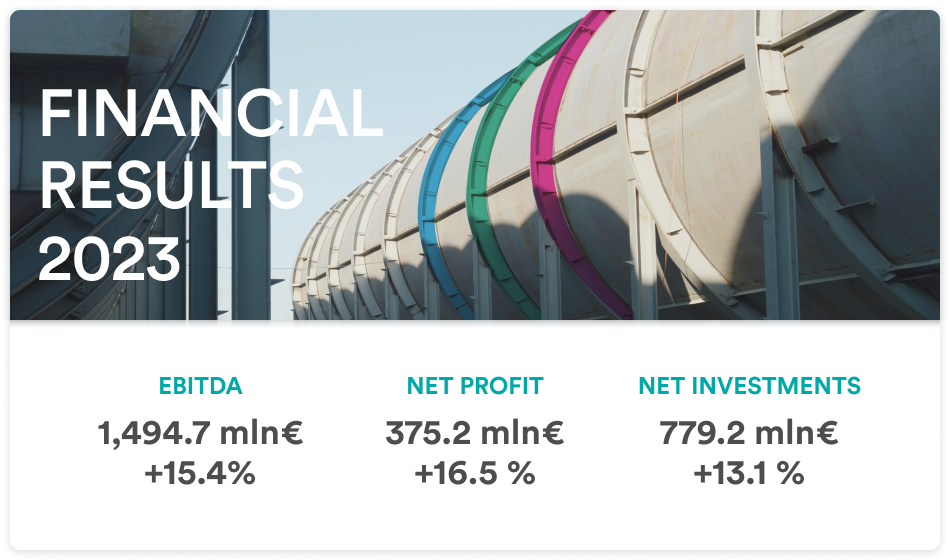

For Hera the year 2023 closed with improvement in operating results and investments compared to the previous year. Adjusted EBITDA amounted to 1,494.7 million euro, up 15.4%; adjusted EBIT was up 18.0%, and adjusted net profit after minorities stood at 375.2, up 16.5%. On the investment side, growth of 13.1% was recorded compared to 2022, reflecting the Group's continued focus on growing, enhancing and strengthening the resilience of assets under management.

All business areas contributed to these results, in particular the good performance of the energy, waste and water cycle areas.

The capital/financial structure showed a significant improvement compared to 2022, with the DEBT/EBITDA ratio reaching 2.56x.

The total value of net financial debt was 3,827.7 million euro, a decrease of about 422.1 million compared to the previous year, thanks to the positive performance of Net Working Capital.

| Economic data (mln €) | 2023* | Inc. % | 2022* | Inc. % | Change% 22-23 |

|---|---|---|---|---|---|

| Revenues | 14,897.3 | 100.0% | 20,082.0 | 100.0% | (25.8%) |

| Ebitda | 1,494.7 | 10.0% | 1,295.0 | 6.4% | +15.4% |

| Ebit | 741.0 | 5.0% | 627.9 | 3.1% | +18.0% |

| Pre tax profit | 563.4 | 3.8% | 502.9 | 2.5% | +12.0% |

| Net profit | 417.0 | 2.8% | 372.3 | 1.9% | +12.0% |

| Shareholders of Parent Company | 375.2 | 2.5% | 322.2 | 1.6% | +16.4% |

| Minority shareholders | 41.8 | 0.3% | 50.1 | 0.2% | (16.6%) |

* Values net of operational adjustments

Economic data (36 kb - XLS)

To learn more: Financial results Hera has reported since its constitution in 2002: Summary data 2002-2023 (73 kb - XLS)

Page updated 26 March 2024